- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Measuring The Ivy 2019: Decoding The Performance Gap

Posted on 2/22/20 at 4:37 pm

Posted on 2/22/20 at 4:37 pm

quote:

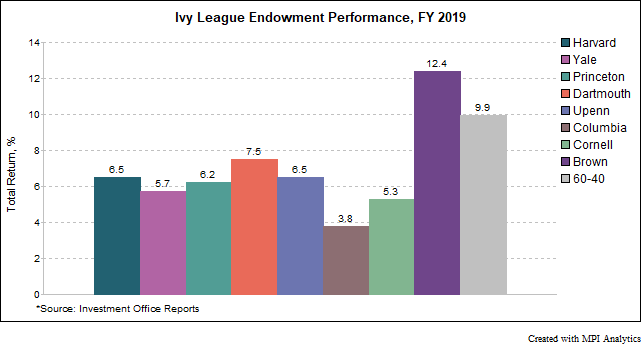

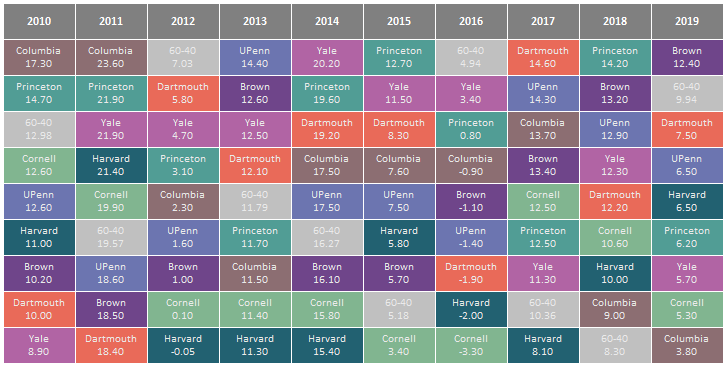

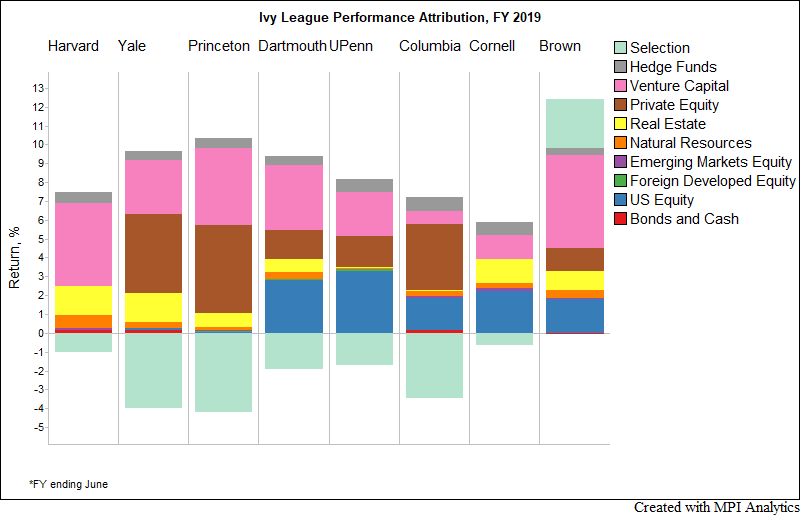

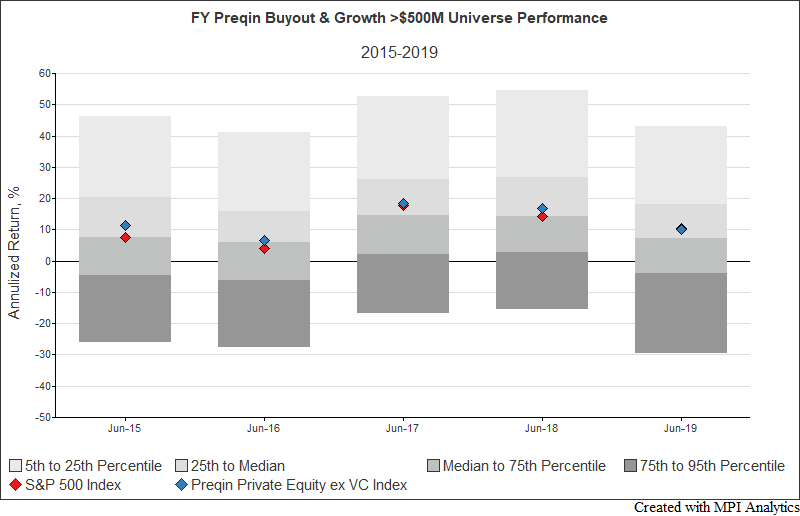

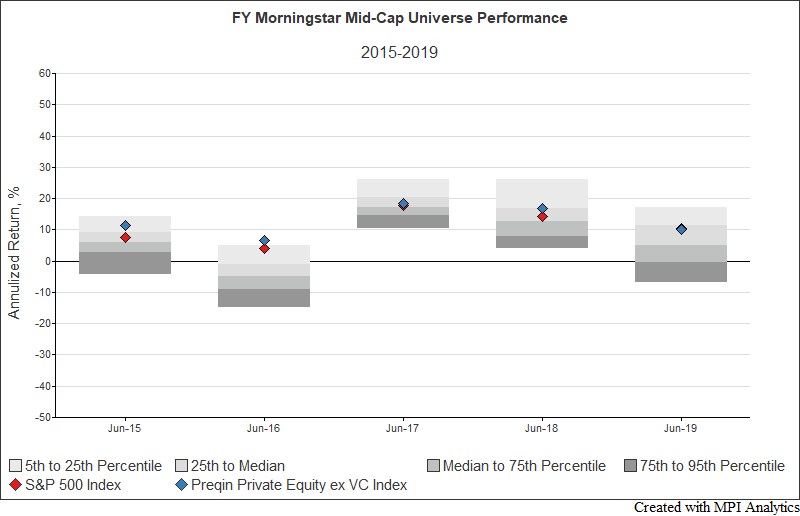

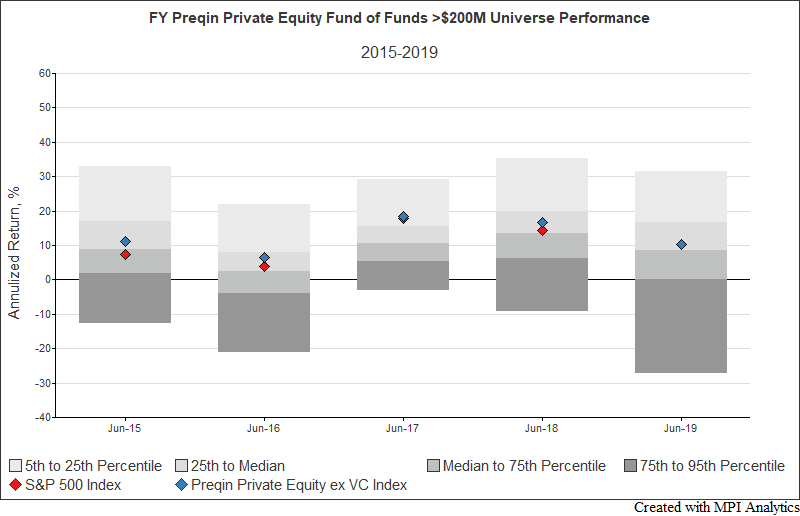

Fiscal year 2019 was a curious year for the Ivy League endowments. In a year with strong returns in key private market investment classes, the average Ivy underperformed a traditional domestic balanced 60-40 portfolio in FY 