- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Dh337225

| Favorite team: | LSU |

| Location: | Augusta, GA |

| Biography: | |

| Interests: | |

| Occupation: | |

| Number of Posts: | 15 |

| Registered on: | 10/6/2022 |

| Online Status: | Not Online |

Forum

Message

re: How much down payment would you put down?

Posted by Dh337225 on 6/14/24 at 7:39 pm to Big Scrub TX

You're leveraging only equity built from making regularly scheduled payments and the difference between future sale price vs purchase price at 'x' date built from the home's sale price to cover the remaining principal/realtor fees/misc closing fees/taxes if you started with nothing. You may not have any cushion when selling within the first 5 years because you're paying mostly interest rather than principal depending on what the home sells for. Any downpayment gives you a better cushion to not come out of pocket if it's anyway upside down and it grows with the appreciation of the home.

Down payment size doesn't affect FHA/VA loans. Only conventional loans. 20% down to not pay PMI, generally, any 5% increments higher than 20% down get better rates. Incomes that are within a zip code's area median income (AMI) limits are eligible for interest rate reductions (conventional only).

Waiving upfront lender fees (underwriting/processing/etc) or origination fees will get baked into the interest rate in exchange for fewer closing costs at the table. Consumers just don't see what's behind the screen when a loan ofifcer is pricing the loan.

Down payment size doesn't affect FHA/VA loans. Only conventional loans. 20% down to not pay PMI, generally, any 5% increments higher than 20% down get better rates. Incomes that are within a zip code's area median income (AMI) limits are eligible for interest rate reductions (conventional only).

Waiving upfront lender fees (underwriting/processing/etc) or origination fees will get baked into the interest rate in exchange for fewer closing costs at the table. Consumers just don't see what's behind the screen when a loan ofifcer is pricing the loan.

re: How much down payment would you put down?

Posted by Dh337225 on 6/14/24 at 5:04 pm to Big Scrub TX

There's a multitude of things to consider for down payment which is the starting equity in the home as it's valued.

Down payment is one factor that weighs into how an interest rate is priced along with loan amount/credit score/eligible loan programs/deciding on waiving origination and lender fees.

Down payment can and more than likely will appreciate over time. Let's say you start a 100% financing and being forced to sell within 5 years. You're coming out of pocket when selling rather than using the equity that would've grown if you've made a down payment of at least 6-8% at closing that can at least cover realtor fees/closing costs with property taxes and attorney fees.

Down payment is one factor that weighs into how an interest rate is priced along with loan amount/credit score/eligible loan programs/deciding on waiving origination and lender fees.

Down payment can and more than likely will appreciate over time. Let's say you start a 100% financing and being forced to sell within 5 years. You're coming out of pocket when selling rather than using the equity that would've grown if you've made a down payment of at least 6-8% at closing that can at least cover realtor fees/closing costs with property taxes and attorney fees.

re: How much down payment would you put down?

Posted by Dh337225 on 6/14/24 at 10:27 am to Thundercles

Everything all depends on these considerations.

1) How long are you planning on staying in the home? Because if you were to sell within 5 years, you're coming out of pocket paying for realtor fees/closing costs because you're paying more on interest than principal with no equity if you were 0% down. 5-6% is been average. Find a monthly payment you're willing to tolerate.

2) Would you need any portion of this cash for emergency purposes regarding the home or personal life events? Park your funds in a high yield savings to accrue interest while fighting current inflation. Any retail bank savings with 0.01% APY is basically losing value of your money day-by-day.

I'm a mortgage broker licensed in the southeast. I can run through scenarios with you over the phone or video call and see what path you want to take. 706-223-0322

1) How long are you planning on staying in the home? Because if you were to sell within 5 years, you're coming out of pocket paying for realtor fees/closing costs because you're paying more on interest than principal with no equity if you were 0% down. 5-6% is been average. Find a monthly payment you're willing to tolerate.

2) Would you need any portion of this cash for emergency purposes regarding the home or personal life events? Park your funds in a high yield savings to accrue interest while fighting current inflation. Any retail bank savings with 0.01% APY is basically losing value of your money day-by-day.

I'm a mortgage broker licensed in the southeast. I can run through scenarios with you over the phone or video call and see what path you want to take. 706-223-0322

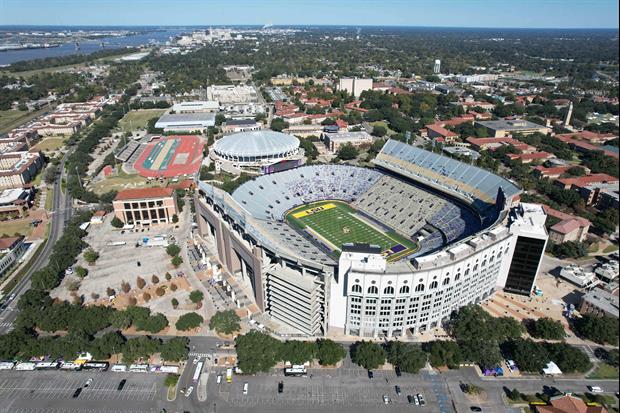

FS - 4 - LSU VS ARMY SECT 412 (SEZ)

Posted by Dh337225 on 9/17/23 at 6:19 pm

For Sale - 4 Tickets vs Army - Sold as Pair or all 4 - no singles ($300 for all 4 , $150 for pair)

Section 412 Rws 41 Seats 15-18

only zelle/apple pay

text 337-356-7936

Section 412 Rws 41 Seats 15-18

only zelle/apple pay

text 337-356-7936

re: WTB 2 Tickets for LSU vs FSU

Posted by Dh337225 on 8/23/23 at 8:50 pm to Mystictiger

I have 2 at section P01 / Row Q / Seats 8&9.

$500 for pair.

706-223-0322

$500 for pair.

706-223-0322

I have 4 for Georgia State.

Section 412 - Row 41 - Seats 15-18.

Georgia State - $50/ea - $200 for 4

Text 706-223-0322

Section 412 - Row 41 - Seats 15-18.

Georgia State - $50/ea - $200 for 4

Text 706-223-0322

FS - LSU VS GA STATE - 4 TIX Together or 2 Pairs

Posted by Dh337225 on 8/21/23 at 9:03 am

Section 412 - Row 41 - Seats 15/16/17/18 - $50 Each - $100/pair. No singles.

Only take apple pay/zelle. Email transfer once payment is received/confirmed.

Text - 706-223-0322

Only take apple pay/zelle. Email transfer once payment is received/confirmed.

Text - 706-223-0322

Popular

1

1