- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 5/16/24 at 10:38 am to BootUpCustoms

quote:

How do I lend out shares on fidelity? I meet all the requirements

ETA: website says

“Once enrolled, there are no extra steps. All eligible securities in your account, now or in the future, will be considered for borrowing based on demand in the lending market.”

Once you're enrolled it happens automatically and you just make money. I've made a few grand a year over the past couple and currently have 7 of my holdings being lent out...which I guess is a great way to make a bit of money off those bags I'm holding...SOXX, IUS, WKHS (

), LCID, TLRY, SOFI, and SLI.

), LCID, TLRY, SOFI, and SLI. Posted on 5/16/24 at 6:31 pm to gautamj

quote:

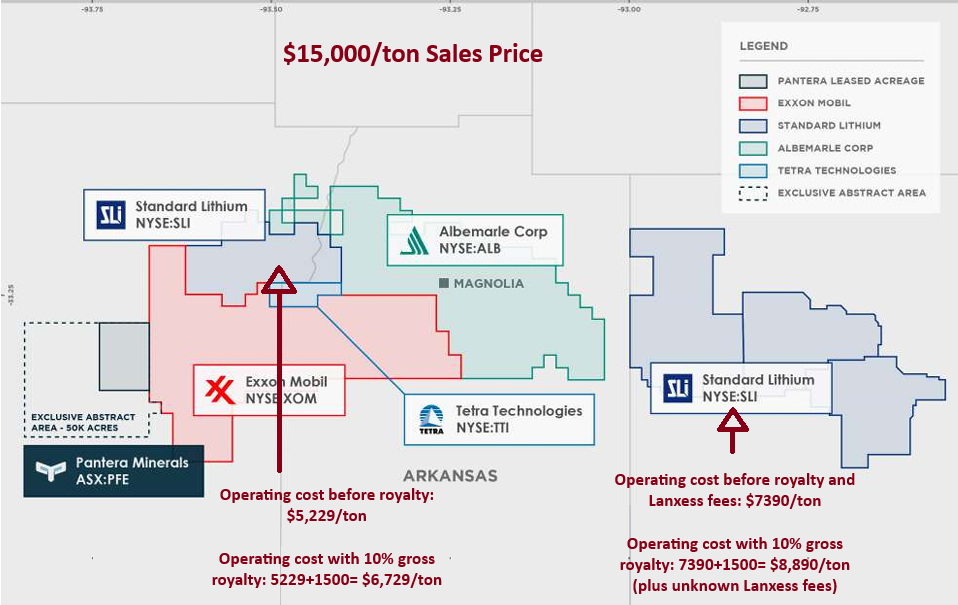

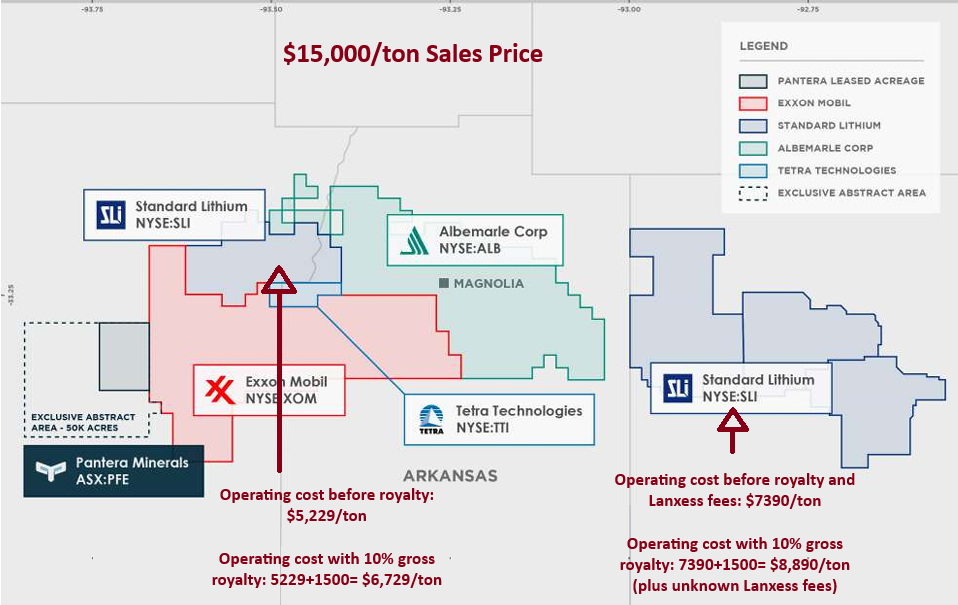

If AOGC ends up setting an obnoxiously high royalty rate like 10%, do you folks think SWA will be financially viable?

I think someone from SLI quoted before AOGC that 1A will not be viable at that high royalty rate.

They're going to piss of more shareholders than landholders.

If they set them too high and kill these projects, there will be hell to pay. Alot of people are invested in SLI, Albermarle etc and the area needs the jobs and taxes this will generate. A fairly small number of people own the land in question. 3.5% v. the 1.5% they've been getting is fair. 10% is ridiculous. Had Exxon not thrown that number out there, I think the 3.5% would've already been set. I told the ones I know that if they do set it that high based on the price of the refined product to expect lawsuits to re-evaluate the oil royalties they pay to base them off the total value of the refined oil. Fair is fair.

Oil royalties were also set after the industry had developed, not before it ever existed. I think political pressure will force lower royalties on the brine to ensure that the industry can develop in south Arkansas.

