- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Options Trading Advice

Posted on 3/10/22 at 8:17 pm

Posted on 3/10/22 at 8:17 pm

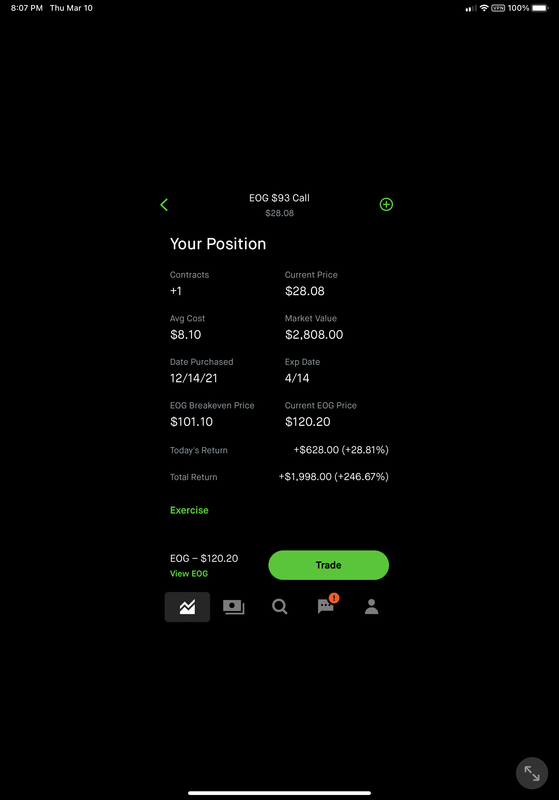

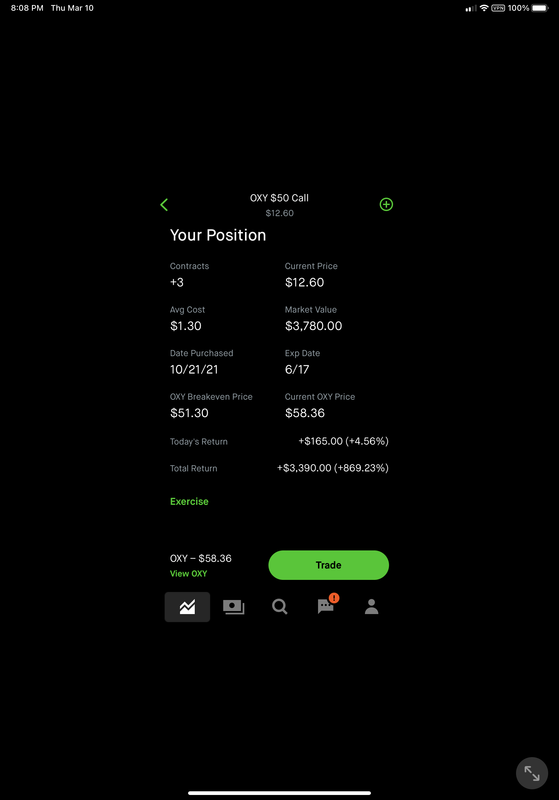

I have a few options that are approaching expiration. The options are all O&G and I have the funds to exercise them. My question is, should I exercise them (buy the shares) or sell the contracts and collect the premiums?

