- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Taxes and Sanity

Posted on 4/11/17 at 9:40 am to germandawg

Posted on 4/11/17 at 9:40 am to germandawg

quote:

So, what is this progressives idea? I think what we need is sensible spending cuts....on every front including entitlements....I think it should be might near impossible for an able bodied person with no dependents to receive ANY sort of public assistance....and I think if they try they should be charged with a crime. I think we need to stop supporting the world's security and allow the world to step up and do some of it themselves. We would all be better off. I think there should be an elimination of the social security wage cap and I think there should be some means testing for benefits...my wife and I pay out of social security by November every year..and we could probably retire right now with a substantial cut in our lifestyle without a penny from social security...and most people in our situation are in similar positions. If we work into our late 60's as we plan to we will never "need" any social security income....but of course we will take it 'cause we are greedy LOL....

I pretty much agree with all of this except means testing can get pretty tricky.

Also it's not greedy to take your social security money when you've been paying into it since you began working

Posted on 4/11/17 at 9:45 am to SoulGlo

quote:Ok what is the minimum amount of money you need to make to qualify for salary and wages not reported on a W2 or 1099? I really would like to know how to make all this free money.

If you make a lot of money and have a w2 or 1099 you're fricked.

Posted on 4/11/17 at 9:46 am to JakeRStephenes

quote:

married, own house, 32.5 effective rate.

try calculating that again and this time leave out your social security that's not income tax.

Posted on 4/11/17 at 9:49 am to tedmarkuson

quote:Whybis that wrong. Do you think dividends are the same thing as wages? Why should they be taxed the same?

bush 2 changed the treatment of dividends from ordinary income to capital gains.

quote:Thst is a TERRIBLE assumption. Anyone with a mutual fund is earning some sort of dividend. As usual, taxes don't hurt the wealthy. They hurt those on the way up. Not that we should be using the tax code to hurt people..

think about that, before you'd assume anyone with dividends was probably gonna be in the 28 and 33% bracket and would pay taxes on dividends at the same rate as interest or rent for that matter.

quote:

now thanks to W we payed 14% on that income as if it was a long term capital gain.

This post was edited on 4/11/17 at 9:59 am

Posted on 4/11/17 at 9:51 am to PygmalionEffect

quote:

I'm considered in the upper middle class income range like a lot of guys on here. Probably do better than most since I'm right in the 90-95 percentile.

quote:At what income does this 15% tax bracket start?

After Bush gave the rich a 15% tax bracket on the majority of their reportable income

Posted on 4/11/17 at 9:54 am to bmy

quote:Simply untrue.

It is an undeniable fact that the tax burden on the middle class is higher than the upper class

Posted on 4/11/17 at 9:59 am to Taxing Authority

Income taxes are abhorrent. They, along with the IRS, should be done away with entirely. Go to a VAT or national sales tax. Give people a choice to save or not.

Posted on 4/11/17 at 10:25 am to Taxing Authority

quote:

Taxing Authority

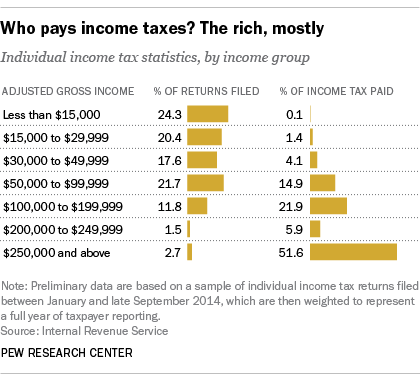

I don't think it's a coincidence that this chart looks like a big middle finger to the middle class:

Posted on 4/11/17 at 11:56 am to Taxing Authority

The tax burden is highest on the middle class. A 5% tax cut makes a big difference to a middle class lifestyle.. and is entirely insignificant to the lifestyle of the rich

Look at that 200-250k stat

Look at that 200-250k stat

Posted on 4/11/17 at 12:04 pm to tedmarkuson

If you are 1099, you pay 15.3 SS (Both sides), then State and Federal income taxes. You can deduct your self employed expenses but if you don't have a lot of those, are single and rent you can easily pay very high taxes. That doesn't include local sales and property taxes.

