- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Dow futures down 500pts

Posted on 5/9/22 at 7:45 pm to Jjdoc

Posted on 5/9/22 at 7:45 pm to Jjdoc

I feel like if you are investing so much that it causes you meaningful stress when the market tanks (and you aren’t of retirement age) or even causes you to not be able to afford a family vacation, you are likely overexposed.

Posted on 5/9/22 at 8:40 pm to Ross

quote:

I feel like if you are investing so much that it causes you meaningful stress when the market tanks (and you aren’t of retirement age) or even causes you to not be able to afford a family vacation, you are likely overexposed.

Just a little bittle

Posted on 5/9/22 at 8:42 pm to Jjdoc

Markets don’t know which way to go this evening… futures were up 100, then down 140, then back even, and now down 70

Posted on 5/9/22 at 8:48 pm to lynxcat

That Upstart earnings movement is nuts. Stock was down 80% from the highs going into earnings and it lost another 45%. Christ.

Posted on 5/9/22 at 8:54 pm to Lsut81

quote:

Markets don’t know which way to go this evening… futures were up 100, then down 140, then back even, and now down 70

We will have a bounce back this week, but finish red

Posted on 5/9/22 at 9:55 pm to slackster

The Coinbase 6 month chart is nuts. Some people went from huge gains to huge losses. Wild.

Posted on 5/9/22 at 11:26 pm to Jjdoc

Technically correction territory.

Posted on 5/10/22 at 7:02 am to bod312

quote:

I see you are buying bitcoin but are really down on equities, do you not share the same concern for bitcoin? What will happen to bitcoin if we go into a recession?

I am buying Bitcoin and equities right now. Just because we are in a recession is no reason for me to stop buying. I continue to DCA Bitcoin whether is is at $60k or $30k. I expect it will either bounce off $30k and run back to $40k pretty quickly or if it breaks $30k that is will have at least another 20% drop from there. I will continue to buy either way. I expect Bitcoin to outperform the market from here for the next 12 years.

You continue to quiz about my buying. What is it you are doing with your money since you are so confident we are not in a recession?

This post was edited on 5/10/22 at 7:20 am

Posted on 5/10/22 at 8:06 am to go ta hell ole miss

quote:

You continue to quiz about my buying. What is it you are doing with your money since you are so confident we are not in a recession?

I am "quizzing" you because you are so sure things are going to get worse and implied we should take some sort of action. I am curious of those actions. You seemed so pessimistic on stocks and was surprised you were buying Bitcoin. If we are going into a recession and the markets continue to slide then Bitcoin is also going lower. I never said we weren't in a recession but I said we weren't in a bear market. I said the recession indicators are lagging thus we could be in a recession but it has not been confirmed yet. I stated that simply screaming at the sky because the market is falling does no one any good. I have not changed my investing strategy and just continue buying on my regular intervals. It doesn't sound like you have changed your strategy much either.