Posted on 5/17/24 at 11:30 am to SmackoverHawg

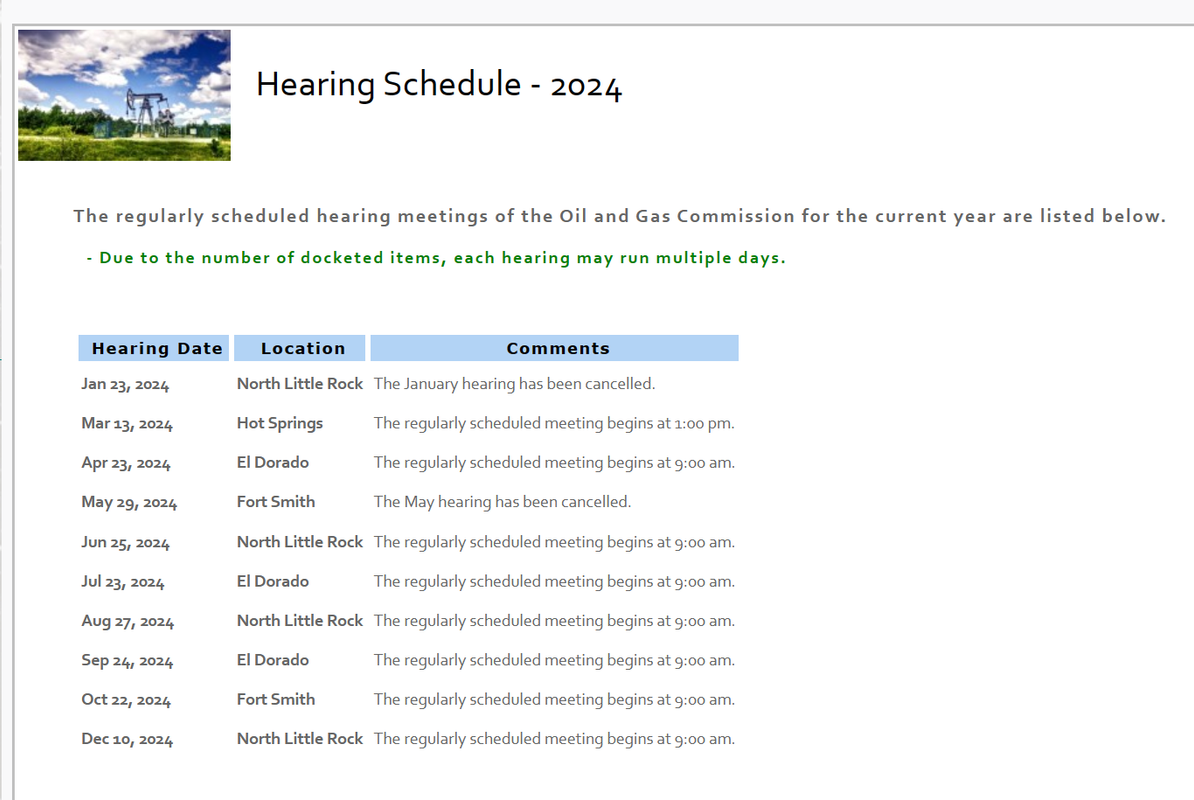

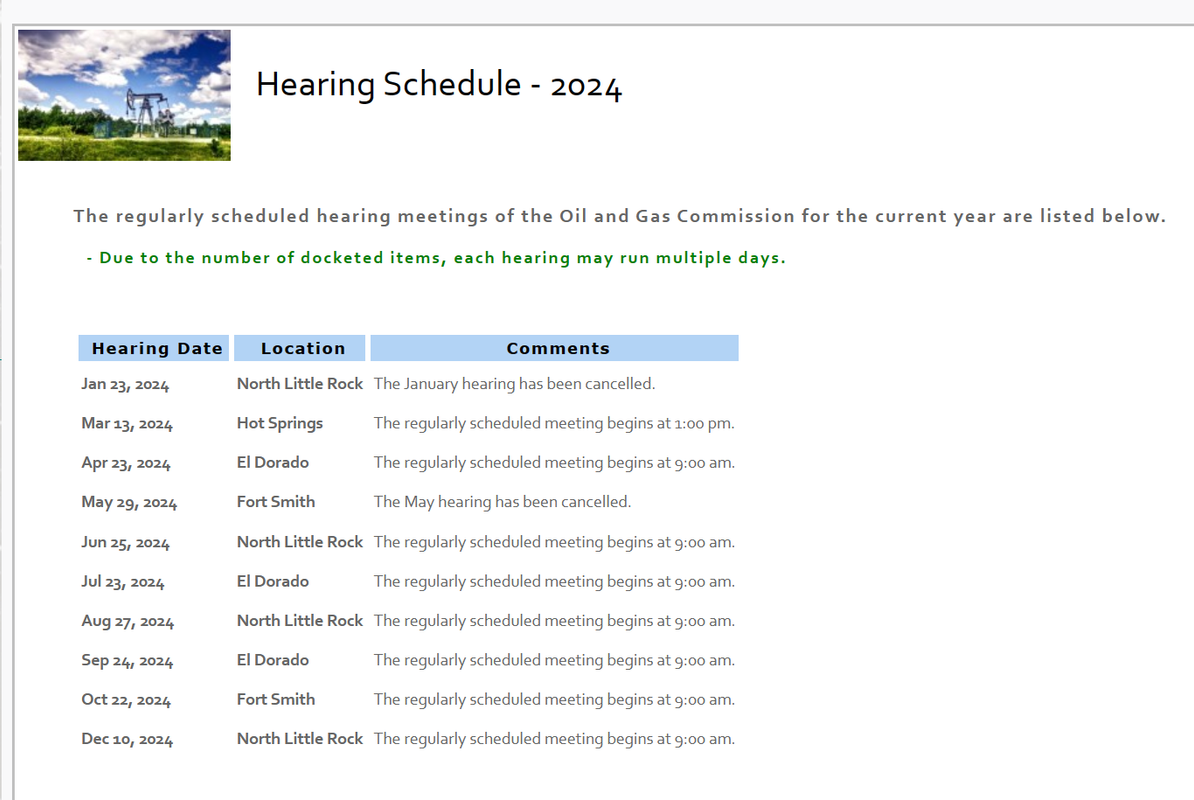

Speaking of royalties, the May hearing has been cancelled.

They're still negotiating a brine/infrastructure deal with Lanxess for 1A anyway, so it's not like the royalty is the only holdup.

