- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Home prices are now contracting at levels only seen 2 times

Posted on 9/23/23 at 12:36 pm to notiger1997

Posted on 9/23/23 at 12:36 pm to notiger1997

quote:

Sure we can blame the government, but how about some blame on everyone buying houses at record pace over the last three years and driving up home prices and rent?

Be carful, you are gonna make many on this board realize how lazy they are when they just blame everything on the current occupant of 1600 Pennsylvania Ave… as tempting and as ignorant and as lazy as it i is to do that, many losers still do it to avoid having to look in the mirror, or looking at their local elected officials .

Posted on 9/23/23 at 12:38 pm to Athis

quote:

She just got her Tax bill and her house is valued at $450,000...

The correlation between assessed tax value and market price is tenuous at best.

Posted on 9/23/23 at 12:39 pm to BK Lounge

biden's economic policies are killing middle class and poor folks bank accounts

Posted on 9/23/23 at 12:54 pm to BK Lounge

An item for sale is only worth what someone is willing to pay for said item.

Lots of people out there make not so smart choices.

Lots of people out there make not so smart choices.

Posted on 9/23/23 at 12:56 pm to C

quote:

Prices in Houston are still going higher.

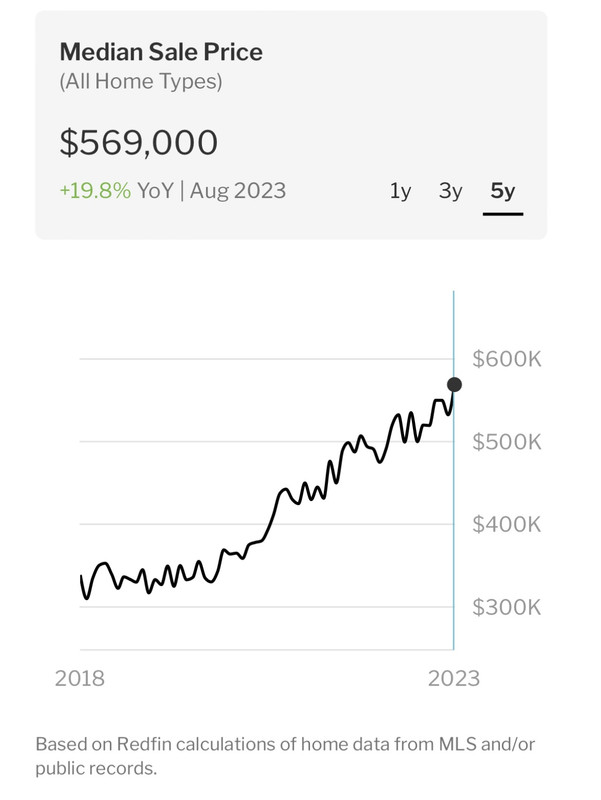

I’ve been tracking it and I think that’s also the case here.

ETA: yup, still rising, quickly

This post was edited on 9/23/23 at 1:04 pm

Posted on 9/23/23 at 1:00 pm to C

quote:

Prices in Houston are still going higher. It’s crazy what my neighbors continue to get for their homes

Same here. On the one hand it’s nice to know you’ve got something of value. But the other, when does the bubble pop? Or a national trend like the OP hit here? Also, if they kept going up that tax nut gets bigger and bigger.

Our house has easily doubled in value. In the present market.

Would be nice to sell and store shite then live in apartment for 2 years to wait it out. Sweep in when it collapsed. If it doesn’t collapse though I’m living in an apartment until I move into a senior living apartment. Lol

Posted on 9/23/23 at 1:14 pm to LSU alum wannabe

quote:

Would be nice to sell and store shite then live in apartment for 2 years to wait it out.

That’s what we’re currently doing.

Posted on 9/23/23 at 1:14 pm to stout

quote:

Home prices are now contracting at levels only seen 2 times. Both ended in deep recessions

Does this mean I'll be able to build a shop at normal prices?

