- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

When will the S&P be back to all time highs?

Posted on 8/31/23 at 4:14 pm

Posted on 8/31/23 at 4:14 pm

Let's hear those predictions.

I'm going with Q4 this year or Q1 of 2024.

Chart shows higher lows this entire calendar year. I see that trend continuing.

I'm going with Q4 this year or Q1 of 2024.

Chart shows higher lows this entire calendar year. I see that trend continuing.

Posted on 8/31/23 at 5:27 pm to SM1010

Got to make it thru Sept first. Always the worst time it seems for stocks. Well mine anyway.

Posted on 8/31/23 at 5:40 pm to SM1010

June 3rd 2024 is the over under

Posted on 8/31/23 at 10:05 pm to SM1010

quote:

I'm going with Q4 this year or Q1 of 2024.

I’m going with Q1 2025. Not because of any specific economic indicator other than the 2024 election.

Posted on 9/1/23 at 1:23 pm to SM1010

August 14, 2025....1:32am CDT.

Posted on 9/2/23 at 8:21 am to SM1010

Halfway through Trump's second term

Posted on 12/13/23 at 8:38 am to SM1010

Bump. S&P looking to threaten all time highs here soon?

Posted on 12/13/23 at 4:35 pm to SM1010

For sure. The Dow Jones Index set the record today so there is the threat.

Let's say the January 3,2022 record S & P Index close of 4796.6 is reached at the end of this year. What would be today's approximate value in purchasing dollars of, for example of each $1000 amount held in an S & P Index fund January 2022?

Let's say the January 3,2022 record S & P Index close of 4796.6 is reached at the end of this year. What would be today's approximate value in purchasing dollars of, for example of each $1000 amount held in an S & P Index fund January 2022?

Posted on 12/13/23 at 5:49 pm to CharleyLake

quote:

What would be today's approximate value in purchasing dollars of, for example of each $1000 amount held in an S & P Index fund January 2022?

Would depend on what a person is purchasing.

Posted on 12/13/23 at 7:00 pm to CharleyLake

quote:

Let's say the January 3,2022 record S & P Index close of 4796.6 is reached at the end of this year. What would be today's approximate value in purchasing dollars of, for example of each $1000 amount held in an S & P Index fund January 2022?

CPI is up 10.1% from December 2021 - November 2023. SPY total return from 1/3/22 to today is 1.2%.

Back each up a year and CPI is up 17.9% while SPY is up 32.9%.

Posted on 12/20/23 at 10:17 am to SM1010

Closing in on the all time high here. Breakthrough or a rejection?

Posted on 12/20/23 at 10:58 am to SM1010

I'm shocked there isn't tax selling pressure. Mag 7 will keep running I'd guess a break out into the new year.

Posted on 12/21/23 at 4:18 am to SM1010

If I'm forced to predict, I'm going with a breakthrough. We still have not seen the wave of the impact of AI and increased automation. Inflation data is favorable. I hope we see a reversion to the mean for small caps that have been woefully underperforming for a few years.

Posted on 12/21/23 at 9:50 am to RoyalWe

quote:

hope we see a reversion to the mean for small caps that have been woefully underperforming for a few years.

Amen

Posted on 12/21/23 at 11:13 am to RoyalWe

quote:

I hope we see a reversion to the mean for small caps that have been woefully underperforming for a few years.

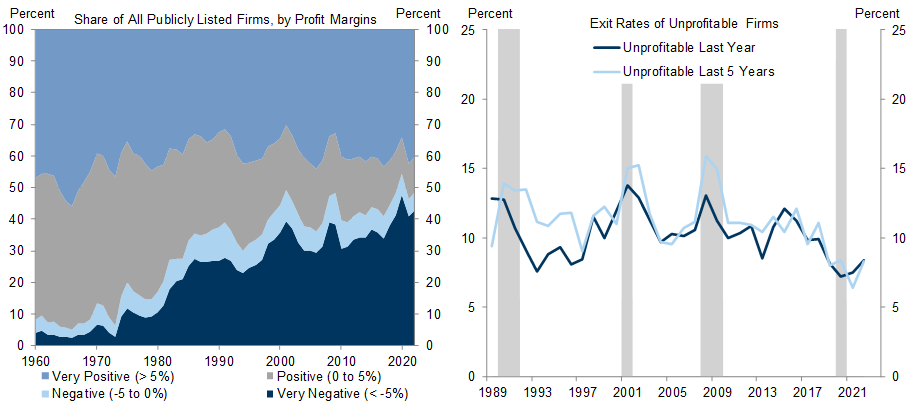

Small caps, in theory, should get destroyed. However, the Russel stocks experienced the worst bear market in recorded history this year so that could soften the blow from the real economy in terms of returns.

All to say I hope we do, too. But it's not going to happen.

Posted on 12/21/23 at 4:25 pm to wutangfinancial

quote:

Small caps, in theory, should get destroyed. However, the Russel stocks experienced the worst bear market in recorded history this year so that could soften the blow from the real economy in terms of returns.

All to say I hope we do, too. But it's not going to happen.

We'll see. Profitability on the R2000 is improving. P/E down to 25ish from 70+ a year ago.

You’re right about refinancing concerns though. Still a big risk on the horizon.

Posted on 12/21/23 at 7:16 pm to slackster

I just looked it up. The P/E was in the 70s last year

Popular

Back to top

11

11