They're still negotiating a brine/infrastructure deal with Lanxess for 1A anyway, so it's not like the royalty is the only holdup.

Posted on 5/17/24 at 12:30 pm to ev247

I edited an Arkansas brine territories map to show how a 10% royalty would affect the operating costs of 1A and SWA, using their DFS and PFS. Notice just how much stronger SWA is than 1A. $15,000/ton seems to be the neighborhood where lithium spot prices have been for the past several months.

Posted on 5/17/24 at 1:04 pm to ev247

Would love to see a ruling from AO&G that since Exxon suggested it, they can operate for the next 5 years with a 10% royalty and everyone else at 3.5% and then have the issue revisited.

Posted on 5/17/24 at 1:26 pm to Wraytex

I'm still not sure how these leasing "territories" work. Like, oil/gas companies can run around and outbid one another for leases, as long as the royalty offered is higher than the state minimum of 12.5%. Why isn't the AOGC setting the lithium minimum at 2% and letting brine/lithium producers try to outbid one another? Not that I would want that for SLI (pre-Equinor), just wondering why that isn't the structure

Posted on 5/17/24 at 1:31 pm to ev247

What a mess, in that situation the landowner would have to decide if exxon who can easily outbid SLI on royalties offered, is even serious about development. They might sign on for something that might not ever occur, while their kinfolk a couple miles away are seeing a lower, but real royalty check.

Posted on 5/17/24 at 1:41 pm to Wraytex

Okay on second thought my last post was ridiculous, they have to have those "units," as they call them, since two different companies can't feasibly get two neighbors' brines.

I'd love to know what came of that one AOGC commissioner's request for the best existing brine lease that anyone could find in the area at the time of the Dec hearing.

I'd love to know what came of that one AOGC commissioner's request for the best existing brine lease that anyone could find in the area at the time of the Dec hearing.

Posted on 5/20/24 at 4:12 pm to ev247

Can we get back over $2.00 by end of week?

Posted on 5/22/24 at 7:37 am to SmackoverHawg

Posted on 5/22/24 at 9:03 am to Dock Holiday

quote:

LinkedIN - Exxon and Arkansas brine

Seems they are on a fast track.

Posted on 5/22/24 at 9:10 am to Dock Holiday

Sounds like they’re still behind SLI.

Posted on 5/25/24 at 7:08 pm to Dock Holiday

quote:

LinkedIN - Exxon and Arkansas brine

Seems they are on a fast track.

They've got deep enough pockets to go-go without all of the begging at conferences.

Posted on 5/25/24 at 7:27 pm to SmackoverHawg

Do you (or anyone else on this board) have any idea what the delay is with the O&G commission? I can't understand what the holdup would be, except perhaps only because this is a new technology/mineral extraction? Maybe?

Otherwise, maybe it is because they are the oil & gas commission, and it'll eventually be competing against o&g in the future?

I feel like there's enough other boards and commissions and royalties on so many different products that it really shouldn't be an issue figuring out a royalty amount.....

Unless the technology really just sucks......

Otherwise, maybe it is because they are the oil & gas commission, and it'll eventually be competing against o&g in the future?

I feel like there's enough other boards and commissions and royalties on so many different products that it really shouldn't be an issue figuring out a royalty amount.....

Unless the technology really just sucks......

Posted on 5/28/24 at 2:00 pm to Ballstein32

quote:

and it'll eventually be competing against o&g in the future

Cars don't run on lithium.

Posted on 5/28/24 at 5:08 pm to GrizzlyAlloy

I watched a short video on the 25 Ramcharger this weekend and it's the type of truck/ vehicle that folks will actually want. A hybrid setup with a V6 running a generator driving two motors. 600+ both HP and torque. 0-60 4.4 sec and with full battery and gas tank = 690 mile range.

