- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

401K v. Real Estate

Posted on 1/27/17 at 3:39 pm

Posted on 1/27/17 at 3:39 pm

I got in a discussion with a friend of mine about whether it is smarter to invest in real estate v. investing in your 401k. So I created a spreadsheet to think through the problem. Caveat: This is extremely rudimentary, but I figured that if I posted it here I could get some more ideas on how to add to the spreadsheet.

I'm certain I'm failing to factor certain things into the equations, so please let me know what I'm missing and how I should calculate it.

Things that aren't factored into the spreadsheets:

Risk of real estate v. risk in market

Employer contributions to 401k.

Taxes!

If I was to take $20,000.00 and put it in a 401k or mutual fund or the like, and it grew steadily at 6% interest. This is what I figure it would be worth in about 60 years:

0- $20,000.00

1- $21,200.00

2- $22,472.00

3- $23,820.32

4- $25,249.54

5- $26,764.51

6- $28,370.38

7- $30,072.61

8- $31,876.96

9- $33,789.58

10- $35,816.95

11- $37,965.97

12- $40,243.93

13- $42,658.57

14- $45,218.08

15- $47,931.16

16- $50,807.03

17- $53,855.46

18- $57,086.78

19- $60,511.99

20- $64,142.71

21- $67,991.27

22- $72,070.75

23- $76,394.99

24- $80,978.69

25- $85,837.41

26- $90,987.66

27- $96,446.92

28- $102,233.73

29- $108,367.76

30- $114,869.82

31- $121,762.01

32- $129,067.73

33- $136,811.80

34- $145,020.51

35- $153,721.74

36- $162,945.04

37- $172,721.74

38- $183,085.05

39- $194,070.15

40- $205,714.36

41- $218,057.22

42- $231,140.65

43- $245,009.09

44- $259,709.64

45- $275,292.22

46- $291,809.75

47- $309,318.33

48- $327,877.43

49- $347,550.08

50- $368,403.09

51- $390,507.27

52- $413,937.71

53- $438,773.97

54- $465,100.41

55- $493,006.43

56- $522,586.82

57- $553,942.03

58- $587,178.55

59- $622,409.26

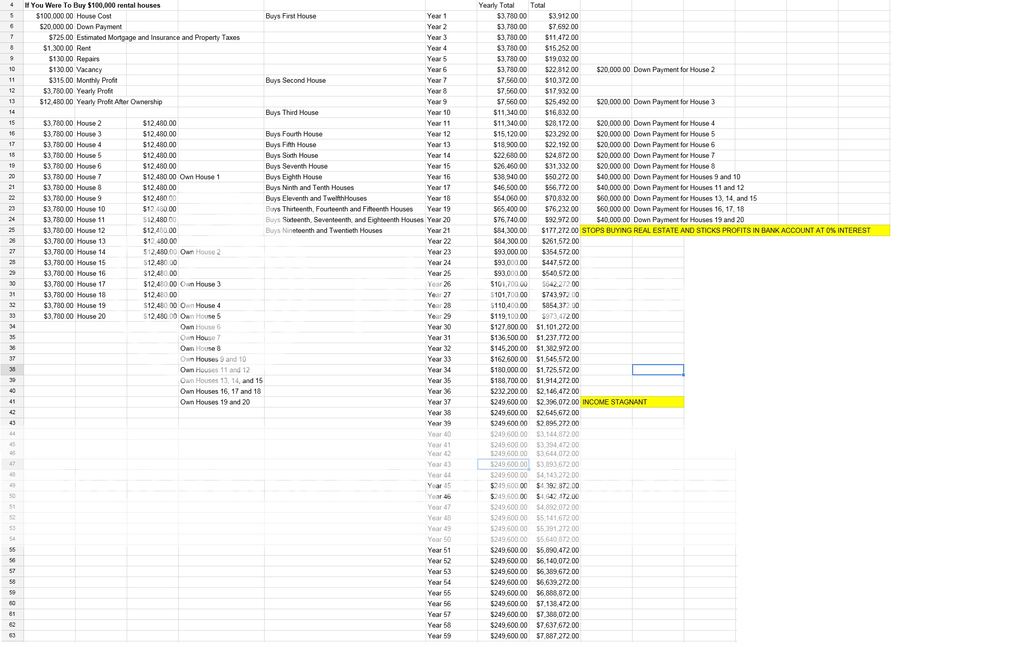

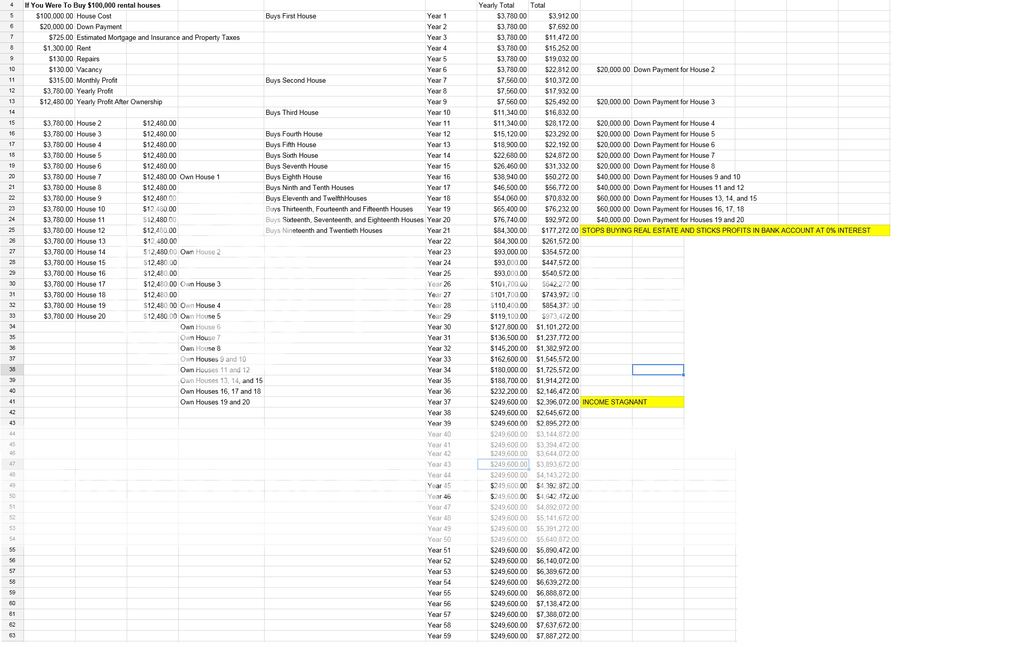