Before tax rates are debated we should insist on cutting spending. At the Federal, State and local levels.

And if you are wondering why JBE needs more money:

LINK

Before tax rates are debated we should insist on cutting spending. At the Federal, State and local levels.

And if you are wondering why JBE needs more money:

LINK

This post was edited on 4/11/17 at 12:07 pm

Posted on 4/11/17 at 12:09 pm to DownSouthJukin

quote:

I don't think it's a coincidence that this chart looks like a big middle finger to the middle class:

The government will be coming for the money. And it's not going to come from "the rich". The "middle class" has A LOT more money.

Posted on 4/11/17 at 12:10 pm to TheXman

how is the government going to pay for trumps weekend vacations if they don't tax you?

Posted on 4/11/17 at 12:11 pm to TheXman

quote:

I pretty much agree with all of this except means testing can get pretty tricky.

Also it's not greedy to take your social security money when you've been paying into it since you began working

I agree about the greedy part but I was only saying that about my wife and myself...we are greedy with money LOL....except we spend waaaaaayyyyyyy to much of it on stupid crap....I have a 2400 square foot building that has a mezzanine in so it is basically 2 stories tall and the damn thing is full of CRAP....Id bet there is $10K worth of damned duck and goose decoys...

Posted on 4/11/17 at 12:12 pm to bmy

quote:$1 = $1.

The tax burden is highest on the middle class.

quote:

A 5% tax cut makes a big difference to a middle class lifestyle..

quote:Odd. You'd consider 5% of someone making $150k "insiginficant"? Do you think %7,500/yr is "insignificant" to a family earning that? I don't.

entirely insignificant to the lifestyle of the rich

quote:Clearly, the Bill Gates' of this world live there.

Look at that 200-250k stat

Posted on 4/11/17 at 12:16 pm to Taxing Authority

quote:

quote:

If you make a lot of money and have a w2 or 1099 you're fricked.

Ok what is the minimum amount of money you need to make to qualify for salary and wages not reported on a W2 or 1099? I really would like to know how to make all this free money.

Not free. Cheap.

If you have enough net worth to live on capital gains, your tax bill is a lower percent than if you made the same amount in wages. How am, I wrong?

Posted on 4/11/17 at 12:23 pm to SoulGlo

quote:Fair point.

Not free. Cheap.

quote:You're wrong because of the first part of your premise. The LTCG rates benefit anyone that invests money. Including those in 401ks and the like. You can "take advantage of it" with a simple S-corp. There is NO minimum income required to take advantage of it.

If you have enough net worth to live on capital gains, your tax bill is a lower percent than if you made the same amount in wages. How am, I wrong?

You'd be correct if you said many fail to do so efficiently. But that's not the government's fault. That's their own.

quote:Of course it is. It's a different thing. Capital is mobile. Wages are not. Plus the opportunity afforded by invested captial. There is no sensible reason these things should be taxed at the same rates.

lower percent than if you made the same amount in wages

This post was edited on 4/11/17 at 12:27 pm

Posted on 4/11/17 at 12:24 pm to Pbhog

quote:

how is the government going to pay for trumps weekend vacations if they don't tax you?

bruh

Posted on 4/11/17 at 12:55 pm to Taxing Authority

quote:

The government will be coming for the money. And it's not going to come from "the rich". The "middle class" has A LOT more money.

It's all about who's writing the rules...

Posted on 4/11/17 at 12:58 pm to Taxing Authority

So how do i, making 90-100k pretax, lower my tax percentage with an S corp?

Serious question. Ive heard of them but dont know about them

Serious question. Ive heard of them but dont know about them

Posted on 4/11/17 at 1:06 pm to SoulGlo

quote:Roughly...become an 1099 Independent contractor. Take only only minimal salary from corp as you dare. Rest as distribution. The killer here is getting health insurance.

So how do i, making 90-100k pretax, lower my tax percentage with an S corp?

This post was edited on 4/11/17 at 1:07 pm

Popular

Back to top

1

1