- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Options Trading Question - Selling Puts

Posted on 1/20/17 at 10:17 am

Posted on 1/20/17 at 10:17 am

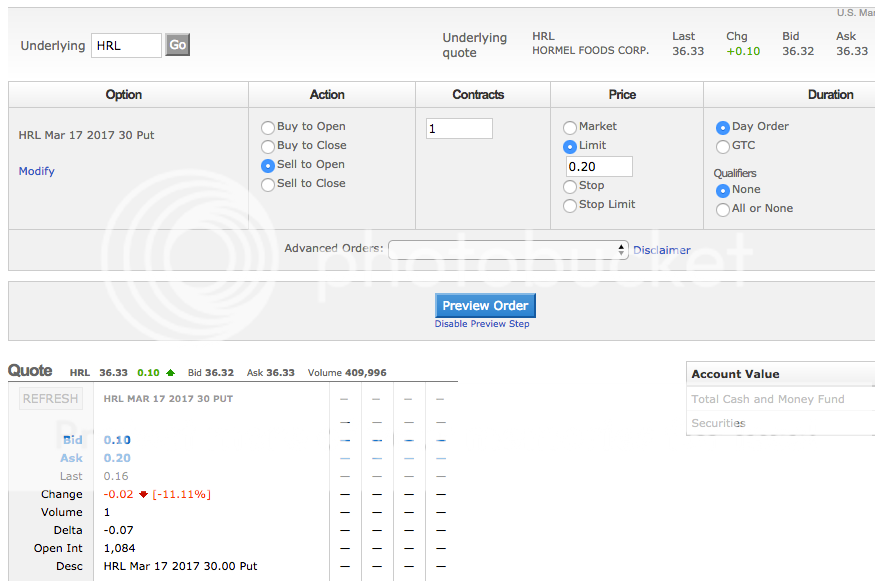

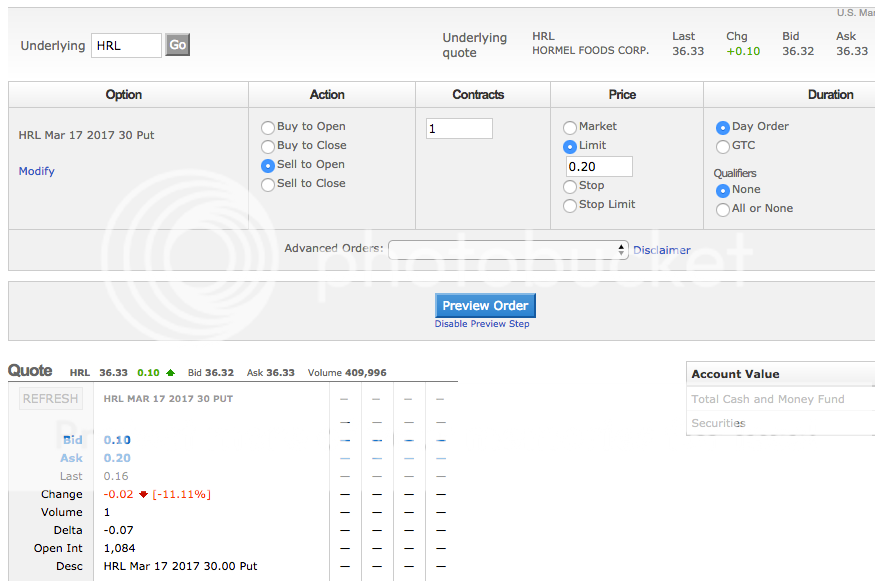

I've never sold puts before, so I'm trying to understand the logistics. I'll use this scenario as an example, and would appreciate some feedback if I've got it down or am off track.

The way I understand this trade, is that if HRL does not hit $30 by March 17, 2017, then I collect $20 as premium, minus whatever my commission is to trade the contract. Between now and March 17, I will need to have a minimum of $3,000 in my account (100 shares x $30 strike), in case the strike price of $30 is reached.

Do I have that right? Thanks.

The way I understand this trade, is that if HRL does not hit $30 by March 17, 2017, then I collect $20 as premium, minus whatever my commission is to trade the contract. Between now and March 17, I will need to have a minimum of $3,000 in my account (100 shares x $30 strike), in case the strike price of $30 is reached.

Do I have that right? Thanks.

Posted on 1/20/17 at 10:46 am to Grits N Shrimp

Yes.

You get a "premium" for agreeing to have shares "put" to you at a price in the future. If it is above that price, you pocket the premium. If below the strike price, you must buy the stock at the agreed on price.

You get a "premium" for agreeing to have shares "put" to you at a price in the future. If it is above that price, you pocket the premium. If below the strike price, you must buy the stock at the agreed on price.

Posted on 1/20/17 at 11:26 am to Grits N Shrimp

if you have to ask a question about options, then maybe they aren't a good thing to play around with.

Posted on 1/20/17 at 11:34 am to Hawkeye95

quote:

if you have to ask a question about options, then maybe they aren't a good thing to play around with.

