- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Predict the market drop/rise after tomorrow’s jobs report

Posted on 2/4/22 at 8:05 am to JJJimmyJimJames

Posted on 2/4/22 at 8:05 am to JJJimmyJimJames

quote:so good news is bad news. clown world

it fell to 34688

-450 dow

Posted on 2/4/22 at 8:06 am to UncleFestersLegs

Two ways to interpret it.

One, they predicted it would fall so stocks benefitting from a fall fell while stocks benefitting from an increase rose.

Two, no one believes any of this shite is backed up by data and that the numbers are far worse than reported.

One, they predicted it would fall so stocks benefitting from a fall fell while stocks benefitting from an increase rose.

Two, no one believes any of this shite is backed up by data and that the numbers are far worse than reported.

Posted on 2/4/22 at 8:06 am to UncleFestersLegs

People in the investment game tend to know a lot more about the economy than people who aren’t. They know the house is on fire around them. Ridiculous propaganda won’t change that

Posted on 2/4/22 at 8:07 am to UncleFestersLegs

And just like that, the jobs report is way better than expected. Instead of a 300,000 jobs lost, it's a 467,000 gain. Are these jobs reports even remotely close to real numbers?

Posted on 2/4/22 at 8:13 am to AirbusDawg

I seriously doubt it.

This is an administration which gamed GDP numbers by shutting down ports until the quarter numbers closed so they didn’t have to count all the imports waiting to be offloaded as part of the quarter.

This is an administration which gamed GDP numbers by shutting down ports until the quarter numbers closed so they didn’t have to count all the imports waiting to be offloaded as part of the quarter.

Posted on 2/4/22 at 8:16 am to AirbusDawg

quote:

And just like that, the jobs report is way better than expected. Instead of a 300,000 jobs lost, it's a 467,000 gain. Are these jobs reports even remotely close to real numbers?

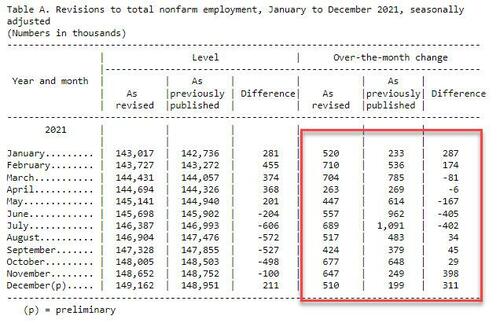

BLS also revised December payrolls from 199K to 510K. November was revised from 249K to 647K. 709K higher over 2 months. So covid 2021 never happened with every month averaging 500k. Amazing. We are (were) saved!

Posted on 2/4/22 at 8:34 am to JJJimmyJimJames

My observation is that jobs numbers usually dont have the impact on markets that last.

The market followed technical indicators last night and this morning

The news that DOES/can impact markets is Federal Reserve news of interest rates, manipulations, and what was said by Fed governors about their actions

The market followed technical indicators last night and this morning

The news that DOES/can impact markets is Federal Reserve news of interest rates, manipulations, and what was said by Fed governors about their actions

Posted on 2/4/22 at 8:36 am to JJJimmyJimJames

quote:So the probability of hikes goes up and the market pukes from withdrawal of the punch bowl. Ill believe it when i see it

The news that DOES/can impact markets is Federal Reserve news of interest rates, manipulations, and what was said by Fed governors about their actions

Posted on 2/4/22 at 11:31 am to UncleFestersLegs

Interesting to see the revised numbers. Some months the report jobs vs the revised numbers are off by a crazy amount. The take away, jobs reports are full of shite. They are reported to help a presidents poll numbers.

Posted on 2/10/22 at 7:42 am to JJJimmyJimJames

quote:like the CPI (consumer price index) did this morning...

The news that DOES/can impact markets is Federal Reserve news of interest rates, manipulations, and what was said by Fed governors about their actions

came in at 7.5% off of forecast 7.3% - dow futures dropped 250 points in 15 minutes

again, interest rates and expectations of rates move markets

Posted on 2/10/22 at 7:43 am to Eli Goldfinger

I don’t think the market really tanks until interest rates begin to rise.

Posted on 2/10/22 at 7:47 am to oklahogjr

quote:Not hedging are you?

May move for other reasons though

Popular

Back to top

3

3