- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Whole Life Insurance

Posted on 5/17/16 at 8:22 pm

Posted on 5/17/16 at 8:22 pm

I'm getting offered whole life insurance policy of $75,00 through work. I have a low rate relatively because im still in a lower age bracket. At age 65 the policy takes on a cash value of $23,000 or something like that. My calculations are that I would only be contributing $18,000 over that time. My question is how does this work out for the insurance company? Kind of seems like too good of an offer and I feel that I'm missing something.

Posted on 5/17/16 at 8:28 pm to Bonjourno

You pay much more than you need to on the front end of a whole life policy, then much less than you should on the back end of it. It does grow cash value over time but beware of that illustration. It's probably showing you non-guaranteed values so that you are suckered into it.

If you want a very safe "investment", and I use that term very loosely here, then whole life may be right for you. You will most likely gain more in an actual investment where you contribute the same monthly premium over the same time period, though.

If the policy has a guaranteed insurability type of rider, the I would suggest you give it some thought since you want to be able to be insured no matter what your future health dictates. However, you could probably get a better deal on a smaller whole life policy complimented by a much larger in face value term policy.

If you want a very safe "investment", and I use that term very loosely here, then whole life may be right for you. You will most likely gain more in an actual investment where you contribute the same monthly premium over the same time period, though.

If the policy has a guaranteed insurability type of rider, the I would suggest you give it some thought since you want to be able to be insured no matter what your future health dictates. However, you could probably get a better deal on a smaller whole life policy complimented by a much larger in face value term policy.

This post was edited on 5/17/16 at 8:29 pm

Posted on 5/17/16 at 8:30 pm to Bonjourno

Do you realize if you saved $50/month at 6.5% interest in 30 years you would have $55,000

Posted on 5/17/16 at 9:05 pm to Tigerpaw123

The key is to actually save it. Most people dont.

Posted on 5/17/16 at 9:10 pm to iknowmorethanyou

just open an IRA and add $100 to a mutual fund, that should do the trick

Posted on 5/17/16 at 9:14 pm to Bonjourno

If you really feel like you want/need insurance, it doesn't sound terrible. If you don't think you could save/invest that money on your own and need a plan, I say go for it, especially if it's a good rate through work. But... what happens if you leave work?

Posted on 5/17/16 at 9:37 pm to Bonjourno

quote:

I'm getting offered whole life insurance policy of $75,00 through work. I have a low rate relatively because im still in a lower age bracket. At age 65 the policy takes on a cash value of $23,000 or something like that. My calculations are that I would only be contributing $18,000 over that time. My question is how does this work out for the insurance company? Kind of seems like too good of an offer and I feel that I'm missing something.

I'm assuming it's $75,000 yes?

I would only consider doing this if you're not otherwise insurable for some reason (i.e. medical situation or whatever) and the work policy is guaranteed to you as part of your employment.

For the sake of doing some quick napkin math I'll just assume you're 30 years old.

If you contribute $18,000 over the next 420 months that is $42.85 a month. At 30, assuming you're healthy, you can get ~$500,000 term life easily for $25 a month or less.

Let's say you turn down the work policy that pays $75,000 if you die and instead buy $500,000 term life for $25 a month, and meanwhile you put the additional $18 a month into your 401k or equivalent account.

Ideally you don't die young. With the whole life policy you paid in $18,000 and can pull out $23,000 at 65.

Here's the real kick in the nuts...With the term life and $18 into the 401k, you paid $10,500 in insurance premiums that bought you peace of mind for all those years (to the tune of $425,000 more than the $75,000 whole life policy) but you fortunately never needed to make a claim on. Your $18 a month into the 401k only needs to earn about 5.5% average to break even with the whole life $23,000. So basically a worst case scenario for premiums paid + low market returns and you break even with the best case projected scenario for the whole life policy.

Most likely though, your $18 a month comes out ahead in cash value.

More importantly, if you die while the policy is in effect, under the whole life policy your family gets $75,000 and the insurance company keeps your account value.

Under the term life policy, your family gets $500,000 PLUS your 401k money.

