- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Looking at Bayer AG (BAYRY) (and Monsanto)

Posted on 8/8/16 at 10:39 pm

Posted on 8/8/16 at 10:39 pm

Price: $106.40

52 week high: $148.92

52 week low: $94.36

Average target price: $120.83 ( LINK)

EPS (TTM - 6/30/16): $5.87

P/E (6/30/16): 18.1

PEG: .86

Dividend: 2.69%

Net Profit Margin (TTM): 9.76%

Article from December, 2015:

LINK

Bayer has been in negotiations to purchase Monsanto.

LINK

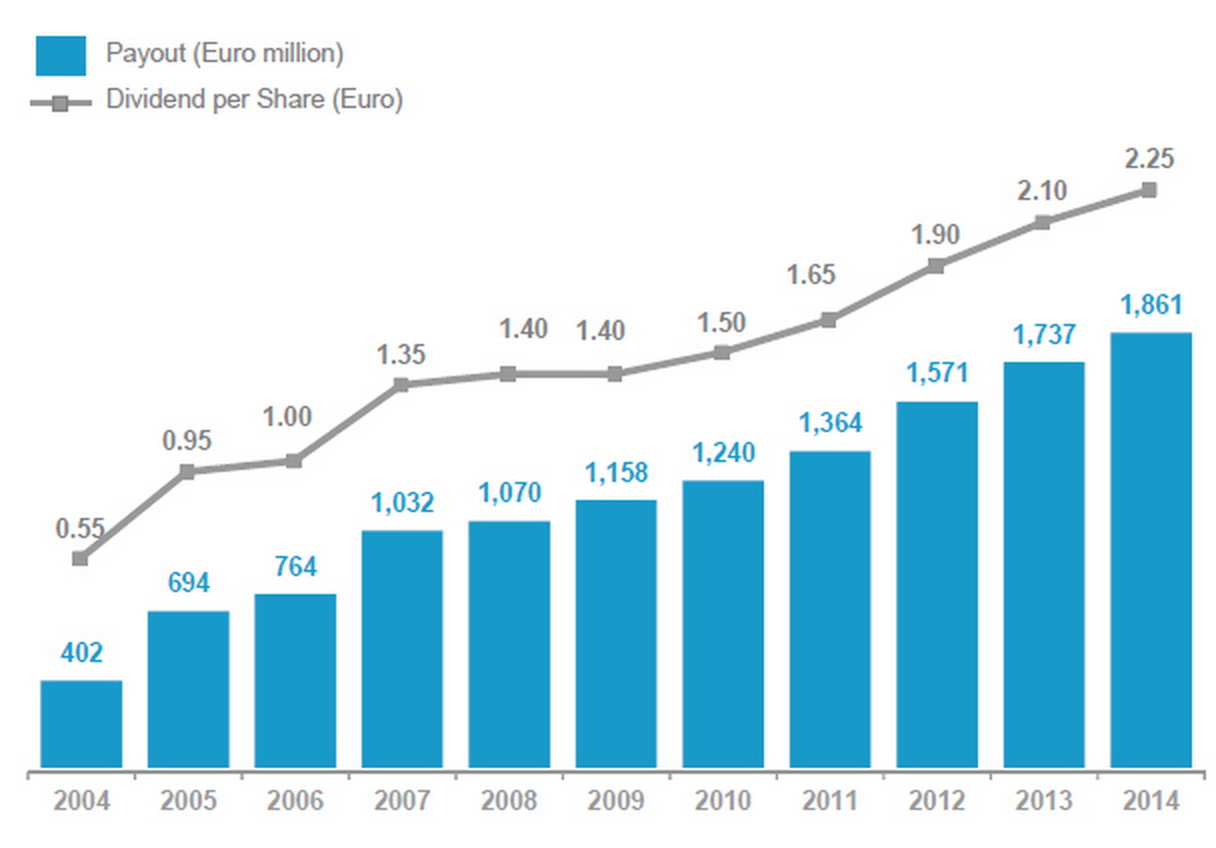

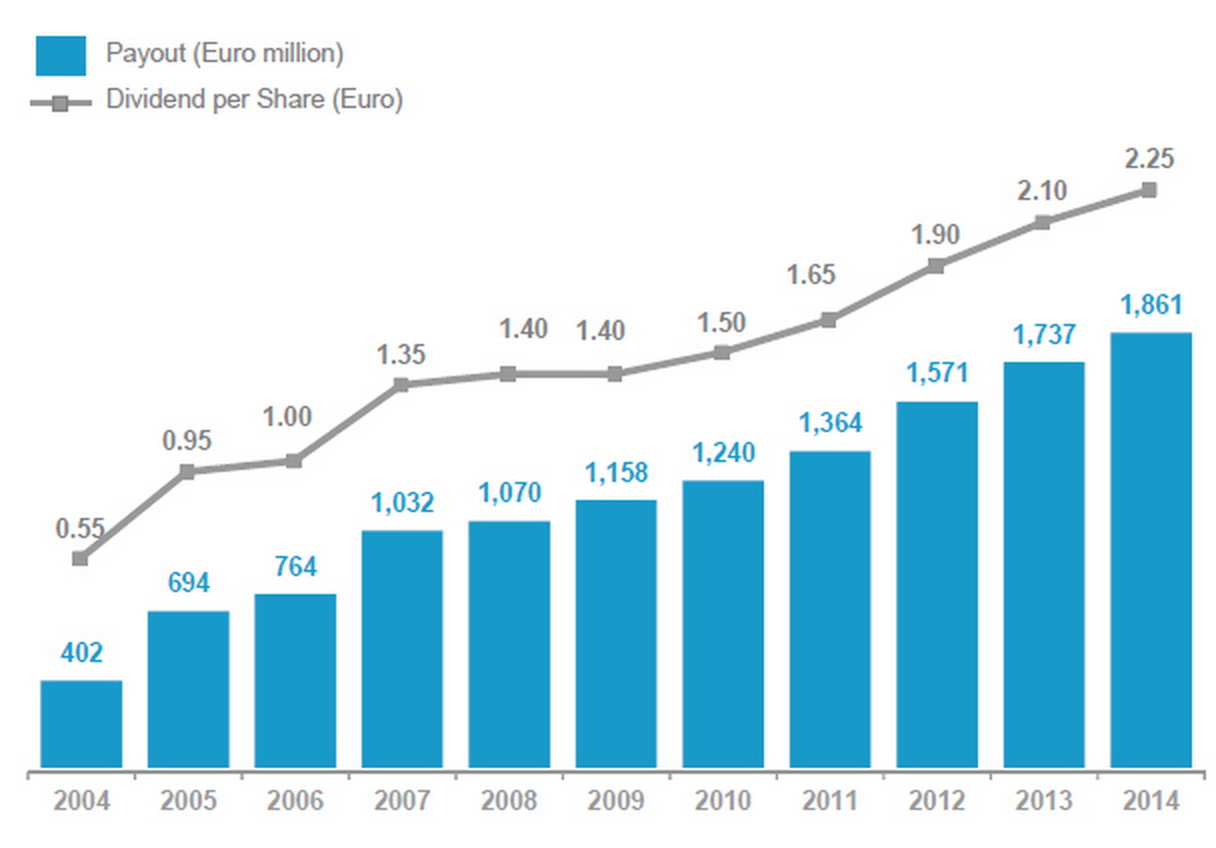

And if you love dividends...

I bought in at $106.61 last week. Would love a spike in the near future but don't mind holding this one long if that doesn't happen. Thoughts?

52 week high: $148.92

52 week low: $94.36

Average target price: $120.83 ( LINK)

EPS (TTM - 6/30/16): $5.87

P/E (6/30/16): 18.1

PEG: .86

Dividend: 2.69%

Net Profit Margin (TTM): 9.76%

Article from December, 2015:

quote:

Bayer's healthcare division saw excellent revenue growth of 19 percent, with pharma revenues growing fifteen percent and consumer health revenues growing 28 percent yoy. This reflects a very strong growth rate we have seen in the previous two quarters, Bayer's healthcare revenues are up 24 percent year to date. The fact that Bayer's healthcare business is growing at a faster pace than all of the company's businesses combined is a strong positive, as healthcare revenues are more valuable due to the high margins these operations provide: Bayer's healthcare business provides an excellent 22 percent operating margin, Bayer's cash margin for its healthcare revenues is 22 percent as well.