Ramcharger specs

Posted on 5/28/24 at 10:13 pm to ev247

Exxon isn't offering a true 10% gross royalty. It's 10% less expenses related to transport, refining, marketing, etc. Who knows what that works out to with corporate accounting. But an interesting point is that Lithium only accounts for ~10% of the marketable value of the minerals in the brine. Ex: Na, Mg and Ca ions are worth considerably more if isolated via electrolysis/distillation given their concentration x spot of industrial grades in Shanghai. The E&P's maintain they're only interested in Lithium, potassium and bromine, but I have my doubts

Also that 10% assumes Exxon, or whoever markets the sourced minerals, sells them in an arms-length deal. I wouldn't be surprised if it's something like this: There are 2 operators partnered on the unit, one which might extract the bromine. The tail-end brine then gets traded like-kind with Albemarle or Dow for chemicals/products equivs needed for ops + a deal for a backend royalty carved out from the revenue generated when they chem cos market the end products, or selling crude brine at discount wellhead rates with an end-profit sharing deal in place

Oh and the lithium doesn't go for $15k/mt, Lithium Carbonate and Lithium Hydroxide are ~$13-15k/mt, but lithium is a small component in those compounds by mass, with the anion considered to contribute no value. Correcting for purity and stoichiometric coefficients, the lithium is actually ~$80,000/ton at current spot

Also that 10% assumes Exxon, or whoever markets the sourced minerals, sells them in an arms-length deal. I wouldn't be surprised if it's something like this: There are 2 operators partnered on the unit, one which might extract the bromine. The tail-end brine then gets traded like-kind with Albemarle or Dow for chemicals/products equivs needed for ops + a deal for a backend royalty carved out from the revenue generated when they chem cos market the end products, or selling crude brine at discount wellhead rates with an end-profit sharing deal in place

Oh and the lithium doesn't go for $15k/mt, Lithium Carbonate and Lithium Hydroxide are ~$13-15k/mt, but lithium is a small component in those compounds by mass, with the anion considered to contribute no value. Correcting for purity and stoichiometric coefficients, the lithium is actually ~$80,000/ton at current spot

This post was edited on 5/29/24 at 11:54 pm

Posted on 5/28/24 at 10:42 pm to Lolathon234

Sounds like an opportunity for legal advisement for the landowners. Seems like theyll be getting duped out of payments on everything other than lithium

Posted on 5/28/24 at 10:56 pm to Lolathon234

I played with a 10% gross royalty based on the worst case that I'd heard. You know these details of Exxon's offer?

I remember reading that the East Texas lease options include all minerals but that Tetra has only leased to SLI rights to extract lithium. So bromine/potash/sodium/calcium/etc are irrelevant to SLI at SWA right?

It also doesn't get talked about much that Koch Minerals and Trading has dibs on SWA's (lithium product) offtake per the 1/25/22 PR. Doesn't seem like there's much room for unexpected fireworks at SWA unless I'm wrong and SLI has rights to more than lithium there.

I'm trying to understand the flow of operations in your second paragraph. Can you dumb it down a little more? (Not sarcasm, I struggle with comprehension.)

Interesting about how valuable pure lithium is in relation to the lithium products. Honestly, to this point my technical interest has been limited to what SLI intends to sell, and the $15k/mt referred to those two products that you've mentioned.

I remember reading that the East Texas lease options include all minerals but that Tetra has only leased to SLI rights to extract lithium. So bromine/potash/sodium/calcium/etc are irrelevant to SLI at SWA right?

It also doesn't get talked about much that Koch Minerals and Trading has dibs on SWA's (lithium product) offtake per the 1/25/22 PR. Doesn't seem like there's much room for unexpected fireworks at SWA unless I'm wrong and SLI has rights to more than lithium there.

I'm trying to understand the flow of operations in your second paragraph. Can you dumb it down a little more? (Not sarcasm, I struggle with comprehension.)

Interesting about how valuable pure lithium is in relation to the lithium products. Honestly, to this point my technical interest has been limited to what SLI intends to sell, and the $15k/mt referred to those two products that you've mentioned.

This post was edited on 5/28/24 at 11:03 pm

Popular

Back to top

0

0