- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Cash value life insurance

Posted on 10/25/22 at 5:08 am

Posted on 10/25/22 at 5:08 am

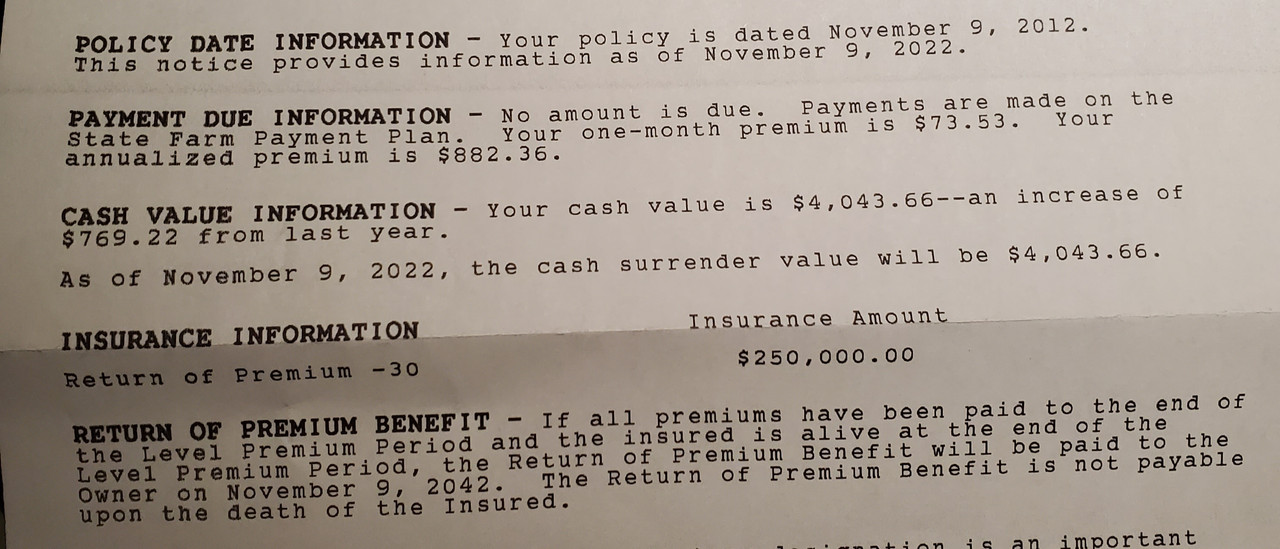

Morning, I have a life insurance plan set up in my state farm "bundle" I forgot about it but got this letter in the mail. Can this 4k be cashed and re-invested or is it best to leave here and mature?

This post was edited on 10/25/22 at 5:11 am

Posted on 10/25/22 at 5:50 am to LSURoss

That is a return of premium policy.

The cash value is pennies compared to what you get at maturity.

If you need life insurance (mortgage debt, dependents, spouse depends upon your income), you are best to keep the policy to maturity and get a 100% refund of all paid premium.

The biggest "loss" in this type of policy is paying that extra money on a term and then getting such a small percentage back for an early surrender.

If you have no need for life insurance, than surrendering can be on the table.

The cash value is pennies compared to what you get at maturity.

If you need life insurance (mortgage debt, dependents, spouse depends upon your income), you are best to keep the policy to maturity and get a 100% refund of all paid premium.

The biggest "loss" in this type of policy is paying that extra money on a term and then getting such a small percentage back for an early surrender.

If you have no need for life insurance, than surrendering can be on the table.

Posted on 10/25/22 at 6:07 am to meansonny

Thanks. I don't need the money, just wasn't sure it it was worth putting into something else.

I'll just tuck it away and look at the statement each year.

I'll just tuck it away and look at the statement each year.

Posted on 10/25/22 at 6:12 am to meansonny

Silly I'm sure, but is there a way to calculate what the maturity value is?

Posted on 10/25/22 at 6:55 am to LSURoss

Monthly payment X 12 X # of years term coverage that you bought.

Posted on 10/25/22 at 6:59 am to LSURoss

The policy is like a marriage.

You are best to either not get into it.

Or get into it and stick it out.

Divorce is the worst case scenario.

It can be good if you need it and see it through. It is tough making a 25 or 30 year commitment like that (which is why many people don't like them).

