- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Does anyone else think we bounce into midterms?

Posted on 9/26/22 at 12:31 pm

Posted on 9/26/22 at 12:31 pm

I'm thinking we're bullish into midterms then pain resumes at the end of 2022/start of 2023.

Posted on 9/26/22 at 12:36 pm to MrSpock

Isn't October historically the worst month for the markets?

Posted on 9/26/22 at 12:38 pm to MrSpock

We will bounce but it will be because of short covering going into earnings reports.

Posted on 9/26/22 at 12:44 pm to MrSpock

Not as long as that stupid SOB is in the White House.

Posted on 9/26/22 at 1:06 pm to MrSpock

FOMC meeting is November 1-2, Unemployment numbers for October release on November 4, Election Day is November 8 and October CPI comes out on November 10.

For the meeting, expect a rate hike of at least .5 (depending on what else is going on).

Unemployment should continue moving up (upward movement started in August). This is actually a good thing as a rise in Unemployment is a signal the Fed is looking for to determine how well the QT is working.

If October's CPI comes out and we're still above 8%, expect that to castrate any recovery attempt. If it's at least a few tenths below 8%, that would help sustain a bounce for a little longer.

We still have fundamental issues that need to be resolved before we see the market trending back upward though.

For the meeting, expect a rate hike of at least .5 (depending on what else is going on).

Unemployment should continue moving up (upward movement started in August). This is actually a good thing as a rise in Unemployment is a signal the Fed is looking for to determine how well the QT is working.

If October's CPI comes out and we're still above 8%, expect that to castrate any recovery attempt. If it's at least a few tenths below 8%, that would help sustain a bounce for a little longer.

We still have fundamental issues that need to be resolved before we see the market trending back upward though.

Posted on 9/26/22 at 1:35 pm to MrSpock

I think there will be bit of a bounce after the mid-terms, but the lame duck Congress will probably try to pass all kinds of garbage and take the blush off of it.

I think the bigger bounce would be in Jan. when the new Congress is seated and Biden and the dems insanity is fully hobbled.

I think the bigger bounce would be in Jan. when the new Congress is seated and Biden and the dems insanity is fully hobbled.

Posted on 9/26/22 at 9:42 pm to Aubie Spr96

According to CNBC, September is historically the worst month. Some of the largest one day drops in market history have occurred in October. The month of October has posted gains more time than it's closed with a loss.