This is my spreadsheet for the real estate. Sorry it's small and blurry. I couldn't figure out another way to post it. In short, it assumes you buy a $100,000 duplex that rents for $1,300 a month. You take out 10% for vacancies, 10% for repairs. You don't take anything out of the business and every time you get $20k in the bank, you buy another house.

Any ideas or insights will be helpful. TIA

I'm certain I'm failing to factor certain things into the equations, so please let me know what I'm missing and how I should calculate it.

Things that aren't factored into the spreadsheets:

Risk of real estate v. risk in market

Employer contributions to 401k.

Taxes!

If I was to take $20,000.00 and put it in a 401k or mutual fund or the like, and it grew steadily at 6% interest. This is what I figure it would be worth in about 60 years:

0- $20,000.00

1- $21,200.00

2- $22,472.00

3- $23,820.32

4- $25,249.54

5- $26,764.51

6- $28,370.38

7- $30,072.61

8- $31,876.96

9- $33,789.58

10- $35,816.95

11- $37,965.97

12- $40,243.93

13- $42,658.57

14- $45,218.08

15- $47,931.16

16- $50,807.03

17- $53,855.46

18- $57,086.78

19- $60,511.99

20- $64,142.71

21- $67,991.27

22- $72,070.75

23- $76,394.99

24- $80,978.69

25- $85,837.41

26- $90,987.66

27- $96,446.92

28- $102,233.73

29- $108,367.76

30- $114,869.82

31- $121,762.01

32- $129,067.73

33- $136,811.80

34- $145,020.51

35- $153,721.74

36- $162,945.04

37- $172,721.74

38- $183,085.05

39- $194,070.15

40- $205,714.36

41- $218,057.22

42- $231,140.65

43- $245,009.09

44- $259,709.64

45- $275,292.22

46- $291,809.75

47- $309,318.33

48- $327,877.43

49- $347,550.08

50- $368,403.09

51- $390,507.27

52- $413,937.71

53- $438,773.97

54- $465,100.41

55- $493,006.43

56- $522,586.82

57- $553,942.03

58- $587,178.55

59- $622,409.26

This is my spreadsheet for the real estate. Sorry it's small and blurry. I couldn't figure out another way to post it. In short, it assumes you buy a $100,000 duplex that rents for $1,300 a month. You take out 10% for vacancies, 10% for repairs. You don't take anything out of the business and every time you get $20k in the bank, you buy another house.

