- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: There are some major issues lurking in the US financial markets

Posted on 3/16/19 at 7:29 am to Doc Fenton

Posted on 3/16/19 at 7:29 am to Doc Fenton

quote:

All while the terrible news on inventories and the underlying economy keep coming. Curious, to say the least.

The thing about it Doc is that there is always some kind of "terrible" news out there that bears can latch onto and say "see". Those are the bricks that make up the wall of worry that confounds bears and makes bulls richer. It’s important to know what kinda of long term market we are in and we are in a long term bull market. If you are shorting the market during a long term bull market, you are making bets against the odds. That's a very difficult thing to do and is a guaranteed losing bet given enough time.

This post was edited on 3/16/19 at 7:38 am

Posted on 3/20/19 at 11:00 pm to CajunTiger92

Well I appreciate that post, because it's important for any active investor to periodically make a critical reappraisal of where we are in the market cycle. Certainly, I've had a bad couple of months, and it's led me to go back and re-question my assumptions.

Having done that, however, I can't find any sufficient justification to abandon my positions. All the advice about maintaining your calm and being rational when the markets are emotional--all that advice holds for bears as well as for bulls. It's not as simple of course, because the long-term drift of the market is up, not down, but on a general philosophical level, I feel like I've got winning positions, and I just need to be calm and stay the course.

Your point about the worry of bears helping to feed opportunity for bulls is well taken. However, it's also missing the other side of the coin. Whatever bricks of worry there are that build the foundation for sustainable bull runs (think of all the worry from 1974-1982), there are also bricks of bulls feeling invincible that build the foundation for gruesome bear markets.

Which brings us to the point of how we can interpret the current signs. (Note that if you're a passive investor, you don't have to worry about this; but that also means you should be agnostic about whether we are currently in a bull or a bear market, and not give cliched "buy the dips" advice.) Some would say that it's a Rorschach test. Others would say I'm cherry picking the bad news over the good.

Well, I've gone back and re-examined what's occurred since 12/24/2018, and I see almost nothing to indicate a mixed bag here. It's been very one-sided and unquestionably worse than expectations. If you look at global leading indicators like semiconductor shipments, M1 growth, FedEx sales growth, etc., you see bad information. Here in the U.S. we have falling home prices and falling EPS projections for 2019. The falling EPS projections drove some of the correction from September to December last year, but--and this point can't be emphasized enough--those projections have continued dropping from 12/31/2018 to the present day.

This rally has been led by large institutional investors reacting to shifting expectations of monetary policy, and rosy speculation about U.S.-China trade talks. That's it. The only good economic data you can point to for 2019 are the following: (1) low unemployment (which of course is a two-sided omen); (2) good consumer confidence; and (3) well-capitalized banks showing low default rates from consumer borrowers.

But that's not going to make up for stalling sales revenue and an evaporating market for leveraged corporate debt issuance. It'll catch up to us eventually.

In addition to all that stuff about the underlying economy, you can look at the mechanics of the rally itself and be confident in assessing it as a bear market phenomenon. In and of itself, this compressed, V-shape market action is a very bearish sign. Even looking at 1987, the most hopeful analogy for bulls, this rally is nothing at all like the multi-year recovery that happened post-October-1987.

