- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

What was the reasoning behind the incredible leases associated with Haynesville shale?

Posted on 4/29/17 at 9:03 pm

Posted on 4/29/17 at 9:03 pm

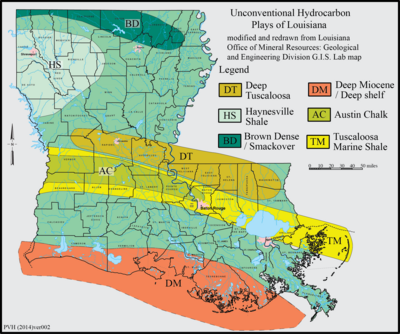

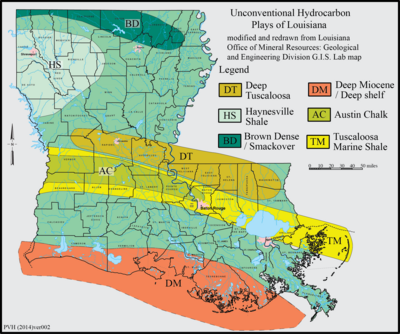

It seems like 5-10 years ago there were a bunch of stories of people getting paid 10's of thousands of dollars for yearly leases on what had always been cattle pasture. I assume most of this was part of the Haynesville shale area, but might have been other cenla areas. What was the driver in the market to get those prices so high? Did the oil companies get their money out of those plays? It doesn't seem like natgas prices every got high enough to justify those numbers (but I don't know much about the industry).

Posted on 4/29/17 at 9:06 pm to Kingpenm3

One of the drivers was that Ten years ago energy analysts were predicting $20/1000cu.ft. natural gas prices. Therefore, everyone was hopping in. What happened? Gas went to $3/1000cu.ft.

Posted on 4/29/17 at 9:07 pm to upgrayedd

quote:

O&G prices were high

Did the nat gas prices get that high? Isn't that the main product of these areas?

Posted on 4/29/17 at 9:09 pm to Kingpenm3

As I recall, gas went to about $13/1000cu.ft. Energy analysts were predicting $20 soon after. Therefore, at that time these leases looked like a good play. Then the price came tumbling down.

Posted on 4/29/17 at 9:09 pm to Kingpenm3

quote:

Did the nat gas prices get that high? Isn't that the main product of these areas?

Posted on 4/29/17 at 9:11 pm to crazycubes

quote:

As I recall, gas went to about $13/1000cu.ft. Energy analysts were predicting $20 soon after. Therefore, at that time these leases looked like a good play. Then the price came tumbling down.

2008 and 2009 happened, and it hasn't sniffed those prices again. In hindsight, the Haynesville shale leases are some of the most absurd contracts to ever be written.

This post was edited on 4/29/17 at 9:12 pm

Posted on 4/29/17 at 9:13 pm to slackster

Wow, I didn't realize that prices got that high, or were as low as they are now.

When they peaked out, were they just tracking with oil? Or did many believe that more auto fleets would be moving to nat gas? Find other uses? Take over coal for electrical? Why aren't we using more nat gas as prices are plummeting?

When they peaked out, were they just tracking with oil? Or did many believe that more auto fleets would be moving to nat gas? Find other uses? Take over coal for electrical? Why aren't we using more nat gas as prices are plummeting?

Posted on 4/29/17 at 9:14 pm to Kingpenm3

American greed will be doing a story about t them in a ge next few years

Posted on 4/29/17 at 9:16 pm to Kingpenm3

There was a thread about this on the Money board that lasted at least a year.

Posted on 4/29/17 at 9:20 pm to Kingpenm3

It was a dry gas, and money started to shift to gas with more liquids because oil prices were higher than gas.

Posted on 4/29/17 at 9:21 pm to slackster

quote:

the Haynesville shale leases are some of the most absurd contracts to ever be written.

This is what I was wondering, if in hind sight, this was how those leases were viewed.

About 4th hand I had heard a story of a very successful professional that made more money in a couple of years just because he owned a few hundred acres out in the sticks than he had in an entire career as a professional.

Posted on 4/29/17 at 9:26 pm to Kingpenm3

Bro nat gas was through the roof at the time, it was a perfect storm of a huge gas boom and companies trying lock up big lease blocks

Posted on 4/29/17 at 9:28 pm to Kingpenm3

Hated working in the haynesville despite it being close to home. High temps would sometime frick up DIR tools then I had to fill out all kinds of paperwork.

Posted on 4/30/17 at 1:52 am to Kingpenm3

Never understood them paying 20,000/acre plus 1/4 royalty. It was like Chesapeake and everyone else thought gas had to stay at $16

This post was edited on 4/30/17 at 7:17 am

Posted on 4/30/17 at 2:12 am to SOLA

From what I heard Chesapeake's drilling planned involved them having more rigs running than existed in NA at the time. I have no clue how those guys didn't go bankrupt in this last downcycle.

Posted on 4/30/17 at 3:32 am to Kingpenm3

quote:

About 4th hand I had heard a story of a very successful professional that made more money in a couple of years just because he owned a few hundred acres out in the sticks than he had in an entire career as a professional.

For sure. I know some families that got tens of millions. Chesapeake was paying 10k+ per acre for about a year.

Posted on 4/30/17 at 7:06 am to SOLA

quote:

Never understood them paying 2,000/acre plus 1/4 royalty. I

How about 20k an acre and a quarter lol, it was crazy.

Posted on 4/30/17 at 7:15 am to RabidTiger

Really makes me wish my dad had gone thru with buying that deer lease in DeSoto Parish.

Popular

Back to top

12

12