Posted on 9/23/23 at 1:26 pm to stout

Just wait until Biden gets mortgage rates up to 12% - 16% like during the Carter administration.

Posted on 9/23/23 at 1:34 pm to stout

quote:

I think 5% will be the floor which is a great rate but still cools things off from the highs we have seen.

There’s a lot of people sitting on sidelines right now specifically Millennials and Gen Z who are either living in mommy and daddy’s basement or renting. Rates going from 7.x% to 5% even if it takes 18 months is just going to cause another buying frenzy which will elevate demand and prices for current homeowners who might consider selling but most have 3% or so rates so they won’t and it is going to keep supply low which is going to keep prices high. There’s no winning solution here for renters right now sans massive job losses. That’s it. Supply is so low these people are screwed whether rate is 7.x% or 5%.

Posted on 9/23/23 at 1:34 pm to Tantal

quote:Not true. My "value" has dropped 20% in the last year.

DFW isn't seeing it.

Example: neighbor's home two doors down: 2.5 years ago, no pool, 3 car garage, 4 br, 3 ba, 3450 sf sold for $825k.

A year ago, the house next to me, also same size home, no pool, but on a larger cornet lot, sold for $725k.

The value of my home, 325 more sf, with a pool, culdesac lot, custom workshop, was valued at $915k 2.5 years ago. Now it's down to $725.

That's a drop of 20% in value.

Posted on 9/23/23 at 1:51 pm to Arkapigdiesel

quote:

Does this mean I'll be able to build a shop at normal prices?

Posted on 9/23/23 at 1:54 pm to stout

quote:

Yes I understand all markets are local but national trends still mean something

They do, but demand areas remain strong.

Even n certain decent parts of Louisiana, 500K houses have multiple offers at ask or above, before the open house concludes.

Posted on 9/23/23 at 1:56 pm to tigersmanager

biden's economic policies are killing middle class and poor folks bank accounts

oh, it's not just his economy.

oh, it's not just his economy.

Posted on 9/23/23 at 1:58 pm to stout

quote:

2008 had a spike but it was more gradual and over a few years. 2004-2007 there was a spike.

I’d be curious to see the same data with a bit more smoothing applied.

The graph doesn’t say, but it looks like it’s something like quarterly YoY changes. So we’re talking about.. ~7 quarters of very high price growth followed by 1 quarter of very high price decline? At first glance that strikes me more as volatility than a true correction, but I realize there are other metrics pointing in the same direction.

I don’t think predicting recession at this point is exactly going out on a limb, in any case. It seems likely that the bubble has to burst at some point.

Posted on 9/23/23 at 2:04 pm to BK Lounge

quote:

Be carful, you are gonna make many on this board realize how lazy they are when they just blame everything on the current occupant of 1600 Pennsylvania Ave…

people might take you seriously if we didn’t remember your constant crying/bitching/moaning over the last occupant of 1600 Pennsylvania Ave.

Posted on 9/23/23 at 2:06 pm to stout

Selfishly, as someone looking to buy in Raleigh, NC I could use some of this.

Prices haven’t budged

Prices haven’t budged

Posted on 9/23/23 at 2:13 pm to LSU alum wannabe

Assuming you live in Fort Bend County, you better pay real close attention to the statement you're going to get from the assessor. In 2022, they assessed my value 40% higher than in 2021. While they can only raise your assessed value 10% more year over year, they made clear what my tax bill was likely to be in 2026.

And yes, I've used a lawyer to dispute for the last five years.

And yes, I've used a lawyer to dispute for the last five years.

This post was edited on 9/23/23 at 2:15 pm

Posted on 9/23/23 at 2:18 pm to HubbaBubba

quote:You misspelled “Reagan.”

rates up to 12% - 16% like during the Carter administration.

Posted on 9/23/23 at 2:21 pm to stout

And they’re still high as giraffe gash

Popular

Back to top

3

3