- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Biden Economic Advisor Doesn’t Understand ECONOMICS

Posted on 5/4/24 at 4:33 am to sonuvapitcher

Posted on 5/4/24 at 4:33 am to sonuvapitcher

The Treasury literally prints and mints currency. 100s, 50s, 20s, 10s, 5s, 2s, quarters, dimes...etc.

The Treasury also borrows money by selling Tresury Bonds to.make up the difference between the revenue we take in and the amount we spend.

But money is actually created by private banks through loans. So every dollar loaned is money, and that money is borrowed at interest.

The fed adjusts the money supply by buying debt. When they buy debt, they basically create money electronically and that is transmitted to a bank. That increases the banks reserves and thereby the amount of reserves. Reserves dictate how much money banks can lend. The bank must maintain 11% on hand currently. The fed can change that ratio.

So when people say we are printing money, they really are not talking about the printing presses. They are talking about the Fed buying debt.

When the Treasury prints physical currency, it's primarily serving as a medium of exchange for transactions and isn't directly impacting the overall money supply. The money supply is more significantly affected by the actions of the Federal Reserve, such as buying debt or adjusting interest rates.

Now here is where it gets interesting. As I was writing this, her question actually made more sense. Why? Why do we borrow all the money in circulation? From banks?

The constitution does not say that new money has to be borrowed. But it is. Originally, banks had to acquire their own reserves in the form of precious metals (remember, reserves determine how much money they can lend or create). They might have bought gold and silver on the open market. They might have exchange greenbacks (currency) for gold and silver for safekeeping. But the important thing is. Then, they had to buy their reserves to make a profit. Now, their primary reserves are from the fed. The fed buys treasures from them. Reserves also come from deposits.

And every dollar distributed to the public is subject to interest.

I might add that a 1913 dollar is worth just a few pennies today, despite the fact that the principal mandate of the fed is to maintain the stability of the currency.

**** corrections***

The fed doesn't just give banks reserves. They buy treasuries held by the bank. The banks assets go down. Reserves go up.

The current reserve requirement is 0.

The Treasury also borrows money by selling Tresury Bonds to.make up the difference between the revenue we take in and the amount we spend.

But money is actually created by private banks through loans. So every dollar loaned is money, and that money is borrowed at interest.

The fed adjusts the money supply by buying debt. When they buy debt, they basically create money electronically and that is transmitted to a bank. That increases the banks reserves and thereby the amount of reserves. Reserves dictate how much money banks can lend. The bank must maintain 11% on hand currently. The fed can change that ratio.

So when people say we are printing money, they really are not talking about the printing presses. They are talking about the Fed buying debt.

When the Treasury prints physical currency, it's primarily serving as a medium of exchange for transactions and isn't directly impacting the overall money supply. The money supply is more significantly affected by the actions of the Federal Reserve, such as buying debt or adjusting interest rates.

Now here is where it gets interesting. As I was writing this, her question actually made more sense. Why? Why do we borrow all the money in circulation? From banks?

The constitution does not say that new money has to be borrowed. But it is. Originally, banks had to acquire their own reserves in the form of precious metals (remember, reserves determine how much money they can lend or create). They might have bought gold and silver on the open market. They might have exchange greenbacks (currency) for gold and silver for safekeeping. But the important thing is. Then, they had to buy their reserves to make a profit. Now, their primary reserves are from the fed. The fed buys treasures from them. Reserves also come from deposits.

And every dollar distributed to the public is subject to interest.

I might add that a 1913 dollar is worth just a few pennies today, despite the fact that the principal mandate of the fed is to maintain the stability of the currency.

**** corrections***

The fed doesn't just give banks reserves. They buy treasuries held by the bank. The banks assets go down. Reserves go up.

The current reserve requirement is 0.

This post was edited on 5/4/24 at 8:30 am

Posted on 5/4/24 at 10:42 am to RiverCityTider

quote:

But money is actually created by private banks through loans. So every dollar loaned is money, and that money is borrowed at interest.

quote:

Now here is where it gets interesting. As I was writing this, her question actually made more sense. Why? Why do we borrow all the money in circulation? From banks?

