- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: 401K v. Real Estate

Posted on 1/28/17 at 9:52 am to The Johnny Lawrence

Posted on 1/28/17 at 9:52 am to The Johnny Lawrence

There's so much you're leaving out including refinancing house one when paid off and turning that one into 5 additional $20k down payments, rinse, and repeat....

This post was edited on 1/28/17 at 10:08 am

Posted on 1/28/17 at 10:14 am to poochie

What does cash on cash , capitalization etc mean?

ETA: never mind I googled it

ETA: never mind I googled it

This post was edited on 1/28/17 at 10:16 am

Posted on 1/28/17 at 10:18 am to plaric

Reading this post it seems like real estate kicks 401k butt on returns

This post was edited on 1/28/17 at 10:19 am

Posted on 1/28/17 at 11:00 am to I Love Bama

quote:

You should strive for diversified investments and multiple income streams.

and RE provides numerous tax advantages, depreciation, equity capture, principal paydown AND CASH FLOW!

It takes alot more money to make money in dividend paying stocks/funds than in RE but I do like both. Multiple income streams. Got tired of the lending, Looking for other things now.

How i only wish tax liens and commodity/futures trading was a passive/semi passive investment!

This post was edited on 1/28/17 at 7:27 pm

Posted on 1/28/17 at 11:13 am to Fat Bastard

FB, would you mind letting me know your thoughts on capitalization rate. I understand cash on cash, but if you would ever considering owning a property with not so good coc, if the cap rate was decent as an example? I'm just curious, I'm not looking for your secrets.

Posted on 1/28/17 at 11:30 am to plaric

quote:

like real estate kicks 401k butt on returns

I put in the match on my 401k but that is it. The rest of my money goes elsewhere. If there was no match i would not even have a 401k. It would all go to other things including RE.

remember we are not talking about ANY appreciation whatsoever in RE. I am only using MY positive cash flow returns as evidence. It beats the market even if you let the market compound capital gains plus dividends. Look at the history. Now if you only use RE appreciation (not cash flow) long term versus the stock market the stock market probably wins barely due to housing crashes, etc. But we are not using that. I do not buy properties for appreciation. I buy for cash flow. You need cash flow to retire. A housing crash doesn't stop my properties from getting positive cash flow. Do you want to draw down a TIRA or RIRA or 401k? I do not. To me it defeats the purpose of busting your arse for decades to put that money away to work for you. Sure, drawing down is better than having nothing but that is not how i operate.

I put that money away to provide dividend income in retirement just like RE.

Your 401k will fail you

quote:

With 90% of Americans retiring at or below poverty income levels, only 10% retire wealthy. Guess what the majority of that 10% own. They own income producing businesses and real estate.

risks of a 401k

quote:

3. There's no cash flow for better opportunities. The theory behind 401(k)s is you keep putting money away, where you can't easily touch it without penalty for 30 years, and it will compound into enough to retire on. We've seen why you should be suspicious of that story. Compounding charts don't look the same at 0.56 percent annual returns. But here's the other problem. Money left to compound unpredictably for 30 years is stagnant money.There's no cash flow ready to direct to today's best uses. Instead, it's sitting still inside one 30-year bet, while newer, better opportunities may be passing you by.

Posted on 1/28/17 at 11:39 am to poochie

quote:

There's so much you're leaving out including refinancing house one when paid off and turning that one into 5 additional $20k down payments, rinse, and repeat....

similar to this right?

how owning 22 properties can retire you faster than 1M in a 401k

Posted on 1/28/17 at 12:59 pm to The Johnny Lawrence

I didn't read all of that but I can tell you this.. I have a friend with a pretty good amount of money osnhis 401k and in the past 5 or so years he's gotten into rental properties and flipping houses.. he's kicking himself for having that money in his 401k and not in real estate

Posted on 1/28/17 at 6:14 pm to Fat Bastard

I can't find properties that do more than break even cash flow wise. What I am I doing wrong?

Do you rehab properties and turn them into rentals?

Do you rehab properties and turn them into rentals?

Posted on 1/28/17 at 6:59 pm to The Johnny Lawrence

You are overstating the reliability of tenets over that long of a time frame, down playing the cost of repairs over that long of a time frame when you factor in renovation overhauls to keep up demand, and assuming the reliability of purchases both in term of availability at price point, and in output.

On paper, it looks nice. But in practice, it is probably best to wave off after a handful of houses. Your risk exposure far exceeds the returns at the higher values.

On paper, it looks nice. But in practice, it is probably best to wave off after a handful of houses. Your risk exposure far exceeds the returns at the higher values.

Posted on 1/28/17 at 7:19 pm to Iowa Golfer

cap rate is good for a ballpark number.

COC return is much more accurate because it factors in interest rate, length of term and down payment along with other variables.

COC is the main thing I use not cap rate.

COC return is much more accurate because it factors in interest rate, length of term and down payment along with other variables.

