- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Exec Sum 10/11/22 (Litquidity)

Posted on 10/11/22 at 10:23 am

Posted on 10/11/22 at 10:23 am

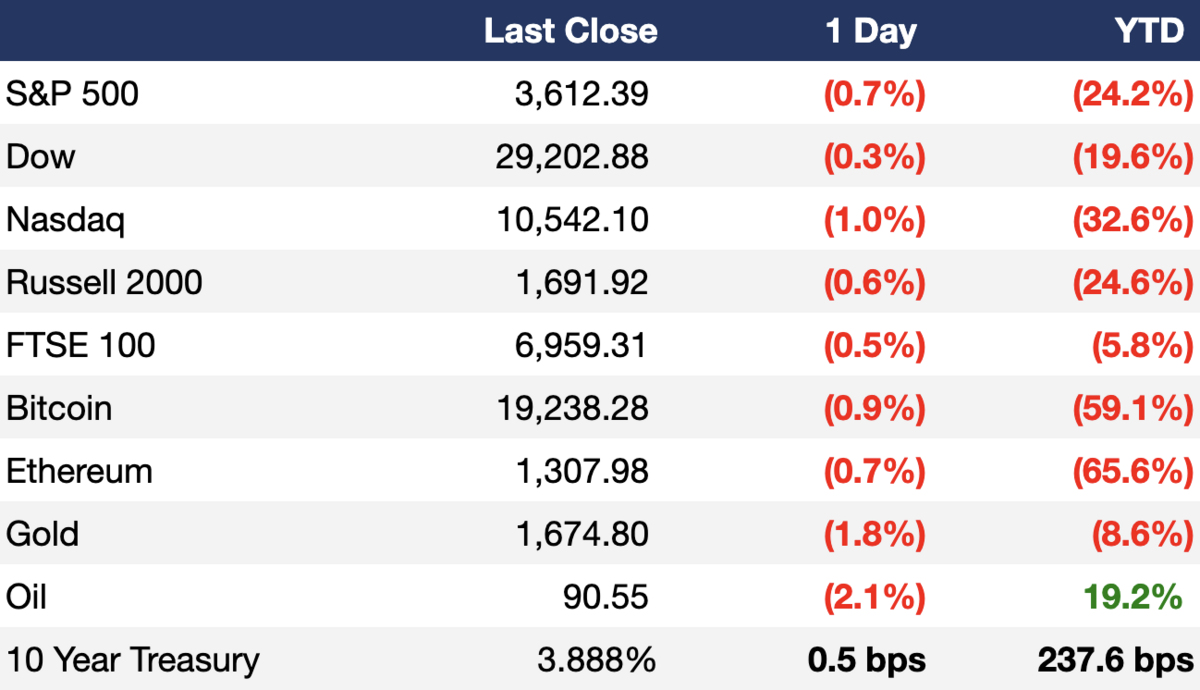

Markets

-US stocks fell on Monday as prospects for policy tightening weighed on investor sentiment

-Nasdaq dipped 1.04% to hit its lowest close since July 2020

-Chinese chip stocks also tumbled amid new US curbs on chip-related Chinese exports

-A big week on the information front, with September's PPI releasing Wednesday, September's CPI releasing Thursday, and major bank earnings kicking off on Friday

Earnings

What we're watching this week:

Wednesday: PepsiCo

Thursday: Delta Air Lines, BlackRock, Taiwan Semiconductor

Friday: JPMorgan Chase, Wells Fargo, Morgan Stanley, Citigroup

Headline Roundup

-Russia unleashed biggest barrage of strikes on Ukraine since invasion (WSJ)

-US banks are expected to set aside $4B for potential losses from bad loans (FT)

-Bank of England will strengthen emergency stimulus to help ease market turmoil (CNBC)

-Investors are rapidly pulling out of UK property funds after bond market shock (FT)

-China's central bank extended currency swaps with ECB worth ~$44B (RT)

-Ark’s Cathie Wood penned an open letter to the Fed criticizing recent rate hikes; her ARKK fund is down 78% from its peak (CNBC)

