- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Options Trading Thread

Posted on 12/8/22 at 9:14 pm to Jag_Warrior

Posted on 12/8/22 at 9:14 pm to Jag_Warrior

Sold cover OKTA strike $63

Currently $63 and change so will probably lose stock for the first time.

Was just trying to lower basis

Currently $63 and change so will probably lose stock for the first time.

Was just trying to lower basis

Posted on 12/8/22 at 11:47 pm to thelawnwranglers

When does the call expire?

Are you familiar with how to execute a roll? Depending on the situation and pricing, you might consider rolling the option out (expiration date) at the same strike or maybe out and up (date and strike price) IF you can do it for a net credit.

Just something to consider if you want to buy yourself some more time and possibly keep the stock.

Are you familiar with how to execute a roll? Depending on the situation and pricing, you might consider rolling the option out (expiration date) at the same strike or maybe out and up (date and strike price) IF you can do it for a net credit.

Just something to consider if you want to buy yourself some more time and possibly keep the stock.

Posted on 12/9/22 at 8:00 am to Jag_Warrior

quote:

When does the call expire?

Are you familiar with how to execute a roll? Depending on the situation and pricing, you might consider rolling the option out (expiration date) at the same strike or maybe out and up (date and strike price) IF you can do it for a net credit.

Just something to consider if you want to buy yourself some more time and possibly keep the stock.

Expire today but I think PPI is about to kill them

I am okay if it gets called I think. We are bumping along bottom but don't feel like I have to be in market

Got greedy - if I can pull weekly $100-200 on covered call over year free stock. I know it won't last that long though.

Good advice on rolling basically I just sell further out and use proceeds to cover buy to close?

Posted on 12/9/22 at 8:55 am to thelawnwranglers

Lol I guess not - kind of interesting I can roll one week at same underwater price and make another 2% on trade

Seems worth it

Seems worth it

Posted on 12/9/22 at 11:34 am to thelawnwranglers

quote:

Good advice on rolling basically I just sell further out and use proceeds to cover buy to close?

Well, the reverse of that. I’m not sure which platform you’re using. On Think or Swim, I just select roll and then decide what strike and date I want for the new option series. It’s done as a simultaneous series of transactions.

But if you have to enter the trade manually, you’d FIRST buy to close the short calls you have now (so you wouldn’t be considered naked on any new short calls - your brokerage might reject that order unless you’re approved for that) and then immediately sell to open the new ones (in that order).

And of course, your net credit (or debit) is calculated from the net proceeds from the original sell to open, minus the net cost of the buy to close and finally plus the net proceeds from the new sell to open.

I’m not sure what your cost basis is or what price you’d be content with, but I just took a look at the 12/23 expiration 66 strike call for OKTA. Midpoint pricing for that call is around $2.87 now. It would cost you about $1.85 to buy back the 63 call that you’re short. I don’t know what you originally sold it for, but that’s an automatic credit, no matter what. And you have the potential of picking up another $3/share.

Posted on 12/9/22 at 12:08 pm to Brobocop

Another winner today on the 0DTE Synthetic Strangle. +$144

Now +$75 for the month of Dec, despite the $445 loss Tuesday.

Now +$75 for the month of Dec, despite the $445 loss Tuesday.

This post was edited on 12/9/22 at 12:09 pm

Posted on 12/9/22 at 4:45 pm to Jag_Warrior

quote:

I’m not sure what your cost basis is or what price you’d be content with

I bought in September at $60.76

Just two weeks ago realized why not covered calls. As long as I make money on combined I don't really care. Net of my last two weeks of options play lowered my basis to $58.15. So basically up 10% since September.

So 200 shares at total cost $12k in a year those shares are free if I can continue to generate $200 a month.

I am sure there is a downside somewhere but good live action to get toe wet in options

Posted on 12/10/22 at 8:02 am to thelawnwranglers

90 dollar puts for 20 Jan on RXDX. overbought with outrageous offering price. Bio company moving into 3rd phase of testing that could last years.

