- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

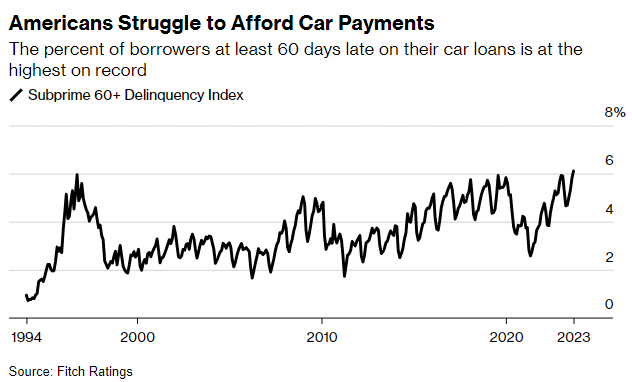

Americans Struggle to Afford Car Payments

Posted on 10/21/23 at 1:50 pm

Posted on 10/21/23 at 1:50 pm

quote:

JUST IN: Percentage of subprime auto borrowers 60+ days past due on loans hits a record 6.1% in September.

This is the highest delinquency rate of all time, even above the 6.0% peak in 1994 and 5.0% in 2008. The return of student loan payments has added pressure to many of these borrowers. Average student loan payments are at $500/month and the average new car payment is at $740/month.

This means just to buy a car and pay off your student loans, the average American is spending $1,240/month. Delinquency rates will continue to rise.

Twitter now “X” link to tweet

Posted on 10/21/23 at 2:30 pm to olemissfan26

Everyone spends entirely too much on vehicles. It’s actually insane to me how expensive they are

Posted on 10/21/23 at 2:32 pm to olemissfan26

And yet they continue to make bad choices and sign a loan for that vehicle.

Posted on 10/21/23 at 3:05 pm to SulphursFinest

quote:

Everyone spends entirely too much on vehicles. It’s actually insane to me how expensive they are

It really is nuts to me how expensive vehicles have become, now tack on the insane interest rates people are borrowing at and it just boggles the mind.

But this specifically is definitely a big product of student loan pausing for way too long and people getting themselves into loans on vehicles they could never afford if they had to make student loan payments and now that student loans are back people are going to have to start deciding and it's usually the car that's gunna go.

This post was edited on 10/21/23 at 3:06 pm

Posted on 10/21/23 at 3:17 pm to thunderbird1100

quote:

But this specifically is definitely a big product of student loan pausing for way too long and people getting themselves into loans on vehicles

Car prices have been exponentially increasing for over a decade now. This isn’t a recent thing.

Posted on 10/21/23 at 4:26 pm to Paul Allen

unrelated to the main topic but question on the chart.

Why the consistent drop what appears to be once yearly?

Tax returns that people put toward the loans?

Why the consistent drop what appears to be once yearly?

Tax returns that people put toward the loans?

Posted on 10/21/23 at 4:34 pm to olemissfan26

quote:Is this real? Who are these people spending 750 a month on a car

the average new car payment is at $740/month.

Posted on 10/21/23 at 5:33 pm to olemissfan26

quote:

the average new car payment is at $740/month.

This just means the average American is an absolute idiot and should have to suffer until they learn their lesson.

Posted on 10/21/23 at 5:39 pm to Pelican fan99

quote:I mean it’s everyone who has bought a new car recently. I’m assuming you haven’t.

Is this real? Who are these people spending 750 a month on a car

Posted on 10/21/23 at 5:55 pm to NaturalBeam

Cars can still be bought for less than $30k. At 8% for 60, a 25k loan is $500/month. People need to buy cars they can afford and not what they want. I don't feel sorry for anyone buying a car they can't afford.

Posted on 10/21/23 at 6:48 pm to Pelican fan99

I bought my Tacoma in May 2020, paid $45k, financed at 0% for 60 months. The note is $750 and I have autopay setup for $800. Vehicles are even more now.