Posted on 9/26/22 at 10:41 pm to MrSpock

Nope

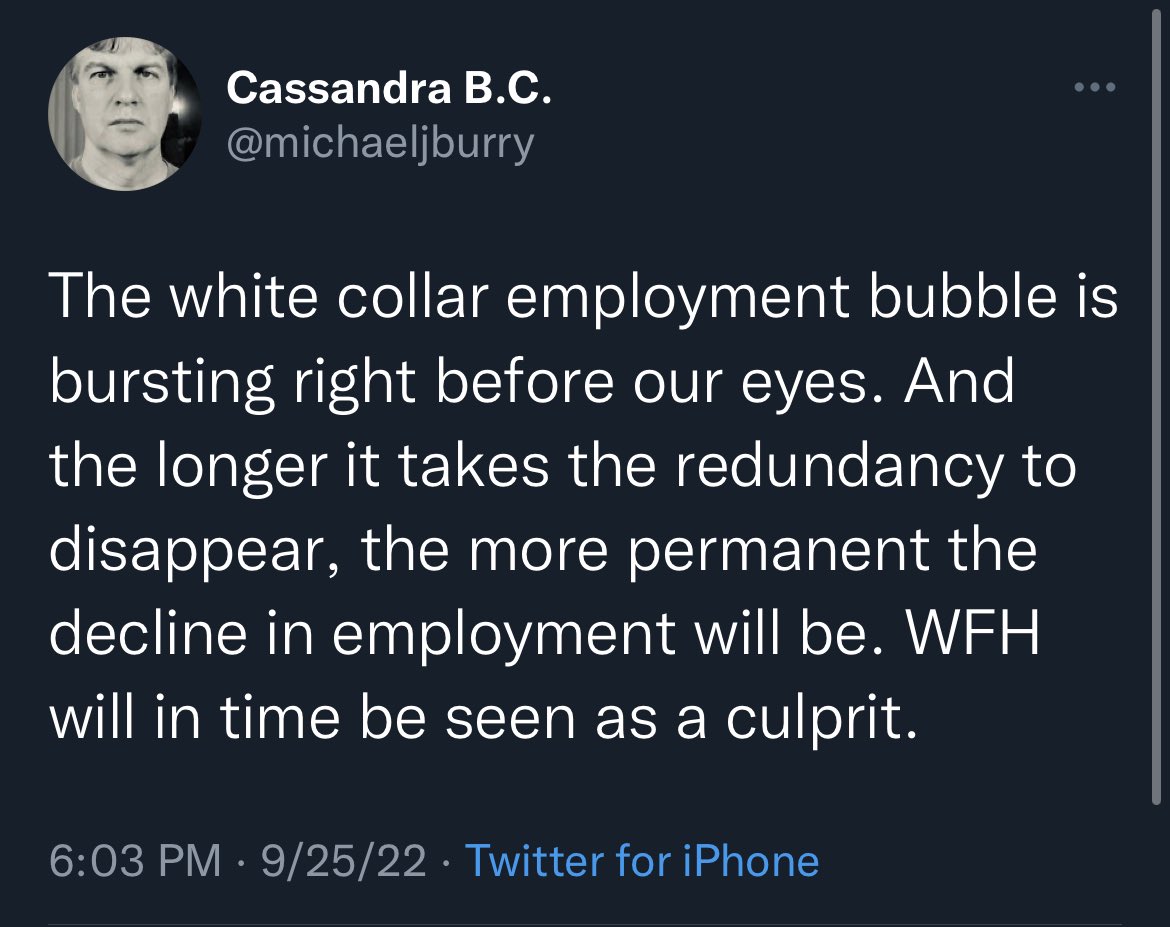

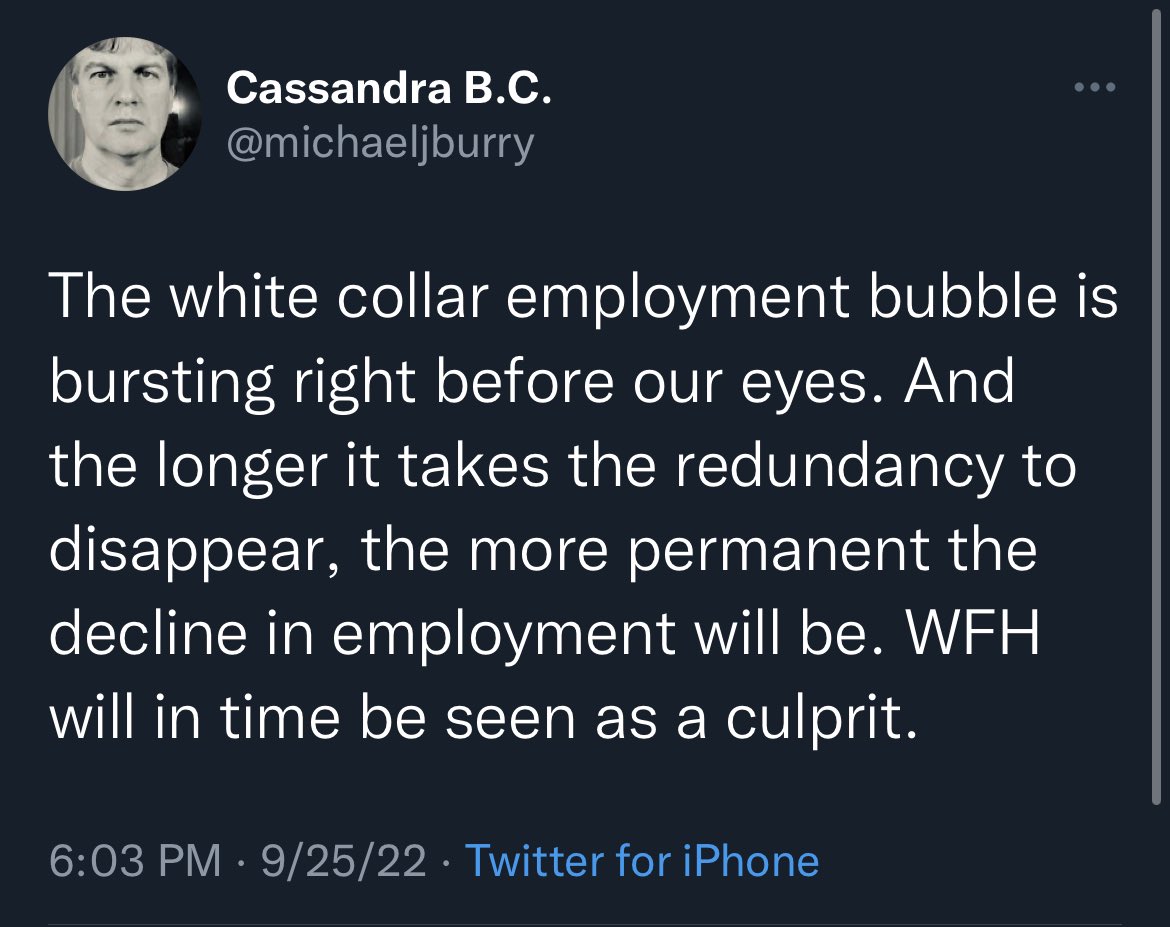

And we have this

LINK

this (with more to come)

LINK

And this

LINK

And one more

And we have this

quote:

Oil Prices Set To Spike Again Due To Struggling Global Supply Chain

LINK

this (with more to come)

quote:

JUST IN: Goldman Sachs, $GS, has begun laying off workers across the US — and the Wall Street giant is focused on culling mid-level investment bankers amid a downturn in dealmaking as the economy slows, per NYP.

LINK

And this

quote:

Morgan Stanley, $MS, sees US dollar surge setting the stage for "something to break."

LINK

And one more

Posted on 9/27/22 at 5:46 am to MrSpock

i think we bounce up for a few days. No way we keep going straight down . I think the rest of the week we end positive. Maybe sideways then down again for rest of year.

Posted on 9/27/22 at 8:25 am to Aubie Spr96

quote:

Isn't October historically the worst month for the markets?

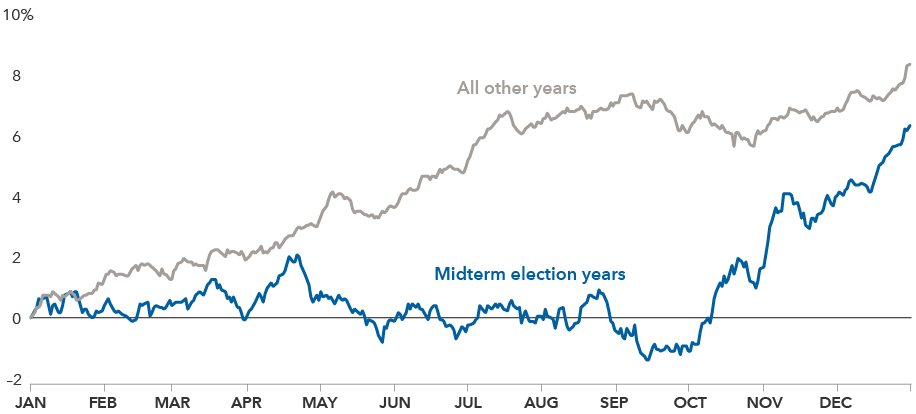

I have been seeing derivations of these charts floating around.

Posted on 9/27/22 at 8:39 am to FlyingTiger1955

Insightful information there, buddy.

Posted on 9/27/22 at 10:30 am to MrSpock