Posted on 5/17/16 at 9:49 pm to Huey Lewis

Perfectly put.

Whole Life Insurance is a screwing for +95% < 40 year-olds.

Whole Life Insurance is a screwing for +95% < 40 year-olds.

Posted on 5/17/16 at 9:52 pm to poops_at_parties

Poops... spin off question.

If I have a whole life policy should/can I change it?

If I have a whole life policy should/can I change it?

Posted on 5/17/16 at 10:17 pm to Mr.Perfect

quote:

If I have a whole life policy should/can I change it?

You most likely can change it/cancel it and pick up a term policy, and you most likely should.

If you can't qualify for a new life insurance policy due to health reasons then definitely do not cancel an existing policy.

You could get penalized for canceling the policy before a certain date and have to surrender all or part of the cash value. Depending on how the math works out with that, it might be better to keep the policy until a certain date rather than canceling it right away.

Posted on 5/17/16 at 11:01 pm to Huey Lewis

Thanks for all the input. I was just kind of hit with it at enrollment and wanted to look into it more to get a better understanding. It definitely looks like a no go for me

Posted on 5/18/16 at 8:24 am to soccerfüt

quote:

Whole Life Insurance is a screwing for +95% < 40 year-olds.

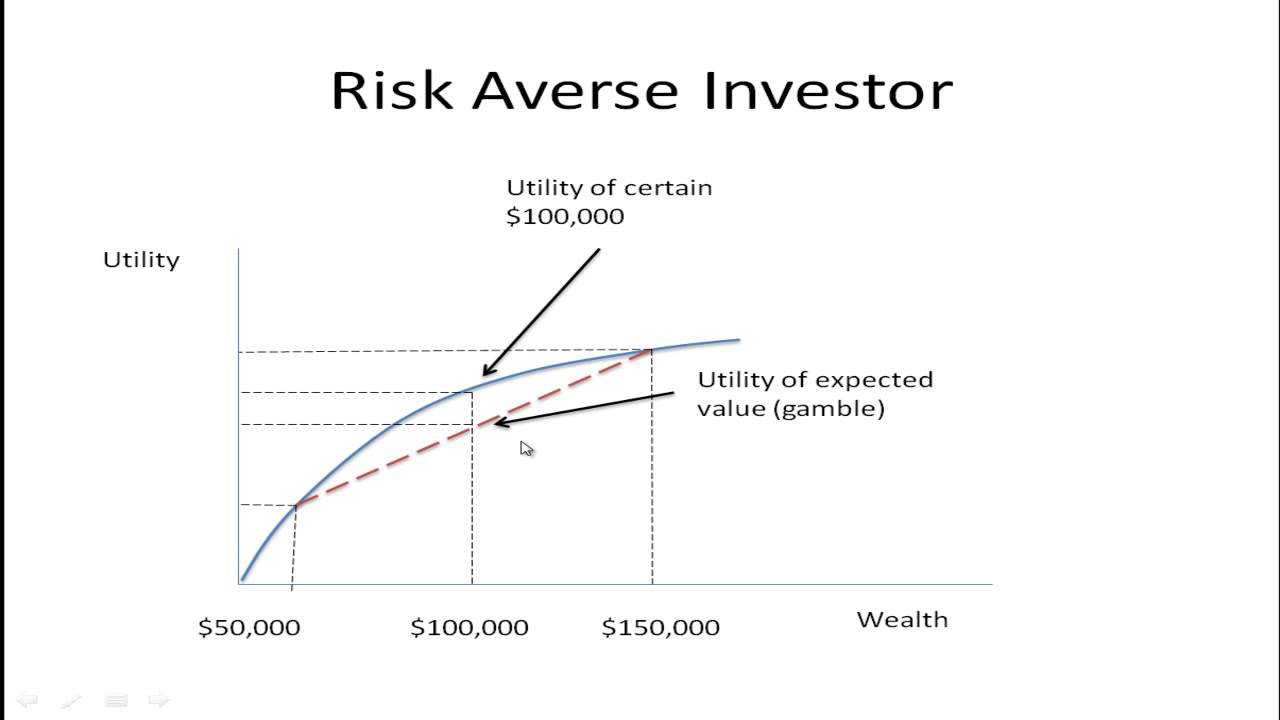

This is factually incorrect. It screws only people who have little to no aversion to risk.