Any ideas or insights will be helpful. TIA

Posted on 1/27/17 at 3:42 pm to The Johnny Lawrence

Does that include the cost of your time as a landlord?

Posted on 1/27/17 at 3:48 pm to jimbeam

No. I thought about factoring in a property management at 10%, but thought about it after I already completed the spreadsheet.

And I don't necessarily know how to factor how much time it will take, assuming you don't use property management. Would seem to vary month to month.

And I don't necessarily know how to factor how much time it will take, assuming you don't use property management. Would seem to vary month to month.

Posted on 1/27/17 at 4:01 pm to The Johnny Lawrence

Property taxes?????

Posted on 1/27/17 at 4:16 pm to The Johnny Lawrence

Laughable. Even with PITI AND vacancies and maintenance and property management my returns are much better than a 401k. I don't have many vacancies and my property management is 8%. Way more control in RE VERSUS a 401k. I'll post an article tomorrow when I'm back at work.

Posted on 1/27/17 at 4:25 pm to 1609tiger

I have those estimated in the mortgage with insurance as well.

Posted on 1/27/17 at 4:42 pm to The Johnny Lawrence

Did you calculate that $20,000 in a 401k is not the same as $20,000 after taxes in real estate? Or does that fall under the "taxes" caveat? You could of course correct it by subtracting some arbitrary amount from the real estate starting funds

This post was edited on 1/27/17 at 4:45 pm

Posted on 1/27/17 at 4:47 pm to Fat Bastard

When did you start by the way. I wouldn't be surprised at all post crash that gains were outpacing a lot of investments.

Looking forward to the article.

Looking forward to the article.

Posted on 1/27/17 at 4:59 pm to The Johnny Lawrence

This doesn't really answer your question, but my input would be an either/or on 401K -v- Real Estate misses what I consider to be a vital part of anyone's portfolio. That is to say, why not have some real estate in addition to securities in a 401K. I own both. I think have have about every assets class represented. I've read everything on why a heavier weighted real estate portfolio outperforms a 401K. I'm personally still more weighted in securities than I am in real estate. There are some pitfalls to real estate tat aren't necessarily inherent to owning a mutual fund. It's difficult to balance a real estate portfolio geographically. It's difficult to balance commercial, residential, office space, warehouse space, multi family, single family. Essentially it does pay a dividend. Essentially there are certainly tax advantages in real estate. But essentially there is also the dilemma of what it is worth when you really need to sell it. Which is the same as a security. But harder to mange due to liquidity.

So I guess my answer is I don't personally care what wins the cage fight between real estate and a 401K, I think everyone should probably own some of each. Securities are easier. Notwithstanding the many on here and elsewhere they say it is not. Securities are more liquid. Moral and morale hazards exist in both. Fannie is getting into buying paper of single family dwellings held as rentals. That probably will be high geographic in impact, but it will have an impact.

Anyway, another novel by myself. Just some thoughts I have based on my experience with both.

So I guess my answer is I don't personally care what wins the cage fight between real estate and a 401K, I think everyone should probably own some of each. Securities are easier. Notwithstanding the many on here and elsewhere they say it is not. Securities are more liquid. Moral and morale hazards exist in both. Fannie is getting into buying paper of single family dwellings held as rentals. That probably will be high geographic in impact, but it will have an impact.

Anyway, another novel by myself. Just some thoughts I have based on my experience with both.

Posted on 1/27/17 at 5:12 pm to The Johnny Lawrence

I'm probably missing something here on your chart, but how do you go from year 1 earnings of $3780, to total earnings after year 1 @ $3,912.

It makes me really not trust your excel spreadsheet formulas.

It makes me really not trust your excel spreadsheet formulas.

Posted on 1/27/17 at 5:27 pm to Teddy Ruxpin

Most my cash on cash returns are in the 20s percentage wise. With a bad maintenance year you could say teens. That's yet to happen. I've got a property giving me 35% now cash on cash return that has never been vacant. Go ahead and knock some return off for that but these are still darn better than my 401k. People have different goals. I'm about cash flow. A 401k does not give me cash flow.

The tax benefits with RE are fabulous also and beat anything the stock market offers. Now do I like to use both? Certainly. I believe in diversification.

The tax benefits with RE are fabulous also and beat anything the stock market offers. Now do I like to use both? Certainly. I believe in diversification.

