- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Can someone explain how to use P/E ratio and EPS ?

Posted on 12/12/19 at 6:57 pm

Posted on 12/12/19 at 6:57 pm

I try to use them when evaluating stocks, but I have no idea if I’m doing it right. I mainly look to see that EPS is generally trending upward. If EPS is low, I check to see if it’s because of the acquisition of another company.

Posted on 12/12/19 at 7:01 pm to C3W

P/E and EPS are ratios so I'm not entirely sure what question you're asking. I would start with these resources:

Resources:

Investopedia

Used Corporate Finance books on Amazon

Youtube

You can pick up the DeMarzo Corp Fin textbook used on Amazon super cheap

Resources:

Investopedia

Used Corporate Finance books on Amazon

Youtube

You can pick up the DeMarzo Corp Fin textbook used on Amazon super cheap

Posted on 12/12/19 at 11:14 pm to C3W

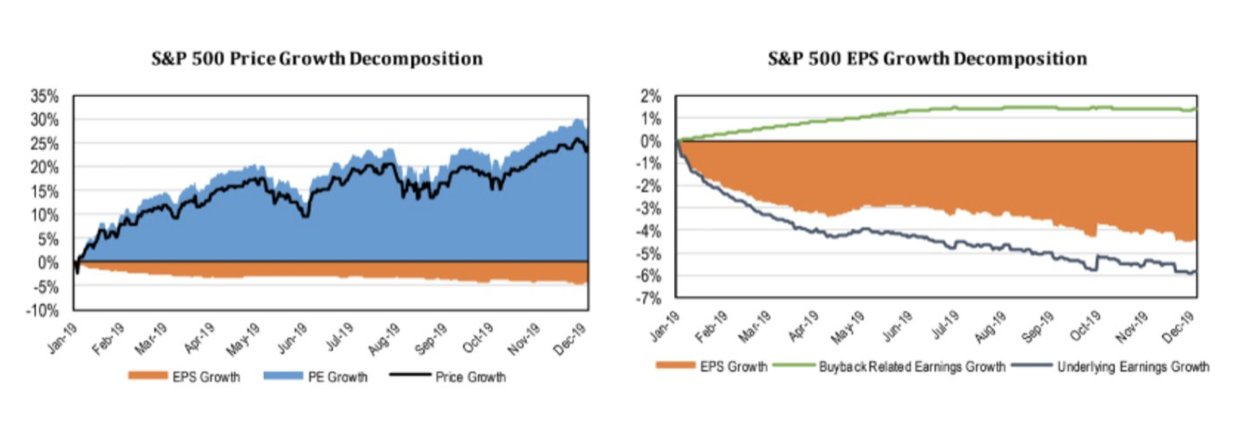

Not to throw a wrench in your learning but look at P/S. Price to sales can’t be manipulated by accounting gimmicks and stock buybacks.

EPS can mislead you if a company buys back 5% of their float but the reinvest $0 in capex/future growth the quarter looks great (random numbers of course). However, all they’ve done is reduce the number of shares, increasing EPS, and therefore decreasing P/E, but really doing nothing but multiple expansion.

It’s much harder to fudge sales figures.

EPS can mislead you if a company buys back 5% of their float but the reinvest $0 in capex/future growth the quarter looks great (random numbers of course). However, all they’ve done is reduce the number of shares, increasing EPS, and therefore decreasing P/E, but really doing nothing but multiple expansion.

It’s much harder to fudge sales figures.

Posted on 12/13/19 at 4:15 am to C3W

Taking a big step back.

P/E is not just misleading but not always a relevant valuation metric.

For example, banks are more about price to tangible book value.

Other hard asset cyclicals are more about EV/EVITDA.

And yet over highly cyclicals are about price to net asset value (ie liquidation value).

Just be careful.

P/E is not just misleading but not always a relevant valuation metric.

For example, banks are more about price to tangible book value.

Other hard asset cyclicals are more about EV/EVITDA.

And yet over highly cyclicals are about price to net asset value (ie liquidation value).

Just be careful.

Posted on 12/13/19 at 4:32 pm to C3W

like others said P/E isn't a great metric. Growth companies specifically the tech industry are often gonna have negative earnings.

You need to look at the 10k and use a few others to get a bigger picture.

EPS isn't always great either. A buyback can inflate those numbers in the short term.

You need to look at the 10k and use a few others to get a bigger picture.

EPS isn't always great either. A buyback can inflate those numbers in the short term.

Posted on 12/19/19 at 8:32 am to C3W

As far as I know - the higher P/E ratio - the bigger expected revenue but at the same time very risky stock shares - they can easily drop (of fly high).

Posted on 12/19/19 at 8:40 am to book32

i prefer it not be negative...

primarily since it scares other investors

primarily since it scares other investors

Posted on 12/19/19 at 10:46 am to mrgreenpants

Wouldn’t P/S leave out profit margin?

Posted on 12/19/19 at 11:20 am to C3W

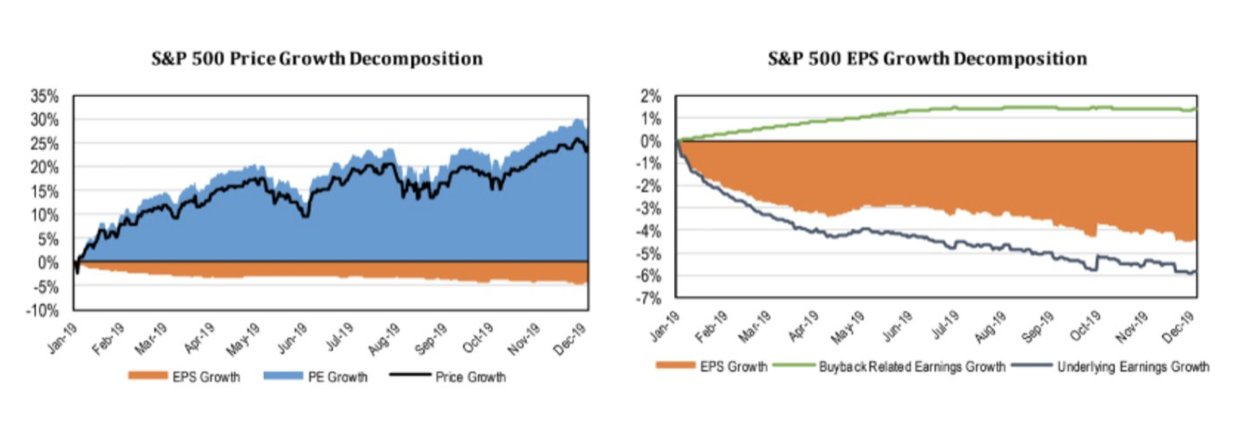

Funny this should get bumped. Just saw this...

Yay for multiple expansion!

Yay for multiple expansion!

Popular

Back to top

6

6