- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Discussion of Fed Liquidity’s Impact on Equity Markets

Posted on 9/4/20 at 12:59 pm to wutangfinancial

Posted on 9/4/20 at 12:59 pm to wutangfinancial

More on the inflation vs. deflation debate, as well as some interesting history within the first half of the article:

Murphy's Law Is Fed's Law, and Everything Is Wrong

One reason we know record low UE rates reported prior to the pandemic were artificial is because we never saw the one thing you'd expect in a "full" or even "beyond full" employment scenario: inflation. As the article says:

And the recent change in stance by the Fed embodied within their Grand Strategy Review is essentially an admission of that:

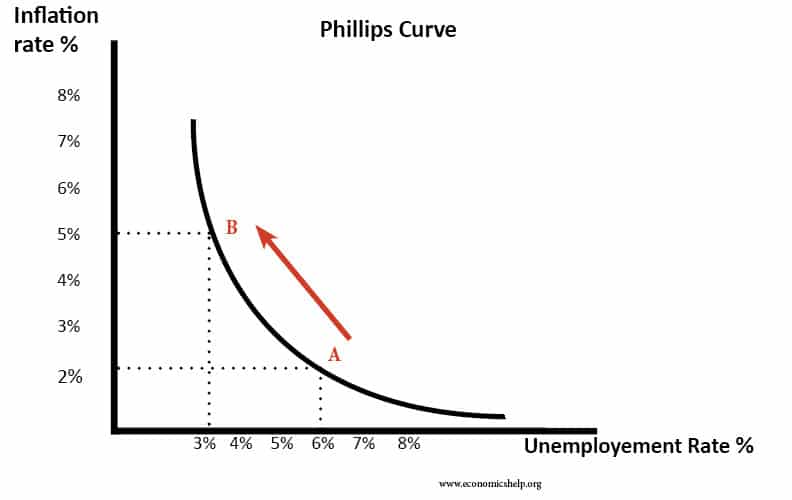

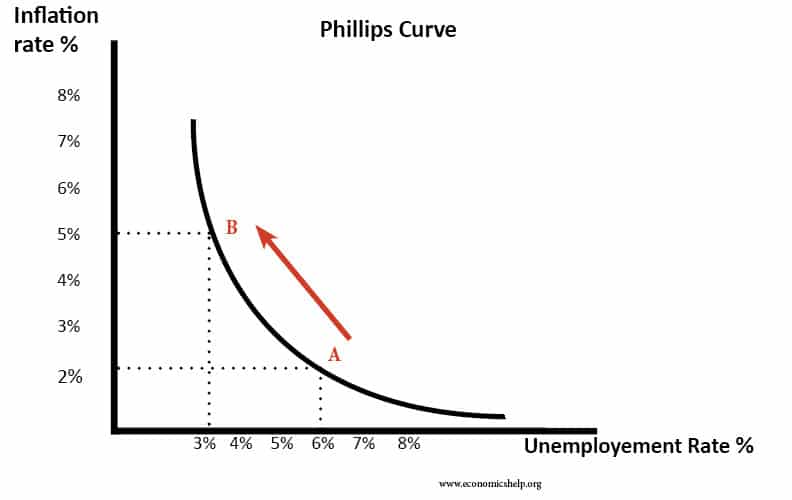

Why didn't it happen? Because employment wasn't really "full." Why wasn't employment really full? Because of the long-known "participation problem," which has been a hallmark of the economy since the Great Recession. In other words, the Phillips Curve didn't all of a sudden fail to hold true; rather, the unemployment rate was drastically understated, which explains why the inflation never showed up:

But the Fed didn't buy that initially, because that would require them to admit their QE programs had failed to achieve BOTH prongs of their mandate. Namely, employment was never full and inflation was never able to achieve their 2% target. So, what did the Fed do? Well, they rewrote the rules of the game rather than admit failure. Essentially, so their warped way of thinking goes, the Phillips Curve is no longer a curve at all; it's essentially a flat line. That means that though employment, in the Fed's view, was "full," inflation nonetheless stayed low. This also provided their justification for keeping rates low even though employment was "full." Namely, if there's no inflation at full employment, then you should also be able to justify lower interest rates at full employment (Fisher equation). But to buy this would be to abandon any relevance of supply and demand in the labor market - why didn't real wages increase if employment was so full?

To sum the Fed-think in a sentence:

Now, on to what QE has essentially done: it's increased the supply of money in the economy. But what is an oversupply of something supposed to do? It's supposed to decrease the per-unit value of said commodity being oversupplied. In other words: inflation. So how is it that the money supply in the economy has ballooned but we've never had any significant inflation? My understanding of how this author puts it is that "devaluation" assumes what is being devalued has any real "value" to begin with:

ETA: This is also worth a read, aimed more at those who already understand the underlying econ:

Exposed Inflation Bubble

Murphy's Law Is Fed's Law, and Everything Is Wrong

One reason we know record low UE rates reported prior to the pandemic were artificial is because we never saw the one thing you'd expect in a "full" or even "beyond full" employment scenario: inflation. As the article says:

quote:

If the unemployment rate had been correct, well below all prior estimates of full employment, wage rates would’ve accelerated sharply setting off sustained, broad consumer price increases as company after company desperately competing for the allegedly scarce marginal worker passed along the increased costs to their customer bases.