Posted on 12/10/22 at 10:35 am to CajunTiger78

quote:

90 dollar puts for 20 Jan on RXDX. overbought with outrageous offering price.

Just a heads up.

Put spread will reduce your risk.

Buy to open Jan 20 put @ $90 for 4.50

Sell to open Jan 20 put @ $80 for 2.55

Total debit of $1.95

Spread of 10.

This gets you a 5 bagger at $80 at exp.

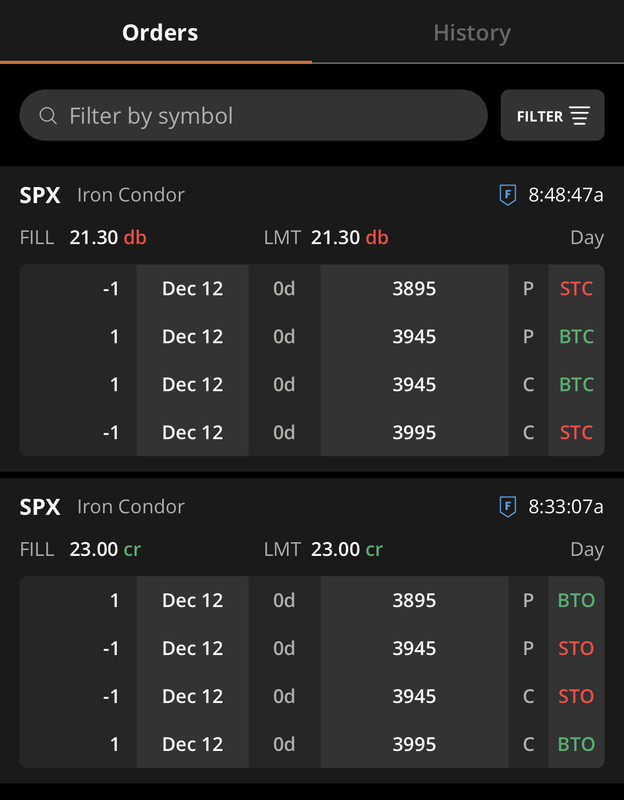

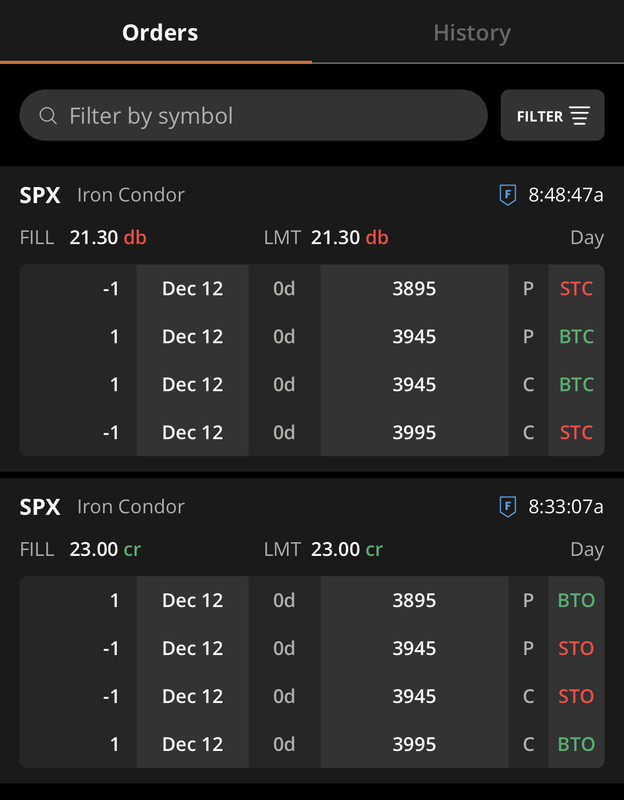

Posted on 12/12/22 at 9:27 am to Brobocop

+$170 on a 0DTE I.F. in 15 minutes.