I would be careful with those, they weren't done during a period where the Fed can't lower rates to spur growth (much less that lowering rates could risk hyperinflation) and with the administration waging a war on oil.

With Durable Goods falling for the 2nd straight month (-.1 for July then -.2 for August), Unemployment moving upward, wages stagnating/falling, food prices continuing to climb and gasoline creeping back up (despite Biden's BS claim that it's below $3/gallon), we will very likely be in a stagflation environment before we see the market truly begin moving back upward.

With Durable Goods falling for the 2nd straight month (-.1 for July then -.2 for August), Unemployment moving upward, wages stagnating/falling, food prices continuing to climb and gasoline creeping back up (despite Biden's BS claim that it's below $3/gallon), we will very likely be in a stagflation environment before we see the market truly begin moving back upward.

Posted on 9/27/22 at 12:13 pm to MrSpock

Dems will deflect as much as possible as midterms get closer

Posted on 9/27/22 at 5:40 pm to CSinLC

Tough to bounce with news like this

LINK

quote:

The S&P 500 just took out its June low, extending the bear market decline to 25% from Jan.'s record-high. With 30-year mortgage rates set to rise above 7% today, real estate prices will follow #Stock prices lower. Collapsing wealth + soaring debt service costs = financial crisis.

LINK

Popular

Back to top

8

8