- My Forums

- Tiger Rant

- LSU Score Board

- LSU Recruiting

- SEC Rant

- SEC Score Board

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: This August downturn has cost me a comma

Posted on 8/22/23 at 6:54 pm to bod312

Posted on 8/22/23 at 6:54 pm to bod312

quote:

Why would the assumption be that you buy a single snapshot of the SP500 and it never changes?

That was his argument when responding to individual stocks.

You need to take it up with him.

Posted on 8/22/23 at 6:58 pm to meansonny

quote:

That was his argument when responding to individual stocks. You need to take it up with him.

The guy didn’t mean an individual stock chart.

No one talks like that. He’s saying stocks in general went no where. I easily disproved him.

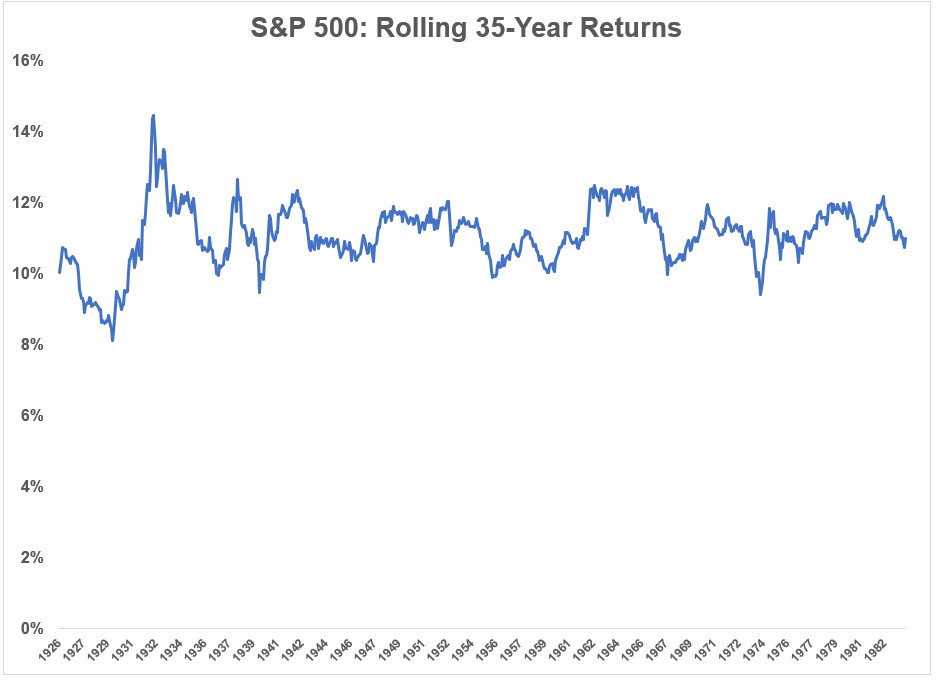

A little dated, but still accurate - S&P 500 has never had a 35 year stretch where the rolling returns were less than 8% annualized.

This post was edited on 8/22/23 at 7:06 pm

Posted on 8/22/23 at 7:10 pm to slackster

Is that relevant if nobody invested that way prior to 1980?

Posted on 8/22/23 at 7:45 pm to wutangfinancial

quote:

Is that relevant if nobody invested that way prior to 1980?

What should we use instead? Since 1980 the S&P 500 has returned over 11% per year.

Posted on 8/22/23 at 8:11 pm to slackster

quote:

You need to take it up with him.

The guy didn’t mean an individual stock chart.

You are speaking on his behalf, now?

Posted on 8/22/23 at 8:14 pm to slackster

quote:

Tesla was added on 12/21/20 and is effectively flat since then, so S&P 500 index funds haven’t benefited from its inclusion at all. In fact, the stock it replaced, AIV, has outperformed it tremendously.

I'm curious. Because you have all of the data at your fingertips.

How many stocks perform like Tesla?

They seem to be different for some reason.

Posted on 8/22/23 at 8:28 pm to meansonny

quote:

You are speaking on his behalf, now?

Posted on 8/22/23 at 8:34 pm to meansonny

quote:

How many stocks perform like Tesla? They seem to be different for some reason.

I don’t understand the question.

You seem to be implying that the S&P 500 is cherry-picking. That makes no sense.

It doesn’t add winners until after they’ve already grown to that stand point, and it has to ride the losers all the way to expulsion. Also, there have only been around 700 companies ever in the index. It’s not like there is some massive turnover.

Posted on 8/22/23 at 10:25 pm to slackster

I wouldn’t be looking at equity returns over the past hundred years to set my return expectations for the next 60. Seems like a very dumb exercise.

Posted on 8/23/23 at 6:30 am to wutangfinancial

quote:

wouldn’t be looking at equity returns over the past hundred years to set my return expectations for the next 60. Seems like a very dumb exercise.

60 year return expectation projections are pretty hard to come by - using past performance of the broad market is as good a place to start as anything else. Most respectable equity market expectations are back-tested using historical data anyways.

Posted on 8/23/23 at 7:21 am to slackster

quote:When you adjust for inflation there would have been extended periods of time where the 35 year annualized return would have been weak. The 50s and 60s were lights out, 70s and early 80s were trash and the market has pretty much exploded since then with the exception of the tech bust and the financial collapse.

A little dated, but still accurate - S&P 500 has never had a 35 year stretch where the rolling returns were less than 8% annualized.

Not refuting you just pointing out that there have been dramatically different eras in the market even when you stretch a theoretical investment horizon out to 30+ years.

Posted on 8/23/23 at 7:46 am to beaverfever

quote:

When you adjust for inflation there would have been extended periods of time where the 35 year annualized return would have been weak.

Weaker, sure, but what’s “weak”? Real returns in the 35 years ending 1982 were 6.4% annualized. I’m pretty sure the inflation adjusted returns have never dipped below 6% annualized in a 35 year stretch.

Popular

Back to top

1

1