- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

FYI The Fed raised interest rates today

Posted on 6/14/17 at 5:12 pm

Posted on 6/14/17 at 5:12 pm

With the massive news coverage today regarding the shooting at the congressional Republican softball practice in DC, you might have missed the Fed raised interest rates .25%.

Posted on 6/14/17 at 5:57 pm to BestBanker

Yeah when it actually happens, the market has already made the corresponding adjustments

Posted on 6/14/17 at 6:06 pm to BestBanker

Does that generally mean higher or lower motgage rates? Or are they really independent of one another?

Posted on 6/14/17 at 6:30 pm to jammintiger

quote:

Does that generally mean higher or lower motgage rates?

Higher

Posted on 6/14/17 at 9:30 pm to castorinho

quote:

Yeah when it actually happens, the market has already made the corresponding adjustments

Posted on 6/14/17 at 9:40 pm to TT

Why lol and why a downvote for an honest question? The mortgage rates went down today after the fed raised rates and I read several articles that at least implied that the fed increase didn't necessarily correlate with mortgage rates. In fact, this is the third or fourth fed rate hike this year and mortgage rates were at their lowest rates of 2017 this week. I was just looking for opinions of people that have seen this happen before since I closed on a house this weekend and am shopping rates right now.

Posted on 6/14/17 at 9:49 pm to jammintiger

quote:

Why lol

Because it was funny

Posted on 6/14/17 at 10:02 pm to kc8876

It's really not a dumb question.

Baw to answer your question, it's likely because the yield curve is very very flat right now. The Fed raising rates only directly affects short term maturities and, today in particular, did very little to affect rates on longer term maturities. Mortgages are of course tied a lot more to longer dated maturities. Generally when the yield curve is flat that signals a lack of market confidence in the economy.

In general the relationship is positive and I can't imagine a scenario in which it would be negative, but maybe there is in some isolated circumstances. I'm pretty sure that there was a broader, planned, almost systematic response by mortgage lenders when the Fed did their first recent hike. But maybe not this time?

I don't personally focus on this area at all, as I'm sure others do on here (correct me if I'm wrong anyone that does), but I am not inclined to think mortgage rates begin to rise rapidly this year given the small magnitude of increases and a yield curve that continues to be flat.

So as it relates to buying a house, doubt that you really need to rush into pulling the trigger. Grain of salt though.

Baw to answer your question, it's likely because the yield curve is very very flat right now. The Fed raising rates only directly affects short term maturities and, today in particular, did very little to affect rates on longer term maturities. Mortgages are of course tied a lot more to longer dated maturities. Generally when the yield curve is flat that signals a lack of market confidence in the economy.

In general the relationship is positive and I can't imagine a scenario in which it would be negative, but maybe there is in some isolated circumstances. I'm pretty sure that there was a broader, planned, almost systematic response by mortgage lenders when the Fed did their first recent hike. But maybe not this time?

I don't personally focus on this area at all, as I'm sure others do on here (correct me if I'm wrong anyone that does), but I am not inclined to think mortgage rates begin to rise rapidly this year given the small magnitude of increases and a yield curve that continues to be flat.

So as it relates to buying a house, doubt that you really need to rush into pulling the trigger. Grain of salt though.

This post was edited on 6/14/17 at 10:04 pm

Posted on 6/14/17 at 10:19 pm to Lou Pai

quote:

In general the relationship is positive

You mean the relationship between a hike on the Fed funds rate and the resulting movement in yield for long-term Treasuries? Yeah, I would tend to agree with you. If I were searching for a theoretical reason why a negative correlation might ever occur, I would say it would be based on market speculation that the Fed is about to induce a significant collapse in asset values.

In any case, the 0.25% rate hike wasn't really the big news today, so much as the forward guidance regarding the Fed unwinding the assets on its balance sheet. I think I read somewhere that the language Yellen used indicated that the FOMC felt that unemployment levels are at their troughs, and that consequently, the Fed intended to go ahead as planned with its unwinding, despite the soft economic numbers. (The Atlanta Fed's GDP Now model is bouncing around 3.0% - 3.2% annualized real GDP growth for the 2Q, which is good on its own, but sub-par in the context of showing little bump off the low 1Q numbers.)

And in what might be an even bigger story, China is still experiencing a monetary tightening that is inverting their 1yr-to-10yr yield curve...

