- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: "Rich People in America Have Too Much Money.." - Warren Buffett

Posted on 6/28/17 at 1:28 pm to WheelRoute

Posted on 6/28/17 at 1:28 pm to WheelRoute

has pledged

Has pledged doesn't necessarily mean will

Has pledged doesn't necessarily mean will

Posted on 6/28/17 at 1:29 pm to rbWarEagle

He doesn't believe a word of that crap. If he did, he would stop trying to secure even more wealth. He would stop investing his money. He would give away all of it minus what he would need to live out the rest of his life. What he really wants is to make it more difficult for others who also desire to achieve his level of success.

Posted on 6/28/17 at 1:53 pm to HailHailtoMichigan!

quote:

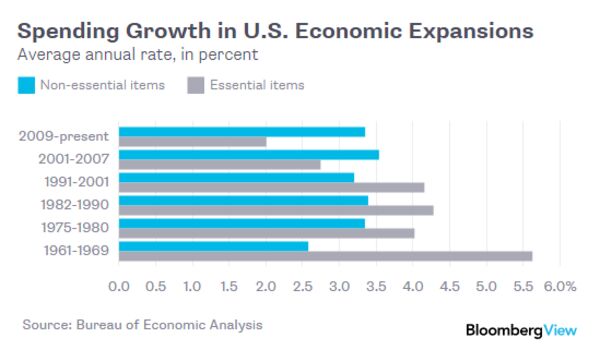

At the end of the day, what matters is not money in your pocket but the goods you can buy with them. Consumption trends DO NOT REFLECT wage stagnation, or remotely any form of middle class decline.

This is flat out nuts. Consumption hasn't decreased because of expanded access to cheap credit and burning through personal savings, NOT because wages have risen correspondingly with prices. Average household debt is 130k. The savings rate is near 0:

Middle class households are staying afloat by drawing down reserves and, when those are extinguished, borrowing.

Neither of the papers you cited extends the argument from "wage growth is measured incorrectly" to "2017 middle class households are financially equivalent to 1982." The papers are about whether growth is understated, not whether that growth has produced equivalent rises in income to match or exceed inflation. Regardless, if you want a counterpoint to the idea that productivity is mismeasured, HERE you go.

Posted on 6/28/17 at 1:54 pm to WheelRoute

quote:

Average household debt is 130k. The savings rate is near 0:

Maybe that's the difference between the rich and the middle class.

Posted on 6/28/17 at 2:02 pm to BBONDS25

quote:

Is 9.45 percent rate of return too high?

Most people would kill for that rate of return, but it's not a "rate of return" it's just a measurement of the growth in wealth of the top 400 households from 1982-2017. And it's only relevance is when compared to the measurement of growth in income brackets of the rest of the country. Statistics show the .01% has done incredibly well while the vast majority of the country has suffered.

Posted on 6/28/17 at 2:05 pm to the808bass

quote:

Maybe that's the difference between the rich and the middle class.

Maybe you should ask why people are having to go into debt to maintain current living standards, and if there's anything that might be done policy-wise to ameliorate their dilemma (or, conversely, if there are any policies that were enacted that caused this problem).

Posted on 6/28/17 at 2:05 pm to WheelRoute

quote:Access to credit is in and of itself not a bad thing, and is a natural by product of an economy that is growing.

WheelRoute

Posted on 6/28/17 at 2:08 pm to WheelRoute

quote:They are going into debt to reach standards of living that were/are higher than they were decades ago.

Maybe you should ask why people are having to go into debt to maintain current living standards,

Consumption has been steadily increasing, not remaining the same. And that reflects cultural shifts that put more value on owning a lot of stuff.

Posted on 6/28/17 at 2:14 pm to Ace Midnight

quote:

"Rich" guilt - another Marxist billionaire.

You first, Warren.

Yeah, all the old tycoons Carnegie, Rockefeller, etc all got the rich guilt as they got older too.

I will say that Buffet does get a good bit of money away. One of his sons is basically a professional philanthropist. He has funded the Cochise County, AZ sheriffs dept for everything from helicopters and APC's to body armor and pistols.

Posted on 6/28/17 at 2:15 pm to HailHailtoMichigan!

quote:

Access to credit is in and of itself not a bad thing, and is a natural by product of an economy that is growing.

Depends on what you use it for.

quote:

They are going into debt to reach standards of living that were/are higher than they were decades ago.

The largest drivers of debt are housing and student loans.

quote:

Consumption has been steadily increasing, not remaining the same. And that reflects cultural shifts that put more value on owning a lot of stuff.

Rises in consumption should be offset by rises in wages. This is the crux of the problem.

Posted on 6/28/17 at 2:16 pm to rbWarEagle

He's virtue signaling that that the lefties don't come after him and his.