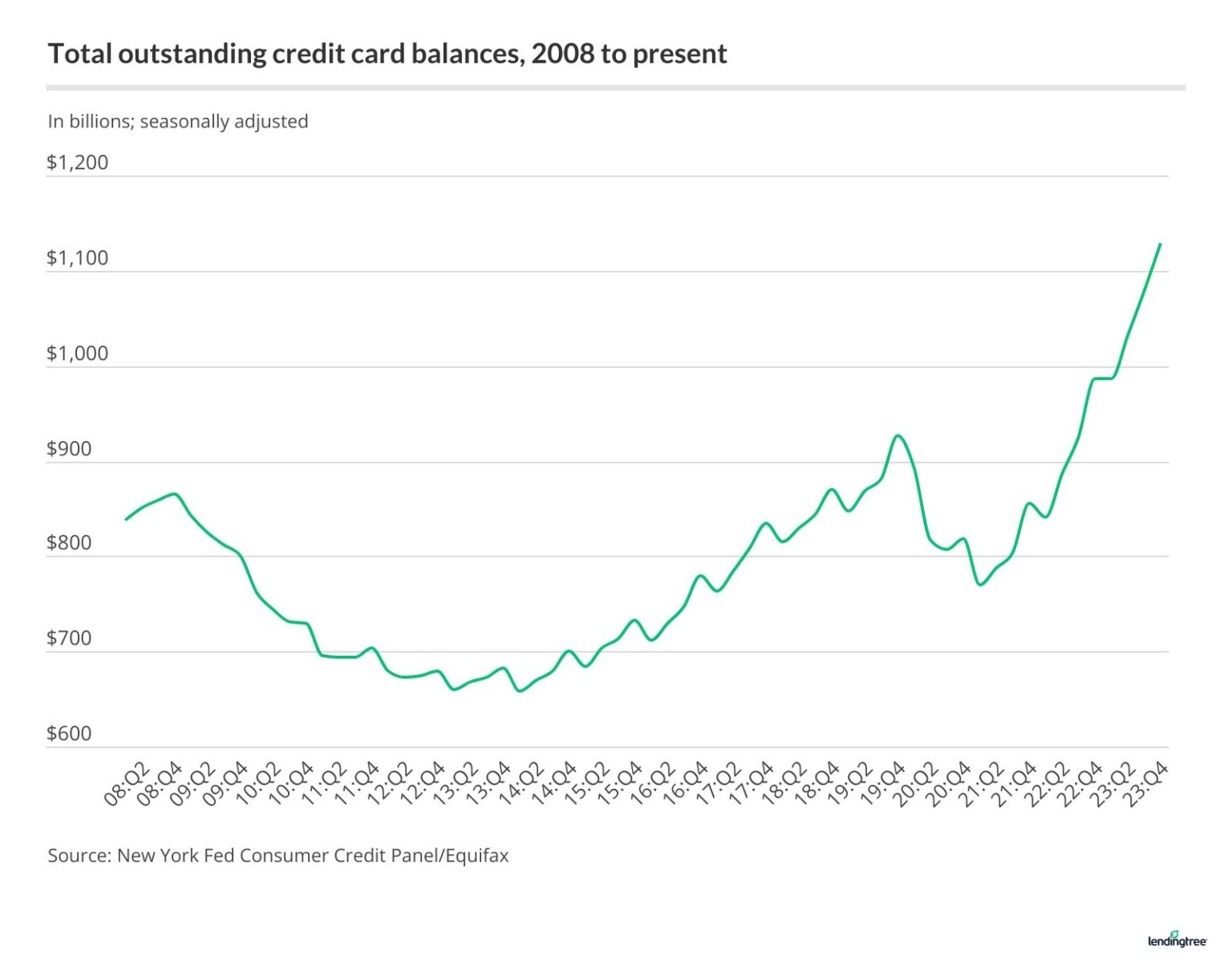

We don't borrow it all from banks. To add another dimension to this, credit cards do the same thing. An aspect I've been harping on for a year now is consumer-created debt. LINK

And a lot of that is running on an interest rate of ~20%. LINK

As inflation has risen, we've seen a rise in delinquencies and defaults. LINK Along with that, we're seeing bankruptcy filings climb. LINK

Every extra dollar created dilutes the value of the already-existing dollars a tiny bit more, consumers creating dollars through debt-creation is no different. As inflation has continued to rise, consumers have tried to offset more and more of it by putting more on their credit cards. The problem is more and more of them are just servicing the debt instead of paying it off (evidenced by savings dropping).

quote:

When the Treasury prints physical currency, it's primarily serving as a medium of exchange for transactions and isn't directly impacting the overall money supply. The money supply is more significantly affected by the actions of the Federal Reserve, such as buying debt or adjusting interest rates.

I think that needs a little more clarity for those who may not understand why it is so.

The vast majority of USD is digital, not physical ( M2 is something like $20T while there is only around $2T in physical currency), so it can be thought of as physical currency printed up is only creating more physical representations for what already exists digitally.

Popular

Back to top

1

1