- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

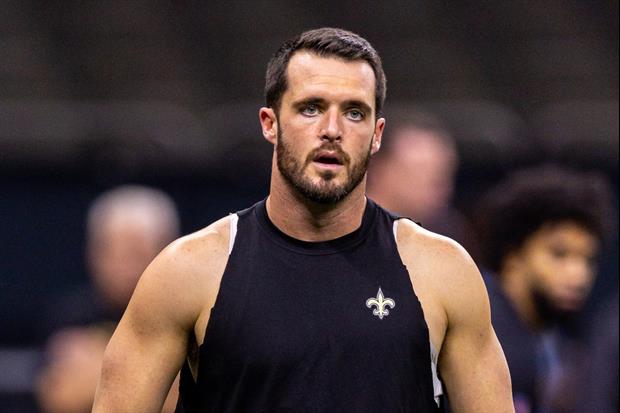

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

BlackRaven

| Favorite team: | LSU |

| Location: | "im on a boat" |

| Biography: | |

| Interests: | jenna jameson :) |

| Occupation: | |

| Number of Posts: | 148 |

| Registered on: | 10/24/2011 |

| Online Status: | Not Online |

Recent Posts

Message

LSU vs OU in BCS if both win out

Posted by BlackRaven on 11/19/11 at 7:41 am

if lsu wins out and okla wins out......they will play each other in the bcscg........

frick bama and da ducks....... :pimp:

frick bama and da ducks....... :pimp:

re: Mixing raw eggs in ground beef when preparing hamburgers...

Posted by BlackRaven on 11/17/11 at 2:43 pm to Chicken

quote:no

Mixing raw eggs in ground beef when preparing hamburgers...quote:it helps to keep the burgers from falling apartis that it? I don't have a problem with my burgers falling apart without eggs. Is there some other benefit?

re: Mixing raw eggs in ground beef when preparing hamburgers...

Posted by BlackRaven on 11/17/11 at 2:42 pm to Chicken

because when u make it in patty form , the burger wont stay together if u use no fat ground and fall apart when ur trying to eat it......ole school tip

re: Going to Commander's tonight

Posted by BlackRaven on 11/17/11 at 2:41 pm to oompaw

the "squirrel lip" gumbo is very good! :pimp:

re: witness the rise of the denver broncos......

Posted by BlackRaven on 11/17/11 at 1:04 pm to BlackRaven

4-5......will win tonight!!! tt15 is going to continue the winning ways

re: Tim Tebow and Denver Broncos

Posted by BlackRaven on 11/17/11 at 1:01 pm to TigerWoody

tt15 is a god person and a great leader on and off the field.....

he will be great during his time in the nfl...he will lead denver to playoffs.....

he has a heisman

he has a bcs title

he will do it in the nfl....he leads the right way....why wouldnt we want him to be successful...instead we want some idiot like ros at pittsburg to win?....come on man

he will be great during his time in the nfl...he will lead denver to playoffs.....

he has a heisman

he has a bcs title

he will do it in the nfl....he leads the right way....why wouldnt we want him to be successful...instead we want some idiot like ros at pittsburg to win?....come on man

re: Sandusky interview: "I have horsed around, showered, touched, but no sexual inte

Posted by BlackRaven on 11/15/11 at 1:00 am to Boosh Dag

anyone got a link on the interview?

re: what would the late "bo shem" or "bear bryant" say to jo pa?

Posted by BlackRaven on 11/11/11 at 7:02 pm to oOoLsUtIgErSoOo

:lol:

what would the late "bo shem" or "bear bryant" say to jo pa?

Posted by BlackRaven on 11/11/11 at 6:59 pm

imagine these 2 football gods "shining down" on jo pa while he is taking a big shite....what do they tell him

:popcorn:

:popcorn:

re: houston nutt or the mad scientist to penn st?

Posted by BlackRaven on 11/11/11 at 6:57 pm to mattz1122

mad scientist would fit in great there with his style.....

houston nutt or the mad scientist to penn st?

Posted by BlackRaven on 11/11/11 at 6:33 pm

:popcorn:

re: Mike McQueary placed on indefinite administrative leave

Posted by BlackRaven on 11/11/11 at 4:56 pm to la_birdman

we all have our opinions about mm.....i for one believe he should have reported to cops.....he went to jo pa.....and the story goes on yada yada....

if im mm......i sue the shite out of penn st....his life is basically over as a coach.....he will always be known with this ordeal......not defending him but im sure he will sue and win

if im mm......i sue the shite out of penn st....his life is basically over as a coach.....he will always be known with this ordeal......not defending him but im sure he will sue and win

re: Due to multiple death threats, McQueary will not coach on Saturday

Posted by BlackRaven on 11/10/11 at 8:58 pm to Festus

UNIVERSITY PARK, Pa. - Due to multiple threats made against Assistant Coach Mike McQueary, the University has decided it would be in the best interest of all for Assistant Coach McQueary not to be in attendance at Saturday's Nebraska game.

re: Man These Texas Fans!!!!!