You are given a deal to transfer mortality risk from yourself to the insurance company. Insurance companies can diversify mortality risk, decreasing the variance which allows you to transfer to them for less cost, even with their added admin expenses.

What if you don't care about mortality risk? Insurance was never meant for you.

This post was edited on 5/18/16 at 8:32 am

Posted on 5/18/16 at 8:49 am to Bonjourno

Whole Life Insurance is a scam, 100% scam.

Posted on 5/18/16 at 9:31 am to GenesChin

quote:

This is factually incorrect. It screws only people who have little to no aversion to risk. You are given a deal to transfer mortality risk from yourself to the insurance company. Insurance companies can diversify mortality risk, decreasing the variance which allows you to transfer to them for less cost, even with their added admin expenses. What if you don't care about mortality risk? Insurance was never meant for you.

This is disingenuous and, no offense, a bit typical from people/salesmen that defend whole life plans or similar cash value insurance.

For the large majority of working people, dying becomes less and less burdensome to our survivors as we age. The largest need for life insurance is when we are young, have dependent children, and are probably in the lower earning years of our working lives.

Whole life policies screw us big time with low death benefits and high costs. All the rest is smoke and mirrors, high pressure sales tactics, emotional manipulation and preying on hard-working peoples' biggest vulnerabilities and fears.

Actually I take back my "no offense" if you are, in fact, a whole life salesman. Because basically unless you're only selling whole life to people who have total assets exceeding estate tax exemption levels then you're just trying to justify ripping off young families.

Posted on 5/18/16 at 10:32 am to Huey Lewis

quote:

This is disingenuous and, no offense, a bit typical from people/salesmen that defend whole life plans or similar cash value insurance.

I am not a salesman, I also agree that sales commissions on these products come across to me as borderline "scam." Ironically, cash value products were started to protect the consumer (not super relevant but fun fact)

Don't blame Whole Life Insurance as a product for the failures of companies setting up commission structures + inefficient expense structures.

Profit by the company and the assumptions used in pricing are highly regulated by state DOIs. The premium that goes towards benefits is not a "scam" in any way shape or form and is theoretically priced properly.

quote:

For the large majority of working people, dying becomes less and less burdensome to our survivors as we age

I agree for most people term products make the most sense. Remember that while this is how it should work, most people don't have adequate savings in retirement at the moment, so I'd guess term products are not appropriate.

quote:

Whole life policies screw us big time with low death benefits and high costs.

I'm with you on higher costs, particularly sales commissions.

For WL, you of course will have lower death benefits. That should be plainly obvious. You also have extended coverage, I could write the mathematical formula that discusses how this changes but it is boring

This post was edited on 5/18/16 at 10:42 am

Posted on 5/18/16 at 12:59 pm to Mr.Perfect

quote:

If I have a whole life policy

no chest??

Posted on 5/18/16 at 1:00 pm to Bonjourno

whole life is a joke. run away from it and do your own investing.

Posted on 5/18/16 at 1:19 pm to Bonjourno

It may be appropriate for some people, but I always found it interesting that out of the numerous financial advisors, planners, bankers, accountants, and estate lawyers that I have discussed my finances with over the last 35 years the only person that thought I needed a whole life policy was the person selling it.

Posted on 5/18/16 at 6:45 pm to EA6B

quote:

It may be appropriate for some people, but I always found it interesting that out of the numerous financial advisors, planners, bankers, accountants, and estate lawyers that I have discussed my finances with over the last 35 years the only person that thought I needed a whole life policy was the person selling it

This thread sparked me to go back and look at my whole life policy I got when I was 25 ten years ago. The insurance salesman preyed on me hard by telling me how good of an investment it was. Ten years laters at 28 bucks a month, there is very little cash value and I would have been much better buying term. My work provides extremely cheap term insurance but the insurance salesman always ask "what happens if you leave?"

Popular

Back to top

9

9