- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: roth 401k vs regular 401k

Posted on 10/17/19 at 3:23 pm to DeathAndTaxes

Posted on 10/17/19 at 3:23 pm to DeathAndTaxes

quote:

Let's say someone retired January 1 of this year, and they need $98,350 a year to live on (I chose this number because it is the amount that brings them to the very top of the 12% bracket.)

If they need $98,000 to live off of. What was the effective tax rate of their Roth contributions? That puts them in at least the 22% category.

Because you just showed the effective rate of their Trad to be 11.61%.

Posted on 10/17/19 at 4:31 pm to baldona

quote:

If they need $98,000 to live off of. What was the effective tax rate of their Roth contributions? That puts them in at least the 22% category.

Because you just showed the effective rate of their Trad to be 11.61%.

Funny you should ask that, because I was just whipping that up.

Let's say our guy made $400,000 a year (spouse didn't work). That means he was firmly in the 32% tax marginal tax bracket. He just happened to make that same amount for the last 30 years of his career (worst case scenario for the Roth, higher income the whole time), and because he didn't read TD, he did't start contributing to his 401k until his last 30 years of work. He contributed $19,000 a year.

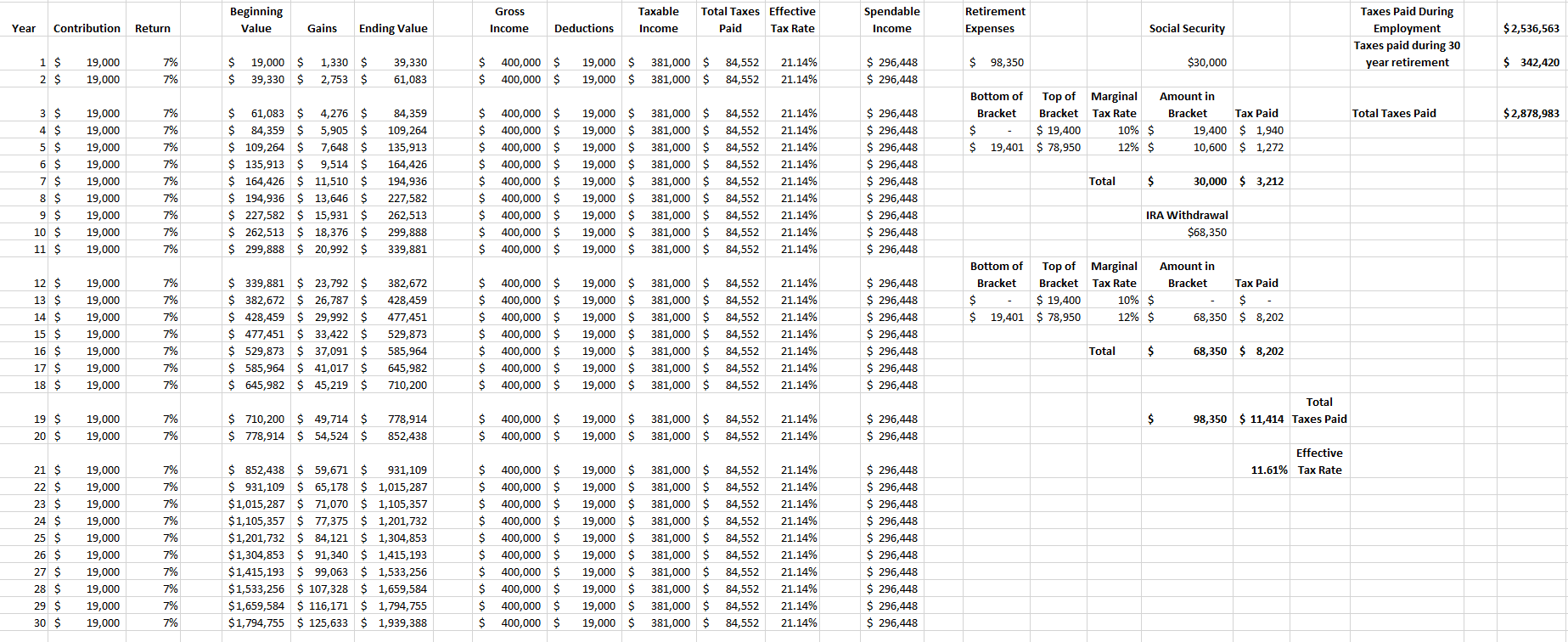

So 30 years of Traditional 401k contributions. Then a 30 year retirement. Lets see how that works out:

I modeled it out how it would actually happen, meaning I put $19,000 in the 401k, and then lowered his taxable income for each year of work by $19,000, and showed the resulting taxes and spendable income. As you can see, he paid $84,552 in taxes every year of work (effective tax rate of 21.14%), which sums to $2,536,563 over 30 years.

If his retirement expenses remained the same for 30 years, and he withdrew the same $68,350 every year, he would pay $342,420 in taxes over the course of his retirement ($11,414 x 30 years).

His total taxes paid over the 60 years of work and retirement would be $2,878,983

But what if our guy actually went and sat down with someone who knew what they were doing and could give him some advice 30 years ago when he started saving?