Crop Science revenues grew 9.5 percent, which is a good result as well, but not as great as Bayer's healthcare division's performance. Crop Science revenues came with a nine percent operating margin in the third quarter, which is not bad, but less than half the profit earned per dollar grossed in comparison to Bayer's healthcare business. Crop Science was able to increase the margin on a yoy basis though, which is a positive indicator for the future profitability of the business.

Covestro, Bayer's former polymer business, was spun off earlier this quarter and is thus not of relevance any longer.

We can say that 2015 has been a great year operationally for Bayer, the company saw revenue growth, margin growth and earnings growth as well as increasing cash flows. The excellent positioning of Bayer's healthcare operations is very positive as we see high growth rates and excellent margins here, I thus believe spinning off the polymer business in order to focus on the most profitable and promising segments was a good decision by Bayer.

The outlook for Bayer's healthcare division is good, just last week the European Medicines Agency's Committee for Medicinal Products for Human Use formed a positive opinion on Bayer's hemophilia drug factor VIII, which will likely be approved during the first quarter of 2016. Factor VIII will be used for treatment as well as prophylaxis in both adults and pediatric patients of hemophilia A. Bayer also saw new indications for existing drugs, e.g. Xarelto got approved for the treatment and prevention of pulmonary thromboembolism and deep vein thrombosis in Japan. This should bode well for Xarelto's performance, which already is among the world's best selling drugs (with $3.7 billion in revenues in 2014 and an almost 80 percent growth rate yoy). Eylea got approved in Europe for a new indication (treatment of visual impairment due to myopic choroidal neovascularization), and Bayer's Betaconnect got approved by the FDA as the first autoinjector for relapsing-remitting multiple sclerosis.

With these catalysts in play for more revenue and earnings growth for Bayer's healthcare division the company looks poised to continue on its path of profitable growth, yet the company trades at an inexpensive valuation:

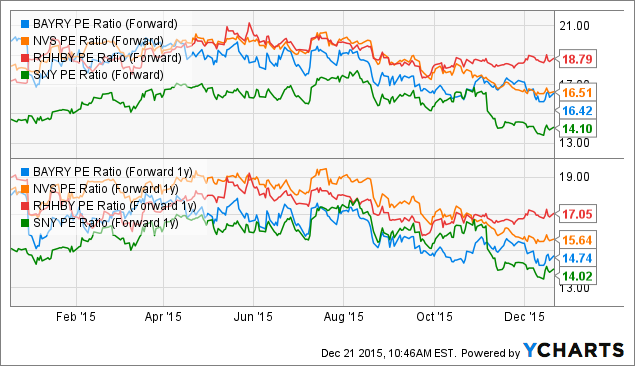

Looking at Bayer's valuation relative to its European pharma peers, we see that Bayer is valued in line with Novartis (NYSE:NVS), Roche (OTCQX:RHHBY) and Sanofi (NYSE:SNY) based on a forward earnings multiple of 16.4 vs 16.5 for its peers. When we look at the forward earnings multiples for the next year, we see that Bayer is trading at a discount to its peers (14.7 versus 15.6), which reflects Bayer's higher growth rates.

LINK

Bayer has been in negotiations to purchase Monsanto.

quote:

Buying Monsanto would give Bayer the largest seed supplier and a pioneer of crop biotechnology, and create the world's largest producer of seeds and pesticides. The kind of genetically modified seeds Monsanto started to commercialize two decades ago now account for the majority of corn and soybeans grown in the U.S. Monsanto also sells seeds in foreign markets including Latin America and India.

LINK

And if you love dividends...

I bought in at $106.61 last week. Would love a spike in the near future but don't mind holding this one long if that doesn't happen. Thoughts?

This post was edited on 9/6/16 at 8:38 am

Posted on 9/6/16 at 8:27 am to Jon Ham

Bayer increased its Monsanto bid to $127.50 from $125. Multiple sources are saying a deal is near and speculating that $130 is the number. Monsanto is currently hovering around $108.

This post was edited on 9/6/16 at 9:40 am

Popular

Back to top

1

1