- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Anyone else rethinking voluntary flood insurance?

Posted on 5/18/21 at 1:28 pm to MrJimBeam

Posted on 5/18/21 at 1:28 pm to MrJimBeam

I didn't come close in 2016, nor did i come close last night despite getting probably 15" of rain in the span of a few hours.

If my house ever floods i think literally all of Baton Rouge would have to be under water.

If my house ever floods i think literally all of Baton Rouge would have to be under water.

Posted on 5/18/21 at 1:29 pm to dyslexiateechur

Just tried to login to AllState to make sure it’s all up today. Looks like their site is down. A lot of people probably thinking about it and slamming their site.

I got mine in 2016 too. Didn’t flood

I got mine in 2016 too. Didn’t flood

Posted on 5/18/21 at 1:30 pm to dyslexiateechur

You should def have it. It is cheap compared to what you could lose in comparison.

Posted on 5/18/21 at 1:32 pm to dyslexiateechur

I lived for 20 years in Katy, TX in flood zone X. Never even had water in the street. In 2017 Hurricane Harvey dumped 51" of rain on the Houston area. I was still OK. But then the Corp of Engineers decided to release the levees that were upstream of me. The water hit the already overburdened waterways and backwashed a ton of water into my subdivision. I had about 5 feet in my house. And because of my location, the water didn't drain very fast. We were under mandatory evacuation for 10 days. The police and the National Guard were posted to keep us out. By the time we got back in everything was covered in mud and mold. We weren't able to salvage anything.

So I will always have flood insurance even if I live on the top of a mountain.

So I will always have flood insurance even if I live on the top of a mountain.

Posted on 5/18/21 at 1:34 pm to mthorn2

quote:

bag of leaves stopping up your neighborhood subsurface drain pipe can flood an entire block. Just saying....its worth the price.

Yep. Serious flooding isn't common here (Atlanta). But we have stormwater that drains through our property so the minimal cost to get at least some insurance is worth it I think.

Posted on 5/18/21 at 1:35 pm to dyslexiateechur

shite, I rent and I have flood insurance for my belongings. Both of them.

Posted on 5/18/21 at 1:40 pm to dyslexiateechur

Not just Flood Insurance, get contents coverage too.

Posted on 5/18/21 at 1:42 pm to TigerstuckinMS

Let's take a time span of 25 years.

$550 a year at 25 years is less than $14k.

How quickly can one accumulate 14k of flood damage with a half inch of water in the house?

Besides peace of mind.

Besides its a tax write off every year.

It just makes financial sense to buy the policy.

And those that don't buy the policy cause lender is not requiring it and you take the convenient excuse of being ignorant, that shite doesn't fly any more these days. Everyone is aware of flood insurance and if they have it or not.

$550 a year at 25 years is less than $14k.

How quickly can one accumulate 14k of flood damage with a half inch of water in the house?

Besides peace of mind.

Besides its a tax write off every year.

It just makes financial sense to buy the policy.

And those that don't buy the policy cause lender is not requiring it and you take the convenient excuse of being ignorant, that shite doesn't fly any more these days. Everyone is aware of flood insurance and if they have it or not.

Posted on 5/18/21 at 1:44 pm to CincoTiger

quote:

But then the Corp of Engineers decided to release the levees that were upstream of me. The water hit the already overburdened waterways and backwashed a ton of water into my subdivision. I had about 5 feet in my house.

I know a lot of people like you, and it sucks. I don't think the Corps had much of a choice... there was significant concern the dam gates were going to blow and then all hell would break loose.

Posted on 5/18/21 at 1:45 pm to dyslexiateechur

Have FEMA flood through State Farm for the last few years and made my first claim with it for damage incurred with Hurricane Delta. The adjuster group out of Pineville were the worst bunch I have ever dealt with. Even FEMA was having issues getting paperwork from them submitted correctly and timely. Repeated calls to their office were not returned and I had to get FEMA on their arse for the answers I was looking for.

It has made me rethink FEMA Insurance and going with another option if I am stuck with that same adjuster group again.

It has made me rethink FEMA Insurance and going with another option if I am stuck with that same adjuster group again.

This post was edited on 5/18/21 at 4:18 pm

Posted on 5/18/21 at 1:46 pm to CincoTiger

"But then the Corp of Engineers decided to release the levees that were upstream of me. The water hit the already overburdened waterways and backwashed a ton of water into my subdivision. I had about 5 feet in my house."

Dang, that is terrible. How much did it cost you to repair? Did you have any government programs available?

