- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: So how many trump haters here are going to go against their self interest on this tax bill

Posted on 9/25/17 at 7:53 pm to HailHailtoMichigan!

Posted on 9/25/17 at 7:53 pm to HailHailtoMichigan!

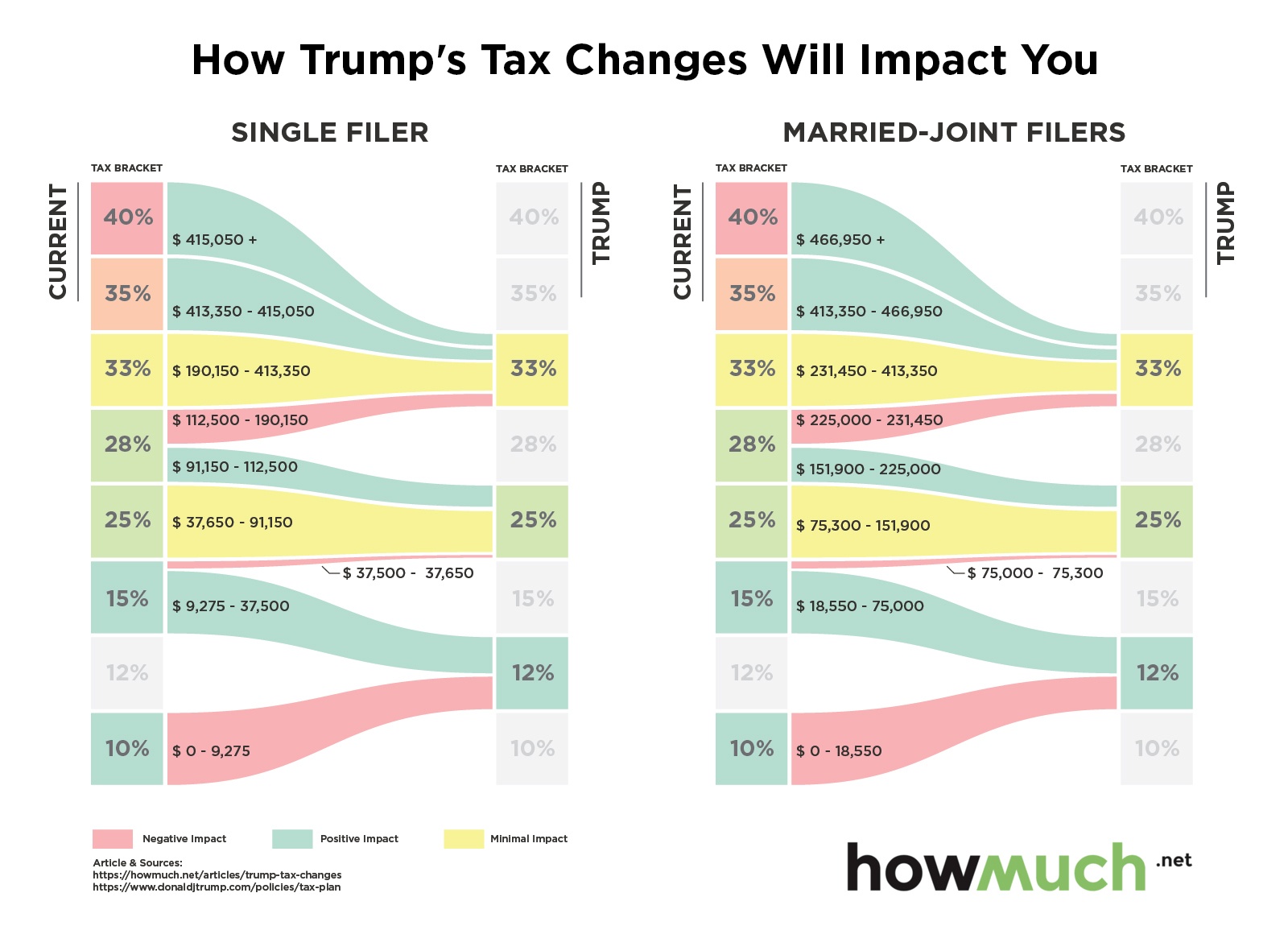

This is Trump's proposal from his campaign. How exactly are middle classes getting much of a tax break when income from $112,500 to $190,150 is going from a 28% tax rate to the highest bracket (33% or 35%)?

Posted on 9/25/17 at 7:54 pm to cameronml

quote:

This is Trump's proposal from his campaign. How exactly are middle classes getting much of a tax break when income from $112,500 to $190,150 is going from a 28% tax rate to the highest bracket (33% or 35%)?

This shows how out of touch you are with everyday Americans. 100k+ isn't middle class

Posted on 9/25/17 at 7:57 pm to cameronml

That's single filer you big dummy. As much as I hate to say it I'm the one Getting shafted immediately, but in about 2 years I'll be making out like a bandit.

Posted on 9/25/17 at 7:58 pm to cameronml

quote:

This is Trump's proposal from his campaign. How exactly are middle classes getting much of a tax break when income from $112,500 to $190,150 is going from a 28% tax rate to the highest bracket (33% or 35%)?

Seriously, and for married, majority of middle class (I guess technically upper middle class?) is either staying flat or paying more. This plan looks like shite.

Posted on 9/25/17 at 8:02 pm to cameronml

112-190k isn't middle class you fricking jamoke.

Posted on 9/25/17 at 8:08 pm to cameronml

quote:How exactly does someone else’s tax rates make a difference of what the “middle class” pays?

How exactly are middle classes getting much of a tax break when income from $112,500 to $190,150 is going from a 28% tax rate to the highest bracket (33% or 35%)?

Provided exemptions, and reductions are pretty close to know the chart is kinda misleading. Pretty much no one u til half-way up I to the 25% bracket actually pays any income tax.

Posted on 9/25/17 at 8:37 pm to cameronml

quote:

How exactly are middle classes getting much of a tax break when income from $112,500 to $190,150 is going from a 28% tax rate to the highest bracket (33% or 35%)?

Do you even know how taxable income works, you pleb?

Posted on 9/25/17 at 8:52 pm to cameronml

quote:

exactly are middle classes getting much of a tax break when income from $112,500 to $190,150 is going from a 28% tax rate to the highest bracket (33% or 35%)?

Progressive tax. While the top portion of their income will go up to 33%, the bottom 2/3 will be taxed at the lower rates.

Overall, they'd pay less

Posted on 9/25/17 at 10:30 pm to cameronml

Mine is either going down 3%, or up 5%. I may need an unpaid vacation in December, even though I have a bunch of pto. It'll be a photo finish.

Posted on 9/26/17 at 12:06 am to cameronml

Man you are a total dumbass. Like a real hollow headed mother fricker. Just shut up.

Back to top

9

9