But the commitment can be a huge win for you if you see it through.

You are best to either not get into it.

Or get into it and stick it out.

Divorce is the worst case scenario.

It can be good if you need it and see it through. It is tough making a 25 or 30 year commitment like that (which is why many people don't like them).

But the commitment can be a huge win for you if you see it through.

Posted on 10/25/22 at 7:50 am to meansonny

Thank you for the clarification

Posted on 10/25/22 at 4:23 pm to LSURoss

According to my math, you are 10 years into a 30 year term, paying roughly $75/month for $250k in life insurance.

My advice would be to get a term policy for 20 years, then simply invest the difference. You’ll be much further ahead in 20 yrs than simply earning $0 on any investment.

Many SF agents push life insurance due to corporate mandates and don’t have your best interest at heart.

My advice would be to get a term policy for 20 years, then simply invest the difference. You’ll be much further ahead in 20 yrs than simply earning $0 on any investment.

Many SF agents push life insurance due to corporate mandates and don’t have your best interest at heart.

This post was edited on 10/25/22 at 7:10 pm

Posted on 10/25/22 at 9:29 pm to meansonny

quote:

But the commitment can be a huge win for you if you see it through.

A huge win for the commissioned agent who sold the policy but not for the customer who paid wayyy more than he needed to for 30 years and let State Farm make money on the investment of the extra amount instead.

Cut your losses now (if you are still insurable) and buy a flat term policy. The loss you’ll take by cancelling the ROP policy early will be more than made up in what you earn on investment of the savings (difference between the ROP and the cost of the flat term). This assumes you can still get a. Lower rate on a flat term policy.

Look, you know you need coverage. Why would you pay way more than you need to when you can be making money for yourself instead of for State Farm — AND still have the peace of mind that comes with a term policy?

Full disclosure: I used to work for State Farm and I sold a grand total of ZERO return of premium term policies and ZERO universal life policies - for the same reason which is that they don’t make sense for almost everyone.

This post was edited on 10/25/22 at 9:32 pm

Posted on 10/25/22 at 9:34 pm to TDsngumbo

Also, how old are you right now? It might indeed be too late for you to save money by switching to a flat term policy. I see your policy is dated ten years ago. $73/month for a $250,000 20 year policy should normally be for a healthy 55-60ish year old male.

This post was edited on 10/25/22 at 9:45 pm

Posted on 10/26/22 at 1:39 am to TDsngumbo

I will be 39 next month

This post was edited on 10/26/22 at 1:40 am

Posted on 10/26/22 at 5:46 am to LSURoss

I just ran you through my website (I’m an Ins agent in AL).

20 yr term for 39 yr old, standard health, non-smoker, living in LA, is like $30/month ($360/yr).

With your $4k in cash value, you could have “free” life insurance for like 15 yrs, then invest $75/month.

$75 month invested for 15 years is WAY more than staying with 0% interest.

Fire that agent as well.

20 yr term for 39 yr old, standard health, non-smoker, living in LA, is like $30/month ($360/yr).

With your $4k in cash value, you could have “free” life insurance for like 15 yrs, then invest $75/month.

$75 month invested for 15 years is WAY more than staying with 0% interest.

Fire that agent as well.

Posted on 10/26/22 at 7:20 am to BamaCoaster

Yea I just ran you through mine too. Assuming good health and no tobacco use, you’re looking at anywhere from 15-28 a month for the same coverage. Start a new application today and fire State Farm as soon as that new one goes into force. State Farm is fricking terrible  . It’s amazing how many people get fricked by them and just take it.

. It’s amazing how many people get fricked by them and just take it.

Posted on 10/26/22 at 7:49 am to TDsngumbo

Why don't you ask him how much he is paying before you tell him what to do? Lol

He may be better off walking away.

He may not.

It kind of makes sense to slow down and get all the info. No?

The benefit of the return of premium is the guaranteed payback at the end of 30 years. No risk. Guaranteed return.

For some reason, I'm reading that as 0 return? Lol. No. He got a 30 year life insurance policy. I never understand why people talk in half truths to make some point.

He may be better off walking away.

He may not.

It kind of makes sense to slow down and get all the info. No?

The benefit of the return of premium is the guaranteed payback at the end of 30 years. No risk. Guaranteed return.

