- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

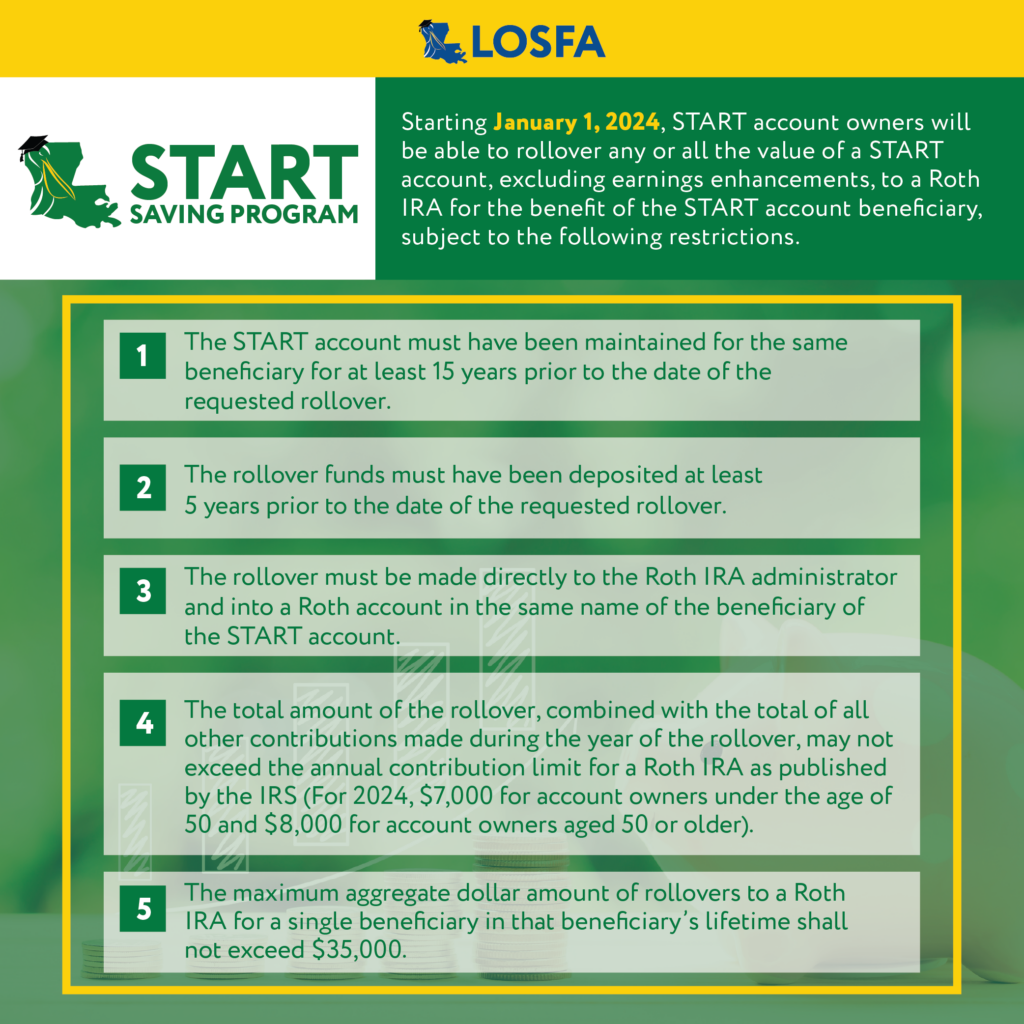

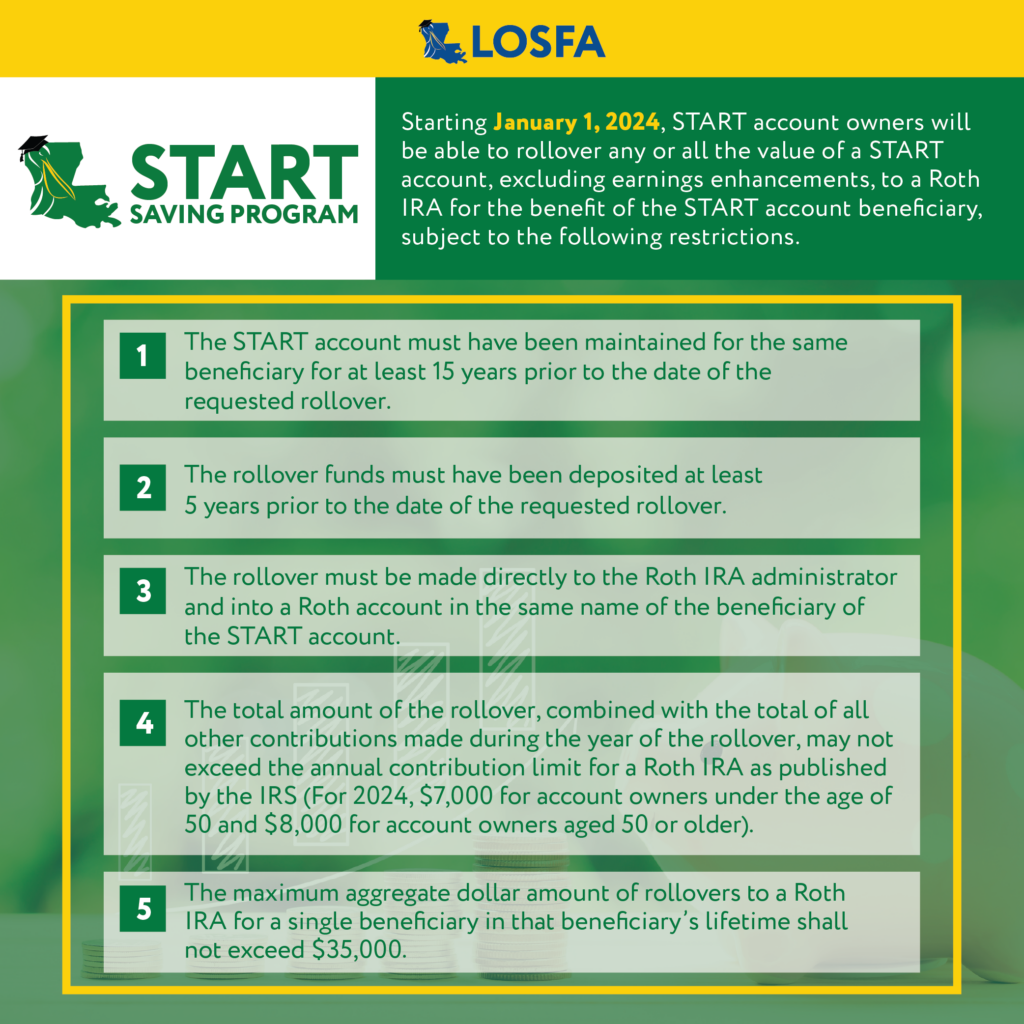

01/01/24 - LA 529 START owners can roll balance to a ROTH for beneficiary

Posted on 12/23/23 at 9:28 am

Posted on 12/23/23 at 9:28 am

This seems like it could change the strategy with these accounts... discuss:

Posted on 12/23/23 at 9:58 am to Zilla

I'm not sure who this might help outside of parents who overfunded their kids' 529s. I certainly don't think it's worth developing a 15-20 year plan around it. But it would be useful for kids out of college (or who flat-out never go) to have a few years of Roth IRA contributions locked up at the start of their working years.

Posted on 12/23/23 at 10:48 am to messyjesse

quote:

I'm not sure who this might help outside of parents who overfunded their kids' 529s. I certainly don't think it's worth developing a 15-20 year plan around it. But it would be useful for kids out of college (or who flat-out never go) to have a few years of Roth IRA contributions locked up at the start of their working years.