-US banks are cutting donations to federal candidates and upping Democrat support ahead of midterms (RT)

-A UK court permitted Elliot and Jane Street to sue the London Metal Exchange for canceling nickel trades in March (RT)

-Jamie Dimon believes US will likely fall into recession in 6 to 9 months (lol) (CNBC)

-Ex-Fed chair Ben Bernanke and two others won the Nobel economics prize for work on banks and financial crises (FT)

-IRS is waiving penalties for some inherited retirement accounts until 2023 (CNBC)

-Amazon will invest ~$1B in European EV van and truck fleet (RT)

-Cloud software firm Five9 fell ~25% after CEO announced resignation (CNBC)

-Nissan is in talks to invest in Renault's new EV unit (WSJ)

-Sequoia Capital and Binance stand by equity funding for Musk's twitter takeover (TI)

-PayPal said it never intended to fine users $2.5k for each misinformation violation on their platform and said it was a mistake in its new user policy (BBG)

Deal Flow

M&A / Investments

-Bio-Rad Laboratories is in talks to combine with peer life-sciences company Qiagen in a potential $10B+ deal (WSJ)

-Insight Partners is nearing a deal to buy a minority stake in software company Aptean at a ~$3.55B valuation (BBG)

-Indian conglomerate Adani Group is in advanced talks to buy India's Jaiprakash Associates' cement business for $606M (RT)

-Qatar Sports Investments agreed to buy an almost 22% stake in Portuguese soccer club SC Braga at an ~$88M valuation (BBG)

-Exxon Mobil is considering buying Denbury, an oil-recovery specialist with the largest carbon dioxide pipeline network in the US (BBG)

-Brookfield Asset Management and DigitalBridge have expressed joint interest in buying a stake in telecom company Vodafone’s wireless towers unit (BBG)

-Turkish fast delivery startup Getir is in advanced talks to buy Berlin-based rival Gorillas Technologies (BBG)

VC

-Singapore-based language learning startup LingoAce is seeking to raise $200M at a ~$1B valuation (BBG)

-Connex One, a cloud-based customer engagement platform, raised a $103M Series C from investors including GP Bullhound (CNX)

-Payment platform startup Airwallex raised a $100M Series E extension at a $5.5B valuation from investors including HostPlus and Tencent (BBG)

-Colombian cloud kitchen and virtual restaurant startup Foodology raised $50M: $30M in debt from TriplePoint Capital and $20M in equity from a16z, Wollef, Kayyak and more (TC)

-Ochre Bio, a startup looking to develop RNA therapies for chronic liver diseases, raised a $30M Series A led by Khosla Ventures, Hermes Epitek and others (BW)

-Endor, a startup working to secure the software supply chain, emerged from stealth with $25M from Lightspeed Venture Partners, Dell Technologies Capital, Sierra Ventures and angels (TC)

-Trendsi, a startup helping sellers and manufacturers predict demand, raised a $25M Series A led by Lightspeed Venture Partners (TC)

-Search-as-a-Service startup Meilisearch raised a $15M Series A led by Felicis (TC)

-Nigerian data and insights firm Stears raised a $3.3M seed round led by MaC Venture Capital with participation from Serena Williams' VC firm Serena Ventures (BBG)

-Psychedelic specialist and clinical research organization Clerkenwell Health raised a $2.3M seed round led by Lionheart Ventures, Convergence Partners and ExceptionalVentures (TC)

SPAC

-Flexjet, which offers a subscription-based private jet service, is in talks to merge with Horizon Acquisition Corp II in a potential $3.1B deal (BBG)

Bankruptcy

-Vital Pharmaceuticals, Bang Energy Drink's parent company, filed for Chapter 11 in Florida with plans to revamp its distribution model. The company listed assets & liabilities of as much as $1B and claims to have $100M of new financing lined up from lenders (BBG)

Fundraising

-Matrix Partners, a VC firm primarily focused on early-stage software infrastructure startups, closed an $800M fund (TC)

Popular

Back to top

0

0