- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

When Tom Lee Speaks, Investors Listen...

Posted on 7/30/24 at 9:19 am

Posted on 7/30/24 at 9:19 am

Lee is a well-known American financial analyst, strategist, and investor. Has been recognized for his bullish market calls and was one of the first major Wall Street strategists to provide formal research coverage of Bitcoin.

Two recent articles bear note:

Small Cap Markets

Fundstrat's Tom Lee told CNBC that the small-cap-focused Russell 2000 is likely to gain 15% or more through August, if history is any guide.

Is it sustainable?

Bank offers opinion

According to the bank, the 10-year US Treasury yield must remain below 4%, while the ISM purchasing managers' index must rise above 50.

"Inflation Will Fall Like A Rock"

“I know there’s a lot of dispute, but I think the last two inflation reports and the fact that 55% of inflation components are back to pre-pandemic levels means inflation is really going to fall like a rock,” he said.

Lee told CNBC that the fundamental picture now “looks stronger.” He anticipates better-than-expected earnings and, coupled with cooling inflation, expressed confidence that “multiples can expand.”

He recognized the need for a revised target.

“I think 5,200 is clearly too low, but I don't know how much above 5,500 there is into year-end. So I think in a couple weeks, we'll be addressing that,” he said.

Two recent articles bear note:

Small Cap Markets

Fundstrat's Tom Lee told CNBC that the small-cap-focused Russell 2000 is likely to gain 15% or more through August, if history is any guide.

Is it sustainable?

Bank offers opinion

According to the bank, the 10-year US Treasury yield must remain below 4%, while the ISM purchasing managers' index must rise above 50.

"Inflation Will Fall Like A Rock"

“I know there’s a lot of dispute, but I think the last two inflation reports and the fact that 55% of inflation components are back to pre-pandemic levels means inflation is really going to fall like a rock,” he said.

Lee told CNBC that the fundamental picture now “looks stronger.” He anticipates better-than-expected earnings and, coupled with cooling inflation, expressed confidence that “multiples can expand.”

He recognized the need for a revised target.

“I think 5,200 is clearly too low, but I don't know how much above 5,500 there is into year-end. So I think in a couple weeks, we'll be addressing that,” he said.

Posted on 7/30/24 at 12:31 pm to Nole Man

If the numbers we get were at all trustworthy, we could believe ol Tom

Posted on 7/30/24 at 1:49 pm to Nole Man

He also says Bitcoin to $150,000 by end of year.

Posted on 7/30/24 at 3:32 pm to LChama

quote:

If the numbers we get were at all trustworthy, we could believe ol Tom

Hard to argue with the man's knowledge or track record.

I believe what he's saying. The key to the Small Cap Market prediction will be the discussions the Federal Reserve have over the next two days. The market has essentially 100% priced in a rate cut by the September meeting.

The Market Is Convinced!

A policy announcement is expected Wednesday. If so, that will help fuel smaller companies more reliant on the cost of capital.

FYI, a link to his Bitcoin predictions for those interested.

Posted on 7/30/24 at 3:53 pm to Nole Man

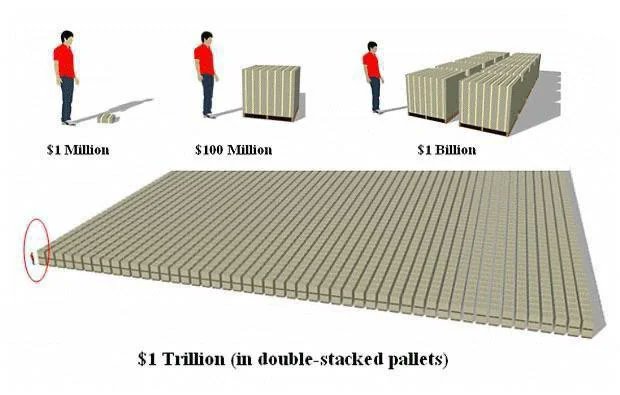

What's he say about the $35T debt?

Did you know that 35 trillion seconds = 1,109,842 years?

Did you know that 35 trillion seconds = 1,109,842 years?

Posted on 7/30/24 at 4:23 pm to Nole Man

Tom Lee is always bullish.

I ignore people that are ALWAYS Bullish, or ALWAYS Bearish.

