- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Predicting a 30 year mortgage rate around October 2022?

Posted on 12/10/21 at 12:50 pm

Posted on 12/10/21 at 12:50 pm

I am about to build a house and obviously have been tinkering with a mortgage calculator. Trying to prepare for worst case situation, have been putting in 4.5% interest rate in hopes it will be less than that (I believe it will end up being about 3.85 to 4%). Where does the board see the 30 year rate for a good ole baw with good credick and down payment. My lender suggested prepping for 4.25 to 4.5 but that’s to be conservative. Anyone else doing this same exercise?

Posted on 12/10/21 at 1:02 pm to JumpingTheShark

Got quoted 3.2 yesterday for immediate buy. We really think it’s gonna go up a whole point? Don’t think the stomachs are there for that.

Posted on 12/10/21 at 1:21 pm to JumpingTheShark

Posted on 12/10/21 at 1:21 pm to JumpingTheShark

3.50...

Posted on 12/10/21 at 2:45 pm to JumpingTheShark

I'd be more concerned on the increase of likely purchase price depending on your market than I would be the interest rate.

Posted on 12/10/21 at 3:39 pm to JumpingTheShark

3.75

Posted on 12/10/21 at 4:20 pm to JumpingTheShark

Get a construction loan that converts to permanent at a fixed rate. You can always refi later if the rates are better.

Posted on 12/10/21 at 5:34 pm to JumpingTheShark

Our first home in 1981 was 15.5% on a 30 year FHA mortgage. This is what you have to look forward to in the future.

Posted on 12/13/21 at 8:48 am to JumpingTheShark

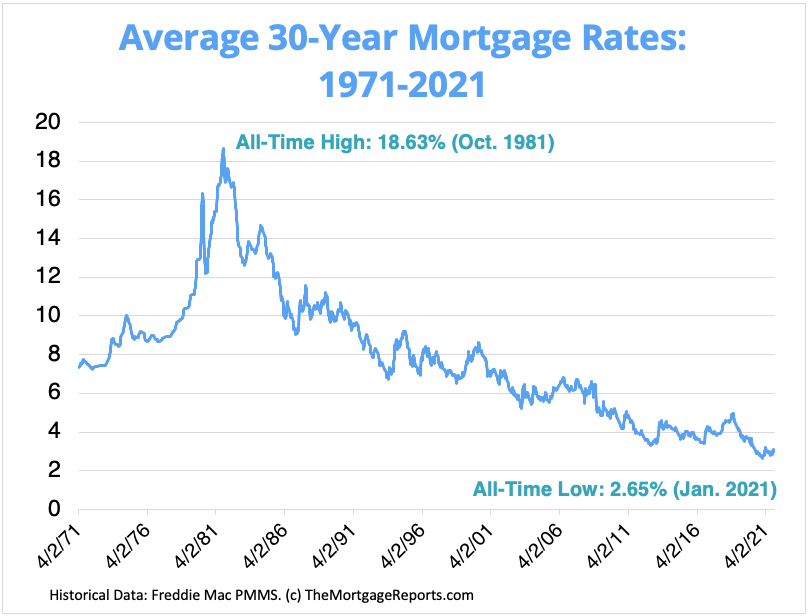

LINK

We will see a rate increase but not sure if it will go into the 4s if you have strong credit. If you are building, you should only have to pay interest only while in construction and then lock 30-45 days out. Time is now to move forward with purchases or refinances because rates will be higher by next year. And the cost of waiting can be detrimental

We will see a rate increase but not sure if it will go into the 4s if you have strong credit. If you are building, you should only have to pay interest only while in construction and then lock 30-45 days out. Time is now to move forward with purchases or refinances because rates will be higher by next year. And the cost of waiting can be detrimental

Posted on 6/26/23 at 7:41 am to JumpingTheShark

Sorry for the late reply, but I’d like to drop in and say that rates can vary based on various factors, so it's a good idea to stay updated and continue monitoring the market as your house-building plans progress. It's great to see that you're taking your mortgage planning seriously and seeking reliable information.

Popular

Back to top

10

10