Posted by BlackRaven on 11/10/11 at 1:34 pm to keithisreal

wut cause we got alittle luck for once?.....frick those losers..... :pimp:

re: How can the board fire Paterno...

Posted by BlackRaven on 11/10/11 at 1:21 pm to RollTide1987

joe pa was not capable of running a clean sports program at his age....his awareness and control was not there.....he got fired.....do u honestly think this gets by a nick saban or a miles? no....sandusky would have been under the jail yrs ago......there are obviously other things they know about joe pa that is being kept quiet

re: DA Associated with Sandusky Case Missing Since 2005

Posted by BlackRaven on 11/10/11 at 9:42 am to okietiger

maybe sandusky popped him.....

re: Things might get worse for PSU. Much, much worse.

Posted by BlackRaven on 11/10/11 at 9:31 am to safetyman

quote:now i see why he was ket there for so long.....no changes in athletic dept....can u imagine if they highered saban or miles there a couple of yrs back and they discovering this?...penn st money didnt want anyone in their to shake the trees...

Things might get worse for PSU. Much, much worse.I sure hope Joe Pa wasn't involved. With all of this.

re: what other info does the fbi have on jo pa?update(sandusky pimpin out kids)

Posted by BlackRaven on 11/10/11 at 9:03 am to BlackRaven

looks like a bigger coverup

re: Things might get worse for PSU. Much, much worse.

Posted by BlackRaven on 11/10/11 at 9:01 am to angryslugs

quote:evidently he had some kinda pull with high dollar people or mob...sandusky went unturned for yrs when people knew

Things might get worse for PSU. Much, much worse.Frankly this wouldn't surprise me too much. I've thought all along this has to be part of a bigger coverup. The people at PSU wouldn't go to these lengths to protect Sandusky only IMO.

re: HS Football State Champ Prediction

Posted by BlackRaven on 11/10/11 at 8:27 am to ItFliesItDies

5a acadiana

4a stm

3a st charles/patterson winner

2a curtis

1a west st john.....

4a stm

3a st charles/patterson winner

2a curtis

1a west st john.....

why TAXES may surge next yr........as per yahoo....

Posted by BlackRaven on 11/10/11 at 7:42 am

In a recent tax planning meeting with one of our clients, we shocked them with what their income tax future looked like for 2013 if Congress continues to do nothing to provide a long-term permanent set of tax laws (and it looks as if lawmakers are headed down this track).

They had no idea what tax breaks were expiring this year and next year, and how much it would cost them personally in extra income tax. But they aren't alone, many Americans and even tax professionals aren't aware that their tax bill could rise dramatically next year.

More from FoxBusiness.com:

• Telling the Kids About Financial Woes: How Much too Much?

• How Thieves Use Facebook to Steal Your Identity

• How to Know if Your Prescription Drugs are Counterfeit

These clients are your average American family and their situation is a good example of the law changes that will affect all of us. Here's their tax situation with a table summarizing the expiring tax laws that are scheduled to occur in 2011 and 2012.

Meet the Smiths: 26-year-olds Bill and Joan have been married for five years and have two young children. Bill earns about $65,000 a year in sales and Joan has gone back to work and earns about $35,000 annually. Bill owes quite a bit on his college student loans and will pay about $3,000 in interest on them in 2013. With Joan working again, they are paying $3,000 for year-round child care. Joan inherited some AT&T stock from her grandmother, which pays her $1,000 in dividends every year. Finally, counting home mortgage interest, they have about $20,000 in itemized deductions.

The first big change affecting the Smiths will be a combined increase in income tax rates, and a tightening of tax brackets as a result of the expiration of the Bush tax cuts. We estimate this will cost them $960 in 2013.

Bill will lose the complete deduction of his student loan interest in 2013, costing about $840. The pair's allowable deduction for child care will drop to $2,400 from $3,000, and they will also see their credit for children drop in half, costing another $1,000.

The marriage tax penalty will come roaring back to hit the Smiths in 2013, costing an estimated $500. The tax on their dividend income will go increase to $280 from $150, adding another $130. Finally, although we did not calculate the effect, without Congressional action to once again "fix" the alternative minimum tax, the Smiths could owe this ugly tax as well!

Luckily for the Smiths — but not for many Americans — other major changes for 2013, which do not personally affect them, include a phase out of itemized deductions and personal exemptions if their income starts to climb.

In summary, because of tax laws expiring this year and next, we estimate that the Smiths will owe $3,598 more in income tax in 2013 than in 2011 with no change in their income.