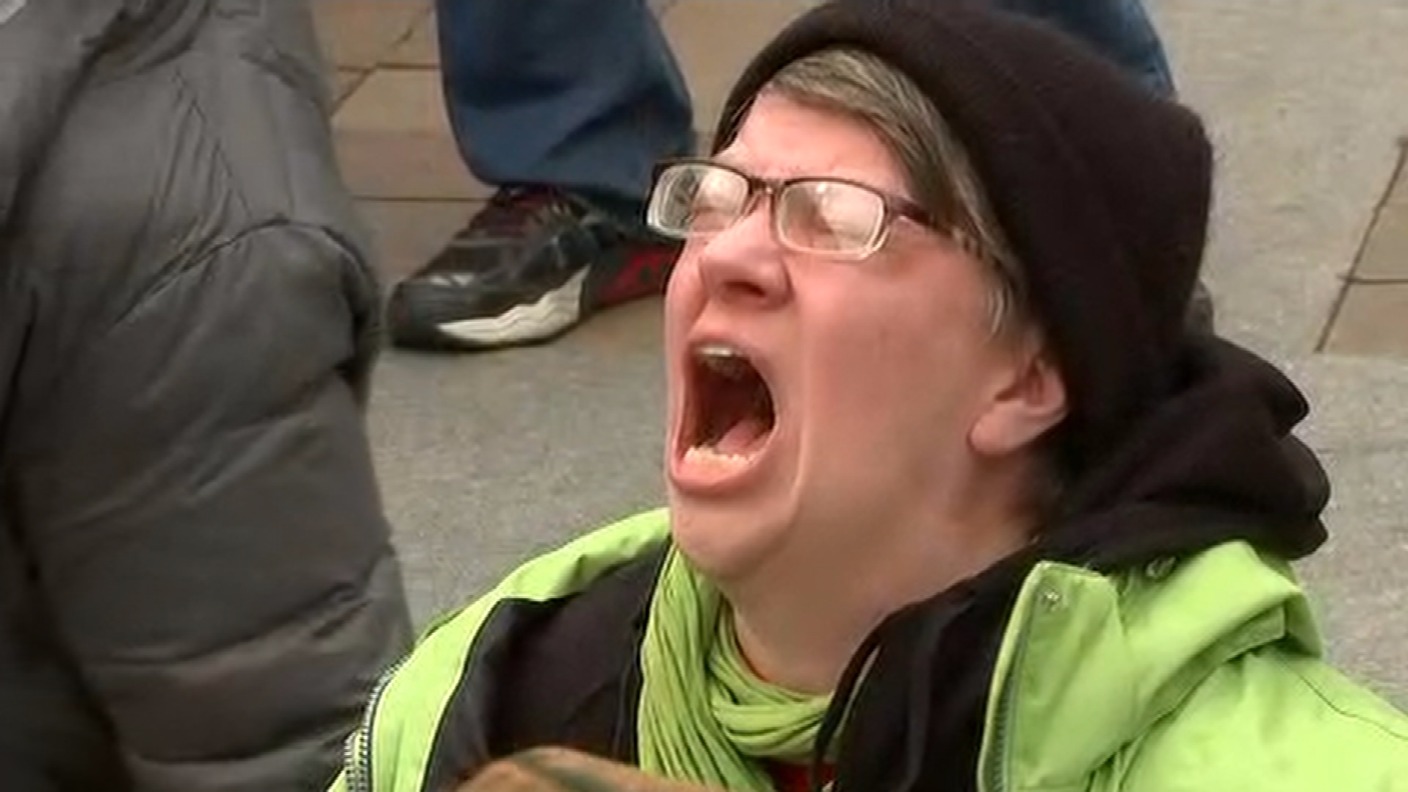

They would hate to admit it but many of the responses in this thread are simply this:

ETA: I am not saying this is you because you have provided at least some actual information and not just crying about the markets currently dropping.

This post was edited on 5/10/22 at 8:08 am

Posted on 5/12/22 at 10:00 am to bod312

quote:

I am "quizzing" you because you are so sure things are going to get worse and implied we should take some sort of action.

Things have gotten worse in just two days. I did not imply or suggest or even pretend to have enough knowledge to suggest others should do anything. I am buying in this market and have laid out my thoughts (Bitcoin only dropped 16 after going below $30k, so I missed that by a few % Apple and Microsoft both went below numbers I suggested and are dragging the S&P down).

Did we finally get into a bear market this morning and are now climbing back out of it based on your metrics?

This post was edited on 5/12/22 at 2:52 pm

Posted on 5/18/22 at 7:49 am to slackster

quote:

Forecasts haven’t been all that positive, but earnings have beaten on average this quarter.

On top of all other others that missed now Walmart and Target missed. I think some of you all continue to underestimate.

Posted on 5/18/22 at 8:53 am to Lsut81

These are the sellers jumping out after the markets have had some nice jumps

Posted on 5/18/22 at 9:00 am to go ta hell ole miss

I can’t find the specific number but I saw it just the other day posted by an economist. It was around 88% of companies had beaten expectations. And the average revenue growth was around 9% I believe.

Posted on 5/18/22 at 10:19 am to Shepherd88

quote:

revenue growth was around 9% I believe.

If its on the retail side, revenue =/= profit. Of course revenues are up, everything costs fricking more. What are their profits, are they up too? Id say no, prob flat at best due to their additional costs too.

Posted on 5/18/22 at 10:45 am to Lsut81

I found it. 77% of the S&P 500 companies have surprised to the upside with an average revenue growth of 12.9%. You do have a point on actual profits though and I’ll try to find that data.

Posted on 5/18/22 at 1:13 pm to Shepherd88

quote:

It was around 88% of companies had beaten expectations.

88% of companies have not beaten earnings expectations this quarter. The concern is not so much the number of companies, it which companies are missing and guidance. Transportation costs matter and it is impacting the largest companies a lot. That is putting more inflationary pressure on the market and taking money away from discretionary.

This post was edited on 5/18/22 at 1:18 pm

Posted on 5/18/22 at 1:57 pm to go ta hell ole miss

-1,100 now. Damn, maybe Huzzzz was right??

Posted on 5/18/22 at 2:00 pm to go ta hell ole miss

77.3% of the S&P 500 companies have beaten earnings (profits) this year with an increase of 9.2% from last year. Revenues are up 12.9%, sir.

Posted on 5/18/22 at 2:06 pm to Shepherd88

And companies making billions are down 40 to 80% in the last couple of months too

Posted on 5/18/22 at 2:11 pm to Shepherd88

quote:

77.3% of the S&P 500 companies have beaten earnings (profits) this year with an increase of 9.2% from last year. Revenues are up 12.9%, sir.

So

PE still at 20.

Back to top

1

1