And the recent change in stance by the Fed embodied within their Grand Strategy Review is essentially an admission of that:

quote:

Implicit in the Fed’s Grand Strategy Review, therefore, is a full-blown admission that this never happened. Fed officials like Powell who charged into office as a hawk kept saying that it was going to happen, that it was beginning to happen, now years later to quietly, meekly accept the reality that it never once did.

Why didn't it happen? Because employment wasn't really "full." Why wasn't employment really full? Because of the long-known "participation problem," which has been a hallmark of the economy since the Great Recession. In other words, the Phillips Curve didn't all of a sudden fail to hold true; rather, the unemployment rate was drastically understated, which explains why the inflation never showed up:

But the Fed didn't buy that initially, because that would require them to admit their QE programs had failed to achieve BOTH prongs of their mandate. Namely, employment was never full and inflation was never able to achieve their 2% target. So, what did the Fed do? Well, they rewrote the rules of the game rather than admit failure. Essentially, so their warped way of thinking goes, the Phillips Curve is no longer a curve at all; it's essentially a flat line. That means that though employment, in the Fed's view, was "full," inflation nonetheless stayed low. This also provided their justification for keeping rates low even though employment was "full." Namely, if there's no inflation at full employment, then you should also be able to justify lower interest rates at full employment (Fisher equation). But to buy this would be to abandon any relevance of supply and demand in the labor market - why didn't real wages increase if employment was so full?

quote:

At nearly a level horizontal line, this would say no matter how large the increase in expectations for growth the result in inflation would be exceedingly small.

Like R*, though, this requires a fundamental rewriting and reordering of basic economic processes to get there. What would those have to be in order to flatten Dr. Phillips’ great legacy to such a huge degree that the 50-year low in unemployment couldn’t muster the slightest sustained elevation in consumer price advances?

Well, you see, they don’t really know. Several crude theories abound, of course, but what’s going on here is about as unscientific as it gets. The theory of monetary policy, that it led to robust economic circumstances, fitted to the data and evidence piled up against it.

To sum the Fed-think in a sentence:

quote:

Humans are as hardwired to cover for their failures, to any dubious lengths, as they are to honestly move forward toward the light of truth.

Now, on to what QE has essentially done: it's increased the supply of money in the economy. But what is an oversupply of something supposed to do? It's supposed to decrease the per-unit value of said commodity being oversupplied. In other words: inflation. So how is it that the money supply in the economy has ballooned but we've never had any significant inflation? My understanding of how this author puts it is that "devaluation" assumes what is being devalued has any real "value" to begin with:

quote:

The original failure, the Fed’s modern original sin it must forever cover up, is money itself. When central bankers and Economists realized they could no longer define it, and this was more than a half century ago, they came up with what they believed was progress.

quote:

August 2007 and thereafter was simply those consequences finally arriving. Contradicting also Keynes, in the long run someone really would have to pay for a system in which central banks are not central and don’t do money. As it turns out, the costs have been born by the whole global economy as it has been deprived for thirteen years of enough necessary monetary oxygen to make things work.

quote:

Nowadays, detached entirely from any accountability whatsoever, we are supposed to call Ben Bernanke, Janet Yellen, and Jay Powell heroes. For what? From the very start, these are all acts of intellectual cowardice, a bankrupt foundation so perverse it is an embarrassment to science itself; becoming ever more so with each additional stab at everything but the truth. Anything other than that.

They’ve perverted Murphy’s Law into a third version, a specific version. Fed’s Law is now this: monetary policy will never go wrong, so everything else will.

ETA: This is also worth a read, aimed more at those who already understand the underlying econ:

Exposed Inflation Bubble

quote:

Wait, wait, wait. Hold up. The Federal Reserve just concluded its near two-year long Grand Strategy Review. The purpose, in its most basic component, was to figure out why inflation hadn’t shown up in the manner everyone at the Federal Reserve spent years promising even though the unemployment tumbled to 50-year lows.

The labor market was so tight, inflation was guaranteed. Then it didn’t happen.

Behind the resulting monetary policy change (spoiler: not a change) to an average inflation target revealed last week first lies a flattened Phillips Curve.

This post was edited on 9/4/20 at 1:03 pm

Posted on 9/4/20 at 1:45 pm to RedStickBR

I'll check out your articles this afternoon and comment. Looks like they'll just make me mad

Popular

Back to top

1

1