I ignore people that are ALWAYS Bullish, or ALWAYS Bearish.

Posted on 7/30/24 at 4:31 pm to GrizzlyAlloy

quote:

What's he say about the $35T debt?

Did you know that 35 trillion seconds = 1,109,842 years?

Posted on 7/30/24 at 4:36 pm to Wolf of Wall Street

quote:

Tom Lee is always bullish.

I ignore people that are ALWAYS Bullish, or ALWAYS Bearish.

So, assuming you read his analysis, where is he wrong then?

Posted on 7/30/24 at 4:38 pm to Nole Man

quote:

So, assuming you read his analysis, where is he wrong then?

He was also bullish on Tech 3 weeks ago.

How did that work out ?

Posted on 7/30/24 at 4:49 pm to Wolf of Wall Street

Well, you didn't answer the question. So still remain interested where you think he's wrong on the topic of the thread: Small Cap Market and the impact of rate cuts in September.

Lee isn't always totally Bullish. There are instances in the past where he has expressed concerns about potential corrections in the tech stock market. But, longer term, yes Lee remains optimistic about the overall market for 2024, predicting that the S&P 500 could ultimately rise to a range of 5,200 to 5,400. Possibly nearly tripling by 2030 to reach 15,000.

Who knows. But he knows his shite so I listen to what he says.

quote:

He was also bullish on Tech 3 weeks ago.

How did that work out ?

Lee isn't always totally Bullish. There are instances in the past where he has expressed concerns about potential corrections in the tech stock market. But, longer term, yes Lee remains optimistic about the overall market for 2024, predicting that the S&P 500 could ultimately rise to a range of 5,200 to 5,400. Possibly nearly tripling by 2030 to reach 15,000.

Who knows. But he knows his shite so I listen to what he says.

Posted on 7/30/24 at 5:05 pm to Nole Man

quote:

Lee isn't always totally Bullish.

Ok, 99 percent of the time he is bullish, and usually uber bullish.

Cathie Wood is always bullish and predicting some podunk stock is going to Eleventy Billion.

Peter Schiff is always Gloom & Doom and predicting the end of the world.

I'm just saying that I tend to ignore people that always sing the same tune.

Especially when they are always bullish.

It's easy to be a Permabull and look smart because over time the market goes up.

I didn't hear Tom Lee calling for a selloff in NVDA, MSFT, & the Nasdaq 3 weeks ago.

Posted on 7/30/24 at 6:44 pm to Wolf of Wall Street

quote:

'm just saying that I tend to ignore people that always sing the same tune.

Fair point. I do generally as well, but I do listen to what he says and try to absorb it.

I mean, I'm sure the posters here, who are incredibly savvy, DCA and DRIP for the long-term. Don't think we have many "market timers" here. Solid long-term discipline from what you read.

But, in this case, I agree with the rotation into Mid and Small Cap markets because of the impact interest rates can have on smaller companies. Not saying you jump whole hog, but it speaks to taking a position (say 5-10%) of your holdings. Have posted on a couple of ETFs, COWZ and CALF, that focus on these markets and should have good upside in the next 12 months. And as Lee noted, the likelihood of the broader S&P market rising over the next few years, driven by technology sectors, is strong.

Posted on 7/30/24 at 7:42 pm to Nole Man

So he is predicting big mortgage rate drops

Better buy a house now

Better buy a house now

Posted on 7/30/24 at 8:26 pm to SDVTiger

Posted on 7/31/24 at 6:13 am to Wolf of Wall Street

quote:I don’t think he was espousing a short-term, technical trade. He has consistently said that the S&P is going way up on the backs of mega caps and he’s been 100% correct.

He was also bullish on Tech 3 weeks ago.

Posted on 7/31/24 at 8:40 am to Nole Man

quote:

pre-pandemic levels means inflation is really going to fall like a rock,” he said

If hes correct about falling like a rock then it will be more than a slight drop

Better buy now before values explode

Posted on 8/4/24 at 5:09 pm to Nole Man

quote:

When Tom Lee Speaks, Investors Listen...

This aged well.

Market immediately dropped like a rock right after this post.

Posted on 8/5/24 at 7:20 am to Wolf of Wall Street

Just print some $1 trillion bills then you don't have to worry about all those stacks

Popular

Back to top

7

7