- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Would it ever be ok to tap into 401k for a first time home purchase?

Posted on 10/30/15 at 9:27 am to Herb484

Posted on 10/30/15 at 9:27 am to Herb484

quote:

Would it ever be ok

I hate phrases like this. There are no rigid, completely unbreakable rules when it comes to finance. Every situation is different.

A few years ago, I bet most of this board would have said absolutely do this, as houses were appreciating must faster than the market.

I don't think it's a good idea to tap a 401K for a first time home purchase - in most situations. There are a few situations where I think it can be an option:

1) It's a loan, which you can repay quickly (maybe a guaranteed bonus will be here in a few months) and you find a great bargain on a house that you really want

2) You are paying significantly more in rent than you would be paying in a monthly mortgage note, so you can easily afford the note, but the rent is so high you are slow in saving the last couple of thousand dollars needed for the house.

Posted on 10/30/15 at 9:39 am to LSUFanHouston

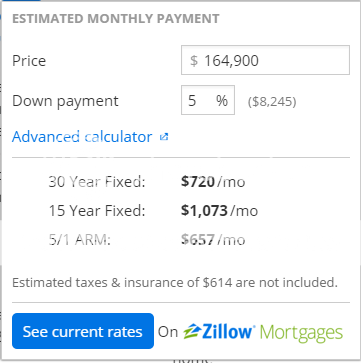

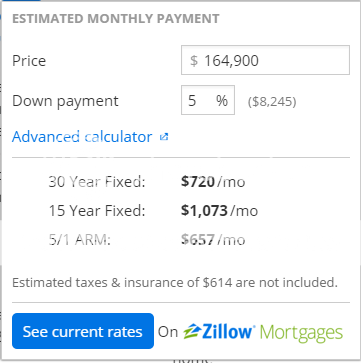

Quick question that I don't want to start a new thread on...

The "estimated taxes & insurance of $614" - is that $614/month?

The "estimated taxes & insurance of $614" - is that $614/month?

Popular

Back to top

1

1