- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Why are democrats so obsessed with restoring SALT deductions?

Posted on 12/18/18 at 1:58 pm to brian_wilson

Posted on 12/18/18 at 1:58 pm to brian_wilson

What was your business?

Posted on 12/18/18 at 1:59 pm to NIH

quote:

What was your business?

consulting.

Posted on 12/18/18 at 2:04 pm to brian_wilson

Businesses didn’t want to hear about the evils of capitalism from you? I’m shocked

Posted on 12/18/18 at 2:06 pm to NIH

quote:

Businesses didn’t want to hear about the evils of capitalism from you? I’m shocked

Naw. One of my clients offered me a lot of money to come on full time, I couldn't turn it down.

Posted on 12/18/18 at 2:10 pm to HailHailtoMichigan!

Does that $150,000 figure come from single and joint-filers? Because a $150,000 joint income may technically be in the top one fifth, but that's basically middle class income for New Yorkers and Californians. And contrary to popular belief, not everyone in those areas is a communist.

Say what you will about Dems but they're pretty consistent about wanting to tax truly wealthy people vs everyone else, at least with regard to income taxes. All bets are off with other taxes

Say what you will about Dems but they're pretty consistent about wanting to tax truly wealthy people vs everyone else, at least with regard to income taxes. All bets are off with other taxes

This post was edited on 12/18/18 at 2:13 pm

Posted on 12/18/18 at 2:13 pm to cahoots

It is single filers

A key thing to remember is that salt wasn’t completely scrapped

You can still deduct up to 10,000 dollars in SALT if you choose to itemize. That was an important safety valve amendment for middle class people in high tax states

A key thing to remember is that salt wasn’t completely scrapped

You can still deduct up to 10,000 dollars in SALT if you choose to itemize. That was an important safety valve amendment for middle class people in high tax states

This post was edited on 12/18/18 at 2:16 pm

Posted on 12/18/18 at 2:49 pm to HailHailtoMichigan!

I’ve never understood why the federal government should absolve you from one iota of your tax liability based on what you pay in lawful taxes owed to another entity.

Both state and federal governments need the tax revenue. They are not surrogates for each other

Both state and federal governments need the tax revenue. They are not surrogates for each other

Posted on 12/18/18 at 3:02 pm to cahoots

quote:

Does that $150,000 figure come from single and joint-filers? Because a $150,000 joint income may technically be in the top one fifth, but that's basically middle class income for New Yorkers and Californians. And contrary to popular belief, not everyone in those areas is a communist.

Say what you will about Dems but they're pretty consistent about wanting to tax truly wealthy people vs everyone else, at least with regard to income taxes. All bets are off with other taxes

The $10,000 cap should cover most middle class earners who take a SALT deduction.

This post was edited on 12/18/18 at 3:19 pm

Posted on 12/18/18 at 3:03 pm to B4YOU

quote:

“Mississippi received $2.13 for every tax dollar the state sent to Washington in 2015, according to the Rockefeller study. West Virginia received $2.07, Kentucky got $1.90 and South Carolina got $1.71.

Meanwhile, New Jersey received 74 cents in federal spending for tax every dollar the state sent to Washington. New York received 81 cents, Connecticut received 82 cents and Massachusetts received 83 cents.”

These NE states with high taxes receive the least money returned per federal tax dollar paid.

It’s not a lie. Find a creditable source stating otherwise.

This is a lie. You did not link a creditable source on this issue. The AP wants you to believe it.

ETA: I bookmarked my response to this elementary line of reasoning previously because I know some idiot is going to spout this nonsense every single year. LINK

quote:

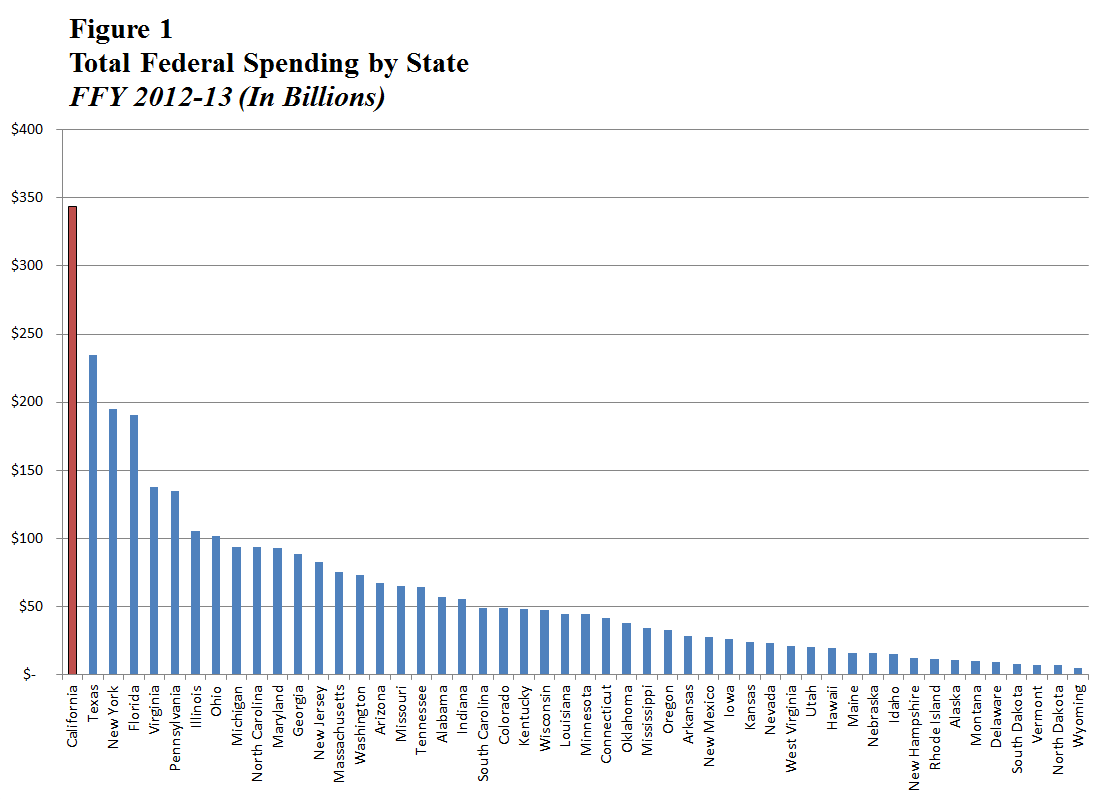

Here are the federal spending numbers, by state, for FY 2010. I didn't spend time looking for a more recent comparison by dollar amount, but I doubt it has changed much. Are you going to pretend the $333B spent in California means they are less dependent on the federal government than Alabama, where only $56.5B was spent, because of "percentage of state general revenue?"

Image is from this article from California's Legislative Analyst's Office.

If you actually do think Alabama is more dependent on the federal government than California, then the question has to be this: What would happen, in Alabama, if the federal government stopped funding Medicaid, and, as a result, stopped forcing the state to pay for Medicaid, which is the largest use of federal funds, after defense spending, in this state (Source: Alabama's 2015 CAFR)? Do you think we would keep Medicaid spending at the same level (or at all)? What about other government-mandated programs? If the federal government were to suddenly stop mandating and funding all federal programs administered by the states, do you truly believe Alabama would have a harder go of it than California? Or are you simply claiming Alabama should raise its tax rates simply to make your "dependency chart" look "better" for the state? All I see is a state, in California, that is over-taxing its citizens.

Are you smart enough to realize that most of that "dependency" is merely federal government-mandated programs administered by the states and funded by the federal government?

The above quote applies pretty much every single time some fool brings up this nonsense argument being fed to you by leftist tools. Use your dang head and a little bit of common sense. This isn't difficult math. "Per capita" numbers mean nothing, and telling me how much my state is forced to spend on Medicaid means little to nothing to me. We didn't want that federal albatross that started the meteoric rise in healthcare costs. It was forced on us. You can't force us to spend federal money and then pretend we're "takers" because you did.

This post was edited on 12/18/18 at 3:14 pm

Posted on 12/18/18 at 3:48 pm to imjustafatkid

It was a good enough source for Fox Business.

LINK

Also, per capita dollars in vs dollars out matters. It’s simple math anyone with a checking account can understand.

LINK

Also, per capita dollars in vs dollars out matters. It’s simple math anyone with a checking account can understand.

Posted on 12/18/18 at 4:52 pm to B4YOU

Move out of areas with high COL and taxes then. Problem solved

Posted on 12/18/18 at 5:09 pm to B4YOU

quote:

per capita dollars in vs dollars out matters.

I just showed you why it doesn't. Do better.

ETA: In terms of federal spending by state, how likely the state would be able to survive without the funding is far more important. Most red states are far better off in this regard.

This post was edited on 12/18/18 at 5:11 pm

Posted on 12/18/18 at 6:34 pm to HailHailtoMichigan!

Because the limousine liberals in their states are howling about it.

Posted on 12/18/18 at 6:42 pm to imjustafatkid

quote:

You can't force us to spend federal money and then pretend we're "takers" because you did.

Absolutely agreed.

Philosophicaly, I don’t like SALT. It allows places like California to tax their residents at otherwise unsustainable rates. It pays for their intrusive government, and it does so at our expense. Someone is making up for that lost revenue, and it’s us.

This post was edited on 12/18/18 at 6:52 pm

Popular

Back to top

1

1