- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Litquidity Headline Roundup 10/10/22

Posted on 10/10/22 at 9:34 am

Posted on 10/10/22 at 9:34 am

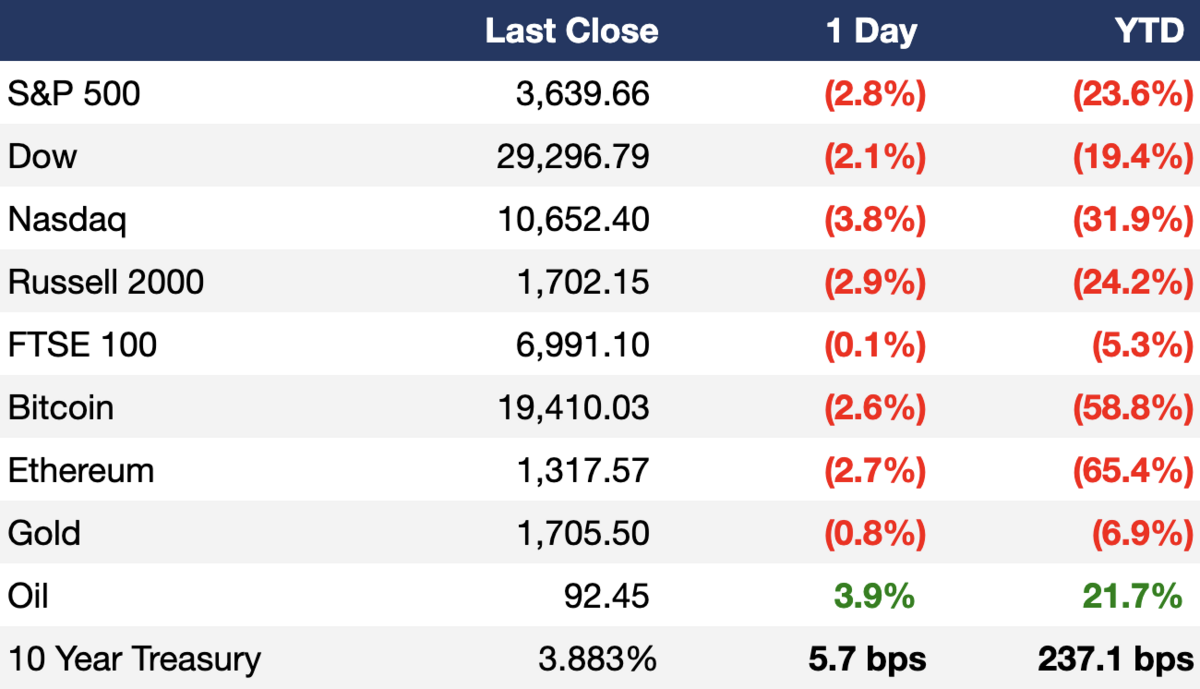

Markets

-Major averages fell across the board on Friday as investors anticipate September's strong jobs report to spark further Fed rate hikes

-The pan-European Stoxx 600 index fell 1.1%, with all major bourses and the majority of sectors trading in the red

--Tech stocks led the slide, falling 4.2%, while oil and gas stocks were the sole outlier to the upside, closing 1.1% higher

-The US bond market is closed today for Columbus Day

Earnings

What we're watching this week:

Wednesday: PepsiCo

Thursday: Delta Air Lines, BlackRock, Taiwan Semiconductor

Friday: JPMorgan Chase, Wells Fargo, Morgan Stanley, Citigroup

Headline Roundup

-US added 263k jobs in September and unemployment fell from 3.7% to 3.5% on a decline in labor force participation (RT)

-Hedge funds were down 6.18% YTD in September (RT)

-Strong US dollar is threatening to undermine US manufacturing rebound (WSJ)

-OPEC+'s oil cuts is bad for the global economy: Yellen (FT)

-Hurricane Ian may have caused ~$67B in insured losses, making it a top 5 US storm (AX)

-Taiwan plans to comply with US's China-related chip rules (RT)

-Biden signed an executive order to implement new framework to protect data transfers between US and EU (CNBC)

-Tesla sold a record China-made vehicles in September following Shanghai factory upgrade (RT)

-Rivian recalled nearly all of its vehicles to address a problem that could affect steering control (WSJ)

-China's holiday home sales fell 37.7% YoY (RT)

-Chinese ambassador to the US thanked Musk for his proposal on Taiwan (RT)

-A Florida buyer bought a rare 11.15ct pink diamond for $49.9M in a record-setting Hong Kong auction (WSJ)

-Twitter locked Kanye West’s account one day after his first post on the platform in nearly two years (BBG)

-RBI, the parent co of Burger King, has earmarked $400M to boost advertising and do a brand revamp as it has slipped to the fourth largest burger chain in the US (WSJ)

-Max Verstappen secured his second F1 world title after winning a chaotic Japanese GP (F1)

Deal Flow

M&A / Investments

-CVS Health Corp. is in exclusive talks to buy health-care provider Cano Health; it has a current market value of ~$4.6B (BBG)

-India has invited bids to sell a 60.72% stake in state-backed IDBI Bank, which has a current market value of ~$5.6B, as it seeks to ramp up its privatization drive (BBG)

-Hong Kong-based fund manager About Capital acquired a 60% stake in top Chinese crypto exchange Huobi Global at a supposed ~$3B valuation (TC)

-MidOcean Energy agreed will buy Tokyo Gas’ portfolio of four Australian liquefied natural gas projects for $2.15B (RT)

-Providence Equity Partners agreed to buy French automotive data firm A2Mac1 for ~$1.36B (RT)

-A consortium led by KKR and Oslo Pensjonsforsikring agreed to buy a 30% stake in Telenor’s Norwegian fiber network for ~$1B (BBG)

-Senior-living community operator Brookdale Senior Living is exploring options including a potential sale (BBG)

-Biotech firm PureTech Health is in talks with US-based drug developer Nektar Therapeutics about a possible offer (RT)

-Brazilian conglomerate Cosan agreed to buy a 4.9% stake in mining company Vale (RT)

VC

-WorkSpan, a cloud-based co-sell management platform, raised a $30M Series C led by Insight Partners (PRN)

-Purple Elephant Ventures, a Kenyan tourism-focused startup studio, raised a $1M pre-seed round led by Klister CreditCorp, The Untours Foundation, and angel investors (TC)

IPO / Direct Listings / Issuances / Block Trades

-Marafiq, a Saudi utility company backed in part by Aramco and PIF, secured enough investor demand for its ~$897M IPO within hours of opening order books. The company would have a market value of $3.1B at the top end of the price range (BBG)

Fundraising

-Convective Capital raised a $35M first fund to invest in early stage startups creating technology to prevent and contain wildfires (TC)

This post was edited on 10/10/22 at 11:36 am

Posted on 10/10/22 at 9:36 am to Sev09

I’ll start posting these daily, as able. It’s a great serving of information each morning

Popular

Back to top

1

1