- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Bad at timing the market? You can still make lots of money...

Posted on 8/27/15 at 12:32 pm

Posted on 8/27/15 at 12:32 pm

This article just came up on CNBC, but the origins were from February of this year, so it may be germans. Either way, I think the board will appreciate the insight:

LINK

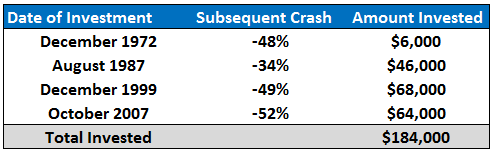

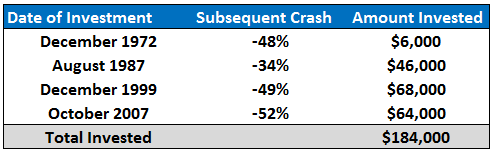

To summarize, even though Bob invested his savings right before major crashes, his $184,000 grew to $1.1M over the 43 year period, roughly an 8% annualized return on his money.

Dollar-cost averaging during the same time period would have grown to $2.3M, but this article illustrates that even with his terrible timing of the market, Bob always had time in the market on his side.

LINK

quote:

Meet Bob.

Bob is the world’s worst market timer.

What follows is Bob’s tale of terrible timing of his stock purchases.

Bob began his career in 1970 at age 22. He was a diligent saver and planner.

His plan was to save $2,000 a year during the 1970s and bump that amount up by $2,000 each decade until he could retire at age 65 by the end of 2013 (so $4,000/year in the 80s, $6,000/year in the 90s then $8,000/year until he retired).

He started out by saving the $2,000 a year in his bank account until he had $6,000 to invest by the end of 1972.

Bob’s problem as an investor was that he only had the courage to put his money to work in the market after a huge run up.

So all of his money went into an S&P 500 index fund at the end of 1972 (I know there were no index funds in 1972, but just go with me here…see my assumptions at the bottom of the post).

The market dropped nearly 50% in 1973-74 so Bob basically put his money in at the peak of the market right before a crash.

Yet he did have one saving grace. Once he was in the market, he never sold his fund shares. He held on for dear life because he was too nervous about being wrong on both his sell decisions too.

To summarize, even though Bob invested his savings right before major crashes, his $184,000 grew to $1.1M over the 43 year period, roughly an 8% annualized return on his money.

Dollar-cost averaging during the same time period would have grown to $2.3M, but this article illustrates that even with his terrible timing of the market, Bob always had time in the market on his side.

quote:

***Assumptions and disclaimers: This is fictional and is in no way how you should invest your money. It takes nerves of steel to hold 100% of your portfolio in stocks for decades on end. This is purely an exercise in the power of long-term thinking and compounding. I used the S&P 500 less a 0.20% expense ratio from the 1972 until 1977 when the Vanguard 500 Fund had its first full year. I used the Vanguard 500 Fund from 1977 on so these were actual results from a real fund, not purely hypothetical.

Posted on 8/27/15 at 12:33 pm to slackster

seems like poor thread timing to me

Posted on 8/27/15 at 12:39 pm to slackster

Your thread is more detailed, and from a different source, I will let it stand.

Oddly enough it seems like one of these guys copied the other. Edit, never mind Ben Carlson is cited in my link on CNBC.

Oddly enough it seems like one of these guys copied the other. Edit, never mind Ben Carlson is cited in my link on CNBC.

This post was edited on 8/27/15 at 12:42 pm

Posted on 8/27/15 at 12:44 pm to slackster

quote:

Once he was in the market, he never sold his fund shares.

People that try to time the market generally don't do this.

Nice "tale", but inaccurate.

Bob is bad at DCA.

Posted on 8/27/15 at 12:59 pm to OnTheBrink

Damnit, I was putting together the OP before you posted your thread, but it took me some time between other things I had to do.

I wanted to find the original source because the CNBC article didn't have much info on the assumptions and what not.

I wanted to find the original source because the CNBC article didn't have much info on the assumptions and what not.

Posted on 8/27/15 at 1:00 pm to TigerDeBaiter

quote:

People that try to time the market generally don't do this. Nice "tale", but inaccurate

C'mon, you get the idea. Timing the market basically encapsulates any strategy that is NOT buy and hold.

Posted on 8/27/15 at 1:05 pm to slackster

quote:

C'mon, you get the idea. Timing the market basically encapsulates any strategy that is NOT buy and hold.

Exactly. Bob bought and held, right?

Posted on 8/27/15 at 1:17 pm to TigerDeBaiter

Fair enough, but it certainly wasn't a dicsiplined buy and hold strategy.

Posted on 8/27/15 at 1:19 pm to slackster

quote:

slackster

I RA'd to have mine deleted.

Posted on 8/27/15 at 1:26 pm to slackster

Bob must not have internet.

Posted on 8/27/15 at 1:27 pm to slackster

Agreed

Still a good lesson to be learned by folks, but I do wish the article would have stressed how foolish "Bob" was; mainly for the reason that a true Bob totally would have sold at the bottom.

Still a good lesson to be learned by folks, but I do wish the article would have stressed how foolish "Bob" was; mainly for the reason that a true Bob totally would have sold at the bottom.

Posted on 8/27/15 at 1:42 pm to hbuc88

Hmmm. We better see the same returns over that period or I'll be pissed. Stuffing in 25k a year here better pay off.

Posted on 8/27/15 at 1:51 pm to Teddy Ruxpin

Maybe we will, maybe we won't, but I fail to see a better alternative for 99% of the public with long term horizons.

Posted on 8/27/15 at 3:25 pm to slackster

quote:

but I fail to see a better alternative for 99% of the public with long term horizons.

wow.

Posted on 8/27/15 at 5:12 pm to castorinho

He's a heavy advocate of real estate so your comment was very closed minded.

Posted on 8/27/15 at 6:35 pm to GoldenD

Putting a little money in real estate back in the 80's is why I have a lot of money (relatively speaking) in stocks today. But it's not a game that everyone should play. For those who can do it well and follow a disciplined approach, you can build a very comfortable net worth. IMO, the same is true of stock investing (and trading): you HAVE to have a plan, discipline, goals and a methodology. Otherwise, you're just gambling.

I bet Bob is married to a stripper and living in Las Vegas now.

I bet Bob is married to a stripper and living in Las Vegas now.

Posted on 8/27/15 at 8:37 pm to Jag_Warrior

quote:

I bet Bob is married to a stripper

Poor Bob. He should have hit it and quit it.

Popular

Back to top

5

5