For some reason, I'm reading that as 0 return? Lol. No. He got a 30 year life insurance policy. I never understand why people talk in half truths to make some point.

Posted on 10/26/22 at 7:52 am to TDsngumbo

State farm is a good company.

They are not the cheapest life insurance. But it is a term policy.

There isn't some undisclosed retirement plan that the agent is getting for this policy. Just a normal term commission.

Some of the takes in here are "hot".

They are not the cheapest life insurance. But it is a term policy.

There isn't some undisclosed retirement plan that the agent is getting for this policy. Just a normal term commission.

Some of the takes in here are "hot".

Posted on 10/26/22 at 9:27 am to meansonny

quote:

Why don't you ask him how much he is paying before you tell him what to do? Lol

He literally posted his annual statement for us all to see.

quote:

He may be better off walking away.

He might be, depending on his current health. Or he may be stuck in an uninsurable state, such as myself, and forced to stick to some vastly overpriced State Farm life insurance. I am there with some life policies I bought through them when I worked for them years and years ago and it is terrible.

quote:

The benefit of the return of premium is the guaranteed payback at the end of 30 years. No risk. Guaranteed return.

Guaranteed return of your premium payments over the past 30 years, while inflation skyrocketed and State Farm made money off of it. People who think of these ROP policies as a good deal are the same ones that Dave Ramsey is good for because they're obviously not great with money. Or they don't think about how it works. Either way, if you have half a brain you know a return of premium policy is a terrible idea.

Are you on the payroll for the captive companies who charge way more than a person needs to pay for an identical policy or something? You're always coming on here and acting as though the NYLs, NWMs, State Farms, etc. are these fantastic options for term life insurance. They're not. Unless you can afford a large whole life policy and it's the right thing for your situation, NYL and NWM and maybe Mass Mutual are the only ones I'd recommend. Otherwise, buy term from another company.

Posted on 10/26/22 at 2:36 pm to TDsngumbo

quote:

Are you on the payroll for the captive companies who charge way more than a person needs to pay for an identical policy or something? You're always coming on here and acting as though the NYLs, NWMs, State Farms, etc. are these fantastic options for term life insurance. They're not. Unless you can afford a large whole life policy and it's the right thing for your situation, NYL and NWM and maybe Mass Mutual are the only ones I'd recommend. Otherwise, buy term from another company.

His monthly payment wasn't listed on the statement. People are guessing.

I'd love to know his monthly payment.

I think it is hilarious that you shite on a return of premium policy but promote whole life policies.

I don't see the need to recommend policies where the "benefit" is 25+ years down the road (a lot can change over that time).

But a return of premium is so much less expensive than a whole life policy and he is going to walk away with cash in hand tens of thousands of dollars to negate a need for permanent life insurance. Honestly. Cash in hand is so much better than whole life.

The "risk" for such a return of premium policy is that he loses more if he cancels before the maturity date.

Posted on 10/26/22 at 2:42 pm to TDsngumbo

quote:

Are you on the payroll for the captive companies who charge way more than a person needs to pay for an identical policy or something?

I get it. You don't like me because I point out that your ideas are kind of basic.

You complain about a state farm commission being outrageous. I presume your commissions are higher than state farm. Am I right? What is the commission on a state farm term policy?

I know that state farm isn't the cheapest life insurance. They are a property and casualty company who sells life insurance. Why would they be the cheapest? But to act like their agents are raping their customers with term commissions is why I call you out.

You promote whole life insurance over a return of premium term policy. Which one pays the higher commission? Honestly.

Which one is more expensive?

If I pay the OP $50,000 at the end of a monthly 30 year term policy, are you going to claim that he still needs permanent life insurance for a burial and final medical expenses?

This stuff is so basic.

I write most of our life insurance through Protective. I don't have a loyalty to protect any company (captive or not). But on a message board, I will call out bad thoughts and ideas.

Posted on 10/26/22 at 5:09 pm to meansonny

quote:

His monthly payment wasn't listed on the statement. People are guessing. I'd love to know his monthly payment.

It’s like the second line man.

And, return of premiums are awful policies.

Take term, invest the difference, and you’ll come out ahead.

It’s that simple.

Popular

Back to top

1

1