- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Anybody considering just dropping flood insurance with the rate increases?

Posted on 7/21/22 at 1:12 pm to Neauxla_Tiger

Posted on 7/21/22 at 1:12 pm to Neauxla_Tiger

I live on SETX and don't carry flood insurance. The ditch in front of my house was dry during Hurricane Harvey. A street around the corner had maybe 6-8 inches of water. I got a quote in 2018 for like $1200 / year and passed on it. That being said, I do wonder how much liability I'm carrying. What kind of total repair cost would I be looking at for 6 in of water in the house for 2 days or so? House is 1,500 sqft and valued around 200k

Posted on 7/21/22 at 4:51 pm to LSUsuperfresh

quote:

That being said, I do wonder how much liability I'm carrying. What kind of total repair cost would I be looking at for 6 in of water in the house for 2 days or so? House is 1,500 sqft and valued around 200k

50-100k min before any contents

Posted on 7/23/22 at 5:47 am to Chad504boy

An elevation certificate will not help you on flood insurance cost in a zone X. The rate is a flat charge no matter how high or low you are.

Often people ask me about carrying flood insurance and my suggestion is always the same,

"If it rains at your house carry flood insurance"

Often people ask me about carrying flood insurance and my suggestion is always the same,

"If it rains at your house carry flood insurance"

Posted on 7/23/22 at 8:27 am to rodnreel

quote:

An elevation certificate will not help you on flood insurance cost in a zone X. The rate is a flat charge no matter how high or low you are.

Incorrect

Posted on 7/23/22 at 8:58 am to Chad504boy

I had the good fortune of being able to see where the water went on my land north of baton rouge in 2016 before i built. It's for that reason alone I don't bother.

Posted on 7/23/22 at 12:17 pm to Neauxla_Tiger

I think this is shortsighted by many in this thread. You can't outthink water.

Our home is in X and was never supposed to flood in a thousand years. Well, LC had a 1,000 year flood. Water made its way in the house. The previous owners had flood and it seemed to pay off.

People with $400,000+ houses shouldn't even be arguing $600 a year for flood insurance. This is an absolute no brainer even if the limit is $250/100K.

Be smart. Never try to outthink the weather, folks.

Our home is in X and was never supposed to flood in a thousand years. Well, LC had a 1,000 year flood. Water made its way in the house. The previous owners had flood and it seemed to pay off.

People with $400,000+ houses shouldn't even be arguing $600 a year for flood insurance. This is an absolute no brainer even if the limit is $250/100K.

Be smart. Never try to outthink the weather, folks.

Posted on 7/23/22 at 1:56 pm to rodnreel

Elevation certificate on my Metairie house in X brought it from $1600 to $1200. So you’re incorrect

Posted on 7/23/22 at 4:09 pm to Neauxla_Tiger

OK, your lot has never flooded before. But it’s the changes during your ownership that are the critical (and unpredictable) factors. Such as increased development (faster water run-off, less space for excess water to accumulate) and drainage changes (silting-in of canals, adding development without enlarging drainage systems). When do you find out your drainage situation has changed? When your house floods.