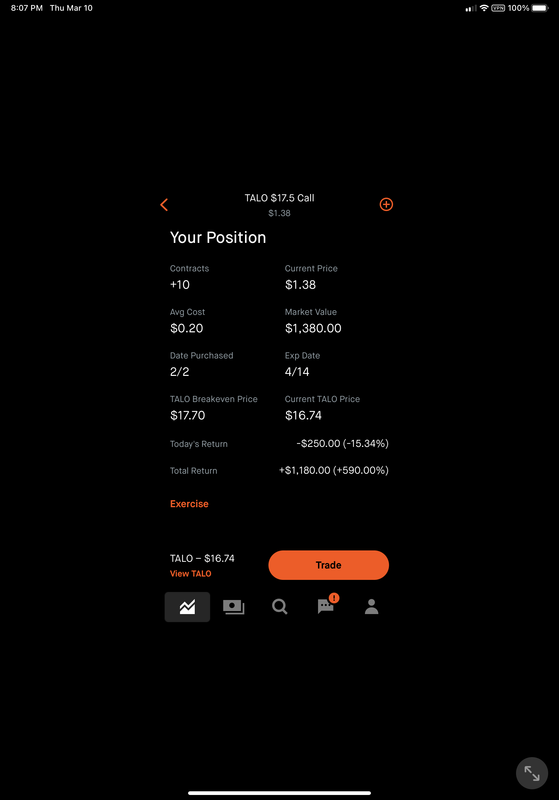

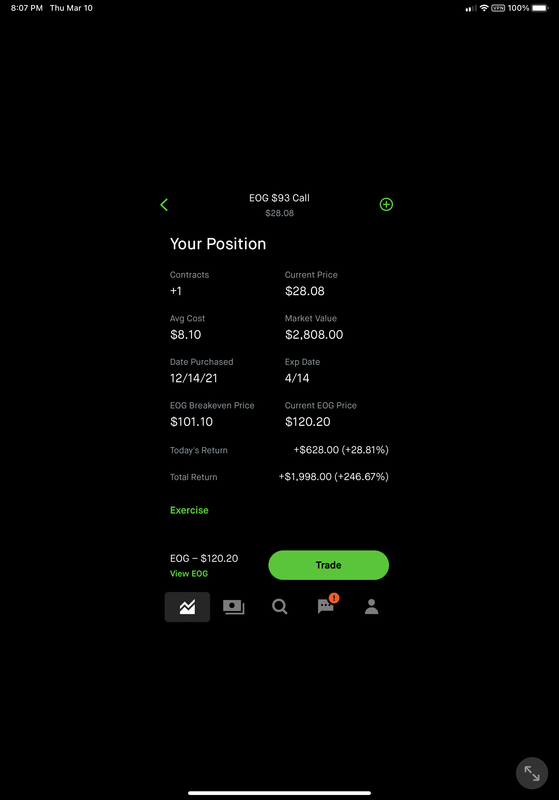

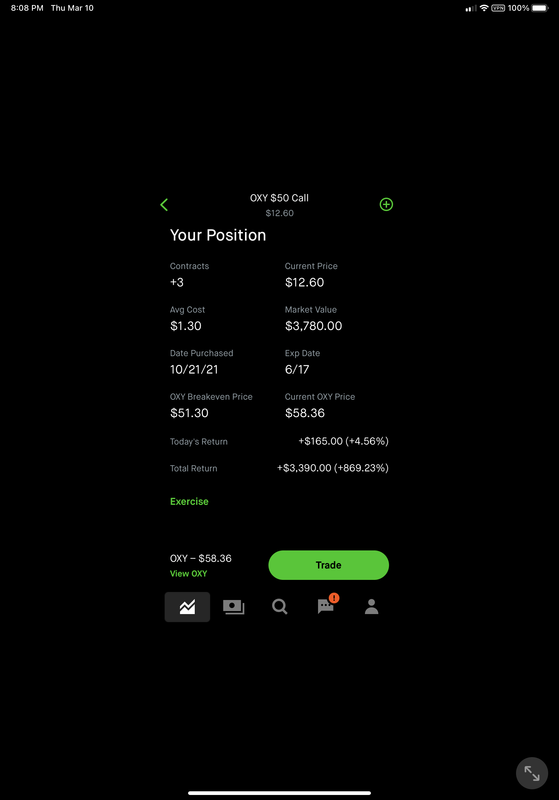

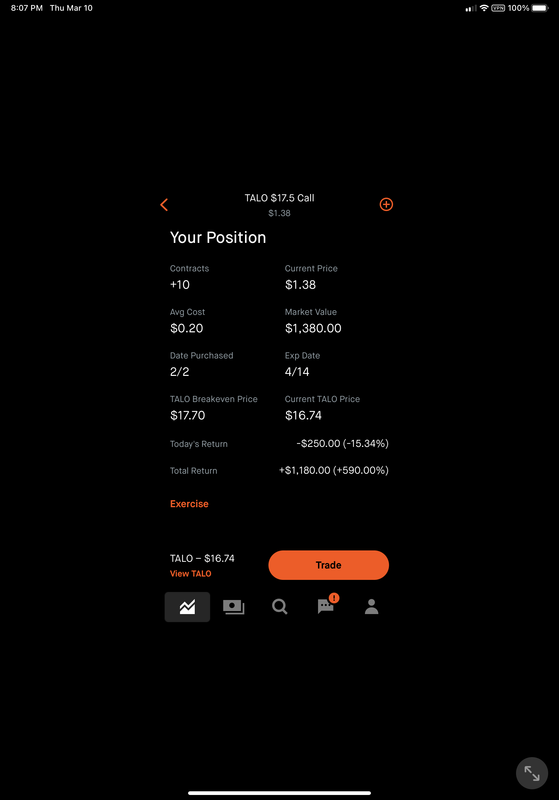

Below are the options in question:

Below are the options in question:

Posted on 3/10/22 at 8:26 pm to Da Cooyon

If you can exercise, then exercise.

Posted on 3/10/22 at 8:47 pm to Da Cooyon

Occidental is up 100% year to date. Unless you believe the situation in Russia is going to get worse, or you have very limited energy exposure altogether, I don’t see how you can be a buyer at these prices. It’s up over 50% just with the invasion.

Posted on 3/10/22 at 8:47 pm to Da Cooyon

Just sell the contracts. Good work btw.

Posted on 3/10/22 at 9:00 pm to Da Cooyon

What you want to do, especially with OXY is create a call spread.

Your strike on the calls you own is at $50. You can sell the June $60 call for $7.80 or the June 65 for $5.75.

Your strike on the calls you own is at $50. You can sell the June $60 call for $7.80 or the June 65 for $5.75.

Posted on 3/10/22 at 9:10 pm to frogtown

Interesting play. I like that.

Popular

Back to top

4

4