Posted on 1/27/17 at 5:37 pm to Fat Bastard

Do you have any sort of preference as to balance with respect o cash on cash -v- capitalization rate?

Posted on 1/27/17 at 6:17 pm to Teddy Ruxpin

Yea. I didn't do taxes on any of it. I knew that was going to be an issue from the start.

Posted on 1/27/17 at 6:20 pm to HYDRebs

Dangit. That's a ten key error. This is the second or third reiteration on this spreadsheet and that is from one of the earlier versions.

The rest is pretty simple formulas. Just summing things.

The rest is pretty simple formulas. Just summing things.

Posted on 1/27/17 at 7:00 pm to The Johnny Lawrence

If you don't factor in management, then you just created yourself a full-time job, even with just a few houses. You have to factor that in, in case you are no longer able to take care of them. You don't want to put that burden on someone else.

I'm not positive, but I think 1% rent is what renters are happy with. 2% is the holy grail.

I'm not positive, but I think 1% rent is what renters are happy with. 2% is the holy grail.

Posted on 1/27/17 at 7:11 pm to Rust Cohle

Yea. I need to go add that in, but I think I could handle the management up until I get multiple houses. So I may only add property management after I own like 4 houses.

Posted on 1/28/17 at 7:31 am to The Johnny Lawrence

I love the chart though, thanks. I really want to get into it, but just can't pull the trigger. Every time I crunch the numbers, I think "am I really going to do this for $100 a month". Maybe I will talk to the management company, if they can take all the work out of it I would reconsider.

I always would add in garbage and lawn maintenance, because if you don't they will bury their trash or hide it under the house, and never cut the grass. And there always seems to be some money for repairing after the tenant leaves, and some on initial purchase. Some have a general maintenance fun, or things that are necessary broken but need to be kept up to have a nice house. Like painting and other small miscellaneous things.

You could factor in the inflation also, but that might be difficult, as your other rental property values and rental prices will increase as well, it might be a wash to consider.

Another thing to consider is increased interest rate, increase property taxes, and increased insurance rates.

I think what you have is the best case scenario . You adjust those numbers to where you have management, your insurance is a little higher, you're not getting the rate that you thought, maybe $1000 a month. Then run the data, I would love to see the chart.

I always would add in garbage and lawn maintenance, because if you don't they will bury their trash or hide it under the house, and never cut the grass. And there always seems to be some money for repairing after the tenant leaves, and some on initial purchase. Some have a general maintenance fun, or things that are necessary broken but need to be kept up to have a nice house. Like painting and other small miscellaneous things.

You could factor in the inflation also, but that might be difficult, as your other rental property values and rental prices will increase as well, it might be a wash to consider.

Another thing to consider is increased interest rate, increase property taxes, and increased insurance rates.

I think what you have is the best case scenario . You adjust those numbers to where you have management, your insurance is a little higher, you're not getting the rate that you thought, maybe $1000 a month. Then run the data, I would love to see the chart.

Posted on 1/28/17 at 8:39 am to The Johnny Lawrence

Why did you use 59 years? No one person will invest for that long of a period.

Considering that the average person starts working in their 20s and retires in their 60s ,I would only use a 40 year time frame.

.

Secondly, when you "invest" in your 401k, typically companies match you at a certain %.

For example, for my 6%, my company adds an additional 4.5%. That's a huge ROI immediately.

Considering that the average person starts working in their 20s and retires in their 60s ,I would only use a 40 year time frame.

.

Secondly, when you "invest" in your 401k, typically companies match you at a certain %.

For example, for my 6%, my company adds an additional 4.5%. That's a huge ROI immediately.

Posted on 1/28/17 at 8:50 am to Fat Bastard

I've been trying to break into the real estate(Nola area) world the last few months but it's been damn near impossible to find a property that works(at least 1% rule).

The only ones that same to make sense are getting section 8 tenants and I imagine that's not what my first property should be.

The only ones that same to make sense are getting section 8 tenants and I imagine that's not what my first property should be.

Posted on 1/28/17 at 8:50 am to The Johnny Lawrence

The correct answer is to have both.

What if you are getting rent and property value increases at 3% a year as well? What if the market tanks and your property is worth 50%?

There is no right answer. You should strive for diversified investments and multiple income streams.

What if you are getting rent and property value increases at 3% a year as well? What if the market tanks and your property is worth 50%?

There is no right answer. You should strive for diversified investments and multiple income streams.

Popular

Back to top

13

13