Posted on 12/13/22 at 8:58 am to Jag_Warrior

Another 0 DTE Iron Fly winner this morning. +$1.55

STO 4095 C/P

BTO 4045 P

BTO 4145 C

$32.35 Cr.

Bought back 17 minutes later for $30.80.

Trade Strategy Breakdown:

Sell an Iron Fly with 50pt wide wings immediately at open.

Set a limit order for $1.50 less than credit received.

Stops are managed manually. I set alerts for SPX at opening strike + credit received up/down. Once those alerts trigger, I manually close the trade for a loss, no questions asked. No emotions. Take the loss and move on.

i.e. Opened today's trade at SPX=4095. I would close the trade for a small loss if SPX broke 4063 (4095-32) or 4127 (4095+32).

STO 4095 C/P

BTO 4045 P

BTO 4145 C

$32.35 Cr.

Bought back 17 minutes later for $30.80.

Trade Strategy Breakdown:

Sell an Iron Fly with 50pt wide wings immediately at open.

Set a limit order for $1.50 less than credit received.

Stops are managed manually. I set alerts for SPX at opening strike + credit received up/down. Once those alerts trigger, I manually close the trade for a loss, no questions asked. No emotions. Take the loss and move on.

i.e. Opened today's trade at SPX=4095. I would close the trade for a small loss if SPX broke 4063 (4095-32) or 4127 (4095+32).

This post was edited on 12/13/22 at 9:02 am

Posted on 12/14/22 at 9:22 pm to Brobocop

Thank you, Mr. Powell. I was having to keep a watchful eye on the short call side of some of my 12/16 SPX synthetic strangles, but as you spoke, the premiums sank like the Titanic. As long as no goblins appear during Triple Witching hour on Friday, I’ll just let them all expire worthless.

While the market was still up and IV was healthy (pre Powell speech), also put on a couple more short SPX syn. strangles (4190/3770) for next week’s expiration at $8.10/contract. Current pricing is $3.85.

While the market was still up and IV was healthy (pre Powell speech), also put on a couple more short SPX syn. strangles (4190/3770) for next week’s expiration at $8.10/contract. Current pricing is $3.85.

This post was edited on 12/14/22 at 9:27 pm

Posted on 12/14/22 at 9:24 pm to Brobocop

quote:

Stops are managed manually. I set alerts for SPX at opening strike + credit received up/down. Once those alerts trigger, I manually close the trade for a loss, no questions asked. No emotions.

I meant to ask you before if you trade throughout the day with this and also other strategies?

Posted on 12/14/22 at 9:33 pm to Jag_Warrior

quote:

Thank you, Mr. Powell

Weak he couldn't stop Okta

Rolled another week 12/23 to 68 calls (closed $70.91)

Will probably let them go

This post was edited on 12/14/22 at 9:49 pm

Posted on 12/14/22 at 10:19 pm to thelawnwranglers

quote:

Rolled another week 12/23 to 68 calls (closed $70.91)

Will probably let them go

As long as you can keep rolling for a net credit, why not just keep rolling up and out?

BTW, you’ve done well with OKTA, haven’t you?

Posted on 12/14/22 at 10:33 pm to Jag_Warrior

quote:

BTW, you’ve done well with OKTA, haven’t you?

Yep- good point just keep rolling

Posted on 12/15/22 at 10:59 am to thelawnwranglers

not a good day for iron condors today, yeesh!

Posted on 12/15/22 at 1:14 pm to GeneralLee

quote:

not a good day for iron condors today, yeesh!

Nope! Stopped today. -$275.

This post was edited on 12/15/22 at 1:15 pm

Posted on 12/15/22 at 2:11 pm to Brobocop

Which short put strike did you have today?

Popular

Back to top

1

1