Dang, that is terrible. How much did it cost you to repair? Did you have any government programs available?

Posted on 5/18/21 at 1:47 pm to Traveler

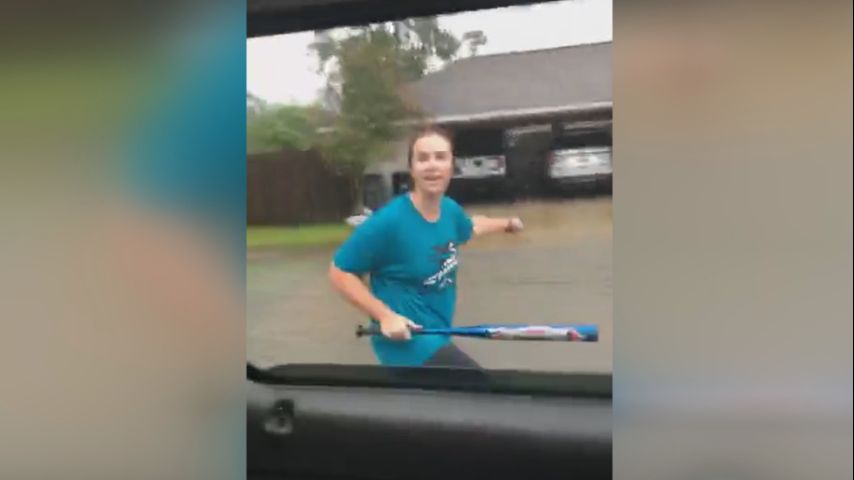

Bad idea is bad

This post was edited on 5/18/21 at 2:08 pm

Posted on 5/18/21 at 1:49 pm to CincoTiger

quote:Smart choice because flood insurance covers mudslides too

So I will always have flood insurance even if I live on the top of a mountain.

Posted on 5/18/21 at 1:50 pm to dyslexiateechur

quote:

rethinking voluntary flood insurance?

Posted on 5/18/21 at 1:56 pm to dyslexiateechur

Don’t live in a flood zone, up high with great drainage.

After seeing it get higher in my yard than ever before, and even though it didn’t come close, I’m getting it as soon as possible. Been meaning to do it, but always procrastinate on it. Not anymore.

I mean, I live in Lake fricking Charles. I need every policy I can get on everything the way life is going.

After seeing it get higher in my yard than ever before, and even though it didn’t come close, I’m getting it as soon as possible. Been meaning to do it, but always procrastinate on it. Not anymore.

I mean, I live in Lake fricking Charles. I need every policy I can get on everything the way life is going.

Posted on 5/18/21 at 1:56 pm to dyslexiateechur

I did not need it in NOLA near City Park. I was glad I had it when Katrina hit. As cheap as it is in the non-flood zones, just get it.

Posted on 5/18/21 at 1:59 pm to Chad504boy

quote:

Let's take a time span of 25 years.

$550 a year at 25 years is less than $14k.

How quickly can one accumulate 14k of flood damage with a half inch of water in the house?

Then divide that 14k by 3 cause the insurance company will undoubtedly frick you over.

I'm flood zone x and have insurance, but I keep hearing all these horror stories of people getting screwed over by their insurance. I think for some people it may be worth it to risk it.

This post was edited on 5/18/21 at 2:00 pm

Posted on 5/18/21 at 2:01 pm to whoisnickdoobs

quote:

Then divide that 14k by 3 cause the insurance company will undoubtedly frick you over.

I'm flood zone x and have insurance, but I keep hearing all these horror stories of people getting screwed over by their insurance. I think for some people it may be worth it to risk it

That doesn't happen so often with flood insurance, since the feds foot the bill anyways (not for private flood, I'm talking about the federal flood program)

Posted on 5/18/21 at 2:03 pm to whoisnickdoobs

quote:

but I keep hearing all these horror stories of people getting screwed over by their insurance. I think for some people it may be worth it to risk it.

that's a pretty low iq take brah.

Posted on 5/18/21 at 2:07 pm to LoneStar23

quote:

You are out of your mind if you don't have flood insurance even not in a "flood zone"

You mean in a coastal region, right? I live in the mountains and if I flood, only Noah and his wooden boat are surviving.

ETA:

The front of my front yard is 15 yards below the lowest part of my foundation. My neighbor down the street's roof is about the same level as my mailbox.

I guess a mudslide could get me, but I don't think that is considered flood damage and I remember making sure I was covered for that.

This post was edited on 5/18/21 at 2:11 pm

Popular

Back to top

0

0