COC is the main thing I use not cap rate.

Posted on 1/28/17 at 7:21 pm to The Johnny Lawrence

The biggest hurdle is the upfront costs associated with real estate. With a 401k/IRA, it's generally a small % of your check taken out before you even see it.

As far as returns, and yes i'm an agent, there is no way a retirement account can touch real estate. This year alone i've got one project i'm anticipating a 150k return on. But the CTB when complete will come in around 700k.

As far as returns, and yes i'm an agent, there is no way a retirement account can touch real estate. This year alone i've got one project i'm anticipating a 150k return on. But the CTB when complete will come in around 700k.

Posted on 1/28/17 at 7:32 pm to poochie

(no message)

This post was edited on 1/28/17 at 11:45 pm

Posted on 1/28/17 at 7:36 pm to Volvagia

(no message)

This post was edited on 1/28/17 at 11:45 pm

Posted on 1/28/17 at 7:43 pm to East Coast Band

(no message)

This post was edited on 1/28/17 at 11:45 pm

Posted on 1/28/17 at 8:19 pm to Atom Knab

quote:

also assuming a 6% growth on the 401k. And some years it could be a lot less.

True. But the 6 percent is also a very conservative average as it is.

My equity portfolio has averaged 11% the past 3 years. A 7 or even 8 is probably a more fair estimate of average returns in securities.

Posted on 1/29/17 at 9:27 pm to jimbeam

quote:

Does that include the cost of your time as a landlord?

this. I'm 100% invested in securities, but there's no question that there is more money to be made, and more tax benefits from real estate.

however, being a landlord isn't for everyone, myself included. Merrill Lynch won't be calling me at 1am to tell me that a pipe broke. I won't need to spend 3 months evicting a shitty holding.

for those that have the time to be a landlord, or the experience and connections to rehab properties, theres more money to be made in RE.

Posted on 1/29/17 at 9:38 pm to RabidTiger

quote:

I can't find properties that do more than break even cash flow wise. What I am I doing wrong?

wrong market? The USA is made up of hundreds of micro-markets. go where the money is.

quote:

Do you rehab properties and turn them into rentals?

some are rehabbed, yes.

Posted on 1/30/17 at 7:47 am to Fat Bastard

For me it is as much about control as it is return. I feel like I have substantially more control on my real estate holdings than I do on my 401k with my mutual fund choices. There is also the benefit of leverage. for 20% of the purchase price I am able to control 100% of the property. That being said I have money in 401ks, IRAs and real estate.

Posted on 1/30/17 at 8:48 am to The Johnny Lawrence

quote:

Why did you use 59 years? No one person will invest for that long of a period.

If you want to stop after 40 years, you can just compare the charts at the 40 year mark. It doesn't take any time to drag the spreadsheet out to any number of years, so I just ran it to 59 for no good reason. I'm also 28, so I figured I probably won't live past 90 or so.

quote:

Secondly, when you "invest" in your 401k, typically companies match you at a certain %.

I agree. I always take advantage of the free money my employer gives me. But this scenario is just a comparison of finding $20k on the street. Basically, you inherit $20k or you win a lawsuit. I just wanted to see if a mutual fund or market could beat real estate.

quote:

There's so much you're leaving out including refinancing house one when paid off and turning that one into 5 additional $20k down payments, rinse, and repeat....

