- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

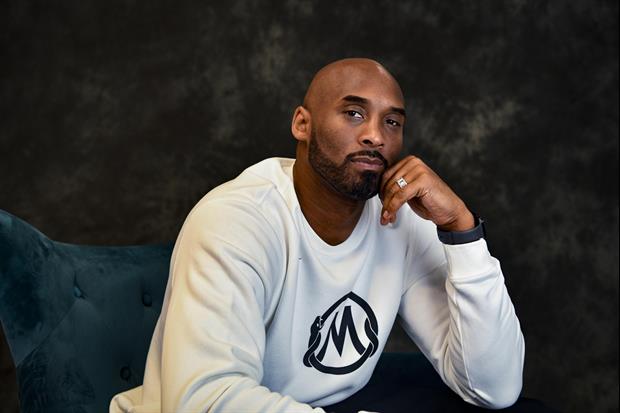

Kobe Bryant's Estate Will See $400M Return On An Early Investment Of $6M Into BodyAmor

by Larry Leo

November 2, 20216 Comments

© Harrison Hill-USA TODAY via Imag

In 2014, Kobe Bryant invested $6 Million into Body Armor. On Monday, Body Armor sold to Coca-Cola for $8 Billion. That means the Bryant family's stake is at $400 Million. Per WSJ...

quote:

Coca-Cola Co. is buying full control of BodyArmor for $5.6 billion in a cash deal that values the sports-drink brand at about $8 billion, amping up a rivalry with Gatorade.

Coke, which already owns a stake in BodyArmor, announced the deal Monday, confirming a report Sunday by The Wall Street Journal and recent reporting from other outlets. Earlier this year, Coke disclosed it was in talks to take a controlling stake in BodyArmor.

Coke bought a 15% stake in BodyArmor in 2018 for $300 million at a $2 billion valuation, according to people familiar with the matter. Coke’s bottling network then took over distribution of BodyArmor, earning the beverage giant an additional 15% equity stake for its distribution and partnership in building the BodyArmor brand, the people said.

Coke is buying the remaining 70% from the company’s founders and investors, as well as a group of professional athletes including the NBA’s James Harden and MLB’s Mike Trout who invested and helped market the drink.

The estate of Kobe Bryant, an early backer of BodyArmor, stands to collect roughly $400 million for its stake, some of the people familiar with the matter said. Mr. Bryant invested $6 million and had served on the BodyArmor board before he died in 2020, these people said.

Loading Twitter Embed....Filed Under: NBA

Popular Stories