- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Beginner investors. My 2 teen kids.

Posted on 4/4/23 at 8:18 pm to lsugorilla

Posted on 4/4/23 at 8:18 pm to lsugorilla

Hot take, they going to college with relevant degrees?

I'd say let them spend it till they graduate college(mostly paid for, working during college). I spent high school studying my arse off, so the money i earned in summer or afterschool jobs, i blew it on cars and some trips. Worth it. If i just studied and saved, i would have missed out on alot of life lessons.

If i had invested that, or kept those investments, i would be a multi millionaire, sure. But i would have missed so much. I'm still financially completely fine, and i had some good times as a young dude.

I'd say let them spend it till they graduate college(mostly paid for, working during college). I spent high school studying my arse off, so the money i earned in summer or afterschool jobs, i blew it on cars and some trips. Worth it. If i just studied and saved, i would have missed out on alot of life lessons.

If i had invested that, or kept those investments, i would be a multi millionaire, sure. But i would have missed so much. I'm still financially completely fine, and i had some good times as a young dude.

Posted on 4/4/23 at 8:29 pm to lsugorilla

Another thing to consider, if you open Roth IRAs (assuming they have enough income) it won't count against them for financial aid on FAFSA. Student owned assets in a regular account are assessed at a higher rate than parent assets. Plus, Roth contributions can be withdrawn anytime no tax or penalty they just wont be able to touch the growth until retirement age.

Posted on 4/4/23 at 8:35 pm to TorchtheFlyingTiger

Btw this is gold

If you could set up a Roth and put in 100k the kids could screw with and active trade they could make a lot of money

If you could set up a Roth and put in 100k the kids could screw with and active trade they could make a lot of money

Posted on 4/4/23 at 8:57 pm to j1897

quote:

I'd say let them spend it till they graduate college

I don’t want them not to spend money. I would like a nice balance. Heck. Even if they only invested a little. That’s 100% more than me

Posted on 4/4/23 at 9:02 pm to lsugorilla

I think you could get them set up with etrade accounts and let them do what they want and decide how much to put in

Im not sure when I got one but I was 18 or possibly younger

Like you hook it up to a bank account and it goes and lets you buy whatever you want and theres no real tax issue there unless they make money

ETA: You at least need to teach them about taxes and the government so they don't become libs in college

if you want to get them to "intermediate" level you could teach them to hate the "market makers" too if you feel me

Im not sure when I got one but I was 18 or possibly younger

Like you hook it up to a bank account and it goes and lets you buy whatever you want and theres no real tax issue there unless they make money

ETA: You at least need to teach them about taxes and the government so they don't become libs in college

if you want to get them to "intermediate" level you could teach them to hate the "market makers" too if you feel me

This post was edited on 4/4/23 at 9:04 pm

Posted on 4/4/23 at 9:25 pm to el Gaucho

quote:

If you could set up a Roth and put in 100k the kids could screw with and active trade they could make a lot of money

No offense, but…

Posted on 4/4/23 at 9:32 pm to TorchtheFlyingTiger

quote:

TorchtheFlyingTiger

Thank you

Posted on 4/4/23 at 9:34 pm to bayoubengals88

quote:

bayoubengals

Thank you

Posted on 4/4/23 at 9:42 pm to el Gaucho

quote:

I’m glad you’re still so cheerful because I’ve seen you take a bunch of l’s in real time

You’re sounding pretty fringe. I hope there’s someone in your life to call you out on it rather than lots of people fueling your echo chamber.

Posted on 4/4/23 at 10:02 pm to bayoubengals88

If they work then getting them fully funding a Roth IRA when they are super young will be an amazing start that they will thank you for in the future.

If you can swing it, then get them to max the ROTH IRA and then just cover the $6K in spending money for them.

If you can swing it, then get them to max the ROTH IRA and then just cover the $6K in spending money for them.

Posted on 4/4/23 at 11:09 pm to lynxcat

Just finished a really good book-RICHER,WISER,HAPPIER by William Green.