If he actually meant what he said he could give away most of his wealth.

If he actually meant what he said he could give away most of his wealth.

Posted on 6/28/17 at 2:18 pm to WheelRoute

quote:Why?

Rises in consumption should be offset by rises in wages. This is the crux of the problem.

Wages are determined by productivity, not by how much "stuff" people want to buy.

Should my boss give me a raise because I want to buy a larger house?

And no, as long as you can pay it off, going into debt is not a bad thing. How do you think new firms get funds?

The act of providing funds and resources to people, who then use it to do something they want with it, with them paying it off, is essentially what capitalism is.

Posted on 6/28/17 at 2:19 pm to WheelRoute

quote:As a % of the population, far more people are going to school and houses are becoming larger and more extravagant.

The largest drivers of debt are housing and student loans.

We are one of the few nations that obsesses over home ownership, btw. Renting is not as taboo in other comparable nations.

Posted on 6/28/17 at 2:21 pm to Seldom Seen

quote:

He's virtue signaling that that the lefties don't come after him and his.

If he actually meant what he said he could give away most of his wealth.

Although they do give him a pass, he gives away a lot of money. Of course, giving away a billion dollars looks good, but doesn't really affect him financially.

I wish he would give it to the treasury instead of private charities since he thinks taxation is a better route than direct donations.

Posted on 6/28/17 at 2:25 pm to WheelRoute

quote:Americans are spending more on stuff they don't need

The largest drivers of debt are housing and student loans.

What if debt is going to service student loans and other vital services because people are becoming more feeble-minded when it comes to differentiating between what to buy and what not to buy?

Posted on 6/28/17 at 2:30 pm to rbWarEagle

Member when becoming rich wasn't a bad thing in this country?

Posted on 6/28/17 at 2:34 pm to Vols&Shaft83

quote:

He doesn't want anyone else to benefit from the system that he has benefited so much from.

Winner Winner.

His biggest interest is to retain his wealth and power, and keep as many people as possible away from getting a piece of it. No wealth distribution policy hurts the ultra rich, it hurts those right below down to the middle class in moving up the ranks.

He knows exactly what he's doing by making this statement too. It empowers politicians to motivate lower classes against the upper middle and upper classes....the "rich."

This post was edited on 6/28/17 at 2:35 pm

Posted on 6/28/17 at 2:45 pm to Ace Midnight

quote:

You first, Warren.

Posted on 6/28/17 at 2:46 pm to HailHailtoMichigan!

quote:

Why?

Wages are determined by productivity, not by how much "stuff" people want to buy.

I'm talking about for people to maintain their standard of living. Yes, I don't think it's unreasonable for people's wages and SOL to increase as they age provided they are a median worker. And productivity, as noted previously, has increased dramatically while wages have remained the same. Even the papers you cited still note that there is a gap even when correcting with a new deflator.

quote:

And no, as long as you can pay it off, going into debt is not a bad thing. How do you think new firms get funds?

I didn't say it's a bad thing. Credit for investment is fine. Having to dip into credit to pay for household/car repairs, school clothes, vacations etc. is more of a problem. The middle class is increasingly relying on credit to maintain living standards, NOT to get new funds to start a firm.

quote:

As a % of the population, far more people are going to school and houses are becoming larger and more extravagant.

I'm very skeptical of your housing argument because the price of a home has dozens of factors and construction price isn't dominant (for one, most people don't buy a new home). Also, productivity gains should be driving down the construction cost per sq foot. And finally, homes are currently being built (slightly) smaller but mortgage as a percentage of household debt continues to rise.

Education is different because it used to be the way in which you would jump from lower/middle to upper class. Currently, it's just a way to stay within the middle class, and even then it's having huge ripple effects on the economy as that debt drives down consumption in hundreds of areas from cars to homes to... well, to anything where you've ever seen an article "Are Millenials to Blame for..."

quote:

We are one of the few nations that obsesses over home ownership, btw. Renting is not as taboo in other comparable nations.

Piecing together your posts in this thread, you are putting together a helluva dystopian vision of American life. I really hope you don't have any plans to run for office.

Posted on 6/28/17 at 2:51 pm to HailHailtoMichigan!

quote:

Americans are spending more on stuff they don't need

What if debt is going to service student loans and other vital services because people are becoming more feeble-minded when it comes to differentiating between what to buy and what not to buy?

Feeble-minded?

Also, read your own article:

quote:

Alternatively, it could reflect the increasing concentration of wealth in the hands of the rich, who naturally devote a larger share of their expenditures to luxury goods and services. Their income has become more volatile in recent decades, so perhaps their spending is doing the same, driving faster growth in nonessential goods during recoveries. If so, that could mean a bumpier ride for less affluent folks.

Popular

Back to top

0

0