Major Individual Income Tax Benefits Expiring 12/31/2011:

• Personal tax credits applied against income tax no longer apply

• Higher alternative minimum tax exemptions revert back to extraordinarily-low thresholds

• $250 school teacher expense deduction ends

• Mortgage insurance premium deduction expires

• State and local sales tax deductions expire

• Tuition and related fees deduction end

• IRA to charity tax-free transfers stop

• 2% Social Security tax reduction ends

Major Individual Income Tax Benefits Expiring 12/31/2012:

• Marriage penalty equalization ends

• Dividends taxed at capital gains rates removed, taxed at regular rates now

• Capital gains low tax rates expires

• Removal of itemized deduction phase out for higher income Americans

• Removal of personal exemption phase out for higher income Americans

• Child care deduction limit of $3,000 reverts to $2,400

• Child credit reduces from $1,000 per child to $500 per child

• Low 10% tax bracket for low income Americans is eliminated

• Lower income tax rates and smaller brackets expires

• Refundable adoption credit and reduced deduction

• American Opportunity college education credit expires

• Major reduction in earned income credits and refunds

• Income tax exemption for debt forgiven on home foreclosures and repossessions

• Deduction for student loan interest ends

• Education IRA limit drops from $2,000 to $500

this sucks a bag of donkey dicks...... :banghead:

They had no idea what tax breaks were expiring this year and next year, and how much it would cost them personally in extra income tax. But they aren't alone, many Americans and even tax professionals aren't aware that their tax bill could rise dramatically next year.

More from FoxBusiness.com:

• Telling the Kids About Financial Woes: How Much too Much?

• How Thieves Use Facebook to Steal Your Identity

• How to Know if Your Prescription Drugs are Counterfeit

These clients are your average American family and their situation is a good example of the law changes that will affect all of us. Here's their tax situation with a table summarizing the expiring tax laws that are scheduled to occur in 2011 and 2012.

Meet the Smiths: 26-year-olds Bill and Joan have been married for five years and have two young children. Bill earns about $65,000 a year in sales and Joan has gone back to work and earns about $35,000 annually. Bill owes quite a bit on his college student loans and will pay about $3,000 in interest on them in 2013. With Joan working again, they are paying $3,000 for year-round child care. Joan inherited some AT&T stock from her grandmother, which pays her $1,000 in dividends every year. Finally, counting home mortgage interest, they have about $20,000 in itemized deductions.

The first big change affecting the Smiths will be a combined increase in income tax rates, and a tightening of tax brackets as a result of the expiration of the Bush tax cuts. We estimate this will cost them $960 in 2013.

Bill will lose the complete deduction of his student loan interest in 2013, costing about $840. The pair's allowable deduction for child care will drop to $2,400 from $3,000, and they will also see their credit for children drop in half, costing another $1,000.

The marriage tax penalty will come roaring back to hit the Smiths in 2013, costing an estimated $500. The tax on their dividend income will go increase to $280 from $150, adding another $130. Finally, although we did not calculate the effect, without Congressional action to once again "fix" the alternative minimum tax, the Smiths could owe this ugly tax as well!

Luckily for the Smiths — but not for many Americans — other major changes for 2013, which do not personally affect them, include a phase out of itemized deductions and personal exemptions if their income starts to climb.

In summary, because of tax laws expiring this year and next, we estimate that the Smiths will owe $3,598 more in income tax in 2013 than in 2011 with no change in their income.

Major Individual Income Tax Benefits Expiring 12/31/2011:

• Personal tax credits applied against income tax no longer apply

• Higher alternative minimum tax exemptions revert back to extraordinarily-low thresholds

• $250 school teacher expense deduction ends

• Mortgage insurance premium deduction expires

• State and local sales tax deductions expire

• Tuition and related fees deduction end

• IRA to charity tax-free transfers stop

• 2% Social Security tax reduction ends

Major Individual Income Tax Benefits Expiring 12/31/2012:

• Marriage penalty equalization ends

• Dividends taxed at capital gains rates removed, taxed at regular rates now

• Capital gains low tax rates expires

• Removal of itemized deduction phase out for higher income Americans

• Removal of personal exemption phase out for higher income Americans

• Child care deduction limit of $3,000 reverts to $2,400

• Child credit reduces from $1,000 per child to $500 per child

• Low 10% tax bracket for low income Americans is eliminated

• Lower income tax rates and smaller brackets expires

• Refundable adoption credit and reduced deduction

• American Opportunity college education credit expires

• Major reduction in earned income credits and refunds

• Income tax exemption for debt forgiven on home foreclosures and repossessions

• Deduction for student loan interest ends

• Education IRA limit drops from $2,000 to $500

this sucks a bag of donkey dicks...... :banghead:

Popular

4

4