- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Fed hides weekly M1 supply, says "money doesn't matter"

Posted on 4/8/21 at 5:50 am

Posted on 4/8/21 at 5:50 am

quote:

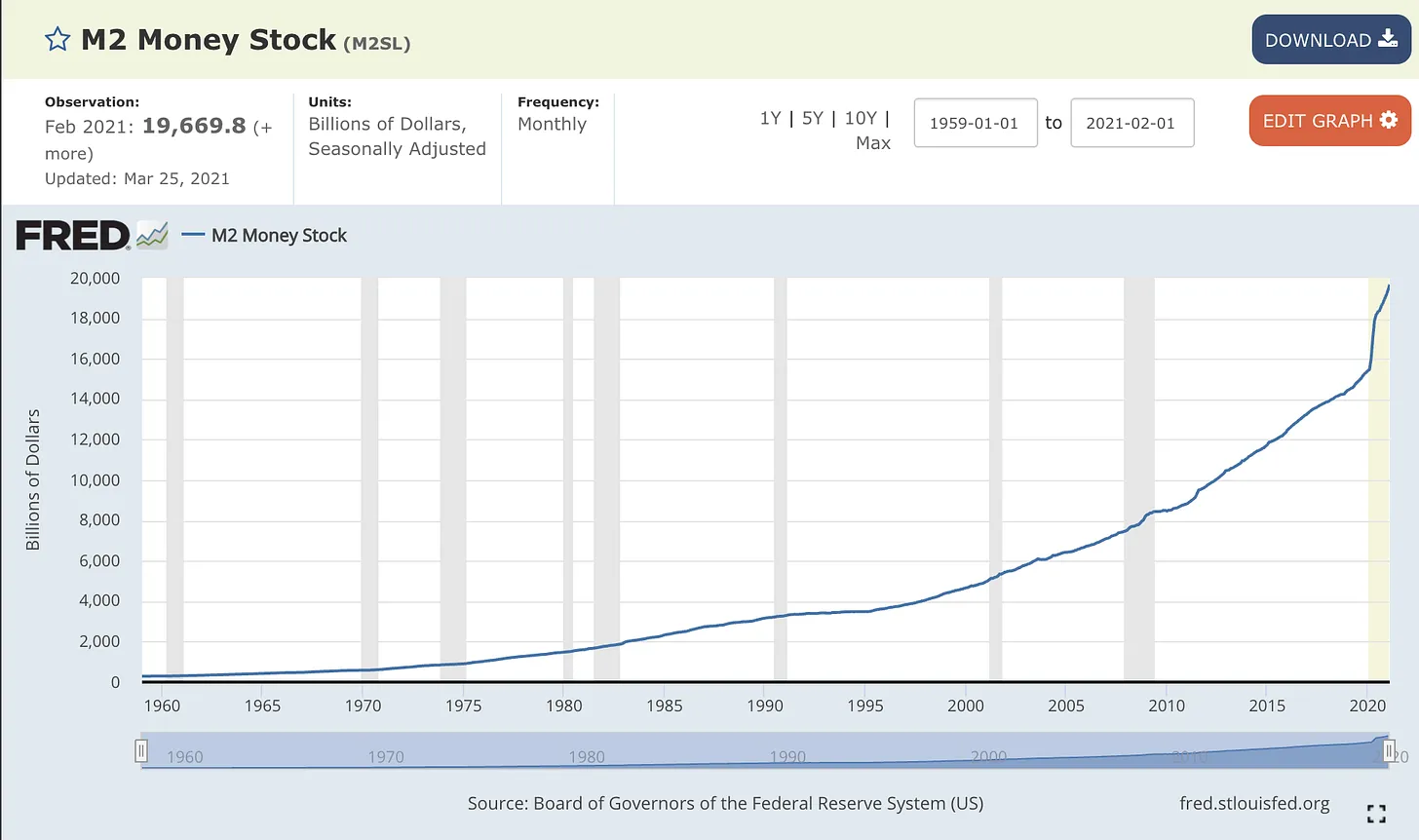

In response to a questions posed by Congressman Warren Davidson about whether “M2 [money supply] going up by 25% in one year” is going to “diminish the value of the U.S. dollar,” Powell responded, “there was a time when monetary policy aggregates were important determinants of inflation and that has not been the case for a long time.”

Powell added that “the correlation between different aggregates [like] M2 and inflation is just very, very low, and you see that now where inflation is at 1.4% for this year. Inflation dynamics evolve over time, but they don’t tend to change overnight.”

Tell that to Zimbabwe and Venezuela, this chicken will come home to roost.

This post was edited on 4/8/21 at 5:54 am

Posted on 4/8/21 at 6:07 am to Strannix

How do people this clueless get one of the most important jobs on the planet?

It's not a matter of if, but when.

Their goal is a global government and global currency. It is even biblical.

quote:

this chicken will come home to roost.

