- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Spinoff On Roth vs 401K

Posted on 2/3/20 at 4:45 pm

Posted on 2/3/20 at 4:45 pm

I just want to get the MBs opinion on what I’m currently doing for retirement. I need some feedback please.

If I continue on this path, what am I looking like when it comes time to retire? I feel like we are way behind the 8-ball with this.

If I continue on this path, what am I looking like when it comes time to retire? I feel like we are way behind the 8-ball with this.

This post was edited on 2/5/20 at 4:31 am

Posted on 2/3/20 at 4:51 pm to sonoma8

quote:

we made $195k total

quote:

401ks from our last jobs into a Roth. It currently has $180k invested through RJ.

quote:

Im 36, shes 34, 2 kids

quote:

I feel like we are way behind the 8-ball with this.

Do you really feel this way?

Posted on 2/3/20 at 4:53 pm to bstew3006

I asked for an honest opinion. I feel like we are not putting up enough.

Posted on 2/3/20 at 8:26 pm to sonoma8

I think it's good that you both put about 9% of your salary into your 403b.

Are you both teachers? If so, do you have other retirement vehicles?

You say you have normal bills, but that's all relative. Do you have a $700,000 house note and a Platinum truck or truly reasonable bills?

Are your kids in affordable daycares/school or is it like New Orleans where PK-4 is $16,000 and regular grades are +/-$20,000?

What are your plans for the $2k/month you save? Is that your E-fund, vacation money, or what?

Are you both teachers? If so, do you have other retirement vehicles?

You say you have normal bills, but that's all relative. Do you have a $700,000 house note and a Platinum truck or truly reasonable bills?

Are your kids in affordable daycares/school or is it like New Orleans where PK-4 is $16,000 and regular grades are +/-$20,000?

What are your plans for the $2k/month you save? Is that your E-fund, vacation money, or what?

Posted on 2/4/20 at 4:24 am to TheWiz

quote:

Are you both teachers? If so, do you have other retirement vehicles?

Kids are out if daycare now. We are lucky to live around one of the better public school systems in LA. Which doesnt say much.

Id say 75% of that $2k is for efund, the rest it vacation.

This post was edited on 2/5/20 at 4:32 am

Posted on 2/4/20 at 6:24 am to TheWiz

quote:

As of this past year, we made $195k total.

quote:

Are you both teachers?

Posted on 2/4/20 at 8:12 am to mylsuhat

To clarify, my wife is a physician but she also teaches Med Students, Residents, and Fellows. By default she is a teacher too and eligible for a 403b (higher ed), 457 (state employee), and TRSL (state teacher's pension).

That's why I asked when I saw the 403b.

That's why I asked when I saw the 403b.

Posted on 2/4/20 at 8:23 am to sonoma8

I'll take a flier here and see if I can help figure this out.

You guys make $195,000 - $18,000(403b) = $177,000

Assuming 30% to taxes, that's $123,900

After $30,000 to your mortgage and car notes that's $93,900.

After the $24,000 e-fund/vacation fund that's $69,900.

I'm gonna go out on a limb here and assume all of your other bills are around $5,000/month.

So that leaves you with just under $10,000 a year to spread into some other retirement accounts. I would personally throw $4,500 each into a Roth IRA. You guys are right at the threshold for income limits, so I think you need to backdoor money into your Roth IRA.

At what point will the coffers be sufficient enough for your e-fund? Once you determine that, and set a goal, you might be able to adjust your retirement contributions one way or the other.

You guys make $195,000 - $18,000(403b) = $177,000

Assuming 30% to taxes, that's $123,900

After $30,000 to your mortgage and car notes that's $93,900.

After the $24,000 e-fund/vacation fund that's $69,900.

I'm gonna go out on a limb here and assume all of your other bills are around $5,000/month.

So that leaves you with just under $10,000 a year to spread into some other retirement accounts. I would personally throw $4,500 each into a Roth IRA. You guys are right at the threshold for income limits, so I think you need to backdoor money into your Roth IRA.

At what point will the coffers be sufficient enough for your e-fund? Once you determine that, and set a goal, you might be able to adjust your retirement contributions one way or the other.

This post was edited on 2/4/20 at 8:24 am

Posted on 2/4/20 at 8:24 am to sonoma8

I would say you need to get to 15% of your salaries ASAP at a minimum. Put it in whatever tax advantaged vehicles you have access to. But the pretax amounts I would be putting into retirement in your situation would be around $30k/yr ignoring any company matches.

Posted on 2/4/20 at 8:36 am to sonoma8

quote:

If I continue on this path, what am I looking like when it comes time to retire?

Does your RJ guy not have planning services?

quote:

I feel like we are way behind the 8-ball with this

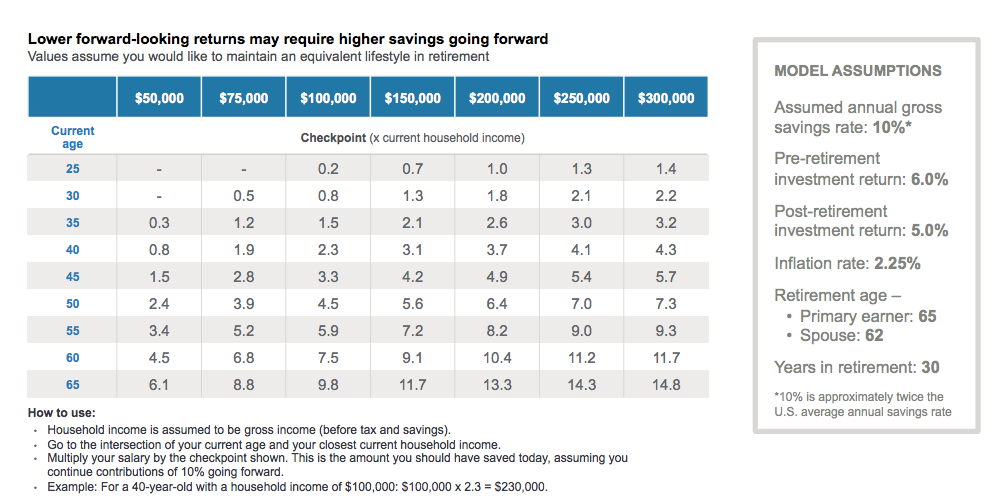

Here is a conservative and very basic checkup.

Posted on 2/4/20 at 8:39 am to TheWiz

quote:

So that leaves you with just under $10,000 a year to spread into some other retirement accounts. I would personally throw $4,500 each into a Roth IRA. You guys are right at the threshold for income limits, so I think you need to backdoor money into your Roth IRA.

A) assuming there is health insurance that has to come out of that gross, $10k is optimistic

B) once the health insurance comes out, their AGI is likely under the limit so no backdoor necessary.

Posted on 2/4/20 at 8:41 am to TheWiz

Thanks guys. Like I said, we are planning on doubling up on our Roth contributions at the end of the year. So that will help. Im going to tweak our finances and see if I can add a few more % to my 403B. What would be a safe Efund amount? 3 months of bills?

Posted on 2/4/20 at 10:38 am to sonoma8

If you have a RJ advisor, you should ask her/him. You're paying him or her for this very thing.

Obviously this board is free and has alot of good advice, but you are already paying for advice elsewhere. If you aren't getting it, you should address that problem.

Obviously this board is free and has alot of good advice, but you are already paying for advice elsewhere. If you aren't getting it, you should address that problem.

Popular

Back to top

4

4