- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Balance transfer offer from Discover: Which to choose and why?

Posted on 3/31/16 at 7:49 am

Posted on 3/31/16 at 7:49 am

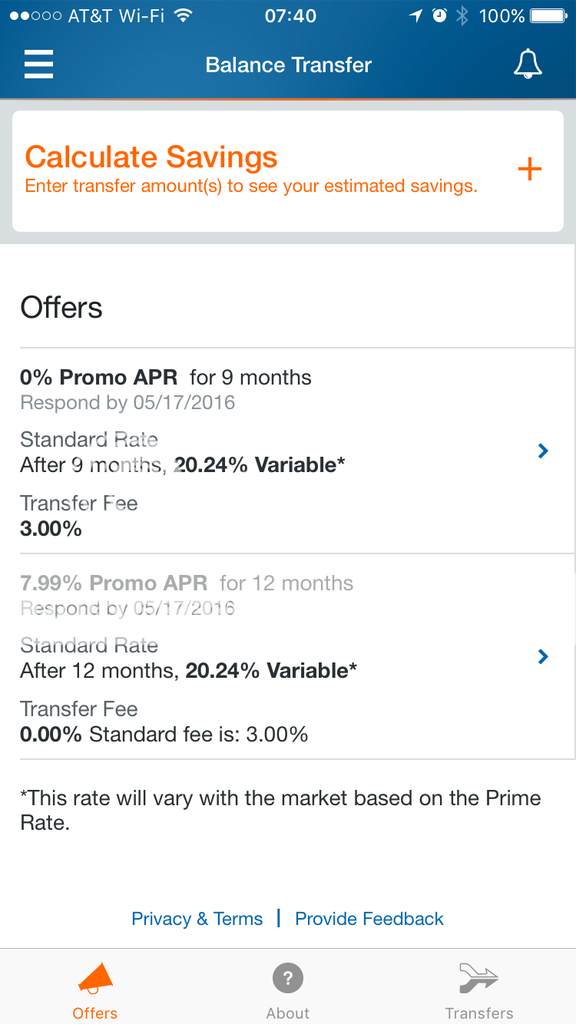

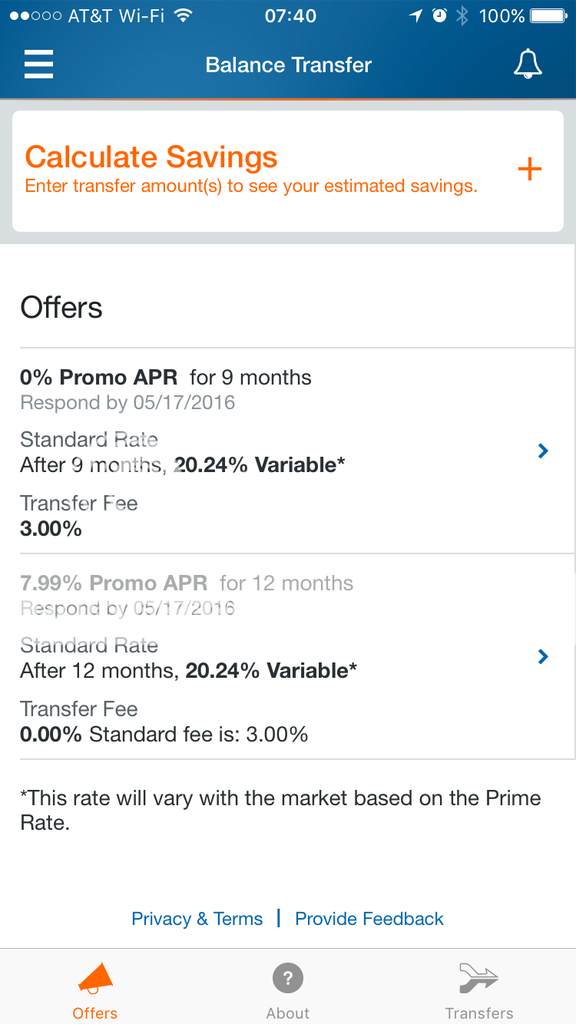

I was just alerted to these two offers.

I'm in the middle of repairing my credit... I have several cards, I'm close to being ~20ish% of balance on two, and around ~50ish% balance on the other... And then I have a loan that's higher interest and I'm at around 50% balance on...

Do I just attack the higher APR or...?

I'm in the middle of repairing my credit... I have several cards, I'm close to being ~20ish% of balance on two, and around ~50ish% balance on the other... And then I have a loan that's higher interest and I'm at around 50% balance on...

Do I just attack the higher APR or...?

Posted on 3/31/16 at 7:56 am to yankeeundercover

To give a detailed response, we'd need actual balances, actual APRs, and a good estimate on how quickly you'd be able to pay off the traditional way.

Posted on 3/31/16 at 8:58 am to yankeeundercover

I wouldn't bother with the offer. Instead, apply for a card with a 0% APR on purchases b/c there's no 3% fee to transfer anything. Start using that for everything you can and pay the minimum balance each month, and then pay extra on your other cards. Repeat as needed.

Also, I assume your payment history is solid since otherwise you wouldn't be getting offers like this. So call your current card issuers and ask for a rate reduction. There's a decent chance they'll do it in order not to lose the business.

Also, I assume your payment history is solid since otherwise you wouldn't be getting offers like this. So call your current card issuers and ask for a rate reduction. There's a decent chance they'll do it in order not to lose the business.

Posted on 3/31/16 at 9:03 am to foshizzle

I'm confused...

Unfortunately, and most likely relatively common, I don't have as tight a grip on financial matters when it comes to 'best practices'.

If you've got an email address I can send you what I'm working with... I've got all the APR's, balances, minimums, etc..

Unfortunately, and most likely relatively common, I don't have as tight a grip on financial matters when it comes to 'best practices'.

If you've got an email address I can send you what I'm working with... I've got all the APR's, balances, minimums, etc..

Posted on 3/31/16 at 10:23 am to yankeeundercover

What he is saying is you can probably get a NEW credit card with 0% for atleast 12 months. Then put all your expenses on the new credit card. Take the money you would use to pay those monthly expenses and pay down your credit cards with the bad rates. Thereby transferring your debt to the 0% card with no transfer fee.

The only problem with this is you may take awhile to transfer your funds depending on your monthly expenses and how much you can put in the CC.

The only problem with this is you may take awhile to transfer your funds depending on your monthly expenses and how much you can put in the CC.

This post was edited on 3/31/16 at 10:25 am

Posted on 3/31/16 at 10:32 am to barry

(no message)

This post was edited on 9/25/20 at 11:09 am

Posted on 3/31/16 at 11:06 am to yankeeundercover

Popular

Back to top

2

2