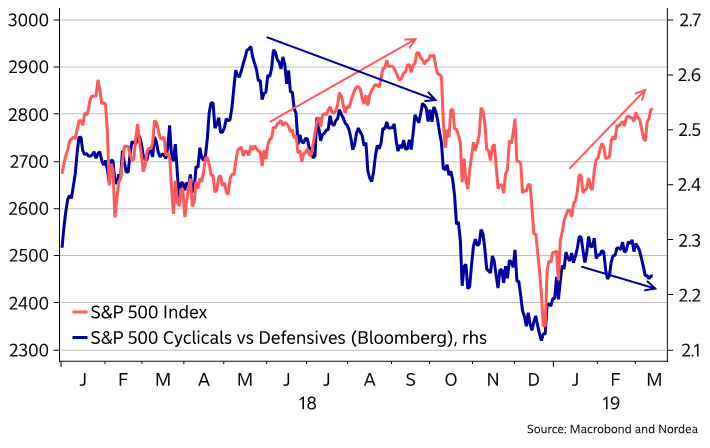

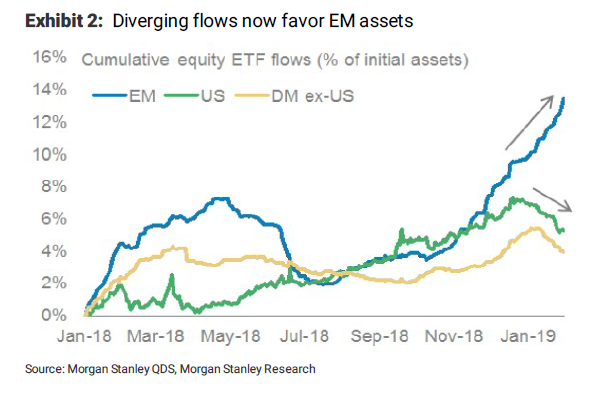

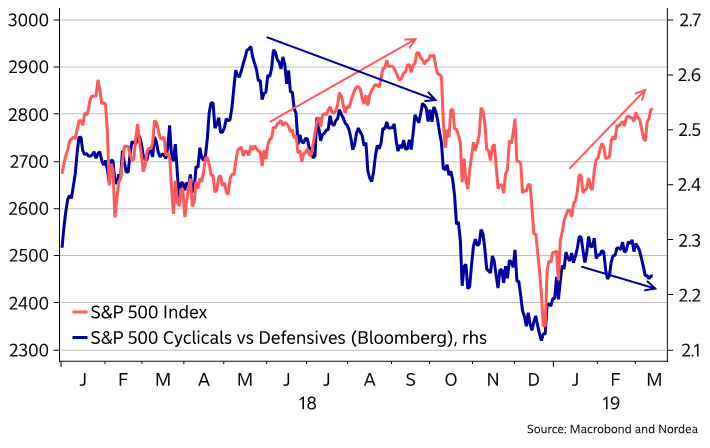

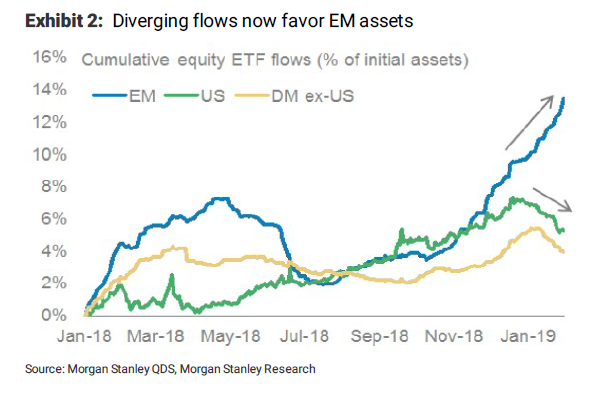

Scrolling through the financial media, you'll see example after example of so-called "alligator" charts--i.e., charts showing unusually sharp divergences that resemble the mouth of an alligator. Look at (1) the market vs. transportation indexes; (2) cyclicals vs. defensives; (3) U.S. equity ETF flows vs. EM equity ETF flows; (4) smart money flows; (5) consumer confidence rates vs. savings rates; etc. It all looks freakishly bad. Do not trust this rally as being indicative of market health.

Having done that, however, I can't find any sufficient justification to abandon my positions. All the advice about maintaining your calm and being rational when the markets are emotional--all that advice holds for bears as well as for bulls. It's not as simple of course, because the long-term drift of the market is up, not down, but on a general philosophical level, I feel like I've got winning positions, and I just need to be calm and stay the course.

Your point about the worry of bears helping to feed opportunity for bulls is well taken. However, it's also missing the other side of the coin. Whatever bricks of worry there are that build the foundation for sustainable bull runs (think of all the worry from 1974-1982), there are also bricks of bulls feeling invincible that build the foundation for gruesome bear markets.

Which brings us to the point of how we can interpret the current signs. (Note that if you're a passive investor, you don't have to worry about this; but that also means you should be agnostic about whether we are currently in a bull or a bear market, and not give cliched "buy the dips" advice.) Some would say that it's a Rorschach test. Others would say I'm cherry picking the bad news over the good.

Well, I've gone back and re-examined what's occurred since 12/24/2018, and I see almost nothing to indicate a mixed bag here. It's been very one-sided and unquestionably worse than expectations. If you look at global leading indicators like semiconductor shipments, M1 growth, FedEx sales growth, etc., you see bad information. Here in the U.S. we have falling home prices and falling EPS projections for 2019. The falling EPS projections drove some of the correction from September to December last year, but--and this point can't be emphasized enough--those projections have continued dropping from 12/31/2018 to the present day.

This rally has been led by large institutional investors reacting to shifting expectations of monetary policy, and rosy speculation about U.S.-China trade talks. That's it. The only good economic data you can point to for 2019 are the following: (1) low unemployment (which of course is a two-sided omen); (2) good consumer confidence; and (3) well-capitalized banks showing low default rates from consumer borrowers.

But that's not going to make up for stalling sales revenue and an evaporating market for leveraged corporate debt issuance. It'll catch up to us eventually.

In addition to all that stuff about the underlying economy, you can look at the mechanics of the rally itself and be confident in assessing it as a bear market phenomenon. In and of itself, this compressed, V-shape market action is a very bearish sign. Even looking at 1987, the most hopeful analogy for bulls, this rally is nothing at all like the multi-year recovery that happened post-October-1987.

Scrolling through the financial media, you'll see example after example of so-called "alligator" charts--i.e., charts showing unusually sharp divergences that resemble the mouth of an alligator. Look at (1) the market vs. transportation indexes; (2) cyclicals vs. defensives; (3) U.S. equity ETF flows vs. EM equity ETF flows; (4) smart money flows; (5) consumer confidence rates vs. savings rates; etc. It all looks freakishly bad. Do not trust this rally as being indicative of market health.

Back to top

1

1