- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Questions about a federal fair tax.

Posted on 6/18/24 at 2:57 pm to SlowFlowPro

Posted on 6/18/24 at 2:57 pm to SlowFlowPro

quote:

who say they're for it, don't realize they will ultimately pay more in taxes.

How so?

Posted on 6/18/24 at 3:02 pm to SlidellCajun

quote:

The material is taxed at point of purchase which aggregates toward the whole cost of the house. There isn’t another tax at closing so the levy is once when materials are bought

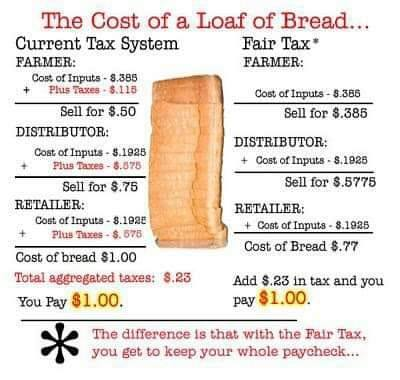

I believe this is incorrect. The house is taxed. Raw materials are not taxed. The materials add to the cost of the finished product, but they are not taxed twice.

A loaf of bread is taxed at the grocery store. The wheat, butter, yeast, packaging, etc, are not taxed. The end product is.

Posted on 6/18/24 at 3:06 pm to DavidTheGnome

quote:

Poor people who are just barely scraping by and currently have to spend every dime they make just to survive. They would be disproportionately negatively impacted by this so calling it a fair tax is a bit of a misnomer.

Okay. I'll bite. How the hell did you come to that conclusion?

Posted on 6/18/24 at 3:07 pm to DavidTheGnome

quote:

Not true, it disproportionately impacts the people who can least afford it. Shifting the burden from the people who can to the people who can’t. If passed either a massive increase in welfare would be required simply for the bottom to be able to exist or there’d be mass chaos/thefts followed by I’d imagine revolution. When people can’t even survive as it is currently the last thing they feel like hearing is the people who can whining they don’t pay enough (enough of what?).

You understand that you are telling us that you don't understand The Fair Tax, right?

Posted on 6/18/24 at 3:11 pm to DavidTheGnome

quote:

In the case of your mother she would be paying alot more in taxes if implemented since every time she makes a purchase or consumes something she's taxed.

Again, how do you figure.

Let's say she has $10K in revenue (plus SS). Let's say the standard deduction is $15K, so she doesn't pay any taxes because her income is less than the standard deduction. Well, guess what? She doesn't pay taxes with The Fair Tax, either. With the prebate, she won't pay the sales tax, either. So explain how she will pay "alot more in taxes"? I'll wait.

Posted on 6/18/24 at 3:21 pm to DavidTheGnome

quote:

I keep hearing no IRS but who do people send all the new sales taxes to? Just mail it to the Treasury and say here ya go? Or would it be revenue internal to the government that needs a service to collect it?

Congratulations - you got through the prebate tax thing and seem to understand it, I think.

You, as a consumer won't have to worry about the IRS, which goes away. A new government agency would be created, which would be the collection mechanism for all of the retail businesses that sell products to retail consumers. Unless you own a retail business, you will no longer have to worry about the government tax authority.

The sole tax mechanism would be the exact same type of system thag most states use to collect sales tax. In fact the federal government can just piggy back on the states systems already in place, so there won't be any complicated changes needed.

This eliminates the payroll taxes like FICA/Medicare/Medicaid, corporate taxes, and the thousands of different taxes on products that have a thousand different agencies that are formed just to collect a small tax on broccoli, or whatever. Did you know that there are some taxes on the books where the cost of compliance or the cost of collection are higher than the revenue generated? Why would we even have that kind of tax on the books at all? Government efficiency...

We can save hundreds of billions in costs of compliance and collection by going with the fair tax.

Posted on 6/18/24 at 3:24 pm to DavidTheGnome

quote:

Okay I consulted your image and it shows the end consumer paying the tax. Where do you get the minus 23% from? If it's a consumption tax it's levied when something is consumed. Currently his mom pays no taxes, she would when she has to pay taxes on everything she consumes.

Somebody replied to your post telling you about the prebate just two posts above this one.

Please, do some research. You obviously don't understand it, and spreading all of the misinformation that you are spreading does no good.

Posted on 6/18/24 at 3:30 pm to DavidTheGnome

quote:

I don't have a hatred of the income tax other than we let the code itself get far too convoluted.

By design. Biden's changes are going to make it even more convoluted than ever.

Also, the prebate doesn't just go to people with income below the poverty line. The prebate goes to EVERY household, so NOBODY pays taxes on goods up to the poverty line.

In addition, if you are poor, you can purchase goods used (something that poor people tend to do, anyway, and pay no taxes on the used items, so the prebate is a bonus, since you aren't paying taxes with it.

Posted on 6/18/24 at 3:34 pm to VoxDawg

quote:

The boo-birds often attempt to understate just how smooth of a transition this would be for average Americans. Folding in the entire cash/shadow economy, foreign visitors' spending, etc is massive.

And all of this is going to be organic and voluntary, not because our Congress passed some piece of punitive legislation that forces you to do something you don't want to do.

Posted on 6/18/24 at 3:38 pm to DavidTheGnome

quote:

we let the code itself get far too convoluted

That's because people started to use it for social engineering instead of a revenue system.

Posted on 6/18/24 at 3:49 pm to moneyg

quote:

despite SFPs declaration otherwise, is about 2.2T.

