- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: McGovern, Warren, Lawmakers to President Biden: Use Executive Authority to Lower Food Pric

Posted on 5/23/24 at 12:25 pm to KiwiHead

Posted on 5/23/24 at 12:25 pm to KiwiHead

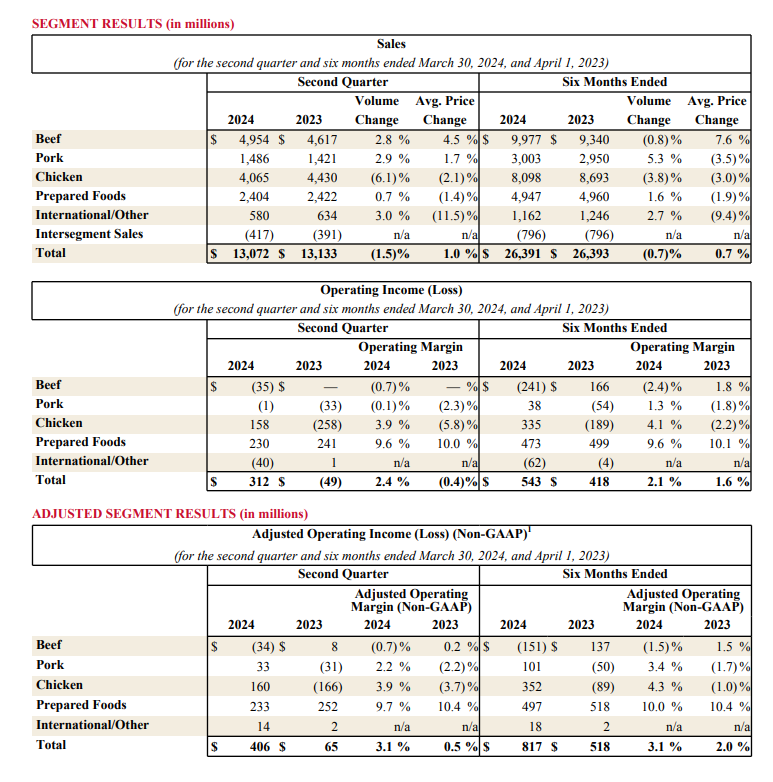

Straight from their Investor Relation page. Here's a link to their 2023 10-K:

Tyson SEC Fillings

2023 vs. 2022 • Cost of sales increased $3,636 million. Higher sales volume increased cost of sales $444 million while higher input cost per pound increased cost of sales $3,192 million.

• The $3,192 million impact of higher input cost per pound was impacted by: • Increase in live cattle costs of approximately $2,135 million in our Beef segment.

• Increase due to net derivative losses of $117 million in fiscal 2023, compared to net derivative gains of $225 million in fiscal 2022 due to our risk management activities. These amounts exclude offsetting impacts from related physical purchase transactions, which are included in the change in live cattle and hog costs and raw material and feed ingredient costs described herein.

• Increase of $322 million due to costs associated with plant closures. • Increase of $238 million related to inventory lower of cost or net realizable value adjustments.

• Increase of approximately $36 million in our Chicken segment related to net increases in feed ingredients costs and growout expenses, partially offset by reduced outside meat purchases.

• Increase of approximately $24 million in our Chicken segment due to $11 million of insurance proceeds, net of costs incurred, in fiscal 2023 compared to $35 million of insurance proceeds, net of costs incurred, in fiscal 2022 related to the fire at our production facility in fiscal 2021. • Decrease in live hog costs of approximately $295 million in our Pork segment.

• Decrease in freight and transportation costs of approximately $175 million. • Decrease in raw material and other input costs of approximately $45 million in our Prepared Foods segment.

This post was edited on 5/23/24 at 12:30 pm

Posted on 5/23/24 at 12:52 pm to wutangfinancial

So they were operating at a 100% +/- loss yoy from a net aspect. How does the CEO still have a job and not working at the Springdale carwash......unless .....he issued new debt and closed some plants

Popular

Back to top

1

1