Posted on 4/5/23 at 12:11 am to el Gaucho

quote:

one part of the market relies on people like you and your family that are easy marks for the carnies that run the stock market

I feel like you took a big hit in day trading, you were in the AT threads, before that you were funny, now it’s all doom and gloom in every thread.. market crashing, fema camps, social security running out, stocks are supporting boomers.. over and over.

Posted on 4/5/23 at 12:19 am to lsugorilla

quote:

Hello. My kids want to get into investing. Where do I start? They are both young teens. I grew up just putting in saving account.

Fidelity has youth accounts. They’ll usually give $50 to start the account. Keep it simple, but interesting.Let them use a portion of it for good companies they are interested in. Lululemon if they like clothes. NVDA if they like video games (or money),etc. This does a few things. One, it keeps them interested. If they get bored, which they will with index value funds, they will lose interest and it will have a long term negative impact. Two, if they lose then they learn the value of value investing. Three, since they have so much time to recover, it is a good time for them to be a bit more risky. Also, kids usually know trends quicker than we do, so we can learn from them, too.

This post was edited on 4/5/23 at 10:52 am

Posted on 4/5/23 at 12:21 am to j1897

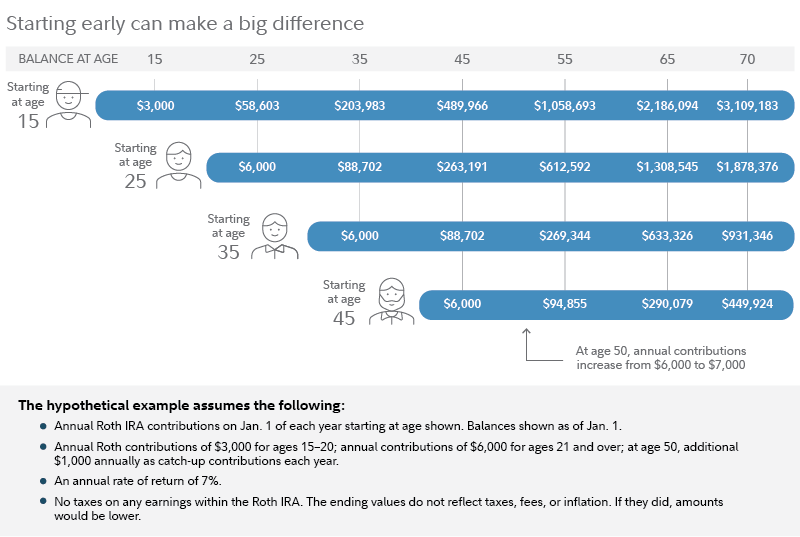

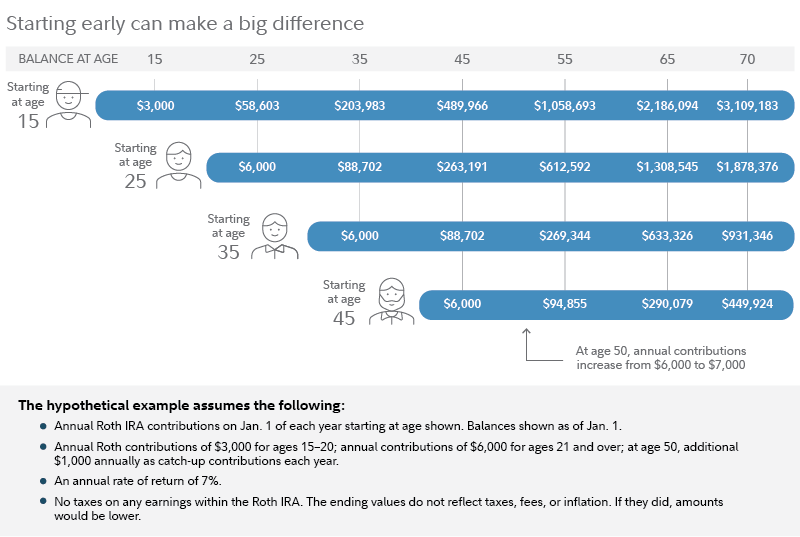

Teach them about the time value of money. There are a lot of charts out there showing you’re better off investing $100/month at the age of 20 than $500/month at the age of 40, those numbers are probably off but you get the picture. The main key is teaching them to live within their means, and if they don’t like it, to change what they are doing to make their means better, this is America and the second option is always available.