2019. Ivies also experienced a wider dispersion of returns and saw a shift in the historical positioning of performance leaders and laggards.

LINK

TL;DR a simple low cost 2 fund 60/40 portfolio outperforms active investing. UpstairsComputer continues to be wrong about life.

Posted on 2/23/20 at 6:31 am to OleWarSkuleAlum

I wonder if they are allowed to take short positions, probably not.

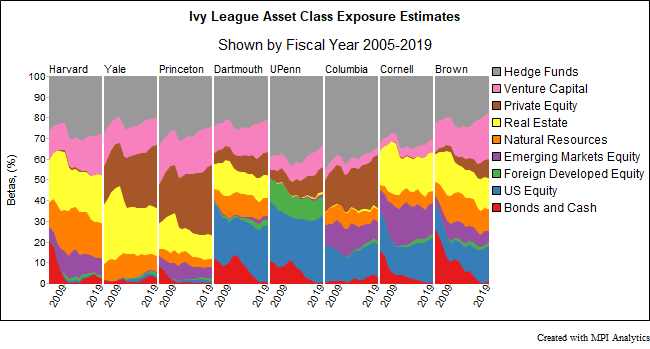

They also have large amounts of their portfolio in VC/PE so marking those can be quite wacky.

They also have large amounts of their portfolio in VC/PE so marking those can be quite wacky.

Popular

Back to top

1

1