No. the Fair Tax also replaces corporate taxes and other government revenue streams, not just income taxes.

I don't think homes are considered part of "retail" numbers, currently. I think their are other products, like medicines and other services that are not considered "retail".

Posted on 6/18/24 at 3:51 pm to Red Stick Rambler

quote:Yes, but not configured on an exclusive basis the way that you are thinking in terms of a state sales tax.

So a national sales tax?

Right now almost a quarter of everything that you're paying at the retail point of sale are embedded corporate income taxes that are passed along the distribution chain and ultimately paid by the consumer. The fair tax would replace those embedded corporate income taxes for a net change of pretty much nothing compared to what you're used to paying at the register.

Obviously there are some recency bias when it comes to prices given the runaway inflation

Posted on 6/18/24 at 4:03 pm to Jorts R Us

quote:

here is simply no evidence backing up your assertion that the compliance burden on businesses is lessened even in European jurisdictions that have gone more VAT than income tax heavy.

If a business is not a retail business (a farmer, for example), they wouldn't have to deal with the IRS.

Let's take a business that IS a retail business, like Amazon. Currently Amazon has to collect sales taxes for all states that have a sales tax, AND report their income/profit, etc. A company like Amazon probably pays millions of millions to lawyers who generate all of the government mandated tax forms that are required to do businessi in the US, invest in the US, use tax shelters in the US, etc. They have hundreds of meetings to discuss revenue and profits and how to infest those profits in order to maximize the tax benefits. Do they pay a dividend, do they invest in infratstructure, do they give out bonuses, do they cut product lines, do they lay off employees, do they raise/drop prices, etc.

Now corporations can focus on making money and increasing market share without worrying about tax liabilities.

Okay, that may not be "evidence", but it should make sense, no?

Posted on 6/18/24 at 4:12 pm to VoxDawg

quote:

That's a solid point. I'd have to do a little more digging to see why HR 25 has the repeal of the 16A baked in as a prerequisite.

I'm pretty sure that it is to satisfy the people who fear us going to the European model where they have both a sales tax AND an income tax. At some point, people in Congress are going to miss the power that an income tax gives them and want to reimplement it. Especially people who want to make the system more progressive.

Posted on 6/18/24 at 4:14 pm to TigerVespamon

quote:

It would generate more revenue because the 50 or so percent that don’t pay any income tax would have to pay their share. Those same POS would be against it. Anymore questions?

Gee, look. Another person who knows nothing about the Fair Tax chimes in to prove it.

Posted on 6/18/24 at 4:25 pm to Jorts R Us

quote:

I challenged your assertion that compliance costs go away (you didn't say reduced).

Okay, let's say you win this point. Compliance costs go away completely for consumers who don't own retail businesses (the vast majority of people, by the way). Compliance costs are REDUCED significantly, for corporations.

Isn't that enough? Do you have to split hairs over "reduced" vs "eliminated" when 150+ million people will no longer have to pay $150 bucks for Turbo Tax (or pay big bucks for an accountant to do them), spend 20 hours doing their taxes, saving receipts in a shoe box in case they are audited, paying quarterly taxes, filling out 1099 forms, and then worry whether or not they are going to get audited for the next 7 years? That is enough in it's own self, no?

And why are you so worried about whether a corporation has only "reduced" vs "eliminated" burden of compliance? Is that the hill you want to die on? "Well, Vox said Amazon would have no burden of compliance, but they still have 10% of what they had before, so he's WRONG!"?

Some people will cut off their nose to spite their face.

The Fair Tax is not perfect, but it is waaaaaaaaaaay better than our current system.

Posted on 6/18/24 at 4:33 pm to Jax-Tiger

It's been my experience that 90% of arguments against the NRST come from deliberate misrepresentation of the bill (like the GHWB commission in 2005 that said the tax would need to be 49% to match government spending in the middle of the post-9/11 overreach era) or picking some minute detail like compliance (that barely impacts a fraction of the fraction of the population whose businesses sell retail but aren't big corporations) or disingenuousness pearl-clutching about what happens to the accountants at H&R Block when no one needs to file an annual tax return.

At this point, it would take a lot to shock me from the FairTax concernfags.

At this point, it would take a lot to shock me from the FairTax concernfags.

Posted on 6/18/24 at 4:38 pm to VoxDawg

Vox - I appreciate your taking this fight to them. I do have one bone to pick. The Fair Tax has to generate revenue, so by default, the tax rate for the Fair Tax must be higher than the embedded taxes currently in the product, or the Tax will not generate any revenue. To be revenue neutral, the Fair Tax has to cover the embedded costs + the income/payroll taxes - the costs of corporate compliance.

If we eliminate the income and payoll taxes, the cost of goods must go up. I understand that we will save some money by eliminating the compliance costs, cost of collection, and IRS, but we still have to generate some revenue. If we eliminate our income tax AND the costs of goods stays the same, then where is our tax revenue coming from? It can't just be from embedded taxes.

I have not doubt that the price of some products will stay the same or close to the same as before, but the price of most products will go up. They have to.

If we eliminate the income and payoll taxes, the cost of goods must go up. I understand that we will save some money by eliminating the compliance costs, cost of collection, and IRS, but we still have to generate some revenue. If we eliminate our income tax AND the costs of goods stays the same, then where is our tax revenue coming from? It can't just be from embedded taxes.

I have not doubt that the price of some products will stay the same or close to the same as before, but the price of most products will go up. They have to.

This post was edited on 6/18/24 at 4:41 pm

Popular

Back to top

0

0