- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Questions about a federal fair tax.

Posted on 6/17/24 at 7:11 pm to bhtigerfan

Posted on 6/17/24 at 7:11 pm to bhtigerfan

It's set up to be revenue neutral with the current income tax racket, so federal receipts would be the same.

This post was edited on 6/17/24 at 7:12 pm

Posted on 6/17/24 at 7:12 pm to LSUSUPERSTAR

quote:

repealing income tax would need go be in the same bill.

Here is no HR 25 FairTax bill without not only abolishing the IRS but repealing the 16th Amendment too.

Posted on 6/17/24 at 7:15 pm to Back to Scat

quote:

My mother doesn't pay income tax.. She is retired has some income, but takes a standard deduction. You want to get rid of the standard deduction?

They want to get rid of the income tax and replace it with literally anything else, no matter that they would still be paying taxes regardless and to hell with all of the negative effects that result. So yes the standard deduction would be done away with since income is no longer being taxed and thus nothing to deduct from.

In the case of your mother she would be paying alot more in taxes if implemented since every time she makes a purchase or consumes something she's taxed. It's to make everything more "fair" ya know

Posted on 6/17/24 at 7:24 pm to bhtigerfan

quote:

They even propose a tax on new home purchases. Can you imagine how much would be?

The exact same as the current prices for the goods bought by businesses to build the house.

23% of the cost of everything bought at retail are embedded corporate income taxes that are paid by the consumer. All that happens is those taxes go away (no IRS = no income taxes) and it's replaced with a 23% retail sales tax. The difference is it's bought with your whole paycheck, not what you're allowed to keep after Uncle Sam has his prima nocte with your earnings.

Posted on 6/17/24 at 7:30 pm to Back to Scat

quote:

You want to get rid of the standard deduction?

There is no standard deduction because there are no deductions because there are no tax returns.

It would be a gross mischaracterization to say that your retired mother would pay 23% more on top of monthly expenses. Trump did this a few times with Desantis and I thought it was an attempt to score cheap political points during the primary season.

All households under the plan would get what's referred to as a prebate at the beginning of the month that's equal to the amount of tax that's anticipated to be paid for that household's size, as well. This eliminates the tax burden for those at/below the poverty level, retirees, etc.

Posted on 6/17/24 at 7:35 pm to VoxDawg

quote:

All that happens is those taxes go away (no IRS = no income taxes)

I keep hearing no IRS but who do people send all the new sales taxes to? Just mail it to the Treasury and say here ya go? Or would it be revenue internal to the government that needs a service to collect it?

And I hear people keep saying no more audits which is nonsense. You can absolutely bet someone is going to be looking through the books to make sure a businesses sales match up with tax revenue received.

Posted on 6/17/24 at 7:36 pm to DavidTheGnome

quote:

she would be paying alot more in taxes if implemented since every time she makes a purchase or consumes something she's taxed.

You might want to sit this one out of you honestly believe that would be the situation.

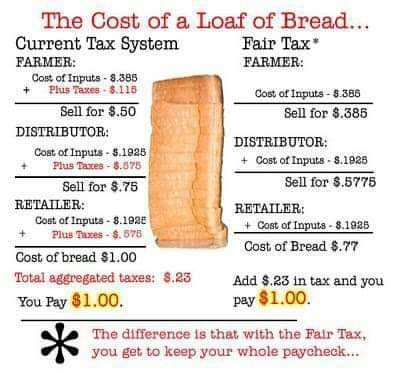

If you're anywhere in the realm of interested in learning where your statement above went off the cliff, please consult the image I posted earlier about the price of bread under our current system vs the FairTax.

If you want extra credit, revisit the bread example and then come back and explain how X -23% + 23% = anything other than X.

This post was edited on 6/18/24 at 10:04 am

Posted on 6/17/24 at 7:37 pm to VoxDawg

quote:

All households under the plan would get what's referred to as a prebate at the beginning of the month that's equal to the amount of tax that's anticipated to be paid for that household's size, as well. This eliminates the tax burden for those at/below the poverty level, retirees, etc.

Jfc and that's better than income taxes how?

Posted on 6/17/24 at 7:39 pm to DavidTheGnome

quote:

who do people send all the new sales taxes to?

They don't. The retailers collect it and handle it the same way that they do state and local sales taxes now.

There would still be some manner of bureaucracy within the Treasury to handle incoming payments from retailers, but it would have Jack shite to do with you nor I. April 15 would be just another day.

The no more audits part is for individual taxpayers.

Posted on 6/17/24 at 7:40 pm to VoxDawg

quote:

You might want to sit this one out of you honestly believe that would be the situation.