In a way "over funding", but if I'm throwing a dart, I think this would be more focused to those people who might take the tack of "well, my kid is going to get a scholarship anyway, and I don't want to tie up money that's difficult to use later, so I just won't open the account". With the ability to roll it over, there's no reason not to fund an account at least to the rollover amount. It's not earth shattering, but it could increase uptake of the program.

Posted on 12/23/23 at 1:48 pm to Joshjrn

I'm planning to use it in a few years. Funded 529s but all or most of college expenses now going to be covered through my transferred GI Bill. It will enable them to max Roth first few years of their careers and put their own $ in 401k or save for house down payment.

Posted on 12/23/23 at 3:29 pm to Zilla

The number one response I hear when I tell people about start is ‘what happens if we don’t use it for school?’ This helps answer that concern.

I wasn’t planning on funding 100% of school but this will certainly allow me to overshoot my goal. If anything, now I’ll try to have 35k left over.

Some parents fund their kids Roth IRAs anyway, this gives them a state tax deduction up to $4,800 each year for doing so for several years. Definitely helps set your kids up.

I’m excited about it.

I wasn’t planning on funding 100% of school but this will certainly allow me to overshoot my goal. If anything, now I’ll try to have 35k left over.

Some parents fund their kids Roth IRAs anyway, this gives them a state tax deduction up to $4,800 each year for doing so for several years. Definitely helps set your kids up.

I’m excited about it.

Posted on 12/23/23 at 4:27 pm to Zilla

I assume the Roth rollover will have a 5 year rule attached to each of the rollovers too?

Posted on 12/23/23 at 5:17 pm to UpstairsComputer

quote:

The number one response I hear when I tell people about start is ‘what happens if we don’t use it for school?’ This helps answer that concern

I would have to look into it on the website, but I think my FA told me ten years ago is that you can also assign it to a new beneficiary (your grandkids) if there is anything left over.

Posted on 12/23/23 at 7:05 pm to Mariner

quote:

I would have to look into it on the website, but I think my FA told me ten years ago is that you can also assign it to a new beneficiary (your grandkids) if there is anything left over.

I looked it up earlier, so it wasn't any effort to find the list again:

The new beneficiary must be a "Member of the Family" of the current beneficiary in order to prevent a non-qualified disbursement. A "Member of Family" must be related to the current beneficiary as one of the following:

Father or mother, or an ancestor of either

Stepfather or stepmother, but not their ancestors

Brother or sister of the father or mother, but not of a step-parent

Brother, sister, stepbrother or stepsister

Son or daughter, or descendant of either father-in-law or mother-in-law

Stepson or stepdaughter

Son or daughter of a brother or sister, but not of a step-sibling

Spouse of the designated beneficiary or any of the above individuals

Brother-in-law, sister-in-law, son-in-law, daughter-in-law

First Cousin

Posted on 12/26/23 at 7:56 am to Zilla

i wasn't considering the START program, but this makes more sense now.

Posted on 12/26/23 at 12:24 pm to Pezzo

Offshoot tax question, I see the maximum state deduction is $4800 for married filing jointly. Is that for each kid or in total? I assume it’s in total.

This post was edited on 12/26/23 at 12:25 pm

Posted on 12/26/23 at 1:46 pm to Dead Mike

Thanks…I missed the per beneficiary part.

Posted on 12/26/23 at 8:22 pm to TJG210

Keep in mind, the earning enhancement (whatever it may be) is not eligible to rollover.

Posted on 12/26/23 at 8:28 pm to slackster

Do you only roll over into your children’s Roth?

Posted on 12/27/23 at 6:29 am to Zilla

That’s pretty cool. I was aware that you could roll it over to your grandkids for their college which has always been my plan but maybe I’ll go this route. Wife and I have been maxing out for our three kids (8,6,3) pretty much since they were born. On pace to have ~$100k per kid in there when they start school so I’ve always been concerned with overfunding

Popular

Back to top

5

5