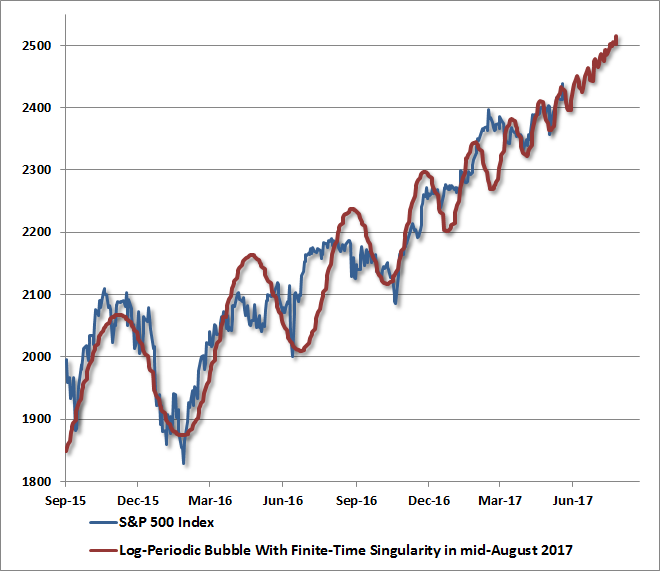

And just for fun, the latest Hussman Weekly Market Comment did an illustration using Didier Sornette's "log periodic" bubble market model, which gives a market-top singularity in mid-August...

That's not John P. Hussman's main model of course. He was just playing around. His core model says you should expect 0-1% annualized nominal total returns from U.S. stocks over the next 12-year period.

Posted on 6/14/17 at 10:25 pm to Doc Fenton

quote:

His core model says you should expect 0-1% annualized nominal total returns from U.S. stocks over the next 12-year period.

Posted on 6/14/17 at 10:30 pm to Doc Fenton

quote:

His core model says you should expect 0-1% annualized nominal total returns from U.S. stocks over the next 12-year period.

How much of that lack of return is tied to a big correction over a relatively short span of time?

Posted on 6/14/17 at 10:35 pm to sneakytiger

I was surprised by the increase.

No jobs are being created.**

And we are not having as much inflation (only 1.7%) as Yellen wants.

** last three months: 50k, 174k and 138k > avg of only 120k per month.

No jobs are being created.**

And we are not having as much inflation (only 1.7%) as Yellen wants.

** last three months: 50k, 174k and 138k > avg of only 120k per month.

This post was edited on 6/15/17 at 12:40 am

Posted on 6/17/17 at 3:19 pm to sneakytiger

The model is not tied to any particular path expectations.

That being said, Hussman does run a bunch of other indicator models to measure "market internals", but these only predict higher probabilities of left-tail corrections. Hussman's big theme is that the market gets overvalued and undervalued at various points of a market cycle (the 12-year mark is roughly where autocorrelation with a previous year's returns becomes zero), and that markets can remain overvalued for extended periods of times due to the psychology of investors being indiscriminate about risk (as evidenced by narrowing credit spreads between junk bonds and Treasuries, the lack of a spread for classic Graham-style "value" stocks over others, etc.).

Right now, we're seeing commercial real estate starting a correction, a contraction in bank wholesale loans to commercial and industrial corporations, and a spike in sub-prime auto loan delinquencies. All of those are minor symptoms though. The root cause of this so-called "everything bubble" is near-ZIRP monetary policy that has resulted in a very high degree of corporate debt and share buybacks, and also the recent craze or mania for passive stock investing and algorithmic investing, over human value-stock-pickers and hedge funds. So "everything" is rising, because investing is becoming over-reliant on passive strategies.

Jesse Felder echoed this in his weekly report this weekend: " This Is What The Blowoff Stage Of A Stock Market Bubble Looks Like."

That being said, Hussman does run a bunch of other indicator models to measure "market internals", but these only predict higher probabilities of left-tail corrections. Hussman's big theme is that the market gets overvalued and undervalued at various points of a market cycle (the 12-year mark is roughly where autocorrelation with a previous year's returns becomes zero), and that markets can remain overvalued for extended periods of times due to the psychology of investors being indiscriminate about risk (as evidenced by narrowing credit spreads between junk bonds and Treasuries, the lack of a spread for classic Graham-style "value" stocks over others, etc.).

Right now, we're seeing commercial real estate starting a correction, a contraction in bank wholesale loans to commercial and industrial corporations, and a spike in sub-prime auto loan delinquencies. All of those are minor symptoms though. The root cause of this so-called "everything bubble" is near-ZIRP monetary policy that has resulted in a very high degree of corporate debt and share buybacks, and also the recent craze or mania for passive stock investing and algorithmic investing, over human value-stock-pickers and hedge funds. So "everything" is rising, because investing is becoming over-reliant on passive strategies.

Jesse Felder echoed this in his weekly report this weekend: " This Is What The Blowoff Stage Of A Stock Market Bubble Looks Like."

Popular

Back to top

3

3