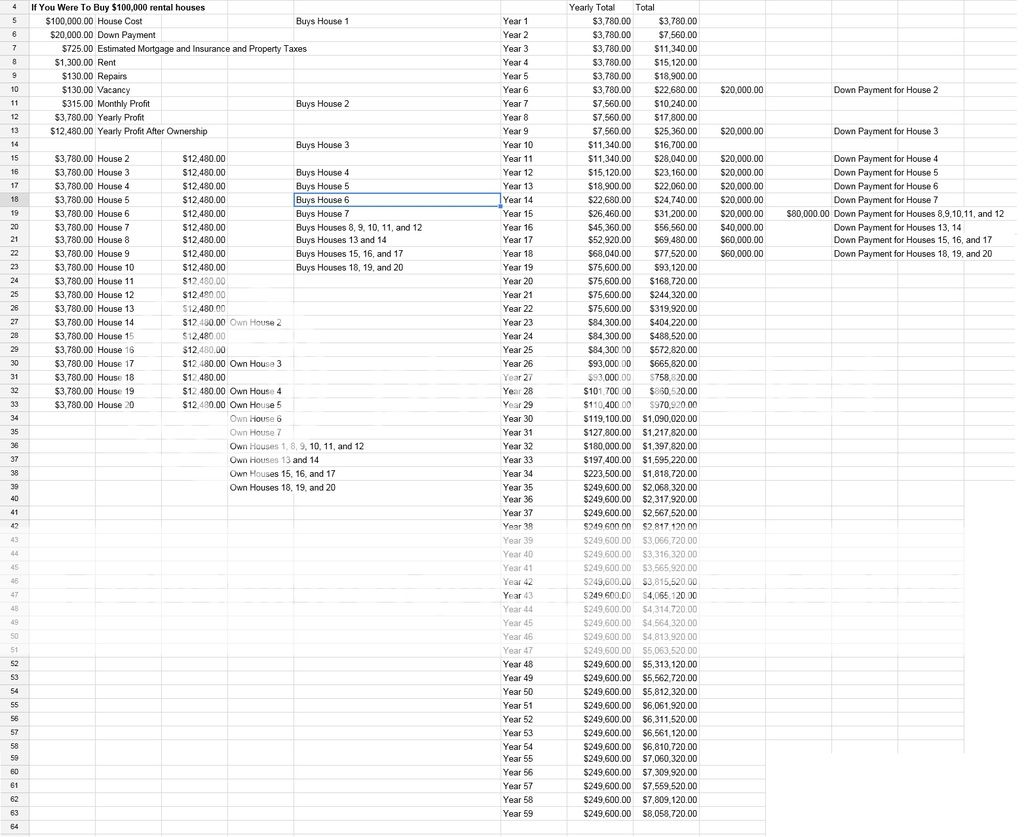

I hadn't even thought of that for the spreadsheet. I had considered it for buying a distressed property and refinancing after a couple of years, but hadn't thought about doing it after you own the property. I ran the numbers and the spreadsheet is below. I don't think it gains you that much, because I just refinanced my first house on the spreadsheet. After I own the second one, I already owned 20 houses and didn't want to compare spreadsheets with a different amount of house ownership.

quote:

remember we are not talking about ANY appreciation whatsoever in RE. I am only using MY positive cash flow returns as evidence. It beats the market even if you let the market compound capital gains plus dividends. Look at the history. Now if you only use RE appreciation (not cash flow) long term versus the stock market the stock market probably wins barely due to housing crashes, etc. But we are not using that. I do not buy properties for appreciation. I buy for cash flow. You need cash flow to retire. A housing crash doesn't stop my properties from getting positive cash flow. Do you want to draw down a TIRA or RIRA or 401k? I do not. To me it defeats the purpose of busting your arse for decades to put that money away to work for you. Sure, drawing down is better than having nothing but that is not how i operate.

Absolutely. I didn't factor in appreciation at all. Typically, houses always go up in value, but it is extremely hard to factor into a spreadsheet. I just wanted to keep it simple.

quote:

You are overstating the reliability of tenets over that long of a time frame, down playing the cost of repairs over that long of a time frame when you factor in renovation overhauls to keep up demand, and assuming the reliability of purchases both in term of availability at price point, and in output.

I've factored in 10% for vacancies and 10% for repairs. From everything I've read, this is the proper amount to hold back. That should cover the down months and cover the repairs as needed. A lot of people run their properties with less set backs for repairs and vacancies. All depends on the property, I guess.

quote:

True. But the 6 percent is also a very conservative average as it is.

I ran your numbers at 11% compound interest. Real estate still does better until you get to the 50ish year mark of 11% compounded annually.

Year 401K

0 $20,000.00

1 $22,200.00

2 $24,642.00

3 $27,352.62

4 $30,361.41

5 $33,701.16

6 $37,408.29

7 $41,523.20

8 $46,090.76

9 $51,160.74

10 $56,788.42

11 $63,035.15

12 $69,969.01

13 $77,665.60

14 $86,208.82

15 $95,691.79

16 $106,217.89

17 $117,901.85

18 $130,871.06

19 $145,266.87

20 $161,246.23

21 $178,983.32

22 $198,671.48

23 $220,525.34

24 $244,783.13

25 $271,709.28

26 $301,597.30

27 $334,773.00

28 $371,598.03

29 $412,473.81

30 $457,845.93

31 $508,208.98

32 $564,111.97

33 $626,164.29

34 $695,042.36

35 $771,497.02

36 $856,361.69

37 $950,561.48

38 $1,055,123.24

39 $1,171,186.80

40 $1,300,017.35

41 $1,443,019.25

42 $1,601,751.37

43 $1,777,944.02

44 $1,973,517.87

45 $2,190,604.83

46 $2,431,571.36

47 $2,699,044.21

48 $2,995,939.08

49 $3,325,492.37

50 $3,691,296.53

51 $4,097,339.15

52 $4,548,046.46

53 $5,048,331.57

54 $5,603,648.04

55 $6,220,049.33

56 $6,904,254.76

57 $7,663,722.78

58 $8,506,732.28

59 $9,442,472.83

I really do appreciate all of the insight. There are a couple of things I'm still trying to figure out how to put into the spreadsheet- Taxes, etc. Once I figure out a fair way to calculate those, I'll make another spreadsheet and post it.

Popular

Back to top

3

3