Posted on 7/23/22 at 6:19 pm to Neauxla_Tiger

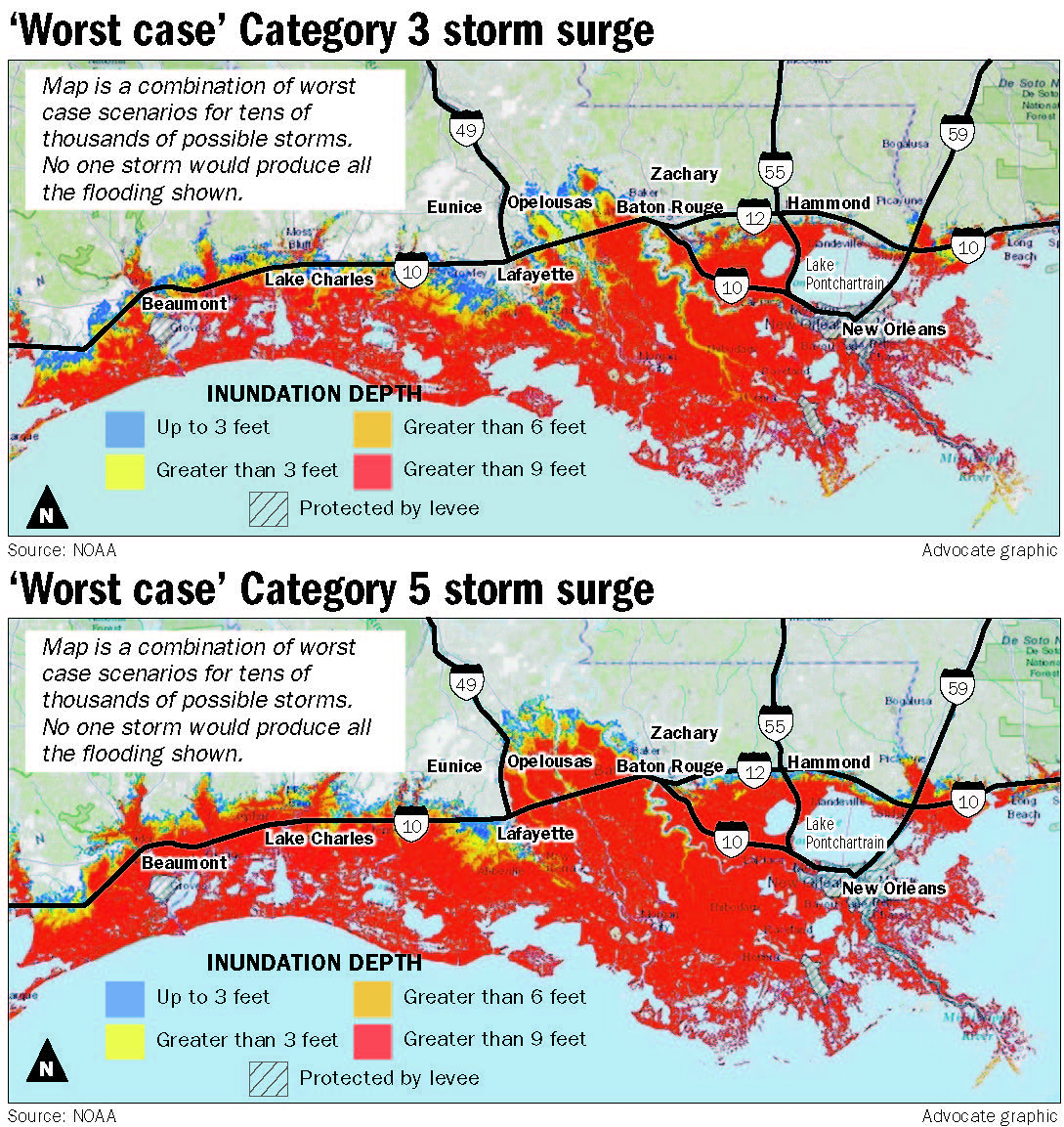

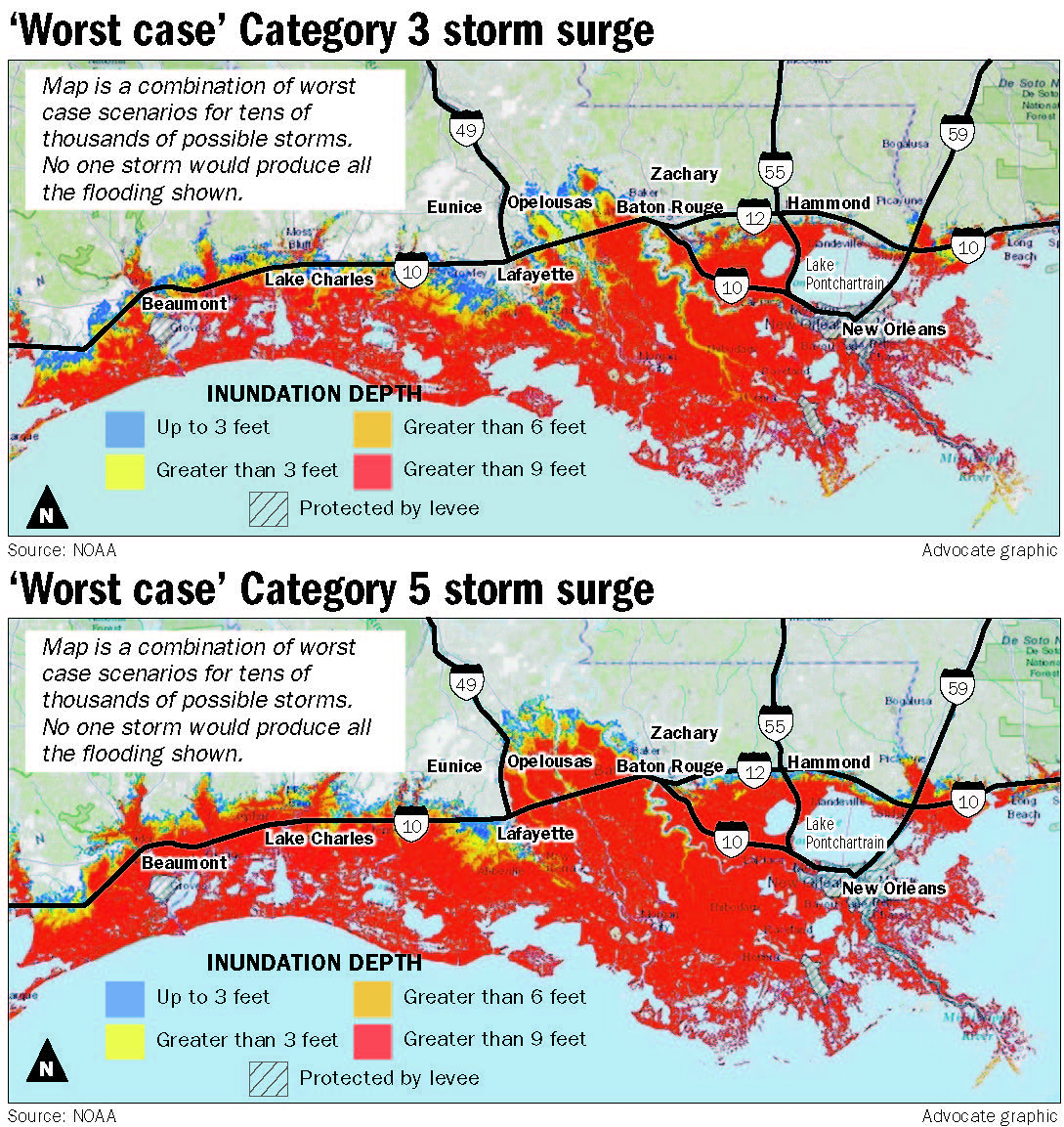

Everyone in Louisiana needs flood insurance. Go look at storm surge models if a hurricane hits right at your area. And that doesn’t even account for unusual heavy rain events. Every area has the possibility to flood if you get hit with 15-20 inches of rain.

This post was edited on 7/23/22 at 6:22 pm

Posted on 7/23/22 at 7:27 pm to SurfOrYak

I know people that live off Hwy 22 in Tangi that flooded in 2016 and they are convinced the dozens of new developments between there and Madisonville drastically changed the water flow in just a couple of years. So yeah, I understand this is something to consider.

However, my area is pretty much completely developed already. I know there can be some other gradual changes to land and water flow over the years, but I don't think getting 12 more feet of water over the worst we've ever had is something that will develop so suddenly that I'm caught with my pants down.

Anyways, I didn't realize that if you're in flood zone x you don't even need a surveyor to do an elev. Cert. You can fill out a couple sections yourself and turn it in. So I submitted that and waiting to see if it changes anything.

However, my area is pretty much completely developed already. I know there can be some other gradual changes to land and water flow over the years, but I don't think getting 12 more feet of water over the worst we've ever had is something that will develop so suddenly that I'm caught with my pants down.

Anyways, I didn't realize that if you're in flood zone x you don't even need a surveyor to do an elev. Cert. You can fill out a couple sections yourself and turn it in. So I submitted that and waiting to see if it changes anything.

