- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

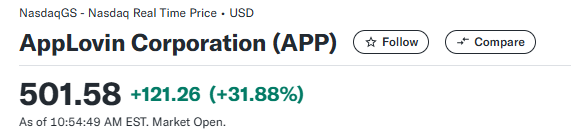

AppLovin (APP) big winner today up 46%

Posted on 11/7/24 at 10:08 am

Posted on 11/7/24 at 10:08 am

Got in about 2 months ago for just some hopeful steady increase, they smashed their Q3 earnings at the right time with the Trump Bump happening.

Something to keep an eye on, it is software for advertising

https://www.investors.com/news/technology/applovin-stock-hits-record-high-on-q3-beat/?src=A00220

This was one recommended by my Edward Jones FA, I guess he earned his 1%

Something to keep an eye on, it is software for advertising

https://www.investors.com/news/technology/applovin-stock-hits-record-high-on-q3-beat/?src=A00220

quote:

"Management made clear that virtually all of its Software Platform business is derived from delivering mobile gaming ads to mobile gaming players," Pachter said. "The company has recently begun beta testing an e-commerce solution as part of its platform that allows national and local businesses to acquire customers who play mobile games by delivering ads on the Axon 2.0 platform."

With the e-commerce tool, local businesses can acquire customers who are playing mobile games near their location. For instance, a pizza parlor could offer a coupon for a pizza to a nearby gamer, Pachter said.

quote:

Wedbush Securities analyst Michael Pachter maintained his outperform rating on AppLovin stock and upped his price target to 270 from 170.

This was one recommended by my Edward Jones FA, I guess he earned his 1%

Posted on 11/8/24 at 8:13 pm to DarthRebel

quote:

I guess he earned his 1%

Just so you know, you are paying well over 1% annually for EJ.

Posted on 11/8/24 at 8:39 pm to auwaterfowler

quote:

Just so you know, you are paying well over 1% annually for EJ.

Technically yes, if you want to get into the little details.

Here is my current YoY return, of which I am doing zero work.

I am completely fine with his fee, I have a life to attend to and a day job. I cannot be Gumbo Gary day trading for massive gains.

Posted on 11/8/24 at 8:48 pm to DarthRebel

This seems like a company that Hindenburg will throw their entire team behind.

Posted on 11/8/24 at 9:01 pm to lsuconnman

quote:

This seems like a company that Hindenburg will throw their entire team behind.

Posted on 11/9/24 at 11:08 am to auwaterfowler

quote:

Just so you know, you are paying well over 1% annually for EJ.

How much do you think it is?

Posted on 11/11/24 at 6:22 am to DarthRebel

I fired my fidelity advisor.

Passive index funds. I don’t spend that much time and I actually beat my advisor last year with low cost index funds.

Long term investing.

Passive index funds. I don’t spend that much time and I actually beat my advisor last year with low cost index funds.

Long term investing.

Posted on 2/13/25 at 10:30 am to DarthRebel

Looks like my comment hasn’t aged well.

Posted on 2/13/25 at 1:52 pm to lsuconnman

wasn’t there thread on here with someone asking about how to short this company?

Posted on 2/13/25 at 2:22 pm to Eighteen

quote:

wasn’t there thread on here with someone asking about how to short this company?

https://www.tigerdroppings.com/rant/money/buying-put-options-in-applovin-with-expiration-of-late-next-year-advice-needed/116732846/

Popular

Back to top

3

3