It's not a matter of if, but when.

Their goal is a global government and global currency. It is even biblical.

Posted on 4/8/21 at 6:38 am to Strannix

quote:

Powell added that “the correlation between different aggregates [like] M2 and inflation is just very, very low, and you see that now where inflation is at 1.4% for this year. Inflation dynamics evolve over time, but they don’t tend to change overnight.”

He’s not wrong. Are you suggesting he is?

You need actual velocity of money to trigger traditional inflation, and then you need that velocity to be maintained for it to be long lasting inflation.

People have been worrying about runaway inflation since 2009 and it simply hasn’t even come close to materializing in this country.

Posted on 4/8/21 at 6:55 am to Strannix

from a purely non-academic view, it seems that the argument is "we have to create massive inflation to prevent deflation" and that's somewhat scary because (1) it seems to be manipulating and ignoring the natural state of the economy and (2) if that underlying deflationary state ever does resolve, then we are looking at hyperinflation

this seems how you get to crazy economic situations like today with our insanely (paper) wealthy top-level with real wage stagnation....and a society that has an ever-decreasing portion of the population that can afford to buy housing, yet housing prices have skyrocketed.

it's pretty clear that this monetary policy just gives certain populations this money and it's going into relatively specific things (like premier stocks and housing) and if you're not on the gravy train, you're fricked, b/c it certainly isn't going into developing an economy that is better or produces more, raising wages.

this seems how you get to crazy economic situations like today with our insanely (paper) wealthy top-level with real wage stagnation....and a society that has an ever-decreasing portion of the population that can afford to buy housing, yet housing prices have skyrocketed.

it's pretty clear that this monetary policy just gives certain populations this money and it's going into relatively specific things (like premier stocks and housing) and if you're not on the gravy train, you're fricked, b/c it certainly isn't going into developing an economy that is better or produces more, raising wages.

Posted on 4/8/21 at 10:27 am to Strannix

If it doesnt matter, why are they hiding it?

Posted on 4/8/21 at 10:32 am to Strannix

I remember NYC back in the post Lindsey days after the massive borrow and social program binge. Interest on the debt ate most of the revenue and the city was in tatters.

Posted on 4/10/21 at 5:24 am to Strannix

quote:is that why a heavy duty pick up truck costs over $100,000 now?

there was a time when monetary policy aggregates were important determinants of inflation and that has not been the case for a long time

Posted on 4/10/21 at 6:39 am to Strannix

quote:Riiiiight.

and you see that now where inflation is at 1.4% for this year.

Posted on 5/5/21 at 10:24 pm to Strannix

quote:

Tell that to Zimbabwe and Venezuela, this chicken will come home to roost.

Or maybe...just maybeeeee...these guys are walking a tightrope between inflation and deflation and might just pull off the greatest monetary policy feat of all time.

Just sayin. We knock these guys, but I’ve been waiting for inflation to reappear for a long time as well.

Posted on 12/12/21 at 11:53 am to Strannix

quote:

"money doesn't matter"

Posted on 7/14/22 at 9:25 am to Strannix

quote:

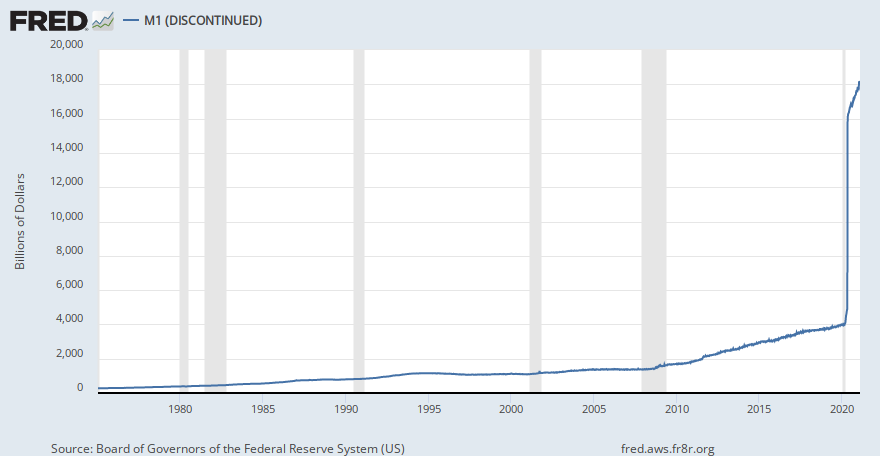

Be careful with that chart. The reason for that massive spike is due to how the Fed changed their view of the money supply. During COVID so many people began using their savings accounts as just another checking (meaning they, generally, became liquid enough to be considered as part of M1) that they added them to M1.

Don't get me wrong, there was an increase in the overall money supply, but it wasn't nearly that big a jump (see: M2)

Popular

Back to top

11

11