- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Would it ever be ok to tap into 401k for a first time home purchase?

Posted on 10/29/15 at 11:25 am to Herb484

Posted on 10/29/15 at 11:25 am to Herb484

quote:

Would it ever be ok to tap into 401k for a first time home purchase?

No and anyone who tells you otherwise does not represent your interest with integrity and capable thought processes.

Posted on 10/29/15 at 11:25 am to yellowfin

I think it can be good under certain circumstances, but taking a loan from your 401k can be playing with fire. for instance, you lose your job boom you get hit with a huge tax bill.

Care to share more specifics on the house, your 401k, income, and what non 401k cash you have to apply to the home purchase?

Care to share more specifics on the house, your 401k, income, and what non 401k cash you have to apply to the home purchase?

Posted on 10/29/15 at 11:57 am to Will Cover

quote:Suppose there is a home that is available now that the person really wants, but they do not have the necessary money immediately, but they are certain they will have the money in 3 months? Why would it be foolish to use a loan from a 401(k) to be able to buy the home they want now instead of waiting 3 months and hoping a home they like as much becomes available?

No and anyone who tells you otherwise does not represent your interest with integrity and capable thought processes.

Every opportunity needs to be analyzed separately to make appropriate decisions. Anytime someone tells you never do something or always do something you should question their advice. And your advice deserves questioning since it deals in absolutes.

Posted on 10/29/15 at 12:31 pm to Ace Midnight

quote:

No. You cannot replace time in the market. Find another way.

This.

Posted on 10/29/15 at 2:17 pm to Herb484

There are situations it can make sense. The answer to these question is rarely always "no, never" like some would have you believe. It depends on the circumstances.

If a 401k loan (in which you pay no taxes or penalties and the "interest" on the loan is actually paid back to yourself) helps you (for example) avoid PMI, get a lower interest rate, seize a great buying opportunity where time is of the essence, lower the mortgage amount at which you are paying the bank interest, etc. then there could certainly be circumstances where it makes sense. Now if the market takes off during the life of the 401k loan, then in hindsight it would have probably been a mistake. Conversely if the market is flat or worse during the loan, then the decision will look ingenious.

If a 401k loan (in which you pay no taxes or penalties and the "interest" on the loan is actually paid back to yourself) helps you (for example) avoid PMI, get a lower interest rate, seize a great buying opportunity where time is of the essence, lower the mortgage amount at which you are paying the bank interest, etc. then there could certainly be circumstances where it makes sense. Now if the market takes off during the life of the 401k loan, then in hindsight it would have probably been a mistake. Conversely if the market is flat or worse during the loan, then the decision will look ingenious.

Posted on 10/29/15 at 2:39 pm to tlsu15

quote:

Plenty of people could afford a monthly note on a house but have trouble saving up the large sums you would need for a down payment. It just depends on your situation.

If you aren't financially savy enough to save up the money or get a sweet PMI deal you have zero business getting a house.

Posted on 10/29/15 at 3:36 pm to Jcorye1

quote:

If you aren't financially savy enough to save up the money or get a sweet PMI deal you have zero business getting a house.

Who said anything about me? I said there are a lot of people who have circumstances that prevent them from having the money for a down payment. That's a true statement.

Posted on 10/29/15 at 3:53 pm to lsupride87

quote:

you can get a house for 5% down...if you can't say 5% you don't need a house

This is such a "i live in a part of the country where housing is cheap" line.

No its not. If you live in SF or NYC and you can't put down 5% then you don't need a house either.

Posted on 10/29/15 at 4:41 pm to Poodlebrain

quote:

Suppose there is a home that is available now that the person really wants, but they do not have the necessary money immediately, but they are certain they will have the money in 3 months? Why would it be foolish to use a loan from a 401(k) to be able to buy the home they want now instead of waiting 3 months and hoping a home they like as much becomes available?

What if this person lost their job? What if their business just up and closed one evening? What happens then? I don't consider anything a certainty. Just me, everyone is entitled to their own opinion.

Posted on 10/29/15 at 10:09 pm to lsupride87

quote:

This is such a "i live in a part of the country where housing is cheap" line.

BS. An $800,000 house with 5% down is only $40,000. If you can't raise that for a down-payment then you don't need to buy a house.

Posted on 10/30/15 at 7:21 am to barry

quote:This board needs to get out of its bubble every now and then. The never wavering rules you blowhards have are retarded

No its not. If you live in SF or NYC and you can't put down 5% then you don't need a house either.

Posted on 10/30/15 at 7:21 am to lynxcat

quote:once again, such a stupid statement

BS. An $800,000 house with 5% down is only $40,000. If you can't raise that for a down-payment then you don't need to buy a house.

Posted on 10/30/15 at 7:48 am to lsupride87

I don't think being responsible when making a home purchase is living in a bubble

Posted on 10/30/15 at 8:43 am to Will Cover

quote:I am certain that you take risks, but you are providing counsel to others that they shouldn't. I'm now certain that you are a hypocrite, just like the rest of us.

I don't consider anything a certainty.

Posted on 10/30/15 at 9:19 am to yellowfin

Being responsible? There are responsible people who don't have 5% that buy homes and it is the right decision. Having hard fast rules that this board loves to spout would cause thousands of people to make the wrong decision

Posted on 10/30/15 at 9:27 am to Herb484

quote:

Would it ever be ok

I hate phrases like this. There are no rigid, completely unbreakable rules when it comes to finance. Every situation is different.

A few years ago, I bet most of this board would have said absolutely do this, as houses were appreciating must faster than the market.

I don't think it's a good idea to tap a 401K for a first time home purchase - in most situations. There are a few situations where I think it can be an option:

1) It's a loan, which you can repay quickly (maybe a guaranteed bonus will be here in a few months) and you find a great bargain on a house that you really want

2) You are paying significantly more in rent than you would be paying in a monthly mortgage note, so you can easily afford the note, but the rent is so high you are slow in saving the last couple of thousand dollars needed for the house.

Posted on 10/30/15 at 9:39 am to LSUFanHouston

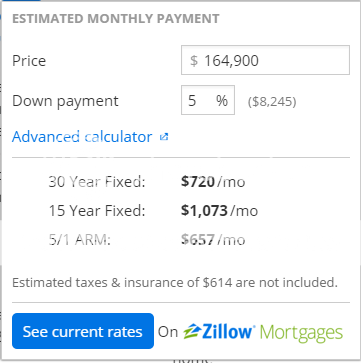

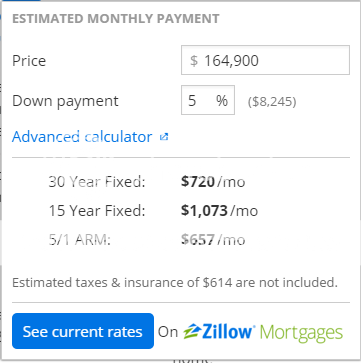

Quick question that I don't want to start a new thread on...

The "estimated taxes & insurance of $614" - is that $614/month?

The "estimated taxes & insurance of $614" - is that $614/month?

Posted on 10/30/15 at 10:44 am to Jon Ham

The taxes and insurance are per month, but that estimation is way off. I'd suspect you'd be closer to $250 on a $164,000 house. You can get the exact tax bill from your county - and insurance would be around $100 a month.

Posted on 10/30/15 at 11:05 am to lsupride87

Let me put it this way, if I can't save at least 5% toward the purchase of a home without pulling from my 401k then I'm not going to buy that home. If anyone ask me for advice on a similar situation I will tell them the same. I'm sure people do it every day, probably some of the same ones that got burned in 08

Popular

Back to top

1

1