Posted on 10/21/23 at 6:52 pm to LSUSUPERSTAR

quote:45k for a freakin Tacoma? Goodness I paid like 28k for mine in 2018

I bought my Tacoma in May 2020, paid $45k, financed at 0% for 60 months. The note is $750 and I have autopay setup for $800. Vehicles are even more now.

Posted on 10/21/23 at 7:35 pm to Paul Allen

quote:

Car prices have been exponentially increasing for over a decade now. This isn’t a recent thing.

I wasnt talking about why car prices have gone up with that comment, I was talking about people getting themselves into unaffordable situations by taking loans on cars they couldnt afford once student loans kicked back in. Loans were paused for over 3 years and that cash flow people just pushed elsewhere basically and cars were a big benefactor of that.

With student loans kicking back in all these people who took out long term car loans are getting a huge awakening trying to pay that and their $300-$700/mo student loan.

This post was edited on 10/21/23 at 7:38 pm

Posted on 10/21/23 at 7:53 pm to olemissfan26

Average American doesn’t have student loans.

That delinquency will only go up. Auto prices at all time highs and 7%+ rates is a recipe for disaster. It doesn’t take much to face a $1,000 note.

That delinquency will only go up. Auto prices at all time highs and 7%+ rates is a recipe for disaster. It doesn’t take much to face a $1,000 note.

Posted on 10/21/23 at 7:59 pm to BabyTac

quote:

This just means the average American is an absolute idiot and should have to suffer until they learn their lesson.

A bit dramatic?

Posted on 10/21/23 at 8:34 pm to olemissfan26

quote:

The return of student loan payments has added pressure to many of these borrowers.

Yea, SL payments will put pressure on car payments, but they have a year to start paying. If right now a choice between car and SL, for the next 12 months it should be car….

…..and they should be looking to sell/trade in said car on something cheaper before that 12 month “onboarding” ends….

Posted on 10/21/23 at 10:51 pm to olemissfan26

As new cars get repossessed and become used cars, this should increase used car inventory, and bring prices down

Posted on 10/21/23 at 10:59 pm to olemissfan26

Regardless of how expensive cars have become, people shouldn't be driving around in 60k cars when they make 45k

Look at the amount of 50k+ cars around BR, not even considering the number of soccer mom Yukons/Tahoes. Compare that to the average income. Absurd.

Most people could get by with a cheaper sedan but they're not "cool" enough

Look at the amount of 50k+ cars around BR, not even considering the number of soccer mom Yukons/Tahoes. Compare that to the average income. Absurd.

Most people could get by with a cheaper sedan but they're not "cool" enough

Posted on 10/21/23 at 11:11 pm to olemissfan26

quote:

This is the highest delinquency rate of all time, even above the 6.0% peak in 1994 and 5.0% in 2008. The return of student loan payments has added pressure to many of these borrowers. Average student loan payments are at $500/month and the average new car payment is at $740/month.

A couple of points...

-The repayments just started back.

-Remember, these are 60+ days past due. That means they stopped paying notes at least two months ago (student loan repayments just started back, so it hasn't yet had the opportunity to really impact car loans).

-These are just the sub-prime borrowers, they make up only 14%-15% of those holding car loans.

So yeah, this is bad news but it's missing a LOT of context. The other side of that is, when adding in more context, it looks even worse.

Consumer Credit Card Debt

Credit Card Interest Rates

Credit Card Delinquency Rates

Along with this, home foreclosures are still very low, but they have been rising somewhat steadily since late 2021.

With it becoming more and more likely we see a serious recession starting up by Q4-23/Q1-24 (and the Fed can't cut rates to ease the pressures), all of those numbers are bound to get worse.

I've said it before and I'll say it again, we are going to be lucky to get through this with just stagflation.

Posted on 10/21/23 at 11:14 pm to evil cockroach

quote:

As new cars get repossessed and become used cars, this should increase used car inventory, and bring prices down

That's going to take a while though and the auto industry is likely to see a serious downturn in sales before that happens. This timing is why I think this was the absolute worst time for the UAW to start striking.

Back to top

15

15