Posted on 7/23/22 at 7:40 pm to Neauxla_Tiger

Just curious with all this talk about flood insurance increases, has anyone else had an experience like me where my flood insurance decreased by nearly 50% this year? I am in flood zone AE and have been ever since I built my home in 2013. My rate started at $475 in 2013 and has been steadily increasing ever since. In 2021 I was paying $790 per year. I have an elevation certificate and my slab is 2 ft above base flood. I’m in southeast BR.

Well this year I got my renewal expecting the worst seeing all these threads and my new premium is $401. Lowest I have ever paid in this house dating back 9 years. Flood zone didn’t change, still AE. I didn’t flood in 2016. Might have been one of the few neighborhoods in flood zone AE that didn’t. I carry the max dwelling coverage of $250k and $100k in contents.

Well this year I got my renewal expecting the worst seeing all these threads and my new premium is $401. Lowest I have ever paid in this house dating back 9 years. Flood zone didn’t change, still AE. I didn’t flood in 2016. Might have been one of the few neighborhoods in flood zone AE that didn’t. I carry the max dwelling coverage of $250k and $100k in contents.

Posted on 7/23/22 at 11:54 pm to LSUEEAlum

I believe the new formula involves assessing risk not just based on flood maps, but also claim history for the property.

I am getting smacked because the prior homeowner made a claim for minimal damage, then sold the house.

I saw 18% increase but I know some in my neighborhood saw nothing. Seems like it helped you but hurt folks like me.

I am getting smacked because the prior homeowner made a claim for minimal damage, then sold the house.

I saw 18% increase but I know some in my neighborhood saw nothing. Seems like it helped you but hurt folks like me.

Popular

Back to top

1

1