- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 6/9/24 at 9:41 pm to MrLSU

Posted on 6/10/24 at 9:51 am to Iowa Golfer

quote:

Exchange guarantees the counter party risk. I saw it mentioned on here the market makers do this. I don’t believe this is accurate. I could be wrong, and I’m willing to learn if I’m wrong.

eta. I posted exchange, it’s probably OCC.

Yes, with (exchange traded) options and certain other derivatives, it’s the OCC that acts as a guarantor and clearing agent.

The OCC does not provide liquidity. That’s the function of market makers. And market makers don’t seek to take on additional risk in order to “manipulate” the underlying’s price one way or another, as some here seem to mistakenly believe. Market makers make their profits from the bid/ask spread, and almost instantly hedge their risk, once a long or short options trade is executed, by buying or selling an equal number of shares or contracts in the underlying. A market maker’s goal is to maintain a net neutral position… not to be net long or short.

Now, what market makers will often do, especially with more thinly traded or more volatile underlyings or strikes, is expand the bid ask spread. If one wants clear evidence of this, simply look at the bid/ask spreads on the 6/14 AAPL 195 (ATM) put or call (.03-.05) and then look at spreads on the 6/14 GME 28 (ATM) put or call (.10-.15).

Posted on 6/10/24 at 10:25 am to Jag_Warrior

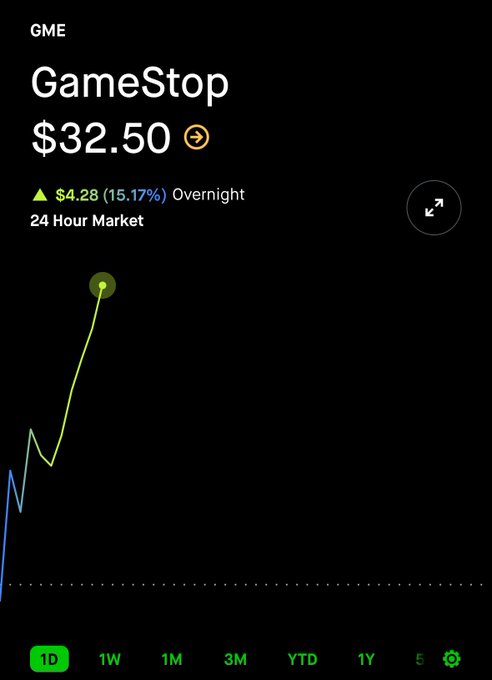

Open interest for those $20 calls expiring June 21 is still massive at 152k contracts but the bid has been sinking all morning.

Volume is currently at 5700 so Kitty could have well over a million in profit if that was him selling but he needs a catalyst to keep what he's got in the money, especially considering the liquidity he'll need to unload his position. The Joker meme didn't do it.

Volume is currently at 5700 so Kitty could have well over a million in profit if that was him selling but he needs a catalyst to keep what he's got in the money, especially considering the liquidity he'll need to unload his position. The Joker meme didn't do it.

Posted on 6/16/24 at 1:25 pm to DJ3K

quote:

maybe he is showing how he made a boat load of money for other traders to use on other stocks when the market continues on as normal and nothing changes.

Use the same strategy going forward elsewhere =stock market dies

The stock market dies because of what… and uh, how???

This post was edited on 6/16/24 at 1:27 pm

Posted on 7/6/24 at 9:34 am to kung fu kenny

kung fu kenny:

Jag_Warrior:

I don’t know if you followed through with this idea, but for fun, I tried to keep following this long put (paper) trade. From the 5.50 entry point that I mentioned above, it could have been closed at roughly 5.82 at the July 5 expiration on Friday. Although I didn’t track it daily, I did note that while it still had some time value/theta, it reached $11.13 a week or two ago. So yes, this would have had a 100%+ return earlier on, and even by the expiration would have still been profitable.

quote:

I am thinking about playing a put about a month out back around $30. Do y’all think this is going to drop back down like always? Or is it dumb to play with fire. Just seems a little too easy.

Jag_Warrior:

quote:

So if you’re buying a 30 strike put with a July 5 expiration, as of yesterday’s close, you’d pay about $550 for it.

I don’t know if you followed through with this idea, but for fun, I tried to keep following this long put (paper) trade. From the 5.50 entry point that I mentioned above, it could have been closed at roughly 5.82 at the July 5 expiration on Friday. Although I didn’t track it daily, I did note that while it still had some time value/theta, it reached $11.13 a week or two ago. So yes, this would have had a 100%+ return earlier on, and even by the expiration would have still been profitable.

Popular

Back to top

1

1