Curious how does one ever learn about options then?

Posted on 1/20/17 at 11:38 am to HYDRebs

It's insurance.

Buyers of puts want downside protection. Sellers of puts take premium.

Sellers of calls collect premium. Buyers of calls may want to control a larger position with less capital out lay.

I sell options, both puts and calls.

Most options expire worthless.

Buyers of puts want downside protection. Sellers of puts take premium.

Sellers of calls collect premium. Buyers of calls may want to control a larger position with less capital out lay.

I sell options, both puts and calls.

Most options expire worthless.

Posted on 1/20/17 at 12:00 pm to HYDRebs

quote:

Curious how does one ever learn about options then?

You take classes on it. and read a lot. You have to acquire knowledge, no doubt. BUt you do so and feel comfortable on them before dipping your toe.

its a great way to lose a lot of money really fast.

Posted on 1/20/17 at 12:05 pm to Hawkeye95

He's selling a cash covered put. He has a maximum loss certain.

Posted on 1/20/17 at 12:12 pm to Hawkeye95

quote:

if you have to ask a question about options, then maybe they aren't a good thing to play around with.

Thanks for your input, bud.

quote:

maximum loss certain

Not necessarily a loss if it's a stock you'd be happy buying at that price anyway, right?

Posted on 1/20/17 at 12:18 pm to Grits N Shrimp

Right, you're lowering your entry cost. Berkshire sells puts for this reason. But it is a maximum loss certain if the stock goes to zero. What you paid including fees, less the premium you collected.

Posted on 1/20/17 at 12:31 pm to Hawkeye95

I'd definitely look at a simulation software to try it out and see what happens and evaluate your strategy.

Posted on 1/20/17 at 12:50 pm to Iowa Golfer

quote:

He's selling a cash covered put. He has a maximum loss certain.

Sure, but I would consider this to be a pretty basic question.

Posted on 1/20/17 at 12:59 pm to Hawkeye95

Anyone want to give us a Quick lesson?

How much would he make from that if it expires worthless? What is his risk?

I've traded but never sold.

How much would he make from that if it expires worthless? What is his risk?

I've traded but never sold.

Posted on 1/20/17 at 1:03 pm to I Love Bama

Investopedia is your friend for a basic overview.

This post was edited on 1/20/17 at 1:04 pm

Posted on 1/20/17 at 1:52 pm to I Love Bama

If he got the 0.2 ask that would give him $20 in premium. However, the bid is only .10 so it's likely not to get filled if the limit is above about 0.16 (last). But let's say it did anyway. The seller (OP) received $20 - $7ish commission for $13 net gain per option contract (100 shares).

The maximum loss is if the stock goes to zero which is obviously quite unlikely. But let's say it does anyway. Then the owner of the put (buyer) would force the seller to take 100 shares at $30 per share or $3000. The seller made $13 earlier, so his maximum loss is $3000 - $13 = $2987.

The maximum loss is if the stock goes to zero which is obviously quite unlikely. But let's say it does anyway. Then the owner of the put (buyer) would force the seller to take 100 shares at $30 per share or $3000. The seller made $13 earlier, so his maximum loss is $3000 - $13 = $2987.

Posted on 1/20/17 at 10:52 pm to HYDRebs

quote:

Curious how does one ever learn about options then?

That's a fair question. My first response is - why do you want to? Why not, for example, real estate? Understand your goal here, because far too many think that options trading is something that will make them rich.

I've known a couple of people in their retirement years who were looking for something to do that would keep them occupied. That's fair, just understand you aren't going to beat Goldman and Citi in your spare time. Both the guys I know did quite well for about a year, and then crashed back to worse than where they'd started. They were fooled by "gamblers ruin" (google it) and bet more and more with their initial wins. If you keep betting more, then you'll lose heavily very quickly.

But if it's just entertainment you're looking for, I do recommend OptionsAnimal. They present the basic concepts of spread trading pretty well and honestly. Just don't think you'll get rich.

Posted on 1/23/17 at 12:40 pm to Grits N Shrimp

quote:

Not necessarily a loss if it's a stock you'd be happy buying at that price anyway, right?

Correct.

And personally, I think that yours was a good question. I didn't take it that you wanted to jump into the options market without being fully prepared. But rather, you were asking a question to see if what you *thought* was the case was indeed the case.

If and when one has a decent sized equity portfolio, I think that it's important to have at least a good, fundamental, working knowledge of how the options markets work - even if you don't immediately use that knowledge by opening options trades. Options can provide profit opportunities and they can also provide downside protection (insurance). Most of what I have is because of real estate investments made years ago. But I use options to protect (and grow) what I have in the equity portion of my portfolio.

As for stocks that you'd be happy to own at a certain price anyway, that's how I felt when I sold some $90 puts on NFLX several months back and I got exercised into a position. Sometimes it just works the way that you want. Sometimes not... but you take the good and run with it.

Good luck to you.

Popular

Back to top

2

2