If you're anywhere in the realm of interested in learning where your statement above went off the cliff, please consult the image I posted earlier about the price of bread under our current system vs the FairTax.

If you want extra credit, revisit the bread example and then come back and explain how X -23% + 23% = anything other than 1.

Okay I consulted your image and it shows the end consumer paying the tax. Where do you get the minus 23% from? If it's a consumption tax it's levied when something is consumed. Currently his mom pays no taxes, she would when she has to pay taxes on everything she consumes.

Posted on 6/17/24 at 7:42 pm to VoxDawg

Bidenomics already raised the COGS by 20% and they get to keep our income taxes too.

Posted on 6/17/24 at 7:42 pm to DavidTheGnome

quote:

Jfc and that's better than income taxes how?

If you wanted to send a check to the Treasury for that former withholding money you earned that they've been confiscating at the point of a gun, even though you don't have to, I bet they'd cash it.

It appears that you're more interesting in trying to complain about the system than you are leading about it.

This'll be here if the pain of laying on the nail ever gets greater than the pain of having to get up and move to a different spot on the porch:

How FairTax Works

Posted on 6/17/24 at 7:43 pm to VoxDawg

quote:

They don't. The retailers collect it and handle it the same way that they do state and local sales taxes now.

So they would collect and send to the government (in this case federal rather than state or local) monthly? Again, someone would need to collect it, a revenue service for the government perhaps.

Posted on 6/17/24 at 7:48 pm to DavidTheGnome

It says it could save Social Security too? Call me skeptical.

Posted on 6/17/24 at 7:50 pm to VoxDawg

quote:

If you wanted to send a check to the Treasury for that former withholding money you earned that they've been confiscating at the point of a gun, even though you don't have to, I bet they'd cash it.

No idea what you're trying to say here or what it has to do with a "prebate".

From your link:

quote:

Get a Tax Refund in Advance on Purchases of Basic Necessities

The FairTax provides a progressive program called a prebate. This gives every legal resident household an “advance refund” at the beginning of each month so that purchases made up to the poverty level are tax-free. The prebate prevents an unfair burden on low-income families

So it tries to setup a progressive tax structure by giving people money each month "in anticipation" of how much they would spend? Doesn't this eliminate the whole point in that everyone isn't paying? And there would absolutely need to be an IRS if we are sending out "prebate" checks to anticipate how much they'll spend each month to millions of Americans.

Posted on 6/17/24 at 7:51 pm to DavidTheGnome

quote:

Where do you get the minus 23% from?

Under the current income tax scheme, approximate 23% of the final cost of an item paid at retail are embedded corporate income taxes that are added in to the cost of the item along its various stops along the distribution chain.

The manufacturer adds in their corporate income tax bill to their sale price. The distributor does the same. So does the wholesaler, etc. By the time the item makes it to Target or Best Buy, Kroger or Publix, right at 23% of that item's final retail cost has nothing to do with the cost to make, distribute or earn profit from the item, but rather to recoup the various income taxes that has been required at each stop along the way.

Under the plan, there is no income tax any longer, so there's no need for those collected corporate income taxes. Maeker forces dictate that the lose companies who remove that dead weight to the price of their wares win.

That's where the 23% comes out of the cost of the item, just to be replaced on an even swap with the NRST.

Prices at the register stay the same, but you're now buying it with your whole paycheck.

Posted on 6/17/24 at 7:52 pm to BigPerm30

quote:

It says it could save Social Security too? Call me skeptical.

Social security could easily be saved by pushing the retirement age out some and/or means testing people

Posted on 6/17/24 at 7:56 pm to DavidTheGnome

quote:

And there would absolutely need to be an IRS if we are sending out "prebate" checks to anticipate how much they'll spend each month to millions of Americans.

I addressed this previously:

quote:

There would still be some manner of bureaucracy within the Treasury to handle incoming payments from retailers, but it would have Jack shite to do with you nor I.

Posted on 6/17/24 at 7:57 pm to VoxDawg

quote:

There would still be some manner of bureaucracy within the Treasury to handle incoming payments from retailers, but it would have Jack shite to do with you nor I.

Unless we own a business. And it still exists, isn't abolished.

And absolutely would to interact with us if they are determining if our income is at the poverty line and sending us "prebates". And to determine our income level id imagine federal income forms needing to be filed each year

This post was edited on 6/17/24 at 8:00 pm

Posted on 6/17/24 at 7:58 pm to DavidTheGnome

quote:

Social security could easily be saved by pushing the retirement age out some and/or means testing people

SS could be saved by removing the barriers for people to save their own money for their own financial independence.

Examples: Remove the cap on Roth IRA contributions. Remove the income cap on who can or can't contribute to a Roth IRA.

I have other ideas, but we can start there.

Back to top

0

0