Posted on 4/5/23 at 12:38 am to lsugorilla

quote:Before they just start buying/selling stuff, I would have them learn the rudiments of value investing. They need to learn about risk/reward and how PRICE IS EVERYTHING.

Beginner investors. My 2 teen kids.

Hello. My kids want to get into investing. Where do I start? They are both young teens. I grew up just putting in saving account.

I want to put into something that grows.

Posted on 4/5/23 at 5:16 am to lsugorilla

Fidelity: Turbocharge your child's retirement with a Roth IRA for Kids

The kid can only contribute up to the amount of their earned income (up to $6,000). You can wait until they get their W-2s and 1099s to establish that amount for a year, then make and designate the contribution for that prior year (until April 15).

If I had a kid or youth I cared about, I would open a Roth IRA for them and make the contribution up to their max allowable each year. Put it in mainly an S&P 500 index fund, but let them pick a few individual stocks to make it interesting.

The real-life example I give is $5,000 I put in Fidelity Blue Chip Growth fund in the mid-90s. Let it ride, with dividends reinvested, ever since. Otherwise never added or withdrew a penny. It's been interesting to watch it go up and down, sometimes crashing and then clawing back, and for a while up to as much as over $80K; it's around $63K now.

Imagine the stash a kid might have at retirement if you funded a Roth for a few years in their early years, and they let it ride for 40 years or so. Watching it grow may also motivate them to hit it harder on their own 401k and other retirement plans.

The kid can only contribute up to the amount of their earned income (up to $6,000). You can wait until they get their W-2s and 1099s to establish that amount for a year, then make and designate the contribution for that prior year (until April 15).

If I had a kid or youth I cared about, I would open a Roth IRA for them and make the contribution up to their max allowable each year. Put it in mainly an S&P 500 index fund, but let them pick a few individual stocks to make it interesting.

The real-life example I give is $5,000 I put in Fidelity Blue Chip Growth fund in the mid-90s. Let it ride, with dividends reinvested, ever since. Otherwise never added or withdrew a penny. It's been interesting to watch it go up and down, sometimes crashing and then clawing back, and for a while up to as much as over $80K; it's around $63K now.

Imagine the stash a kid might have at retirement if you funded a Roth for a few years in their early years, and they let it ride for 40 years or so. Watching it grow may also motivate them to hit it harder on their own 401k and other retirement plans.

Posted on 4/5/23 at 5:33 am to Jag_Warrior

quote:

And let them watch porn channels before allowing them to even know who (or what) Jim Cramer is. Seriously.

Why not just watch Cramer and fade him?

Posted on 4/5/23 at 8:32 am to Twenty 49

Show them this.

And ignore the advice to stock pick. Teach them to invest in the market with index funds and not try to beat the pros. A small percent in individual stocks for sport may be ok. But runs the risk of giving false sense they have some special ability to beat the market when in long term they almost certainly wont. Small wins now could lead to excess risk and big loses later when substantial assets are at play.

And ignore the advice to stock pick. Teach them to invest in the market with index funds and not try to beat the pros. A small percent in individual stocks for sport may be ok. But runs the risk of giving false sense they have some special ability to beat the market when in long term they almost certainly wont. Small wins now could lead to excess risk and big loses later when substantial assets are at play.

Posted on 4/5/23 at 10:00 am to TorchtheFlyingTiger

quote:

Teach them to invest in the market with index funds and not try to beat the pros.

Can I do that with fidelity?

Popular

Back to top

2

2