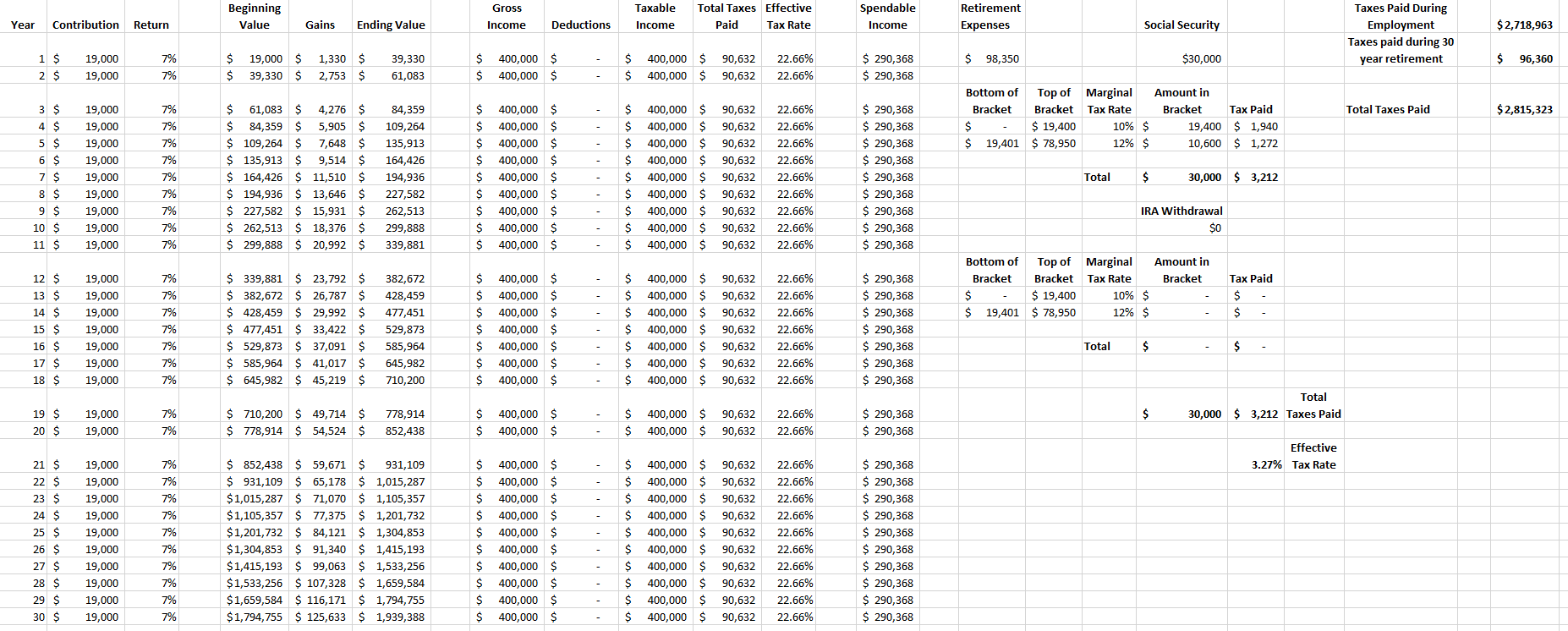

This time, he made Roth 401k contributions instead. I put $19,000 every year into the 401k, but those contributions didn't lower his taxable income. He paid taxes on all $400,000, resulting in $90,632 paid in taxes each year (effective rate of 22.66%), totaling $2,718,963 over his 30 year career.

While retired, he still needs $98,350 a year, but because he is able to withdraw from his Roth assets tax-free, he would only pay taxes on his social security of $30,000 a year. His total taxes each year would be $3,212 (effective tax rate of 3.27%.) He would pay $96,360 in taxes over his retirement ($3,212 x 30 years.)

His total taxes paid over 60 years of work and retirement would be $2,815,323.

Jesus tap dancing Christ! He would pay $63,660 LESS with the Roth? Even with his marginal tax rate going down 20%? What kind of black magic frickery is this?!

The difference in tax rates while working (21.14% for the Traditional, 22.66% for the Roth), is far less impactful than 30 years of the difference in in tax rates while retired (11.61% for the Traditional, 3.27% for the Roth).

Mind you, his spendable income (Gross Income - Deduction - Taxes paid) over his 30 years of work would have been reduced by $182,403 with the Roth. Netted out, over the course of 60 years the Traditional IRA would have given him $118,743 extra dollars. Less than $2,000 a year.

And this is in this very specific scenario, where he was in a high bracket his entire working career, and he cut his spending from $296,448 a year to $98,350. Not very likely. If instead, he needed 75% of his previous spending in retirement, that would be $222,336 a year, meaning he would need to withdraw $192,336 a year from his IRA, resulting in taxes of $44,786 a year, while the Roth would remain at $3,212 a year.

Now we are talking about a difference of $1,064,790 in taxes paid over the course of 60 years. In favor of the Roth.

Come at me bro.

This post was edited on 10/17/19 at 5:08 pm

Popular

Back to top

1

1